Samurai Bonds are yen-denominated bonds issued by foreign entities in Japan's capital market. These bonds enable foreign governments, supranational organizations, and corporations to raise capital in Japan, tapping into the country's deep pool of savings and investment. Samurai Bonds serve several purposes, including helping issuers diversify their funding sources, providing access to the Japanese investor base, and offering competitive pricing and lower borrowing costs compared to domestic markets. Samurai bonds possess certain distinctive characteristics that set them apart from other types of bonds. Understanding these features is crucial for both issuers and investors. Samurai bonds are denominated in Japanese yen (JPY). This is a critical aspect of these bonds, as it provides issuers with access to the Japanese market and allows them to diversify their funding sources. Foreign governments, supranational organizations, and corporations are eligible to issue Samurai bonds. These issuers seek to raise capital from Japanese investors and take advantage of the competitive pricing offered by the Samurai bond market. Samurai bonds typically have a maturity period ranging from short-term (less than one year) to long-term (over ten years). This flexibility enables issuers to match their funding needs with their debt maturity profile. The risk associated with Samurai bonds depends on the creditworthiness of the issuer. Credit rating agencies assign ratings to these bonds, reflecting the issuer's ability to fulfill its debt obligations. Samurai bonds offer several advantages to both issuers and investors, making them an attractive financing option. By issuing Samurai bonds, foreign entities can access the vast pool of Japanese capital and diversify their funding sources. This diversification reduces reliance on a single market or currency and helps to mitigate potential risks. Samurai bonds provide Japanese investors with the opportunity to invest in foreign entities without the need for currency conversion. This eliminates foreign currency risk for investors and opens up a broader range of investment options. As the Japanese bond market is highly competitive, issuers can benefit from competitive pricing and lower borrowing costs. This makes Samurai bonds an attractive financing option for foreign entities. Issuers can hedge their exposure to currency risk by issuing Samurai bonds. By raising capital in Japanese yen, they can match their funding needs with their yen-denominated expenses. Investing in Samurai bonds comes with certain risks and challenges that need to be considered by both issuers and investors. Currency risk arises from fluctuations in exchange rates between the Japanese yen and the issuer's domestic currency. This can impact the issuer's ability to service its debt obligations and affect the bond's performance for investors. Credit risk is associated with the issuer's ability to fulfill its debt obligations. Credit rating agencies assign ratings to Samurai bonds, reflecting the creditworthiness of the issuer. Investors need to consider these ratings when making investment decisions. Market risk refers to the potential for changes in interest rates, economic conditions, or other factors to affect the Samurai bond market. Investors need to be aware of these risks and their potential impact on bond prices and yields. Regulatory risk arises from changes in Japanese regulations or policies that could impact the Samurai bond market. Both issuers and investors need to be aware of the regulatory environment and potential changes that could affect the market. Liquidity risk refers to the possibility that investors may not be able to sell their Samurai bonds in the secondary market at a reasonable price. This can be a concern for investors who need to liquidate their investments quickly or in large volumes. Issuing Samurai bonds involves a well-defined process that ensures compliance with Japanese regulations and market practices. Before issuing Samurai bonds, foreign entities must obtain approval from the Ministry of Finance and file with the Japan Securities Dealers Association (JSDA). This process ensures that the bonds meet the necessary regulatory requirements. Issuers collaborate with Japanese banks and select underwriters to manage the bond issuance. These underwriters play a crucial role in the pricing, distribution, and market-making of the bonds. A bond prospectus is prepared to provide potential investors with detailed information about the issuer and the bonds. This document includes the issuer's financial statements, business operations, credit ratings, and the bond's terms and conditions. The pricing and book-building process involves determining the bond's yield and finalizing the list of investors. Underwriters and issuers collaborate to set the price, and investors submit their bids during the book-building period. After the book-building process, the bonds are settled and listed on the Tokyo Stock Exchange (TSE). This allows investors to trade the bonds in the secondary market, providing liquidity for both buyers and sellers. The Samurai bond market involves several key players, each playing a critical role in the functioning and growth of the market. Foreign governments, supranational organizations, and corporations are the primary issuers of Samurai bonds. These entities seek to raise capital from the Japanese market to finance their projects, operations, or refinance existing debt. Japanese institutional investors, such as pension funds, insurance companies, and asset managers, as well as retail investors, are the primary buyers of Samurai bonds. These investors seek exposure to foreign entities without the need for currency conversion. Underwriters and market-makers play a crucial role in the Samurai bond market. They assist issuers in pricing, distributing, and providing liquidity for the bonds in the secondary market. The Ministry of Finance and the Japan Securities Dealers Association (JSDA) are responsible for overseeing the Samurai bond market. They ensure that the bonds meet the necessary regulatory requirements and maintain market integrity. The Samurai bond market has evolved over time, influenced by global economic events, innovations, and new structures. The market has grown steadily over the years, with increased participation from foreign entities and investors. This growth can be attributed to the market's competitive pricing, access to Japanese investors, and diversification benefits. Global economic events, such as changes in interest rates, currency fluctuations, and geopolitical risks, can impact the Samurai bond market. Investors and issuers need to be aware of these factors and their potential effects on bond pricing and performance. There has been a growing interest in green and social Samurai bonds, which are designed to finance projects with positive environmental or social impacts. These bonds cater to the increasing demand for sustainable investments from both issuers and investors. The Samurai bond market has witnessed innovations and new structures, such as dual-currency bonds and bonds with embedded options. These structures provide issuers and investors with more flexibility and risk management options. Samurai bonds offer a unique financing option for foreign entities seeking to access the Japanese market and diversify their funding sources. With competitive pricing, access to Japanese investors, and the ability to hedge against currency risk, Samurai bonds have become an attractive choice for issuers worldwide. Investors, on the other hand, can benefit from a broader range of investment options without the need for currency conversion. As the Samurai bond market continues to grow and evolve, it is crucial for both issuers and investors to stay informed about market trends, risks, and opportunities. By understanding the market's intricacies and learning from past successes and challenges, issuers and investors can make informed decisions and capitalize on the potential benefits offered by Samurai bonds.What Are Samurai Bonds?

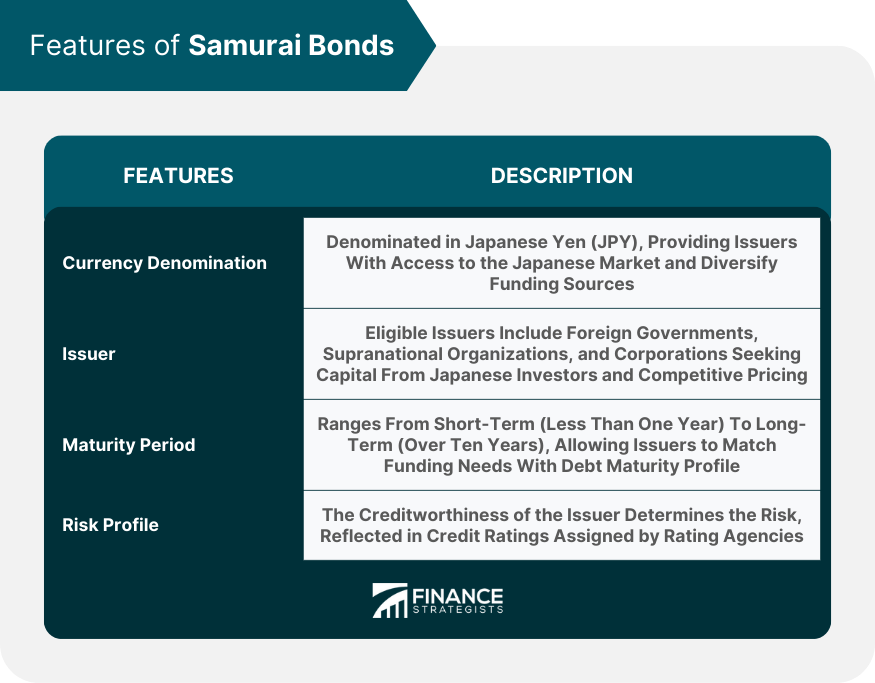

Features of Samurai Bonds

Currency Denomination

Issuer

Maturity Period

Risk Profile

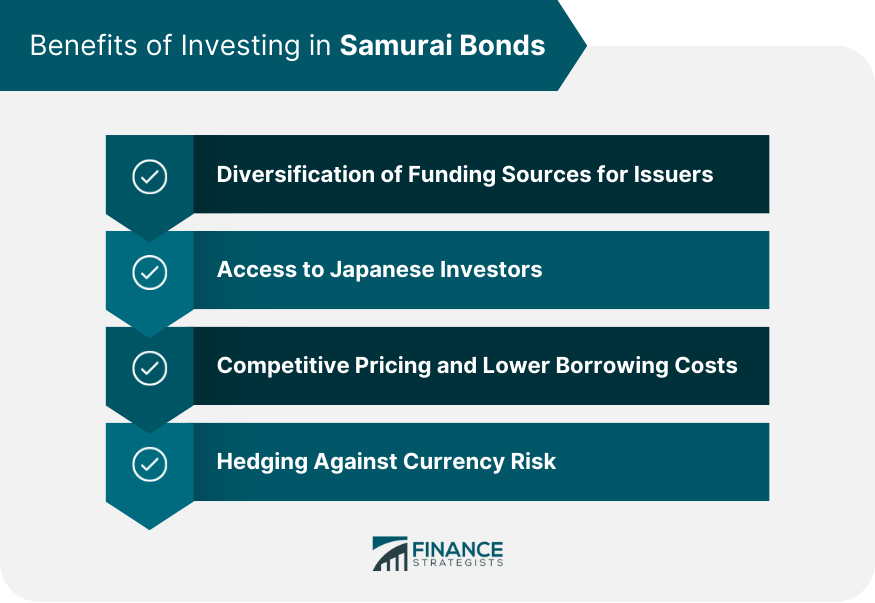

Benefits of Investing in Samurai Bonds

Diversification of Funding Sources for Issuers

Access to Japanese Investors

Competitive Pricing and Lower Borrowing Costs

Hedging Against Currency Risk

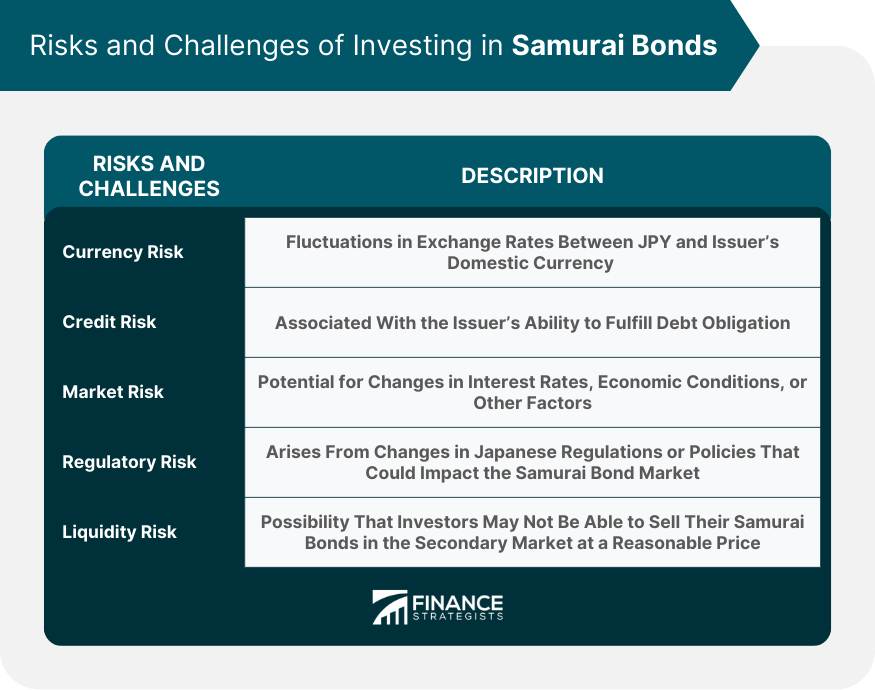

Risks and Challenges of Investing in Samurai Bonds

Currency Risk

Credit Risk

Market Risk

Regulatory Risk

Liquidity Risk

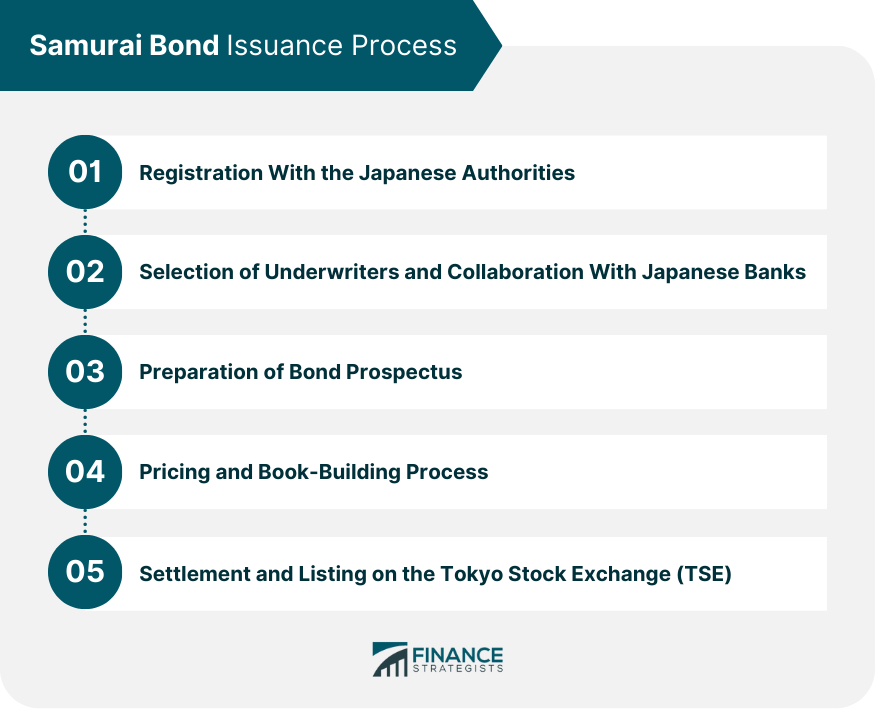

Samurai Bond Issuance Process

Registration With the Japanese Authorities

Selection of Underwriters and Collaboration With Japanese Banks

Preparation of Bond Prospectus

Pricing and Book-Building Process

Settlement and Listing on the Tokyo Stock Exchange (TSE)

Key Players in the Samurai Bond Market

Issuers

Investors

Underwriters and Market-Makers

Japanese Regulatory Authorities

Market Trends and Developments of Samurai Bonds

Growth of the Samurai Bond Market

Impact of Global Economic Events on Samurai Bonds

Green and Social Samurai Bonds

Innovations and New Structures in Samurai Bonds

Conclusion

Samurai Bonds FAQs

Samurai Bonds are yen-denominated bonds issued in Japan by foreign governments, institutions, or corporations, allowing these entities to raise funds from Japanese investors.

Issuers benefit from Samurai Bonds by gaining access to the Japanese investor base, diversifying their funding sources, obtaining competitive pricing and potentially lower borrowing costs, and possibly receiving favorable tax treatment.

Samurai Bonds carry risks such as currency risk (fluctuations in exchange rates), interest rate risk (changes in interest rates), credit risk (issuer's ability to meet payment obligations), and regulatory and compliance considerations.

While Samurai Bonds are issued in Japan and denominated in yen, Yankee Bonds are issued in the U.S. and denominated in U.S. dollars, Bulldog Bonds are issued in the U.K. and denominated in British pounds, and Eurobonds are issued outside the issuer's home country and denominated in a currency other than that of the country where they are issued.

The future of Samurai Bonds will be influenced by global economic conditions, monetary policies, the growth of Environmental, Social, and Governance (ESG) Samurai Bonds, and the impact of technological advancements on the Samurai Bond market.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.