Check endorsement refers to the act of signing the back of a check for the purpose of transferring it to another entity, whether that be a person or a bank. It's a crucial step in the process of cashing or depositing a check, serving as a legal verification of the transfer of ownership of the check from one party to another. The purpose of endorsing a check is to validate its authenticity and approve its payment to the designated payee. Endorsements essentially serve as an insurance mechanism for banks, mitigating the risk of fraud or bounced checks. This endorsement doesn't merely involve a simple signature; it also necessitates understanding the various types of endorsements, as well as their implications. Misunderstanding or misuse can lead to a variety of complications, from check fraud to legal repercussions. The endorser simply signs their name on the back of the check in the designated area. However, this step should ideally be performed in the bank or right before depositing or cashing the check to prevent any misuse if the check is lost or stolen. Different types of endorsements serve different purposes and entail varying levels of risk. The endorser must understand the implications of each type to select the most appropriate one based on the situation. A blank endorsement happens when the endorser signs their name exactly as it appears on the "Pay to the Order of" line on the front of the check. It is the simplest form of endorsement but also the riskiest, as anyone who possesses the check can cash or deposit it. A restrictive endorsement limits the actions that can be taken with the check. The most common form involves writing "For Deposit Only" followed by the endorser's account number and signature. This endorsement adds a layer of security, specifying the check can only be deposited into a specific account. A special endorsement, also known as an endorsement in full, allows the endorser to specify a third party to whom the check can be transferred. This endorsement is made by writing "Pay to the order of [third party's name]" followed by the endorser's signature. Special endorsements are often used when checks are transferred from one person to another. Rules governing check endorsements are established by the Uniform Commercial Code (UCC), which most states have adopted in some form. These rules ensure the validity of the check and protect the parties involved. For instance, a bank is not required to honor a check if the endorsement is missing or if it suspects fraud. The legal implications of check endorsements are significant. An incorrect or fraudulent endorsement can lead to serious repercussions, such as legal disputes, financial loss, and in some cases, criminal charges. Understanding the proper way to endorse a check can mitigate these risks. Check endorsement adds a layer of security to the check processing procedure. By requiring a physical signature and providing various endorsement options, banks can validate the authenticity of the transaction and minimize the chances of fraud. In particular, restrictive endorsements can offer additional protection by designating a specific course of action with the check, such as depositing it directly into a specified account. This can protect the payee if the check is lost or stolen. Check endorsement enables the legal transfer of a check's ownership from the payee to another party or a financial institution. By signing a check, the original payee provides their consent for this transfer, ensuring the check’s negotiability. Without this key step, banks would not have the necessary authorization to process the check, making endorsements integral to the check-cashing or depositing process. Endorsements assist in the tracking and documentation of financial transactions. Each endorsed check leaves a paper trail that can be traced back if questions or disputes arise. This makes check endorsement a valuable tool for both personal and business accounting. Moreover, with the increasing use of digital imaging in banks, endorsed checks can be stored and retrieved digitally. This aids in record-keeping and provides easy access to transaction history. Check endorsements also contribute to banking convenience. By endorsing checks, customers can deposit them via ATMs or mobile apps, thus reducing the need to visit a bank branch. This convenience, combined with the security measures associated with endorsements, makes checks a practical option for various transactions, despite the prevalence of electronic payments. If a check is endorsed but then lost or stolen, it can be cashed or deposited by unauthorized individuals. This risk is especially high with blank endorsements, which don't limit who can cash or deposit the check. While restrictive and special endorsements provide additional security measures, they are not foolproof. Banks often process checks automatically, and discrepancies in endorsements may not be caught, resulting in fraudulent transactions. Once a check is endorsed, it is effectively "live" money, and if it falls into the wrong hands, it can lead to financial loss for the endorser. The risk is particularly high for businesses that deal with a large volume of checks. They must have robust systems in place for check storage and processing to prevent theft or misplacement. Misspelled names or missing information in a restrictive or special endorsement can lead to delays in check processing. In some cases, banks might refuse to accept checks with incorrect endorsements. Endorsers must ensure the correct spelling of names and accurate account information, particularly for restrictive or special endorsements. Mistakes not only cause inconvenience but can also lead to disputes or legal issues. One of the best practices in check endorsement involves endorsing the check accurately and in a timely manner. This means signing the check immediately before presenting it for cashing or depositing, not in advance. Endorsing a check right before its negotiation minimizes the risk of unauthorized access in case the check is lost or stolen. Accuracy in endorsement, particularly in restrictive or special endorsements, ensures the check is processed without issues. Given the security risks associated with blank endorsements, it is often advisable to use restrictive endorsements, especially for checks of large amounts. Writing "For Deposit Only," followed by the account number, can provide added security and direct the funds to the correct account. While it might take a little more time than a simple signature, a restrictive endorsement can save a lot of potential trouble down the line by minimizing the risk of unauthorized transactions. Regular monitoring of financial transactions is crucial to ensuring their integrity. This practice involves regularly reviewing bank statements to detect any fraudulent activities or irregularities. Regular audits, either done internally or by a third-party auditor, can also be highly beneficial. They help in identifying procedural issues or potential vulnerabilities that could lead to fraud or loss. A check endorsement is a crucial step in the process of cashing or depositing a check, serving as a legal verification of the transfer of ownership from one party to another. It facilitates banking convenience, allowing customers to deposit checks via ATMs or mobile apps. However, check endorsement also presents challenges and risks. There is potential for fraud, especially with blank endorsements. Misplacement or theft of endorsed checks can lead to financial loss. Errors in endorsement can cause delays or disputes in check processing. To mitigate these risks, best practices include timely and accurate endorsement, the use of restrictive endorsements for added security, and regular monitoring and auditing of financial transactions. By following these practices, individuals and businesses can ensure the integrity of their check endorsements and safeguard against potential issues.What Is Check Endorsement?

How Check Endorsement Works

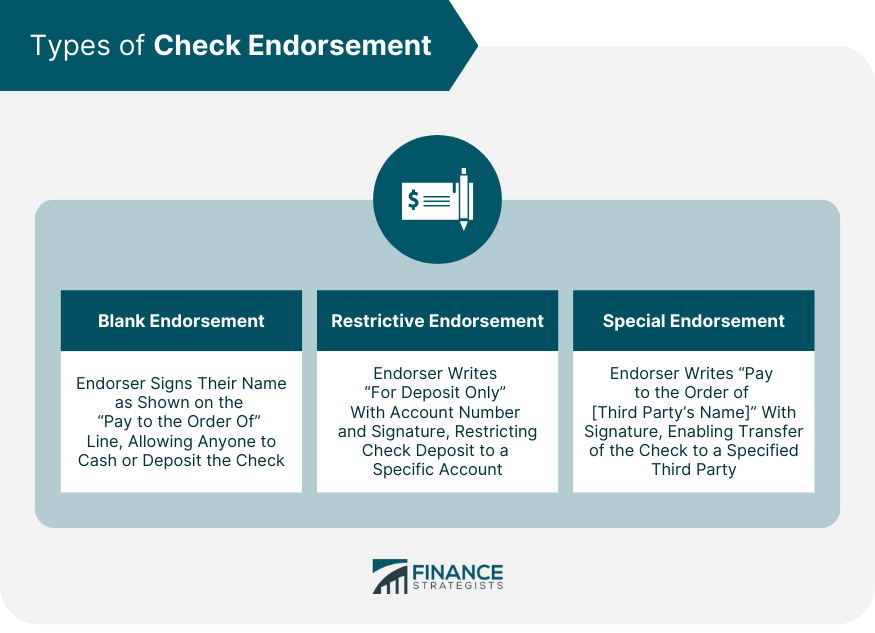

Different Types of Check Endorsement

Blank Endorsement

Restrictive Endorsement

Special Endorsement

Rules and Legal Implications

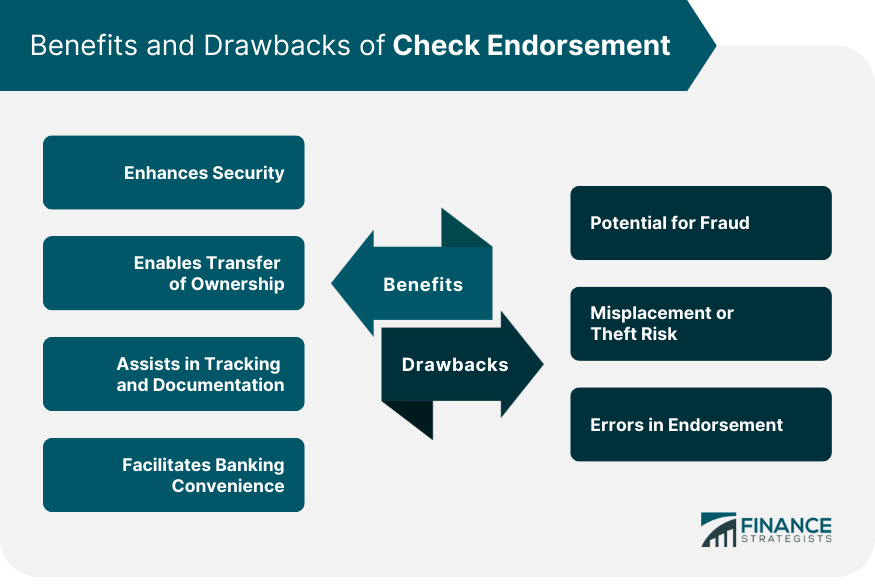

Benefits of Check Endorsement

Enhances Security in Check Processing

Enables Transfer of Ownership

Assists in Tracking and Documentation

Facilitates Banking Convenience

Drawbacks of Check Endorsement

Potential for Fraud

Misplacement or Theft Risk

Errors in Endorsement

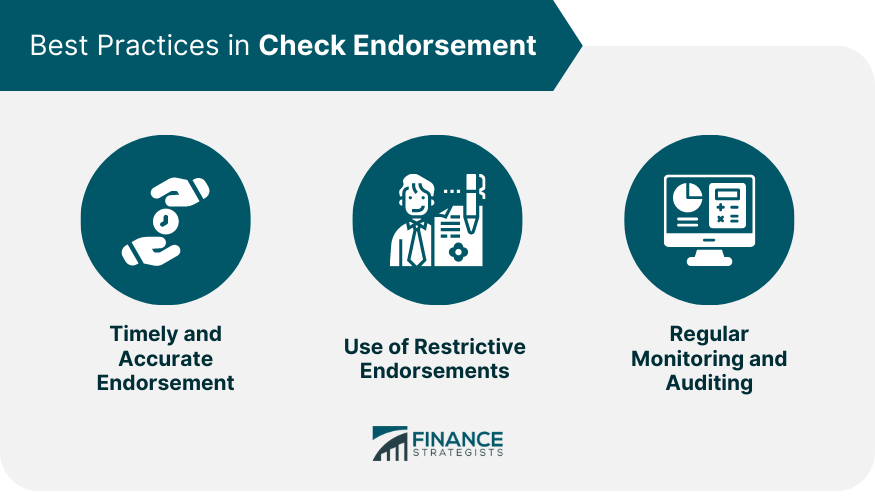

Best Practices in Check Endorsement

Timely and Accurate Endorsement

Use of Restrictive Endorsements for Security

Regular Monitoring and Auditing

Conclusion

Check Endorsement FAQs

Check endorsement refers to signing the back of a check to transfer its ownership to another entity, serving as a legal verification for cashing or depositing the check.

Check endorsement is important because it validates the authenticity of the check and approves its payment to the designated payee, mitigating the risk of fraud or bounced checks for banks and ensuring smooth financial transactions.

The different types of check endorsement include blank endorsement, where the endorser signs their name; restrictive endorsement, which limits check actions; and special endorsement, where the endorser specifies a third party to whom the check can be transferred.

Yes, there are legal implications. An incorrect or fraudulent endorsement can lead to serious repercussions, including legal disputes, financial loss, and, in some cases, criminal charges. Understanding the proper way to endorse a check is crucial to mitigate these risks.

To ensure the security of check endorsement, it is advisable to use restrictive endorsements, accurately endorse checks in a timely manner, regularly monitor financial transactions, and conduct audits to detect any irregularities or potential vulnerabilities that could lead to fraud or loss.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.