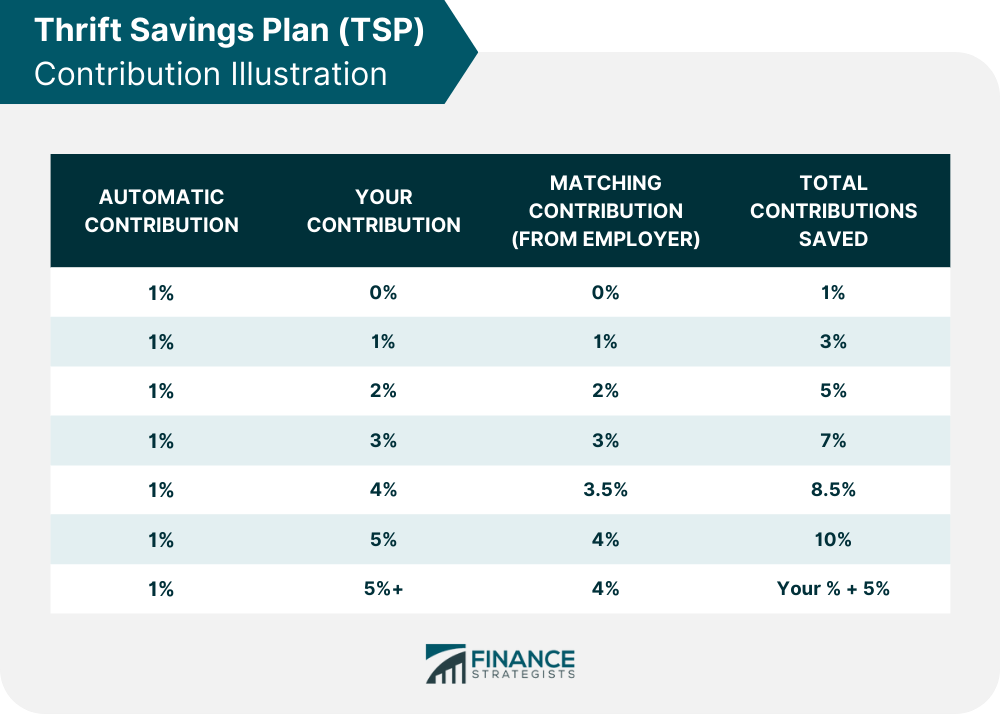

If you are a federal employee or serve in the military, you have probably heard of the Thrift Savings Plan at one of the mandatory finance briefings you have attended. The TSP, a key part of your federal benefits package, is a valuable tool to help you grow your retirement savings. It is a unique kind of account and there are some specific tax advantages to using it. To fully understand the tax implications of the TSP there are several key things to know. In 2024, TSP participants can contribute up to $23,000 annually and $30,500 if they are over the age of 50. The total combined contributions, including both employee and employer amounts, can reach a maximum of $69,000. This is especially important for those receiving combat pay, as they may be able to contribute more than the standard $23,000 limit due to special tax rules. When you log in to your MyPay account you will find two options to put your deferred compensation into. There is a Traditional and Roth option. Both work towards retirement, but are treated differently when it comes to taxation. When you put money into this bucket, you get to deduct your contributions against your income. This provides an immediate reprieve when it comes to the tax liability of your income. By taking this benefit now, it means you will have to pay taxes later when you begin to withdraw your money. Say you reach age 59.5 and want to take some money out. All of that money will be taxed at your ordinary income tax rate. So if you are in the 12% tax bracket and take out $10,000 you will pay $1,200 in taxes. If you are in the 32% tax bracket, you could pay $3,200 in taxes. A Roth TSP means you do not get to deduct your contribution against your income. Because you pay taxes on that money now, when you are older and take that money out, all of it is tax-free. It is important to note that right now, the government only contributes to Traditional TSP accounts. So any matching contributions will go there. Keep that in mind when you are thinking about what will be taxable in retirement. When choosing between TSP accounts, a key question to ask yourself is: "Is my tax bracket higher now or will it likely be lower in retirement?" This answer can help you decide whether to pay taxes now (Roth TSP) or in the future (Traditional TSP). Only federal employees and military personnel enrolled in the Blended Retirement System(BRS) get matching contributions in their TSP accounts. Both of these groups will receive an automatic 1% contribution to their TSP from the government even if they do not contribute anything. Beyond the 1%, the match goes like this: dollar-for-dollar matching on the first 3% of your salary and 50% of each dollar contributed for the next 2% contributed. Here is a graphic to help you visualize the difference: Since SECURE 2.0 was passed, the new default savings contribution has been increased to 5%. This means that unless you elect to contribute 5% to your TSP, it is likely that you are already getting the full match. Since this money is intended for retirement, the IRS has rules to encourage long-term saving. Early withdrawals from your TSP may incur an additional 10% penalty unless one of the following circumstances applies: You are Age 59.5 or older You Died Qualify as separated from service in the year you turn 55 Total Disability as defined by the Internal Revenue Service (IRS), not Veterans Affairs (VA) For medical expenses to the extent they exceed 7.5% of your Adjusted Gross Income (AGI) Substantially equal payments made over your life expectancy Payments made due to a qualified domestic relations court order (QDRO) If you are terminally ill Up to $5,000 for the birth or adoption of a child If none of these conditions apply, you may face a penalty in addition to any taxes owed on the withdrawal. When a service member is deployed to a designated combat zone, they have unique options that can significantly boost their TSP savings. Increased Contribution Limits: Combat zone pay can be exempt from federal income tax. This means you may be able to contribute significantly more to your TSP than the standard annual limits, as those limits do not apply to your tax-exempt income. Tax-Free Contributions and Growth: Not only are eligible contributions tax-free when made, but any investment growth on those contributions is also tax-free, even after leaving the combat zone. A popular topic regarding the TSP is its loan feature. A participant essentially lend themselves money from their TSP. The amount borrowed must be at least $1,000 and you can borrow up to 50% of the balance of your own contributions plus earnings (not including vested matching contributions.) The maximum you can take is $50,000 but this is possible only if you have $100,000 in your own contributions and earnings in the account. TSP loans function like regular loans – you will pay interest, though the rate is considered fair. Currently, that interest rate is 4.375%. The good news is that the interest you pay goes back into your own TSP account. While you can borrow from your TSP for various reasons, you cannot use these loans to directly fund your retirement. TSP loans can impact your retirement savings growth in two ways: Reduced Cash Flow: Loan payments will decrease your available cash for other expenses. Lost Growth: Money used to repay the loan misses out on potential investment growth within your TSP. TSP is subject to RMDs. An RMD is an amount that must be withdrawn from your account starting at Age 73. If you do not withdraw this amount, you will have to pay a 25% penalty. This RMD requirement applies to both Roth and Traditional TSPs and comes with tax considerations if you have a lot of money in a Traditional TSP. Imagine having $500,000 in a traditional TSP and you are age 73. You would withdraw $18,868. This would be in addition to your income from your pension and any other sources. It could affect your medicare premiums and tax bracket. A common strategy is using Roth conversions to help pre-emptively mitigate these possible problems. This strategy essentially pays taxes now to convert money from a traditional to a Roth account. This is not currently available to do within a TSP and has to be done through the use of an IRA. Also, keep in mind that Roth conversions, while potentially beneficial, can trigger significant taxes in the year they are done. TSP accounts are assets and in the event of death, you should make sure you have beneficiaries designated. Be sure to keep these updated as what you put on the account will trump anything your will designates. The TSP is a powerful tool to secure your financial future. Understanding its options, tax benefits, and contribution strategies is crucial for maximizing your retirement savings. Be sure to weigh the pros and cons of Traditional and Roth options, take full advantage of employer-matching contributions, and carefully consider any early withdrawals or loans to avoid penalties and maximize growth. Remember, the TSP is a key part of your overall retirement plan, and along with your pension and other benefits, it can help you achieve the comfortable retirement you deserve. As everyone's financial situation is unique, it is best to consult a financial advisor or tax professional for advice tailored to your specific needs.Thrift Savings Plan (TSP) Overview

TSP Contribution Limits (2024)

Traditional TSP vs Roth TSP: Key Difference

Traditional TSP

Roth TSP

How to Choose

Matching Contributions

Penalties vs Taxes

Combat Zone Pay

TSP Loans

Impact on Retirement Savings

Required Minimum Distributions (RMDs)

Key Takeaways

Thrift Savings Plan (TSP) FAQs

In 2024, the standard limit is $23,000. Participants over age 50 can contribute up to $30,500 (catch-up contributions). The total combined limit for employee contributions plus employer contributions is $69,000. Combat zone pay may allow for higher contributions.

Traditional TSP: Contributions lower your current taxable income, but withdrawals in retirement are taxed. Roth TSP: Contributions are made with after-tax dollars, so withdrawals in retirement are tax-free.

Federal employees and BRS military personnel receive a 1% automatic contribution. Additional matching is available: dollar-for-dollar match on the first 3% of salary contributed, and 50% match on the next 2%.

The 10% penalty applies to TSP withdrawals before age 59½ unless specific circumstances apply (death, disability, certain medical expenses, etc.). See the full list on the TSP website.

Yes. TSP loans start at $1,000, with maximums based on your account balance. Interest is paid back into your own account, but be aware a loan reduces the amount of money growing for your retirement.