A tracking stock is a type of equity security issued by a parent company to track the financial performance of a specific subsidiary or business segment. The value of the tracking stock is tied to the financial performance of the tracked business, but the parent company retains control and ownership of the subsidiary. Tracking stocks allow investors to invest in a specific part of a company's operations without actually owning shares of the subsidiary or business segment. Tracking stocks can be an important tool in wealth management, as they allow investors to gain exposure to specific business segments or industries that they believe have high growth potential. By investing in tracking stocks, investors can potentially realize higher returns by focusing on the most promising parts of a company's operations. Furthermore, tracking stocks can offer increased diversification and risk management opportunities for investors seeking to build a balanced investment portfolio. Tracking stocks are unique financial instruments that offer several distinct features. First, the value of a tracking stock is directly linked to the financial performance of the specific business segment it tracks, allowing investors to participate in the growth of that particular segment. Second, tracking stocks typically pay dividends based on the performance of the tracked business, providing income for investors. Third, although tracking stocks represent ownership in the parent company, they generally do not come with voting rights, as the parent company retains full control over the subsidiary or business segment. Equity tracking stocks are issued by a parent company to track the performance of a specific subsidiary or business segment that is wholly or partially owned by the parent company. Investors who own equity tracking stocks have a claim on the earnings and assets of the tracked business, but they do not own the actual subsidiary or business segment. Asset tracking stocks are issued by a parent company to track the performance of a specific group of assets, such as intellectual property, real estate holdings, or a portfolio of investments. These tracking stocks allow investors to gain exposure to the performance of the assets without directly owning them. One of the main advantages of tracking stocks is the flexibility they offer in corporate restructuring. By issuing tracking stocks, a parent company can separate the financial performance of a subsidiary or business segment from its core operations, making it easier to evaluate and potentially sell or spin off the tracked business in the future. Issuing tracking stocks can also help a parent company raise capital without diluting its ownership of the tracked business. Investors who purchase tracking stocks gain exposure to the financial performance of the tracked business but do not receive an ownership stake in the subsidiary or business segment itself. Tracking stocks can provide investors with increased transparency into the financial performance of specific subsidiaries or business segments. By offering tracking stocks, a parent company can provide detailed financial information about the tracked business, allowing investors to make more informed decisions about their investments. In some cases, issuing tracking stocks can offer tax benefits for both the parent company and investors. For example, if a parent company issues tracking stocks for a subsidiary that generates significant profits, the subsidiary's earnings may be taxed at a lower rate than if they were consolidated with the parent company's earnings. One disadvantage of tracking stocks is the potential confusion over voting rights. While tracking stocks generally do not come with voting rights, some investors may mistakenly believe that they have a say in the parent company's decisions regarding the tracked business. Issuing tracking stocks can introduce legal complexities for the parent company, as it must navigate the regulatory requirements surrounding these unique financial instruments. In addition, the parent company may face increased scrutiny from regulators and shareholders who may question the rationale behind issuing tracking stocks. The use of tracking stocks can lead to increased risk of corporate governance issues, as the parent company retains control over the tracked business. This may result in conflicts of interest and a lack of accountability, as the parent company may prioritize its own interests over those of the tracked business or its investors. Tracking stocks can sometimes suffer from limited liquidity, as they may be less widely traded than the parent company's primary stock. This can make it more difficult for investors to buy or sell tracking stocks, potentially leading to larger price swings and increased volatility. Dell Technologies, a multinational technology company, has used tracking stocks in the past to track the performance of its subsidiary, VMware. The tracking stock allowed investors to invest in VMware's financial performance without actually owning shares of VMware itself. Alphabet Inc., the parent company of Google, has issued tracking stocks to reflect the performance of its various subsidiaries and business segments. This approach has allowed investors to gain exposure to specific parts of Alphabet's operations, such as Google's core internet search business or its "Other Bets" segment, which includes experimental projects like self-driving cars. Comcast Corporation, a leading telecommunications and media company, has issued tracking stocks to represent the performance of its NBCUniversal subsidiary. This allowed investors to invest specifically in the financial performance of NBCUniversal without owning shares of the subsidiary directly. While both tracking stocks and spinoffs allow a parent company to separate the financial performance of a subsidiary or business segment from its core operations, there are key differences between the two approaches. A tracking stock represents a financial interest in the tracked business but does not confer actual ownership of the subsidiary or business segment. In contrast, a spinoff involves the parent company distributing shares of the subsidiary to its existing shareholders, effectively creating a separate, independent company. Tracking stocks offer the advantage of flexibility in corporate restructuring and the ability to raise capital without diluting ownership. However, they can also introduce confusion over voting rights, legal complexities, and potential corporate governance issues. On the other hand, spinoffs provide a clean separation between the parent company and the spun-off business, offering greater clarity and independence for both entities. However, spinoffs can be more complex and time-consuming to execute, and may not offer the same tax benefits as tracking stocks in some cases. Tracking stocks are unique financial instruments that allow investors to gain exposure to the financial performance of specific subsidiaries or business segments without directly owning shares of the tracked business. They offer advantages such as flexibility in corporate restructuring, the ability to raise capital, and enhanced investor transparency, but also come with potential drawbacks, including confusion over voting rights, legal complexities, and increased risk of corporate governance issues. Understanding the features, types, advantages, and disadvantages of tracking stocks can help investors make informed decisions about whether these instruments are suitable for their investment objectives and risk tolerance.What Is a Tracking Stock?

Features of Tracking Stocks

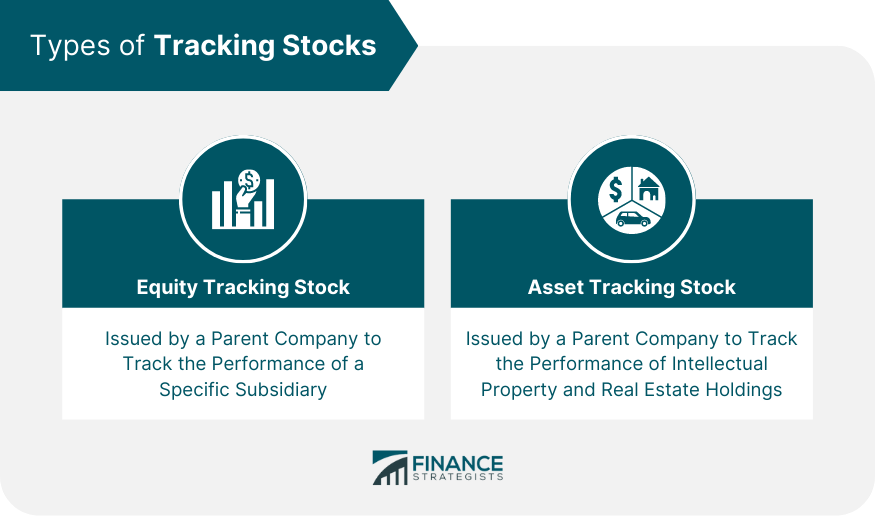

Types of Tracking Stocks

Equity Tracking Stock

Asset Tracking Stock

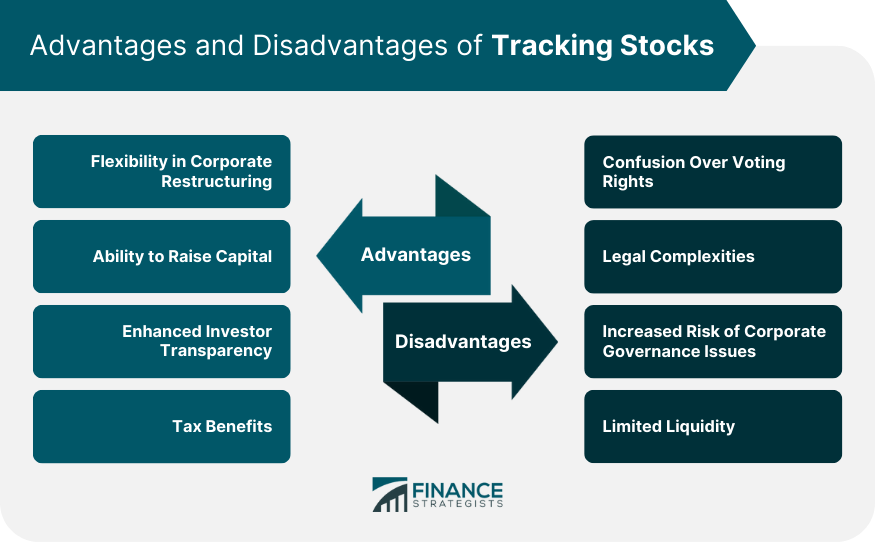

Advantages of Tracking Stocks

Flexibility in Corporate Restructuring

Ability to Raise Capital

Enhanced Investor Transparency

Tax Benefits

Disadvantages of Tracking Stocks

Confusion Over Voting Rights

Legal Complexities

Increased Risk of Corporate Governance Issues

Limited Liquidity

Examples of Companies With Tracking Stocks

Dell Technologies

Alphabet Inc. (Formerly Google)

Comcast Corporation

Tracking Stock vs Spinoff

Differences Between Tracking Stocks and Spinoffs

Benefits and Drawbacks of Each

Bottom Line

Tracking Stock FAQs

Tracking stock is a type of stock that is designed to track the performance of a specific business unit or division of a company.

Unlike common stock, tracking stock does not represent ownership in the company as a whole, but rather in a specific division or asset.

Tracking stock provides flexibility in corporate restructuring, ability to raise capital, enhanced investor transparency, and tax benefits.

Disadvantages of tracking stock include confusion over voting rights, legal complexities, increased risk of corporate governance issues, and limited liquidity.

Companies such as Dell Technologies, Alphabet Inc. (formerly Google), and Comcast Corporation have issued tracking stock in the past.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.