501(c)(3) Church Rules refer to the regulations that govern the tax-exempt status of religious institutions under section 501(c)(3) of the Internal Revenue Code (IRC) in the United States. To qualify for this status, a religious Institution must be organized and operated exclusively for religious, educational, scientific, or charitable purposes and must not engage in any activity that benefits any private individual or shareholder. In addition, the organization must not participate in political campaigning or lobbying activities. 501(c)(3) tax-exempt status provides a number of benefits to religious organizations. These include exemption from federal income tax, the ability to receive tax-deductible contributions from donors, eligibility for government grants and funding, and other financial benefits. To obtain 501(c)(3) status, a religious organization must meet certain requirements and follow certain procedures. These include registering with the IRS and filing Form 1023, Application for Recognition of Exemption Under Section 501(c)(3) of the Internal Revenue Code. Form 1023 is a comprehensive application that requires detailed information about the organization's activities, governance, finances, and operations. The application must include a statement of the organization's religious beliefs and practices, as well as its history, mission, and objectives. It must also include a detailed financial statement and a statement of the organization's activities, including any political or lobbying activities. The application process can be complex and time-consuming and requires careful attention to detail. Special considerations may apply to churches that are seeking 501(c)(3) status, including the fact that they may be exempt from filing a Form 1023 if they meet certain requirements. Once a religious organization obtains 501(c)(3) status, it must comply with the rules and regulations that govern that status. Qualification Requirements: A religious organization must be organized and operated exclusively for religious, educational, scientific, or charitable purposes, and must not benefit any private individual or shareholder. Application for Recognition of Exemption: To obtain tax-exempt status under 501(c)(3), a religious organization must file Form 1023, Application for Recognition of Exemption Under Section 501(c)(3) of the Internal Revenue Code, with the IRS. Prohibition on Political Campaign Intervention: Religious organizations are prohibited from endorsing or opposing political candidates or political parties and cannot make donations to political campaigns. Limits on Lobbying Activities: Religious organizations may engage in some lobbying activities but are subject to limits on the amount of time and resources they can devote to such activities. Reporting Requirements: Religious organizations must file annual information returns with the IRS, such as Form 990, and make their financial records available to the public upon request. Maintenance of Accurate Financial Records: Religious organizations must maintain accurate financial records and retain them for a certain period of time. Exceptions to 501(c)(3) Church Rules: Exceptions to the 501(c)(3) Church Rules exist, such as for small churches, churches that engage in nonpartisan voter education activities, and churches that provide housing allowances to ministers. The penalties for noncompliance with 501(c)(3) Church Rules can vary depending on the severity and frequency of the violation. For example, religious organizations that engage in prohibited political activity, such as endorsing or opposing political candidates, may be subject to a penalty of up to 5% of the amount spent on the activity, up to a maximum of $10,500. In addition to penalties, religious organizations that fail to comply with 501(c)(3) Church Rules may also be subject to fines and legal action. For example, if an organization fails to file annual information returns with the IRS for three consecutive years, its tax-exempt status will automatically be revoked. Loss of tax-exempt status can be particularly damaging for religious organizations, as it can result in the organization being required to pay federal income tax and losing its eligibility for tax-deductible contributions. This can have significant financial consequences and affect the organization's ability to operate and serve its community. To avoid penalties and loss of tax-exempt status, religious organizations with 501(c)(3) tax-exempt status must understand and comply with the rules and regulations that govern their status. This includes avoiding prohibited political activity, maintaining accurate financial records, filing annual information returns with the IRS, and other requirements. Religious organizations that are unsure about the rules and regulations or need assistance with compliance should seek the guidance of experienced tax professionals or attorneys. By staying informed and taking proactive steps to comply with 501(c)(3) Church Rules, religious organizations can protect their tax-exempt status and continue to serve their communities. There are some exceptions to the 501(c)(3) Church Rules. For example, small churches with gross receipts of less than $5,000 are automatically exempt from the requirement to file Form 1023 and are granted tax-exempt status by the IRS. Additionally, churches that engage in political activities may be exempt from the prohibition on political campaign intervention under certain circumstances. For example, churches can engage in nonpartisan voter education activities and distribute nonpartisan voter guides that compare the candidates' positions on issues. Another exception to the 501(c)(3) Church Rules is the provision of housing allowances to ministers. Under certain conditions, ministers may exclude from their income the fair rental value of a home provided by the church, as well as certain utilities and other expenses related to the home. 501(c)(3) Church Rules offer numerous advantages that include tax exemption, tax-deductible contributions, eligibility for grants and funding & credibility and transparency. One of the primary benefits of obtaining 501(c)(3) status is that the religious organization becomes exempt from paying federal income tax on its income. This can save religious organizations a considerable amount of money, which they can use to fund their programs and activities. Another benefit of 501(c)(3) status is that donations made to religious organizations are tax-deductible for the donors. This can encourage individuals and businesses to give more generously to religious organizations, knowing that their contributions will be tax-deductible. Religious organizations with 501(c)(3) status are eligible to apply for government grants and funding, as well as private foundation grants and funding. This can provide significant financial support for the organization's programs and activities. Obtaining 501(c)(3) status can enhance the credibility and transparency of a religious organization, as it is required to maintain accurate financial records and make them available to the public upon request. It is important for religious organizations to carefully consider these disadvantages before seeking tax-exempt status under 501(c)(3). One of the major disadvantages of 501(c)(3) status is that religious organizations are prohibited from endorsing or opposing political candidates or political parties and cannot make donations to political campaigns. This can limit the organization's ability to advocate for certain political causes or to support certain candidates. Religious organizations with 501(c)(3) status are required to comply with various rules and regulations, such as reporting requirements and maintenance of accurate financial records. This can be time-consuming and costly for the organization, as it may need to hire professionals to help with compliance. Religious organizations with 501(c)(3) status are limited in their ability to engage in profit-making activities, as these activities may jeopardize their tax-exempt status. This can limit the organization's ability to generate revenue and fund its programs and activities. Religious organizations with 501(c)(3) status are required to make their financial records available to the public upon request. This can limit the organization's privacy and confidentiality. 501(c)(3) Church Rules are a set of regulations that govern the tax-exempt status of religious organizations in the United States. To obtain and maintain tax-exempt status, religious organizations must meet certain qualifications. Further, they must comply with various rules and regulations, including the prohibition of political campaign intervention, limits on lobbying activities, reporting requirements, and maintenance of accurate financial records. While exceptions to these rules exist, they are limited and subject to strict conditions. Noncompliance with 501(c)(3) Church Rules can result in penalties, fines, or loss of tax-exempt status. Therefore, it is crucial for religious organizations to seek the guidance of experienced tax professionals or attorneys and use available resources from the IRS and other organizations to ensure compliance with these rules and regulations. By following the 501(c)(3) Church Rules, religious organizations can maintain their tax-exempt status and continue to serve their communities while staying in compliance with the law.What Are 501(c)(3) Church Rules?

Requirements for Obtaining 501(c)(3) Church Status

Compliance with 501(c)(3) Church Rules

Penalty for Failing to Comply With 501(c)(3) Church Rules

Exceptions to 501(c)(3) Church Rules

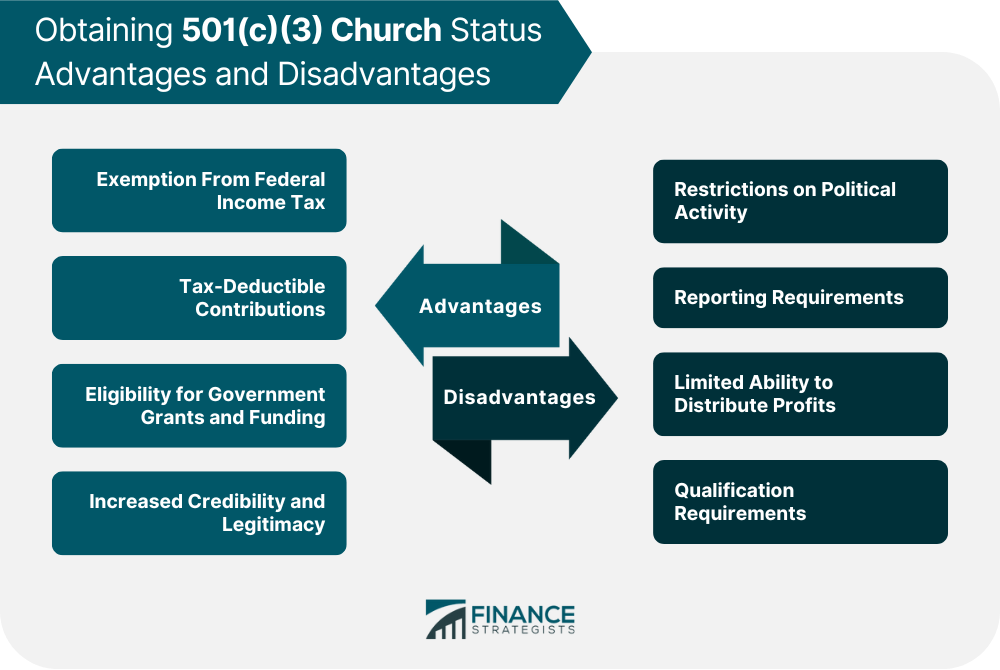

Advantages of Obtaining 501(c)(3) Church Status

Tax Exemption

Tax-Deductible Contributions

Eligibility for Grants and Funding

Credibility and Transparency

Disadvantages of Obtaining 501(c)(3) Church Status

Limitations on Political Activity

Compliance Requirements

Limited Profit-Making Opportunities

Public Disclosure Requirements

Final Thoughts

501(c)(3) Church Rules FAQs

No, religious organizations with 501(c)(3) tax-exempt status are prohibited from endorsing or opposing political candidates or political parties and cannot make donations to political campaigns.

Noncompliance with 501(c)(3) Church Rules can result in penalties, fines, or loss of tax-exempt status. Penalties can vary depending on the type and severity of the violation.

Yes, there are exceptions to the 501(c)(3) Church Rules, such as for small churches, churches that engage in nonpartisan voter education activities, and churches that provide housing allowances to ministers.

Religious organizations can obtain 501(c)(3) tax-exempt status by filing Form 1023, Application for Recognition of Exemption Under Section 501(c)(3) of the Internal Revenue Code, with the IRS.

Benefits of 501(c)(3) tax-exempt status for religious organizations include exemption from federal income tax, the ability to receive tax-deductible contributions from donors, eligibility for government grants and funding, and increased credibility and legitimacy.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.