A holding company is a company that owns the outstanding stock of another company. It is a corporate ownership structure in which a parent company owns sufficient equity and voting stock in another company, called a subsidiary, that it can control that company's policies and management decisions. Holding companies may also own real estate, commodities, intellectual property, or a variety of other assets. While the holding company legally owns the assets of its subsidiary, it often only maintains oversight and does not always participate in day-to-day business operations. The purpose of a holding company is to consolidate control of several companies under one umbrella corporation. This offers holding companies a few advantages. For example, they are protected from losses in the event that one of their subsidiaries goes bankrupt. If this happens, the holding company may experience a capital loss, but it is not legally liable for the debt of one of their subsidiaries, meaning that creditors cannot collect directly from the parent company. Furthermore, the loss of one subsidiary does not impact the other assets held by the holding company, so the remainder of its sources of income will still be safe. A pure holding company exists solely for the purpose of holding shares in another company. It doesn’t have any operational activities or active business undertakings of its own. Such companies purely control the underlying assets or businesses without mingling in their operations, ensuring a clean and undiluted control structure. In contrast, a mixed holding company combines the features of a holding company with active operational functions. While it owns a significant portion of shares in other businesses, it also engages in its own set of business activities. This allows the company to diversify its sources of income and can provide strategic benefits by integrating various stages of production or distribution. By owning multiple companies across various industries or sectors, holding companies can spread their exposure, ensuring that a downturn in one sector doesn't severely impact the entire conglomerate. This diversified portfolio approach enables steady revenue streams even in volatile markets. Holding companies can often reap significant tax benefits. They can structure themselves to optimize tax obligations by taking advantage of intercompany transactions, dividends, and other financial structures. This can lead to substantial savings and can improve overall profitability. Holding companies, with their broader view of the conglomerate's various businesses, can efficiently allocate capital where it’s most needed or where it will provide the highest return. This centralized decision-making often results in better investment choices and resource distribution. Another advantage is the ability to pool and centralize resources. Whether it's human resources, technology, or infrastructure, holding companies can optimize usage across subsidiaries, leading to economies of scale and operational efficiencies. Holding companies, given their complex structures and significant control over various industries, often face stringent regulatory compliance. Navigating these regulatory waters requires expertise, and any oversight can result in severe penalties or reputational damage. Given that a holding company might own businesses in multiple sectors, there's potential for conflicts of interest. One subsidiary might benefit at the expense of another, leading to internal strife and potential ethical dilemmas. The more subsidiaries and assets a holding company possesses, the more complex its organizational structure becomes. This complexity can lead to communication breakdowns, inefficient decision-making, and challenges in executing a cohesive corporate strategy. Holding companies are typically required to produce consolidated financial statements. These documents combine the financial statements of the parent company and all its subsidiaries, providing a comprehensive view of the conglomerate's financial health. This can be a complex process but offers stakeholders a holistic perspective on the company's operations. Intercompany transactions refer to the financial activities that occur between the holding company and its subsidiaries or between the subsidiaries themselves. Proper pricing and documentation of these transactions are crucial for both transparency and tax reasons. Mispricing or poorly documenting such transactions can lead to both regulatory and financial challenges. Holding companies play a pivotal role in determining how their subsidiaries are funded. Whether it's through equity, debt, or a combination of both, the parent company can influence the financial strategies of its offspring. This power ensures that capital is allocated effectively and that each subsidiary is positioned for success. When a subsidiary company is entirely owned by a holding company, it is said to be wholly owned. For example, Warren Buffet's company, Berkshire Hathaway, wholly owns GEICO, Fruit of the Loom, Helzberg Diamonds, and several others. However, many holding companies also have significant partial ownership of some companies; Berkshire Hathaway owns 26.7% of Kraft Heinz, 17.6% of American Express, and 9.9% of Wells Fargo, among others. A holding company is a strategic corporate structure with distinct advantages and inherent risks. The purpose of a holding company is to centralize control over multiple entities, offering benefits like risk diversification, tax optimization, efficient capital allocation, and streamlined resource management. By holding equity in various subsidiaries, a holding company can mitigate losses through its diversified portfolio and capitalize on tax efficiencies. However, challenges such as regulatory compliance, conflicts of interest, and complex organizational structures must be navigated. Through consolidated financial statements, proper intercompany transaction management, and funding strategies for subsidiaries, holding companies ensure their effective operation. Notably, examples like Berkshire Hathaway showcase both wholly owned and partially owned subsidiaries, demonstrating the diversity and potential of this corporate structure in contemporary finance.Holding Company Definition

The Purpose of a Holding Company

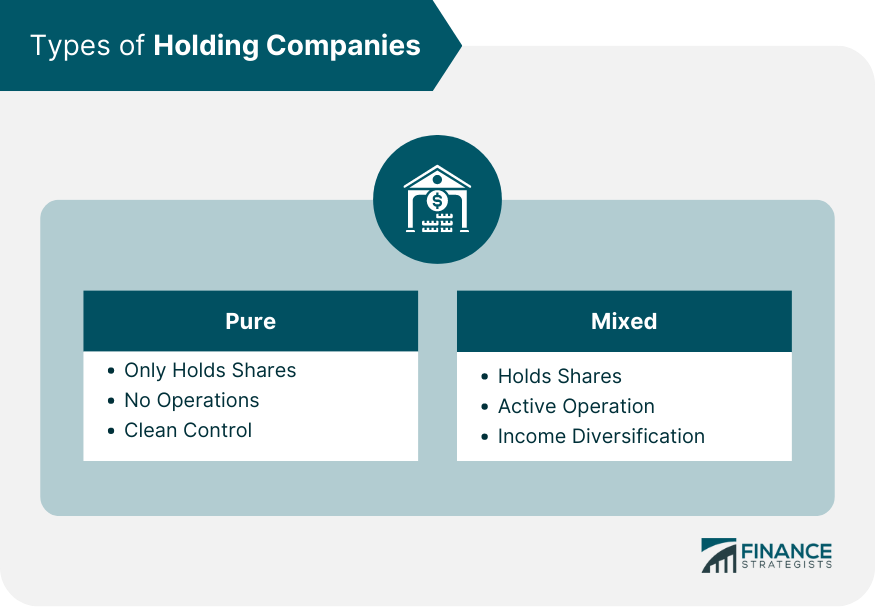

Types of Holding Companies

Pure

Mixed

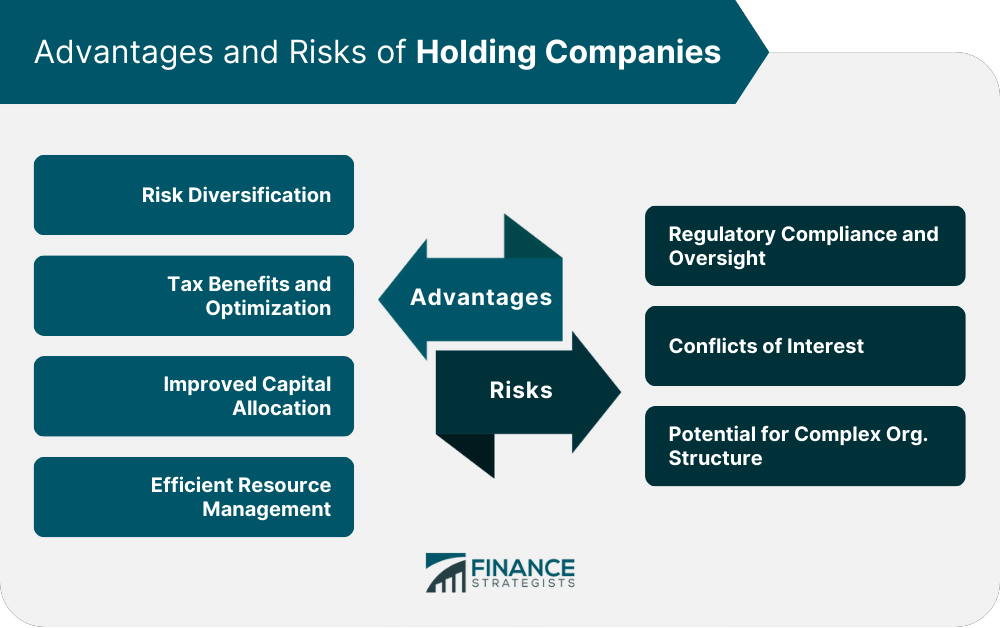

Advantages of Holding Companies

Risk Diversification

Tax Benefits and Optimization

Improved Capital Allocation

Efficient Resource Management

Risks of Holding Companies

Regulatory Compliance and Oversight

Conflicts of Interest

Potential for Complex Organizational Structure

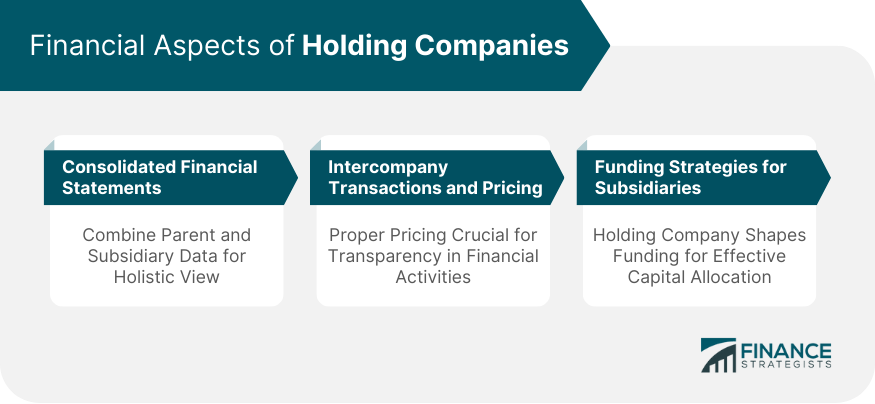

Financial Aspects of Holding Companies

Consolidated Financial Statements

Intercompany Transactions and Pricing

Funding Strategies for Subsidiaries

Example of Holding Company

Conclusion

Holding Company FAQs

A holding company is a company that owns the outstanding stock of another company.

It is a corporate ownership structure in which a parent company owns sufficient equity and voting stock in another company, called a subsidiary, that it can control that company’s policies and management decisions.

The purpose of a holding company is to consolidate control of several companies under one umbrella corporation.

While the holding company legally owns the assets of its subsidiary, it often only maintains oversight and does not always participate in day-to-day business operations.

One notable advantage to a holding company: A holding company is protected from losses in the event that one of their subsidiaries goes bankrupt. Furthermore, the loss of one subsidiary does not impact the other assets held by the holding company, so the remainder of its sources of income will still be safe.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.