Certainly, you can file taxes early. While there is a specified deadline for tax filing, typically set around April 15th in the U.S., there isn't a strict rule about how early one can submit their returns. In fact, the Internal Revenue Service (IRS) usually starts accepting tax returns in late January. Filing early offers several advantages, including quicker tax refunds, ample time to address discrepancies, reduced risk of tax-related identity theft, and peace of mind by eliminating last-minute stress. However, it's essential to ensure that you have received all necessary tax documents, such as W-2s and 1099s, and to stay informed about any tax law changes or updates that might affect your return. By being organized and informed, early tax filing can be a smooth and beneficial process. Typically, the IRS begins accepting tax returns in late January. However, this date can vary depending on the tax year and other administrative considerations. Keeping a close watch on IRS announcements at the start of each year can provide clarity on this. Filing taxes ahead of the official deadline often results in faster processing of refunds. This accelerated processing is especially pronounced for those who choose electronic filing combined with a direct deposit option. When individuals opt for this combination, they sidestep potential postal delays, ensuring a swifter deposit of their refund amount. Moreover, early filers are also likely to experience less congestion in IRS processing, facilitating even quicker turnarounds. Submitting taxes early gives taxpayers a cushion of time to thoroughly review their returns for any discrepancies, errors, or omissions. This proactive approach provides ample opportunity to make necessary corrections before the official tax deadline. Additionally, if an issue arises that requires consultation with a tax professional, early filers have the luxury of time on their side, ensuring they can get the best advice without last-minute panic. By choosing to file their taxes promptly, individuals minimize the window of opportunity for malicious entities to engage in identity theft. The faster one's legitimate claim is on record with the tax authorities, the harder it becomes for fraudsters to submit a counterfeit return using that person's details. As a result, early tax filing becomes a proactive step in safeguarding one's financial identity, adding an extra layer of protection against potential scams. The psychological benefits of early tax filing cannot be understated. Completing and submitting tax returns well in advance provides taxpayers with a profound sense of accomplishment and relief. This preemptive action removes the looming pressure of an approaching deadline, allowing individuals to focus on other essential tasks in their lives. Furthermore, eliminating the last-minute scramble often leads to a more meticulous and error-free filing process, reinforcing the confidence that all is in order. Choosing to file taxes early can sometimes be hindered by the delayed arrival of essential tax documents. For instance, W-2s, 1099s, or other tax-related statements might not be immediately available at the beginning of the tax season. These delays can be due to various reasons, such as administrative backlogs or issues with postal services. Without these crucial documents, taxpayers might find themselves in a position where they want to file early but lack the necessary information to do so accurately. Tax laws are dynamic and subject to change based on legislative decisions and economic shifts. Filing taxes immediately after the tax season starts might mean that taxpayers are unaware of recent changes or updates that could be beneficial to their financial situation. Additionally, the IRS might release new forms or update existing ones to align with the latest tax regulations. Taxpayers who rush to file might end up using outdated forms, potentially leading to inaccuracies in their returns and potential conflicts with the tax authorities later on. The enthusiasm to get taxes out of the way can sometimes overshadow the need for careful review and accuracy. While early filing can be advantageous, it's essential that it doesn't come at the expense of precision. Filing in haste might lead to missed deductions, incorrect data entry, or overlooking significant financial transactions from the previous year. Such oversights can result in either underpaying or overpaying taxes, both of which have their own sets of complications, from incurring penalties to missing out on potential refunds. It's crucial to strike a balance between being prompt and being thorough. Embracing a structured and systematic approach to organizing tax documents can significantly facilitate the early filing process. Not only does this ensure that you have all the required information at your fingertips, but it also reduces the chances of missing out on vital deductions or credits. Implementing a yearly routine, where you start gathering tax-related documents well before the tax season kicks in, can prove to be a game-changer in ensuring a stress-free tax filing experience. It's pivotal to keep essential tax documents such as W-2s, 1099s, and receipts readily accessible. Designing dedicated storage systems, be it physical folders or digital storage spaces, can greatly streamline the retrieval process. Additionally, regular categorization and timely storage of these documents throughout the year can save significant time when the tax season arrives, eliminating the scramble to locate scattered records. Staying abreast of the latest tax reforms, new deductions, or credits is crucial to ensure maximum benefits while filing. Tax laws and provisions frequently undergo changes, and being uninformed can result in missed opportunities. Subscribing to tax news updates, attending webinars, or even joining tax-related forums can serve as effective avenues to stay informed about the ever-evolving tax landscape. These tools and experts are adept at keeping track of the newest tax laws, ensuring that your return is both accurate and optimized for the best possible refund. Furthermore, relying on recognized software or a certified professional minimizes errors, providing an added layer of assurance that your tax obligations are being met diligently. 1. Checking When the IRS and Other Tax Agencies Begin Accepting Returns: This sets the pace for early filing. 2. Gathering and Verifying All Income Sources: Ensure all streams of income are documented and accounted for. 3. Deductions and Credits: Proper understanding and application of deductions and credits can lead to significant savings. 4. Submitting Your Return: Decide between electronic submission or traditional mail. Electronic submissions are faster and often more convenient. 5. Tracking the Status: Keep tabs on the status of your submission and refund to ensure all processes go smoothly. Handling Incomplete or Missing Tax Documents: Always double-check documentation. If something is amiss, reach out to the respective agency or organization to obtain a copy or clarify information. Navigating Complex Tax Situations or Scenarios: Whether it's freelance work, investments, or international income, these intricate scenarios may require consultation with a tax professional to ensure accuracy and maximum benefits. Dealing With Errors or Corrections Post-submission: Mistakes happen. If you discover an error post-submission, you can file an amended return to correct the discrepancies. Early tax filing is a strategic approach to handling annual tax obligations, offering numerous benefits, such as faster refunds and reduced stress. However, this proactive approach requires careful planning, including meticulous organization of tax documents and a thorough understanding of relevant tax laws. While the IRS usually commences tax return acceptance in late January, it's imperative for taxpayers to ensure the receipt of all essential documents and be wary of potential pitfalls, like changes in tax laws or hasty errors. Leveraging tax software or consulting professionals can be invaluable in navigating this process with accuracy and efficiency. Despite the challenges like document delays and evolving tax norms, early filing, when approached judiciously, can provide peace of mind, financial security, and a sense of accomplishment. By understanding both the advantages and potential challenges, individuals can make informed decisions that best suit their financial situations.Understanding Early Tax Filing

Can You File Taxes Early?

Earliest Date to File

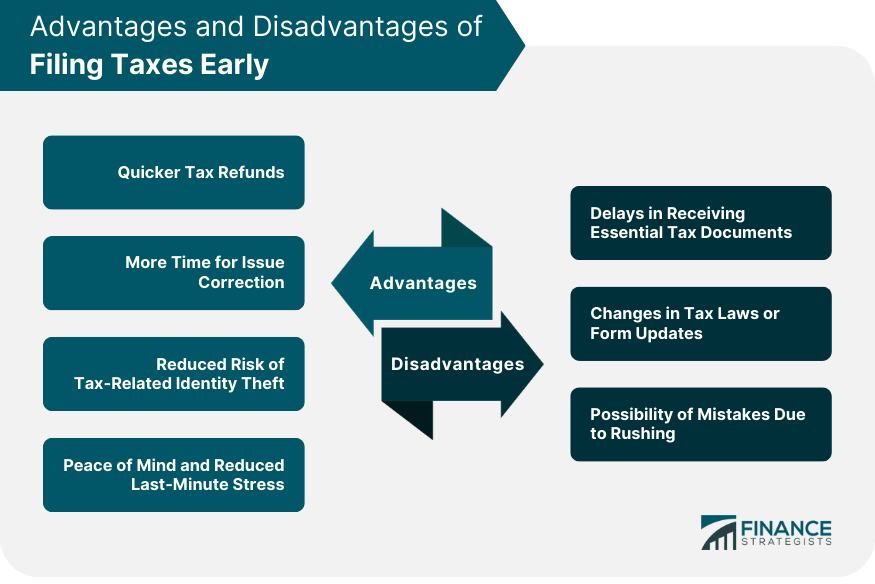

Advantages of Filing Taxes Early

Quicker Tax Refunds

More Time to Address Issues or Corrections

Reducing the Risk of Tax-Related Identity Theft

Peace of Mind and Reduced Last-Minute Stress

Possible Disadvantages of Early Tax Filing

Delays in Receiving Certain Tax Documents

Changes in Tax Laws or Updates to Forms

Possibility of Mistakes Due to Rushing

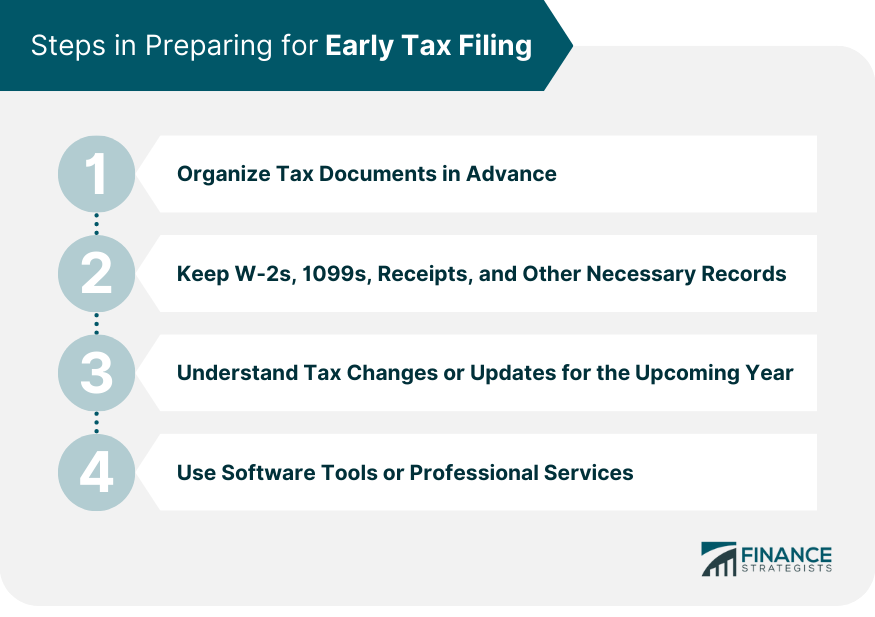

Preparing for Early Tax Filing

Organizing Tax Documents in Advance

W-2s, 1099s, Receipts, and Other Necessary Records

Understanding Tax Changes or Updates for the Upcoming Year

Using Software Tools or Professional Services

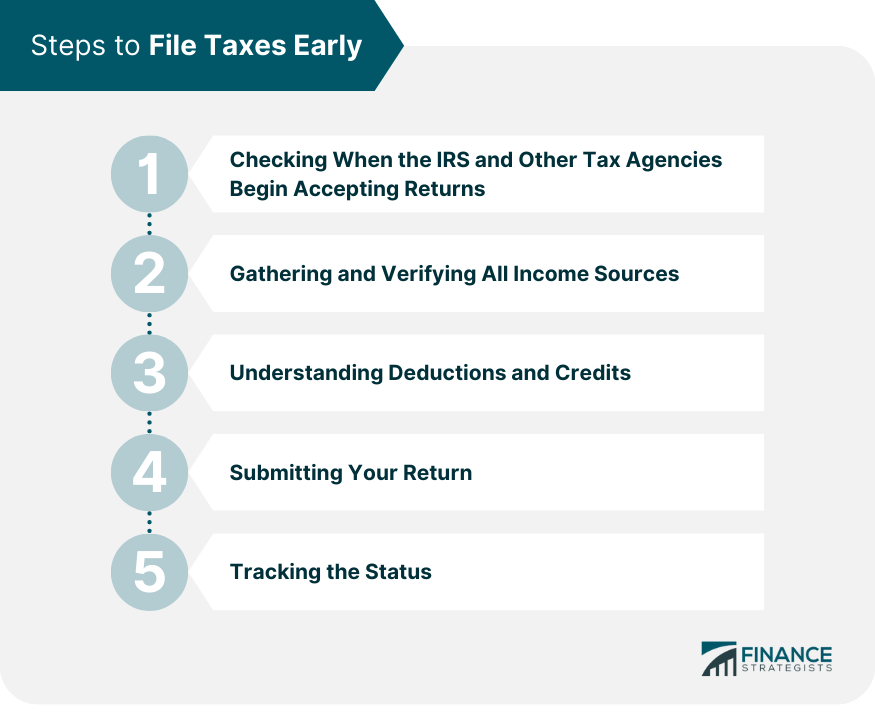

Steps to File Taxes Early

Early Tax Filing Potential Challenges and How to Address Them

Conclusion

Can You File Taxes Early? FAQs

The standard deadline for individual tax returns in the U.S. is April 15. However, if this date falls on a weekend or public holiday, the deadline might be extended to the next working day.

The IRS generally begins accepting tax returns in late January. However, this start date can vary each year, so it's crucial to monitor IRS announcements for the specific year in question.

Yes, there can be some disadvantages, including delays in receiving certain tax documents, potential changes in tax laws or updates to forms that you might miss, and the possibility of making mistakes if you rush through the process.

If you file electronically, you can track the status of your tax return and anticipated refund through online tools provided by the IRS or the respective tax software you use. For mailed returns, the tracking process may take longer.

If you identify an error post-submission, you can file an amended return to rectify the discrepancies. It's advisable to consult with a tax professional to ensure the corrections are made accurately.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.