Family wealth education is a process that aims to educate and prepare families for the effective management of their wealth across generations. The goal of family wealth education is to help families understand the responsibilities and opportunities associated with their wealth, and to develop the skills, knowledge, and attitudes necessary to manage their wealth in a way that aligns with their values and goals. Family wealth education can cover a broad range of topics, including financial planning, investment management, estate planning, philanthropy, and governance. The specific content and format of family wealth education programs may vary depending on the needs and interests of the family, but they often involve a combination of group discussions, workshops, coaching sessions, and other interactive learning activities. Effective family wealth education programs also recognize the importance of addressing the emotional and relational aspects of wealth management, as well as the technical and practical aspects. This may involve helping family members to develop communication skills, manage conflict, and build trust and collaboration within the family.

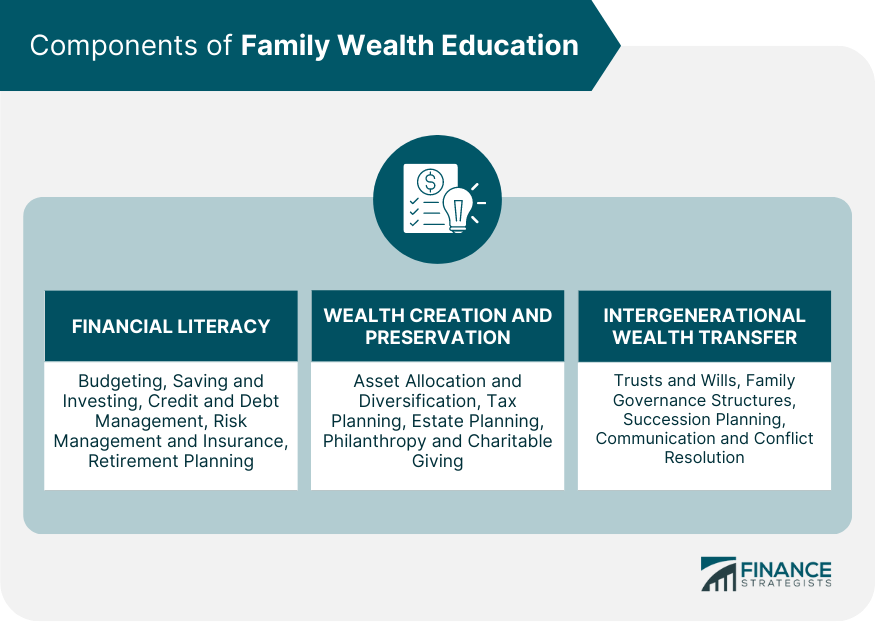

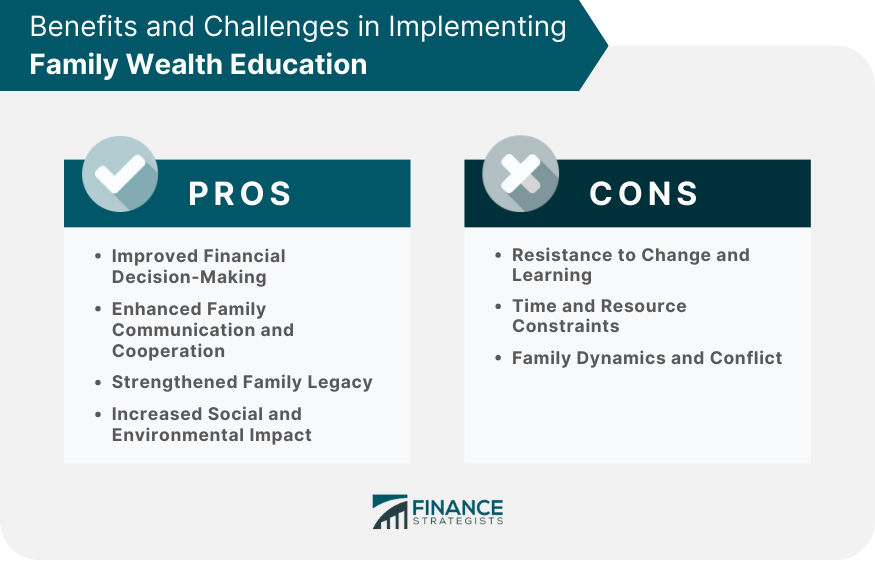

Financial literacy is a foundational skill that enables individuals to make informed decisions about their personal finances. It encompasses various aspects, including: Understanding how to create and follow a budget is essential for managing family finances. It helps families track income and expenses, prioritize financial goals, and live within their means. Educating family members about saving and investing strategies can help them accumulate wealth and achieve long-term financial goals. Learning how to use credit responsibly and manage debt is vital for maintaining a healthy financial life. Family wealth education should cover topics such as credit scores, debt repayment strategies, and the consequences of poor credit management. Families should be educated about the importance of risk management and insurance, including how to select appropriate coverage to protect their assets and mitigate potential financial losses. Teaching family members about retirement planning can ensure that they are financially prepared for their later years, helping them maintain their standard of living and preserve wealth for future generations. Beyond financial literacy, family wealth education should also address strategies for creating and preserving wealth, such as: Understanding how to allocate and diversify investments can help families optimize their risk-return profile, thus maximizing their wealth over time. Effective tax planning can minimize a family's tax burden, enabling them to retain more of their wealth for investment and growth. Estate planning is crucial for preserving family wealth and ensuring a smooth transfer of assets upon the death of a family member. This includes creating wills, designating beneficiaries, and establishing trusts, among other strategies. Educating families about philanthropy and charitable giving can help them make a positive impact on their communities and instill a sense of social responsibility in future generations. To ensure a lasting family legacy, wealth education must address the complexities of intergenerational wealth transfer, covering topics such as: Teaching family members about the importance of creating trusts and wills can ensure that their assets are distributed according to their wishes and minimize potential disputes among heirs. Establishing clear family governance structures can promote effective decision-making, communication, and conflict resolution related to wealth management. Succession planning is critical for maintaining family businesses and other assets across generations. Family wealth education should address the intricacies of choosing successors and preparing them for their future roles. Effective communication and conflict resolution skills are essential for navigating the challenges that can arise during the wealth transfer process. Family wealth education should be tailored to the needs and roles of different family members, considering factors such as: Different age groups may require different levels of financial education and wealth management skills. The financial education needs of family members may vary depending on their roles and responsibilities within the family unit. Several methods can be employed to teach family wealth education, including: Enrolling family members in financial education courses or degree programs can provide a structured learning environment. Attending workshops and seminars can offer targeted learning opportunities and access to experts in the field of family wealth management. Online courses and resources can provide flexible, self-paced learning options that cater to the individual needs of family members. Mentorship and coaching from experienced professionals can offer personalized guidance and support throughout the wealth education journey. Regular assessments and feedback can help family members gauge their progress in wealth education and identify areas that may need further attention or adjustment. Family wealth education offers numerous benefits, including: Increased financial knowledge and skills can lead to more informed decisions regarding investments, spending, and debt management, ultimately contributing to the growth and preservation of family wealth. Open discussions about family finances can promote better understanding and collaboration among family members, helping to minimize disputes and foster a positive environment for wealth management. By effectively managing, preserving, and transferring wealth across generations, families can ensure the longevity of their legacy and the continued success of their assets. Through philanthropy and charitable giving, families can make a meaningful difference in their communities and contribute to a better world for future generations. Despite its importance, there are challenges in implementing family wealth education, such as: Some family members may be reluctant to embrace new ideas or learn about financial management, which can hinder the adoption of wealth education principles. Finding the time and resources to invest in family wealth education can be difficult, especially for busy families juggling multiple responsibilities. Family dynamics and existing conflicts can make it challenging to introduce wealth education and effectively communicate about financial matters. Family wealth education plays an indispensable role in securing a family's financial success and preserving its legacy for generations. By tackling the multifaceted aspects of wealth management and transfer, families are empowered to make informed decisions, enhance communication, and maximize their social impact. Committing to wealth education can help families overcome potential challenges, enabling them to build a lasting foundation for financial stability and growth. Despite the obstacles that may be encountered, investing time and resources in family wealth education is crucial for promoting financial literacy and responsible wealth management practices within the family unit. The benefits of this investment extend beyond the immediate family, creating a ripple effect that positively impacts their communities and future generations. By embracing the principles of family wealth education, families can pave the way for a brighter, more secure financial future for themselves and their descendants.What Is Family Wealth Education?

Components of Family Wealth Education

Financial Literacy

Budgeting

Saving and Investing

Credit and Debt Management

Risk Management and Insurance

Retirement Planning

Wealth Creation and Preservation

Asset Allocation and Diversification

Tax Planning

Estate Planning

Philanthropy and Charitable Giving

Intergenerational Wealth Transfer

Trusts and Wills

Family Governance Structures

Succession Planning

Communication and Conflict Resolution

Teaching Family Wealth Education

Identifying the Right Audience

Age Groups

Family Roles and Responsibilities

Selecting Appropriate Methods

Formal Education

Workshops and Seminars

Online Courses and Resources

Mentorship and Coaching

Assessing Progress and Adapting the Curriculum

Benefits of Family Wealth Education

Improved Financial Decision-Making

Enhanced Family Communication and Cooperation

Strengthened Family Legacy

Increased Social and Environmental Impact

Challenges in Implementing Family Wealth Education

Resistance to Change and Learning

Time and Resource Constraints

Family Dynamics and Conflict

Conclusion

Family Wealth Education FAQs

Family wealth education is a process of teaching family members, particularly the next generation, about financial literacy, wealth management, and values surrounding wealth. It can also involve coaching and guidance to help them develop the skills, knowledge, and attitudes needed to manage and preserve family wealth.

Family wealth education is essential for ensuring that future generations are equipped with the skills and knowledge they need to manage and preserve the family's wealth successfully. It also helps to promote a sense of shared values, responsibility, and accountability among family members.

Family wealth education can be provided by a variety of professionals, including financial advisors, wealth managers, attorneys, and family business consultants. Some families also choose to hire dedicated family wealth educators or establish family offices to provide these services.

Family wealth education can cover a range of topics, including financial planning, investment management, tax planning, estate planning, philanthropy, and family governance. It can also involve discussions around family values, legacy planning, and intergenerational wealth transfer.

Families can start by identifying their goals and values and creating a family mission statement. They can also begin educating themselves on the various financial and wealth management topics they wish to cover and seek out professional guidance where necessary. Additionally, families can establish regular family meetings to discuss financial matters and ensure that everyone is on the same page.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.