Premium bonds are a type of bond that is sold at a price higher than their face value, also known as the par value. These bonds tend to have a higher coupon rate than the current market interest rate, making them more attractive to investors and thus, leading to their premium pricing. Despite their higher initial cost, premium bonds can offer competitive yields over time. Premium bonds play a crucial role in the bond market by providing investors with an opportunity to earn higher profits compared to other bonds trading at par or at a discount. Moreover, they act as a useful tool for income-focused investors and serve as an effective instrument for diversifying investment portfolios. A bond is priced at a premium when its coupon rate, or the annual interest payment, is higher than the current market interest rate. This happens because investors are willing to pay more for a bond that offers higher periodic income. The yield of a bond is inversely related to its price. When a bond is sold at a premium, its yield to maturity (YTM) will be less than its coupon rate because the investor paid more upfront for the bond. Over time, as the bond approaches maturity, its price will converge to its face value, causing the yield to increase towards the coupon rate. Premium bonds pay interest to bondholders based on the face value of the bond, not the premium paid. Therefore, the effective yield of a premium bond can be less than the stated interest rate, as the premium cost dilutes the bond's overall returns. The premium paid for the bond is gradually amortized over the bond's life, effectively reducing the investor's taxable income. This is an important aspect to consider when calculating the bond's yield to maturity. When interest rates fall, a chain reaction occurs within the bond market. The new bonds issued in this low-interest-rate environment come with correspondingly lower coupon rates. This development makes older, existing bonds with their higher coupon rates look increasingly attractive. Investors seeking greater returns through interest income prefer these older bonds, resulting in increased demand. This heightened demand consequently pushes their market prices above their face value, transforming them into premium bonds. During periods of economic uncertainty or instability, investors tend to seek safer investment avenues that provide stable returns. Bonds, particularly premium bonds, often fit this bill. They are considered less risky than equities and offer the added advantage of regular income in the form of coupon payments. Therefore, during economically turbulent times, investors may gravitate towards bonds, including premium bonds, thereby increasing their demand and pushing their prices into premium territory. Various factors, such as changes in monetary policy, the creditworthiness of issuers, and global economic trends, can impact the demand and supply of bonds. When demand for bonds with certain desirable characteristics intensifies, it can drive up their prices. For instance, high credit quality is one such characteristic that investors often seek. Bonds issued by entities with high credit ratings are deemed safer as they bear a lower risk of default. Hence, investors might be willing to pay a premium for such bonds. Similarly, bonds with longer maturities could be in demand in a low-interest-rate environment, as they lock in the interest rate for a longer period. If these bonds are in limited supply, they may also be sold at a premium. These are the periodic interest payments made to bondholders throughout the bond's life. This feature can be incredibly beneficial for investors, especially those who depend on their investment income to support their regular cash flow needs, such as retirees. The steady and predictable income makes premium bonds a desirable investment for income-focused portfolios. This type of risk arises when an investor might have to reinvest income at a lower rate than the original investment, usually due to a fall in market interest rates. With premium bonds, the coupon rate is fixed and remains unchanged for the bond's life, even if the market rates decrease. Therefore, the bondholder continues to receive high-interest income, effectively reducing their exposure to reinvestment risk. The premium, which is the amount paid over and above the face value of the bond, can be amortized over the bond's lifespan. This gradual reduction of the premium effectively lowers the investor's taxable income, providing a tax benefit that could make premium bonds an even more attractive investment proposition. The premium price of these bonds, which is above their face value, demands more capital upfront. This might deter some investors, particularly those with a limited investment budget or those unwilling to allocate a larger portion of their capital to a single investment. This risk represents the potential for loss resulting from a change in interest rates. If market rates rise significantly, the price of a premium bond might decline. If the bondholder decides to sell the bond before its maturity under such circumstances, they may experience capital losses, degrading the investment's overall return. YTM represents the total return an investor can expect if the bond is held until it matures. Given the higher purchase price of premium bonds, their YTM is usually lower compared to bonds purchased at par or at a discount. Therefore, despite the higher coupon payments, the actual return on premium bonds might not be as attractive once the premium price is factored in. This could potentially limit the investment's attractiveness to investors looking for a higher overall yield. Investors should have a good understanding of the bond market and interest rate trends before investing in premium bonds. This knowledge can help them anticipate price movements and make informed decisions. Investors should also assess their risk tolerance. Those with a lower risk appetite prefer premium bonds for their steady income, despite their higher upfront cost. Including premium bonds in an investment portfolio can provide diversification benefits. They can help reduce the portfolio's overall risk and ensure a steady stream of income. It is important to distinguish between US premium bonds and UK Premium Bonds. In the US context, premium bonds refer to bonds sold above their face value, offering a higher coupon rate. On the other hand, UK Premium Bonds do not pay interest. Instead, the interest that would be paid is pooled into a prize fund, and cash prizes are awarded through a monthly lottery draw. The prizes are tax-free, and each bond has an equal chance of winning, regardless of when or where it was purchased. This lottery system makes UK Premium Bonds a unique savings product compared to other bonds, including US premium bonds. Premium bonds are a unique type of bond that is sold at a price higher than its face value. They provide investors with an opportunity to earn competitive yields and diversify their investment portfolios. Premium bonds offer benefits such as higher coupon payments, lower reinvestment risk, and tax advantages. However, potential drawbacks include the higher initial investment required and a lower yield to maturity compared to other bonds. To invest in premium bonds successfully, investors should have a good understanding of the bond market, assess their risk tolerance, and consider diversifying their portfolios. It's also important to differentiate them from UK Premium Bonds, which operate as a savings product with cash prizes awarded through a monthly lottery draw. Premium bonds provide a unique opportunity for investors seeking stable returns and a gradual reduction of taxable income over the bond's lifespan. By carefully assessing the market, understanding risk tolerance, and considering the specific features of premium bonds, investors can make informed decisions and potentially benefit from their competitive yields and long-term advantages.What Are Premium Bonds?

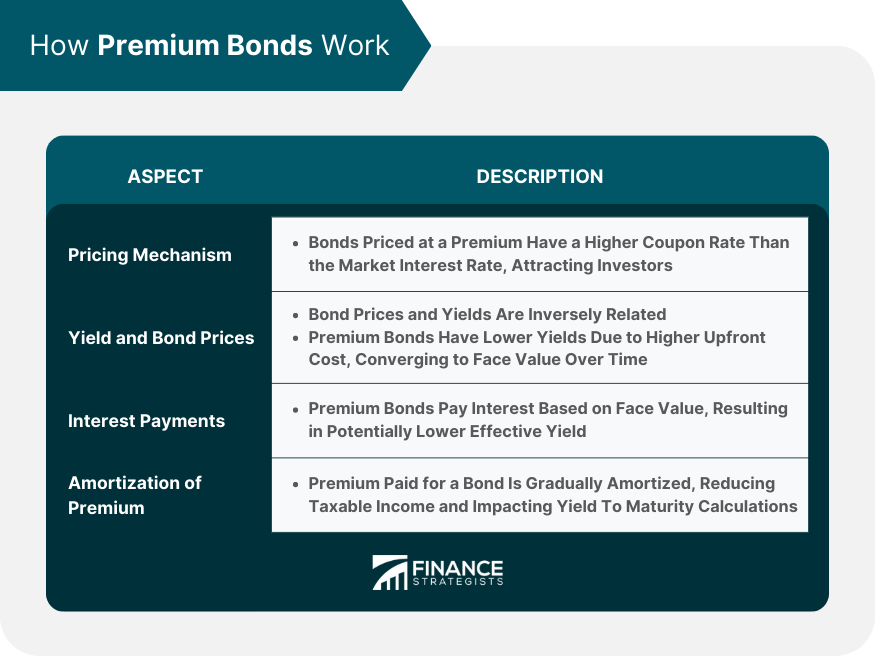

How Premium Bonds Work

Pricing Mechanism

Yield and Bond Prices

Interest Payments

Amortization of Premium

Factors Influencing Premium Bonds

Interest Rate Fluctuations

Economic Conditions

Market Demand and Supply

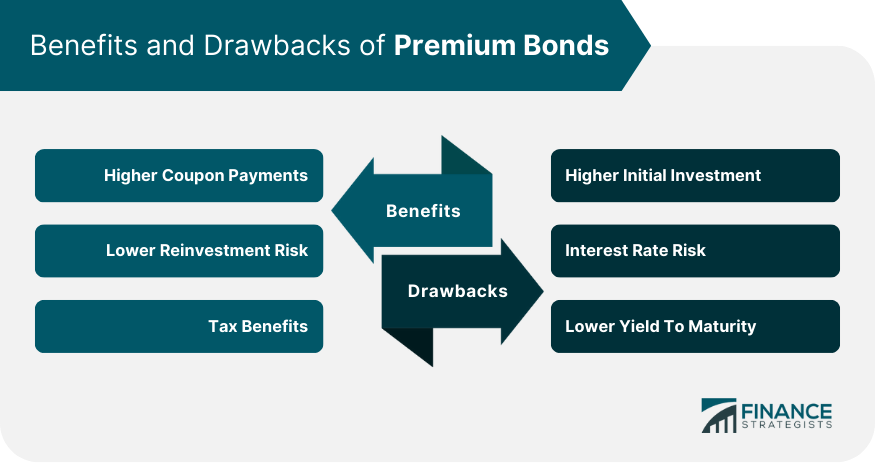

Benefits of Premium Bonds

Higher Coupon Payments

Lower Reinvestment Risk

Tax Benefits

Drawbacks of Premium Bonds

Higher Initial Investment

Interest Rate Risk

Lower Yield To Maturity

Tips for Investing in Premium Bonds

Understanding the Market

Assessing Risk Tolerance

Diversification

US Premium Bonds vs UK Premium Bonds

Final Thoughts

Premium Bonds FAQs

The main difference is that premium bonds are sold at a price higher than their face value, while regular bonds are sold at their face value or at a discount. This premium pricing of premium bonds is due to their higher coupon rate compared to the prevailing market interest rate.

Several factors can influence the pricing of premium bonds, including interest rate fluctuations, economic conditions, and market demand and supply. Changes in monetary policy, the creditworthiness of issuers, and global economic trends can all impact the demand and supply of premium bonds.

Premium bonds reduce taxable income through a process called amortization. The premium paid for the bond is gradually amortized over the bond's life, resulting in a lower taxable income for the investor. This can be a significant tax benefit, making premium bonds more attractive for certain investors.

Premium bonds are generally considered safer than equities, but like any investment, they carry a level of risk. The risk associated with premium bonds includes interest rate risk, where rising interest rates can lead to a decline in the bond's price. It's important for investors to assess their risk tolerance and consider their individual financial goals before investing in premium bonds.

Premium bonds exist in various countries, but it's important to note that the specific features and characteristics may vary. For example, in the United States, premium bonds refer to bonds sold above face value with a higher coupon rate. On the other hand, in the United Kingdom, premium bonds operate as a savings product with cash prizes awarded through a monthly lottery draw. It's essential to understand the specific context and regulations of premium bonds in the country of interest before investing.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.