Applying for a bank account online is a straightforward process that saves you time and effort. Firstly, research and choose a bank that suits your financial needs and offers the type of account you desire. Visit the bank's official website or download their mobile app, and find the online application page. You'll need to provide personal information like your name, address, Social Security Number, and possibly employment details. After this, the bank will verify your identity, often asking security questions or requiring additional identification documents. Once your identity is verified, you'll select the type of account you want, review the terms and conditions, and submit your application. The bank will then review your application, and upon approval, you'll be able to set up your online banking details, activate the account, and make an initial deposit. Before diving into the application process, it's vital to lay some groundwork. This involves understanding your banking needs, becoming familiar with different types of accounts, and preparing necessary documents. The type of bank account that will best serve you largely depends on your individual financial needs. Consider what you'll primarily be using the account for. If it's for everyday transactions like paying bills or grocery shopping, a checking account would be a good fit. However, if you're looking to earn interest over time, you might consider a savings account. Reviewing your financial habits and goals will help you determine the right kind of account for you. Banks offer a range of accounts, each designed to cater to different financial needs. Checking accounts, savings accounts, money market accounts, and certificate of deposit (CD) accounts are common. Each has its pros and cons, so it's important to understand what each offers before making a decision. To apply for a bank account online, you'll need to have certain documents on hand. These typically include a form of government-issued identification, your Social Security Number (or another taxpayer identification number), and proof of address. Preparing these documents beforehand will make the application process smoother. Selecting the right financial institution is just as critical as choosing the right type of account. The right bank should align with your financial needs, lifestyle, and preferences. The actual process of applying for a bank account online can be broken down into several key steps. These include finding the bank's official website, filling out your personal information, and more. The first step involves going to the bank's official website or downloading their mobile app. Always ensure that you're on a legitimate banking site to protect your personal information from phishing scams. Once you've navigated to the bank's official site, find their account application page. This is usually accessible from their homepage. Click on the appropriate link to start the application process. During the application process, you'll be asked to provide personal details such as your name, address, Social Security Number, and employment information. Ensure you have all this information ready to avoid delays. To protect against fraud, banks will verify your identity using the details you provided. This typically involves answering security questions or providing additional identification documents. At this stage, you can select the type of account you want to open based on your earlier research. Some banks offer the option to open multiple account types at once. Before completing your application, review the terms and conditions of the account. This includes the bank's fee structure, interest rates, withdrawal limits, and any other account rules. Ensure you understand these terms before proceeding. Once you've filled out all necessary details and reviewed the terms, you can submit your application. Most banks will send an email confirmation or notification acknowledging receipt of your application. Once you've submitted your application, there are a few more steps to getting your new account up and running. After submitting your application, you'll have to wait for the bank to review and approve it. The duration varies from bank to bank but typically takes a few business days. Once approved, you'll be asked to set up your online banking details, including your username and password. Some banks will also ask you to set up security questions for further protection. After setting up your online banking details, you'll need to activate your account. This often involves making an initial deposit, which can vary based on the bank and the type of account. To activate and start using your account, you'll need to deposit money. Banks allow deposits through various methods, including wire transfers, direct deposit, mailing a check, or depositing a check through the mobile app. While applying for a bank account online is convenient, it also requires vigilance to protect your personal information. Here are some safety tips to consider. Before you begin the application process, ensure the bank's website is secure. Look for "https://" at the start of the URL – the "s" stands for secure. There should also be a padlock symbol next to the URL. Only provide personal information if you initiated the contact or you're sure you're dealing with the actual bank. Be wary of unsolicited emails or texts asking for personal information. Remember, banks will never ask for sensitive information via email or text. Be vigilant about unusual activity on your account. Regularly monitor your account, set up transaction alerts, and report any suspicious activity to your bank immediately. Applying for a bank account online simplifies the traditionally tedious process, offering convenience and speed. Crucial steps include understanding your financial needs, selecting the right account and bank, gathering necessary documents, and completing the online application. Always ensure the bank's website is secure and protect your personal information. After application approval, you'll set up your online banking details and fund your account. Despite the convenience of online banking, maintaining vigilance against potential fraud is crucial. Monitor your account regularly, stay alert for any unusual activity, and report suspicions promptly to your bank. The process may seem daunting at first, but with research, preparation, and vigilance, applying for a bank account online becomes a manageable task that can significantly enhance your financial management.Applying for a Bank Account Online: Overview

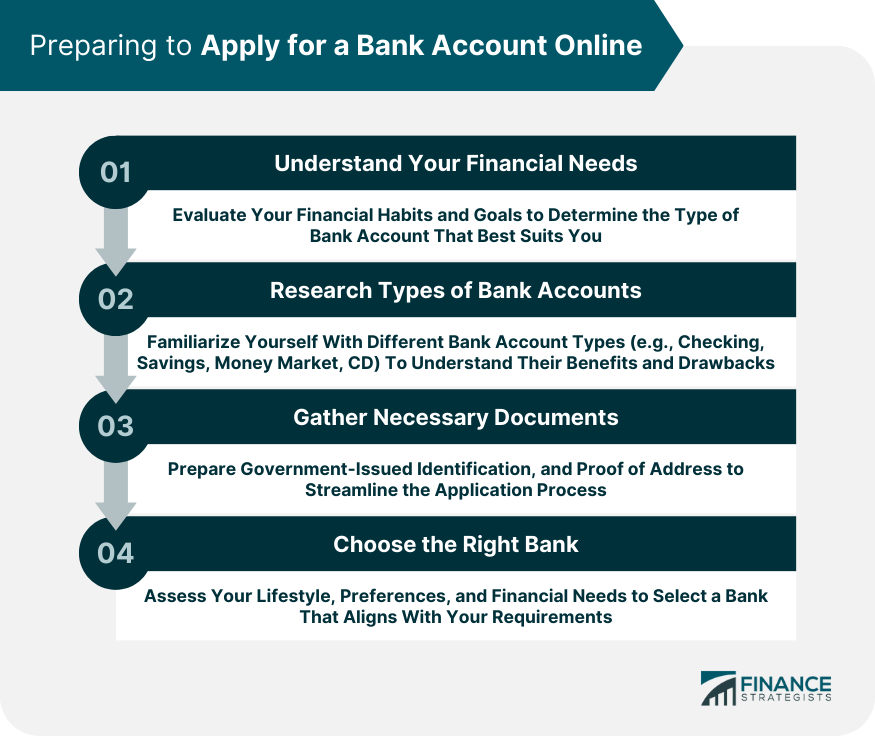

Preparation Steps to Apply for a Bank Account Online

Understand Your Financial Needs

Research Types of Bank Accounts

Gather Necessary Documents

Choose the Right Bank

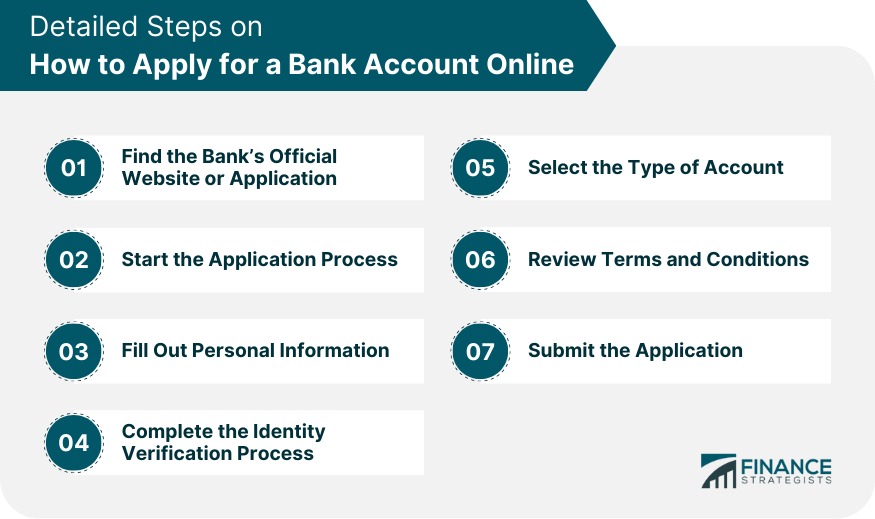

Detailed Steps on How to Apply for a Bank Account Online

Find the Bank's Official Website or Application

Start the Application Process

Fill Out Personal Information

Complete the Identity Verification Process

Select the Type of Account

Review Terms and Conditions

Submit the Application

What Happens After Applying for a Bank Account Online

Wait for Application Approval

Set Up Online Banking Details

Activate the Bank Account

Fund Your New Online Bank Account

Safety Tips When Applying for a Bank Account Online

Recognize Secure Websites

Protect Personal Information

Avoid Online Banking Fraud

Conclusion

How to Apply for a Bank Account Online FAQs

First, research and choose a bank that suits your needs. Then, visit the bank's website or download their app, and navigate to the online application page. Provide your personal information, verify your identity, select the account type you want, review the terms and conditions, and submit your application. Once approved, set up your online banking details, activate the account, and make an initial deposit.

You'll need government-issued identification, your Social Security Number, and proof of address. Understanding your financial needs and researching different types of accounts will also help make the process smoother.

Consider factors like the bank's reputation, customer service, interest rates, fee structure, the types of accounts they offer, their online services, and whether these align with your lifestyle.

Ensure the bank's website is secure, protect your personal information, and avoid sharing sensitive information through email or text. Be vigilant for unusual activity on your account and report any suspicions immediately.

After submitting your application, you'll need to wait for the bank's approval. Once approved, you'll set up your online banking details, activate the account by making an initial deposit, and start using your account.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.