Charitable organizations, educational institutes, religious bodies, and various other non-profit entities are collectively identified as 501(c)(3) organizations in the United States. They derive their name from Section 501(c)(3) of the U.S. Internal Revenue Code. This section specifically refers to tax-exempt, nonprofit organizations that have been approved by the Internal Revenue Service (IRS). These organizations offer a variety of services that directly or indirectly benefit the public, thus earning them their tax-exempt status. Additionally, the tax law allows donors to these entities to claim tax deductions on their donations. 501(c)(3) organizations play an integral role in society, addressing and providing solutions to community issues that might otherwise be ignored. The mission statement succinctly communicates the organization's purpose and guides its work. While it should be short, it needs to clearly articulate the organization's intentions. The goals are the measurable and time-bound objectives that the organization aims to achieve to fulfill its mission. These should be specific, achievable, relevant, and timely. A clearly defined mission and goal provide a strategic direction to the organization. They not only help the organization's members stay focused and unified in their efforts, but they also assist external stakeholders, such as donors, understand what the organization does and why it matters. It is from this standpoint that all subsequent steps for establishing the organization emerge. Most often, these organizations are set up as nonprofit corporations, but other legal structures like trusts or unincorporated associations can also be considered. The choice of legal structure significantly influences the governance, liability, and operation of the organization. A nonprofit corporation, for instance, offers the advantage of limited liability protection. This means that directors, officers, and members are not personally responsible for the organization's debts or liabilities. It also has an established structure for governance with a board of directors. On the other hand, trusts and unincorporated associations may have different benefits and constraints. Thus, one should thoroughly research and consider the implications of each option before deciding on the most suitable legal structure for their organization. The Articles of Incorporation, also known as the Certificate of Incorporation or Corporate Charter, is a document that officially recognizes the creation of a corporation. It's a crucial step in the formation of a 501(c)(3) organization. The document typically includes the organization's name, purpose, duration, and information about its initial directors or incorporators. The Articles of Incorporation must comply with the state's nonprofit corporation law and include certain provisions required for tax-exempt status by the IRS. It's often advisable to seek legal counsel while drafting this document to ensure it complies with all regulations. Once prepared, the document is filed with the appropriate state agency, often the Secretary of State's office. The board serves as the governing body for the organization, responsible for its overall strategic direction and accountability. Board members are typically responsible for hiring and overseeing the executive director or CEO, developing policies, and ensuring the organization’s financial health. The IRS requires that the organization's board be composed of individuals who are not related and have no business relationships with each other. This ensures the board operates independently and acts in the best interest of the organization. It's important to carefully select board members who are committed to the organization's mission and bring valuable skills or networks to the table. Bylaws serve as an organization's operational handbook. They outline the rules and procedures for decision-making and clarify roles and responsibilities within the organization. A typical set of bylaws will detail the composition and responsibilities of the board of directors, membership rules (if any), procedures for meetings and elections, and provisions for amending the bylaws. Creating bylaws is a collaborative process involving the organization’s board of directors. They should be written with clarity and flexibility to guide the organization’s operations effectively. Importantly, bylaws should be consistent with the organization's Articles of Incorporation and comply with state law and IRS requirements. A conflict of interest policy helps to ensure that decisions made by the organization's board members are in the organization's best interest and not influenced by personal or financial gain. The IRS highly encourages, and in some cases, requires 501(c)(3) organizations to adopt a conflict of interest policy. This policy should outline procedures for disclosing potential conflicts, define what constitutes a conflict, and detail how conflicts will be managed or avoided. It serves as a key element in maintaining public trust and ensuring ethical operation within the organization. The final step in forming a 501(c)(3) organization is to apply for tax-exempt status from the IRS by filing Form 1023 or 1023-EZ. This application is comprehensive and requires detailed information about the organization's structure, governance, and planned activities. The IRS will use this information to determine if the organization qualifies for tax-exempt status under Section 501(c)(3). The application process can be complex and time-consuming, so it's important to be thorough and accurate. The IRS often requires several months to review the application. If approved, the organization will receive a Letter of Determination stating its tax-exempt status. After achieving tax-exempt status, an organization might need to register with various state agencies depending on the state in which the organization operates and the activities it performs. This may include registering with the State Attorney General's Office, the Department of Revenue, and the Department of Labor. Registering with these agencies typically involves additional paperwork and reporting requirements. In some states, organizations may be required to register before they can begin fundraising activities. They might also need to submit annual reports or financial statements to maintain their good standing. It's important to understand and comply with state-level requirements to avoid legal issues and potential fines. Depending on the nature of its activities, a 501(c)(3) organization may also need to obtain various licenses and permits. These could include a general business license, zoning permits, health department permits (if preparing and serving food), and licenses related to conducting specific activities such as childcare, healthcare, or education. Each license or permit may have its application process and associated fees. Failure to obtain necessary licenses or permits can lead to fines, legal trouble, and even the revocation of the organization's 501(c)(3) status. Therefore, it's crucial to thoroughly research the requirements applicable to the organization’s activities and locations. Effective financial management and record-keeping are crucial to the success and sustainability of a 501(c)(3) organization. They provide transparency, enhance credibility, and help ensure compliance with legal requirements. Implementing a robust financial system involves setting up accounting systems, developing a budget, and establishing financial policies and procedures. Record-keeping is also crucial, especially for maintaining tax-exempt status. Records should be kept regarding the organization's earnings and expenses, asset and liability tracking, and documentation of board meetings and decisions. Good record-keeping practices provide a clear picture of the organization's financial health, support decision-making, and demonstrate accountability to donors, funders, and regulators. Fundraising is the lifeblood of most 501(c)(3) organizations. It allows organizations to carry out their mission and reach their goals. Strategies for fundraising can vary widely depending on the organization's size, mission, and community and might include individual donations, grants, corporate sponsorships, fundraising events, and online crowdfunding. However, it's crucial to remember that fundraising is regulated by both state and federal laws. Organizations must comply with these laws to maintain their tax-exempt status and avoid legal issues. This includes properly accounting for funds raised, acknowledging donations appropriately, and, in some cases, registering with state agencies before soliciting donations. Compliance is an ongoing obligation for 501(c)(3) organizations. This includes regular filings with the IRS and other state and local agencies, maintaining accurate financial records, and adhering to governance practices. Effective compliance helps maintain the organization's tax-exempt status and avoids penalties or the potential revocation of this status. Creating a 501(c)(3) organization involves careful planning, legal compliance, and ongoing adherence to requirements. These organizations are crucial in addressing community issues and providing valuable services. Key steps include defining the mission and goals, choosing a legal structure, filing the Articles of Incorporation, establishing a board of directors, and developing bylaws and conflict of interest policies. Obtaining tax-exempt status through the IRS application is vital. Post-formation obligations include state agency registrations, acquiring licenses and permits, and setting up robust financial and record-keeping systems. Fundraising must comply with regulations, and ongoing compliance ensures the organization maintains its tax-exempt status. Professional guidance and staying informed are essential for long-term success.What Is a 501(c)(3) Organization?

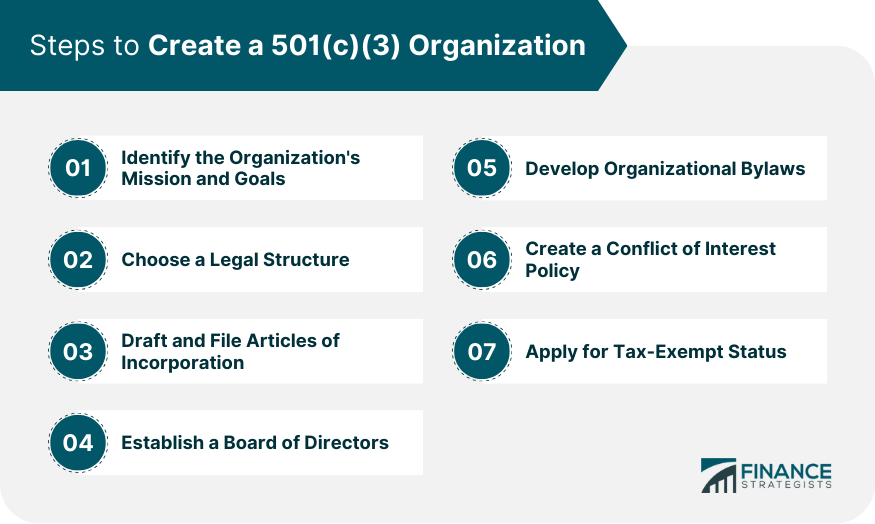

Steps to Create a 501(c)(3) Organization

Identify the Organization's Mission and Goals

Choose a Legal Structure

Draft and File Articles of Incorporation

Establish Board of Directors

Develop Organizational Bylaws

Create a Conflict of Interest Policy

Apply for Tax-Exempt Status

Post-formation Obligations

Register with State Agencies

Apply for Necessary Licenses and Permits

Establish Financial and Record-Keeping Systems

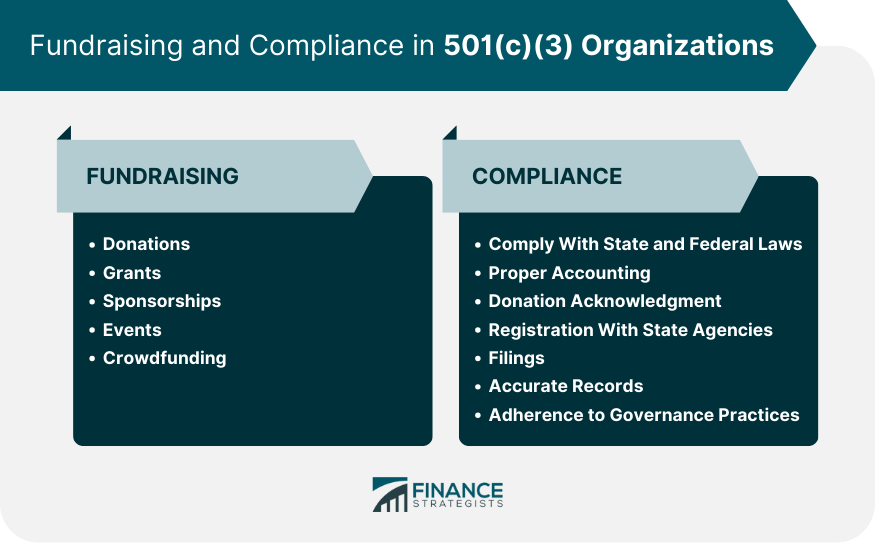

Fundraising and Compliance

Conclusion

Creating a 501(c)(3) FAQs

A 501(c)(3) organization is a tax-exempt nonprofit organization in the United States, as designated by the Internal Revenue Service. These organizations typically serve charitable, religious, educational, or similar purposes that benefit the public.

Creating a 501(c)(3) organization involves several steps, including identifying the organization's mission and goals, choosing a legal structure, drafting and filing articles of incorporation, establishing a board of directors, developing organizational bylaws, creating conflict of interest policies, and applying for tax-exempt status with the IRS.

Post-formation obligations of a 501(c)(3) organization include registering with state agencies (if required), applying for necessary licenses and permits, and establishing financial and record-keeping systems. They must also adhere to ongoing compliance and fundraising regulations.

Maintaining tax-exempt status involves meeting IRS requirements, such as operating exclusively for exempt purposes, not distributing profits to benefit private individuals, limiting lobbying activities, and refraining from participating in political campaigns. Regular filings with the IRS and other state and local agencies, maintaining accurate financial records, and adhering to governance practices are also part of this process.

Fundraising is vital for most 501(c)(3) organizations as it provides the financial resources necessary to carry out their mission and reach their goals. However, fundraising activities must comply with state and federal laws to maintain the organization's tax-exempt status and avoid legal issues.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.