Unlisted Trading Privileges refer to the permission granted by regulatory bodies like the Securities and Exchange Commission (SEC) to securities exchanges, allowing them to trade securities not explicitly listed on their exchange. This system broadens the range of securities available for trading across different exchanges, thereby enhancing market liquidity and fostering competition among exchanges. For an individual investor, UTPs can provide more opportunities and better pricing for investment, making it a critical aspect of understanding effective wealth management. However, knowing the potential challenges and regulatory issues associated with UTPs is essential in navigating the investment landscape effectively. Unlisted Trading Privileges were introduced in the United States as part of the Securities Exchange Act 1934. This legislation aimed to bring more transparency and order to the financial markets by establishing regulations and oversight bodies. Over time, UTPs and the financial market landscape have evolved. With the advent of electronic trading systems and platforms, UTPs have become an integral part of the trading architecture, enabling exchanges to provide more options to their clients. Several regulatory changes have occurred over the years to refine further and streamline the use of UTPs. For instance, the introduction of Regulation NMS (National Market System) in 2005 has significantly influenced UTPs by promoting fair and efficient markets. Unlisted Trading Privileges (UTPs) are governed by a complex regulatory framework designed to ensure the integrity of financial markets. This framework is under the purview of regulatory bodies, is grounded in legislation, and varies across different regions globally. The Securities and Exchange Commission (SEC) is the primary regulatory body that oversees UTPs in the United States. It is responsible for ensuring that the usage of UTPs is fair and aligns with the broader goals of market integrity and investor protection. The SEC reviews the applications from exchanges seeking UTPs, monitors their compliance with market rules and regulations, and has the authority to enforce these rules when necessary. UTPs are primarily governed by the Securities Exchange Act of 1934, which first established the concept. This Act set forth the essential requirements and rules for exchanges seeking to trade securities not explicitly listed on their platform. Rules like those found in Regulation NMS (National Market System) also apply. This regulation aims to promote fair and efficient markets, including provisions related to UTPs that further ensure their fair usage. While the concept of UTPs originated in the U.S., similar principles have been adopted by global financial markets, though with regional variations. In Europe, for example, the Markets in Financial Instruments Directive II (MiFID II) includes provisions similar to UTPs. This directive promotes transparency across the European Union's financial markets and sets forth rules for trading securities across different exchanges. The first step in acquiring Unlisted Trading Privileges (UTPs) involves the interested exchange submitting a request to the Securities and Exchange Commission (SEC). This request, usually a formal application or filing, must outline the exchange's intentions for trading a specific security not listed on their platform. It must also include detailed plans on how the exchange intends to adhere to regulations associated with UTPs. Upon receiving the request, the SEC initiates a rigorous review process. This includes assessing the exchange's compliance capabilities, market monitoring systems, and trading platform robustness. The SEC scrutinizes the exchange's ability to maintain fair and orderly markets and protect investors. After thoroughly reviewing the request, the SEC then decides whether to grant or deny the UTPs. If the SEC finds that the exchange meets all the required standards and that granting UTPs will be in the public interest and aligns with the goals of the Securities Exchange Act, it approves the request. If approved, the exchange gains the privilege to trade the specified security. This continues the process, though. The SEC continues to monitor and regulate the exchange's activities involving the UTP to ensure ongoing compliance with market rules and regulations. The first and foremost requirement for acquiring Unlisted Trading Privileges (UTPs) is complying with the associated market rules and regulations. The Securities and Exchange Commission (SEC) expects exchanges to demonstrate that they can maintain fair, orderly, and efficient markets. Exchanges must have robust trading systems and procedures in place to handle the trading of unlisted securities. This includes technological infrastructure that supports high-volume trading and real-time monitoring. The SEC needs to ensure that the exchange can effectively manage the complexities and potential risks associated with UTPs. Not all securities can be traded under UTPs. The securities must meet specific standards, typically of financial performance, corporate governance, and disclosure requirements. The specifics may vary depending on the jurisdiction regulations where the security is traded. Exchanges are expected to have measures in place to protect investors. This includes procedures for handling investor complaints and mechanisms to detect and deter market manipulation or other unfair practices. Exchanges must be able to provide transparent and timely information about trades made under UTPs. They must also submit regular reports to the SEC about their trading activity, including unusual or suspicious transactions. The eligibility criteria and requirements for UTPs aim to ensure that the exchange is competent in handling the unique aspects of trading unlisted securities. It also ensures robust protections for investors, essential for maintaining trust and confidence in the financial markets. The concept of Unlisted Trading Privileges, while essential to the functioning of modern financial markets, carries both advantages and disadvantages. Understanding these can provide a more nuanced view of their role within the financial system. One of the most significant benefits of UTPs is the improvement in market liquidity. UTPs offer investors a broader range of options by allowing securities to be traded on multiple exchanges. This can lead to more trading activity and increased liquidity, making it easier for investors to buy or sell securities without causing significant price changes. UTPs also foster competition among exchanges. This competition can benefit investors by leading to better services, more innovative trading tools, and potentially lower transaction costs. Furthermore, competition among exchanges can improve efficiency and responsiveness to investor needs. One significant drawback is the potential for market fragmentation. When securities are traded on multiple exchanges, the trading volume can be spread thinly across these platforms. This fragmentation can lead to challenges in managing the market, making it more difficult to maintain fair and orderly trading. Critics also argue that UTPs could be manipulated by unscrupulous market participants to gain an unfair advantage. For example, they could use sophisticated trading algorithms to exploit minor exchange price differences. This could lead to market distortions and unfair trading practices. UTPs significantly impact market liquidity by facilitating a wider range of tradable securities across multiple exchanges. This leads to more trading options for investors and, as a result, a more fluid market. By enabling securities to be traded across different exchanges, UTPs stimulate competition among these exchanges. This competition can drive down transaction costs and improve price discovery, benefiting the overall market. UTPs can foster market transparency. By trading securities on multiple exchanges, information about those securities is disseminated more widely, leading to a more informed marketplace. For individual investors, UTPs can offer benefits such as access to a wider range of securities and potentially more competitive prices. However, they also pose challenges, like the potential for market manipulation, which could affect investor confidence. Institutional investors, like mutual funds and pension funds, also leverage UTPs. They typically have more resources to manage the complexities of trading on multiple exchanges and thus can benefit more from UTPs. Investor protection measures, like stringent regulations and active oversight by bodies like the SEC, are in place to mitigate risks associated with UTPs. Technology also plays a role in monitoring trading activity and detecting irregularities. Unlisted Trading Privileges (UTPs) are regulatory permissions that allow securities exchanges to trade securities not explicitly listed on their platform. They play a significant role in the financial market landscape, impacting liquidity, competition, and transparency. Despite the controversies and complexities surrounding UTPs, their significance in the financial markets cannot be overstated. They contribute to market fluidity, offer a more comprehensive selection of securities for trading, and foster competition among exchanges, benefiting investors with better pricing and investment opportunities. Investing in financial markets can indeed be complex. However, understanding key concepts like UTPs can equip you with the knowledge to navigate this intricate landscape effectively. Should you feel overwhelmed by these complexities, engaging with a wealth management professional could provide valuable insights and guidance. Their expertise can help you leverage mechanisms like UTPs to make informed decisions, potentially bolstering your financial growth in this ever-evolving financial market.What Are Unlisted Trading Privileges (UTPs)?

Historical Background of Unlisted Trading Privileges (UTPs)

Establishment of UTPs

Evolution Over Time

Key Milestones and Regulatory Changes

Regulatory Framework Governing UTPs

Role of the Securities and Exchange Commission (SEC)

Important Legislation and Rules

International Regulation Perspectives

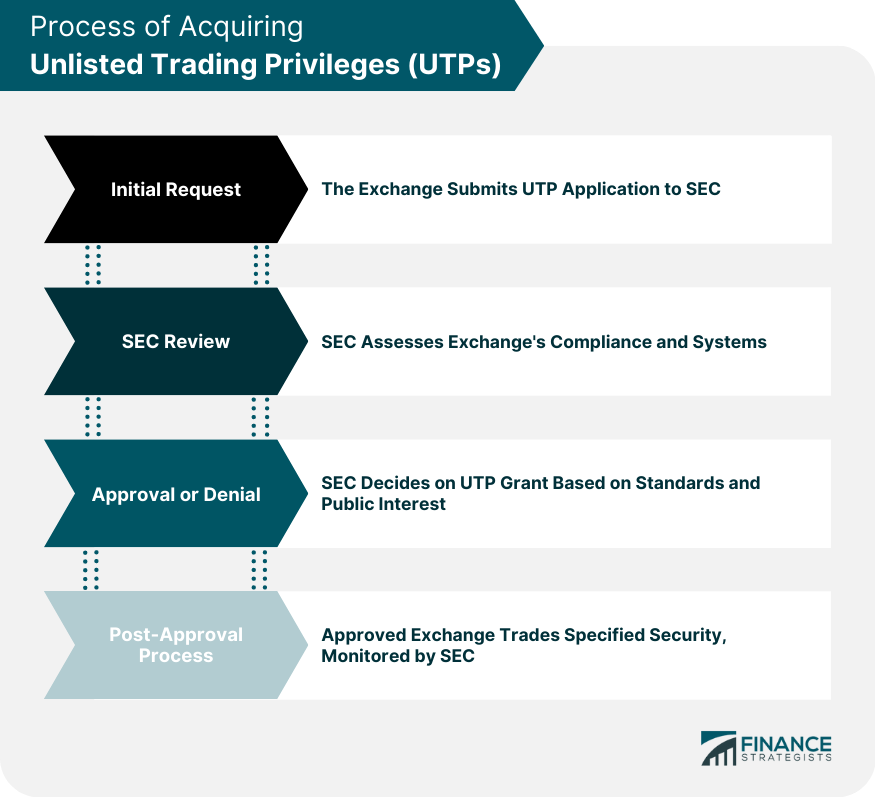

Process of Acquiring Unlisted Trading Privileges (UTPs)

Initial Request

SEC Review

Approval or Denial

Post-approval Process

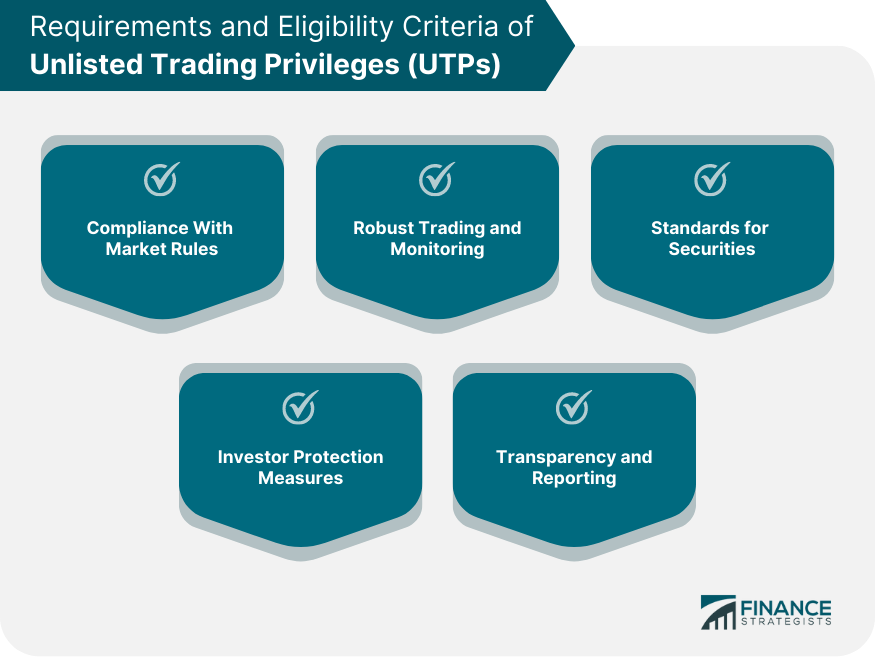

Requirements and Eligibility Criteria of UTPs

Compliance With Market Rules and Regulations

Robust Trading and Monitoring Systems

Standards for Securities

Investor Protection Measures

Transparency and Reporting

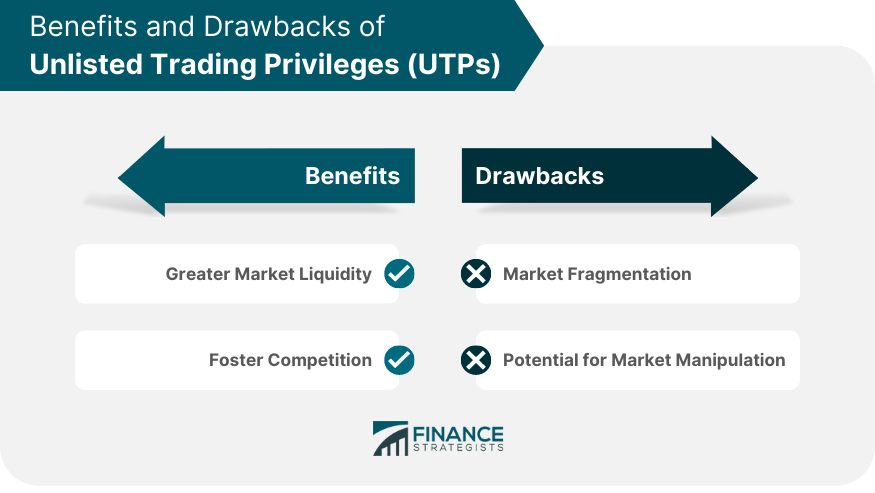

Benefits and Drawbacks of Unlisted Trading Privileges (UTPs)

Benefits

Greater Market Liquidity

Foster Competition

Drawbacks

Market Fragmentation

Potential for Market Manipulation

Role of Unlisted Trading Privileges in Financial Markets

Impact on Liquidity

Effect on Market Competition

Relationship With Market Transparency

Unlisted Trading Privileges and Investor Protection

Impact on Individual Investors

Role in Institutional Investment

Measures in Place to Protect Investors

Conclusion

Unlisted Trading Privileges (UTP) FAQs

Unlisted Trading Privileges refer to the ability of a securities exchange to trade stocks that are not explicitly listed on their exchange.

UTPs can improve market liquidity and foster competition among exchanges. They also enhance market transparency by enabling the wide dissemination of information about securities.

Critics argue that UTPs can lead to market fragmentation and may be exploited for market manipulation. There are also concerns about whether current regulations are adequate to govern UTPs.

Regulatory oversight by bodies like the SEC, stringent regulations, and technological systems are in place to monitor trading activity and detect irregularities, protecting investors in markets involving UTPs.

Technological advancements, regulatory changes, and shifts in the global financial landscape will likely shape the future of UTPs. Although their role may evolve, they will continue to be a crucial part of the financial market.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.