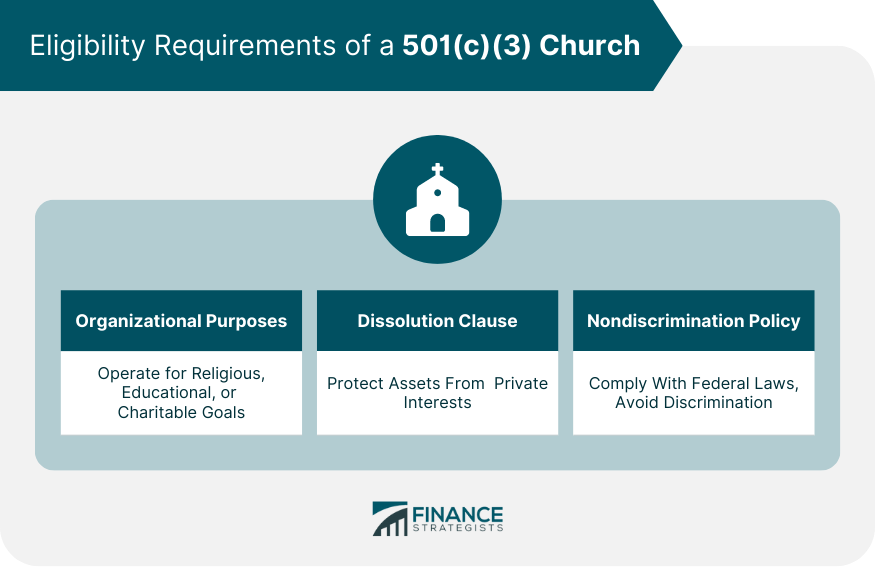

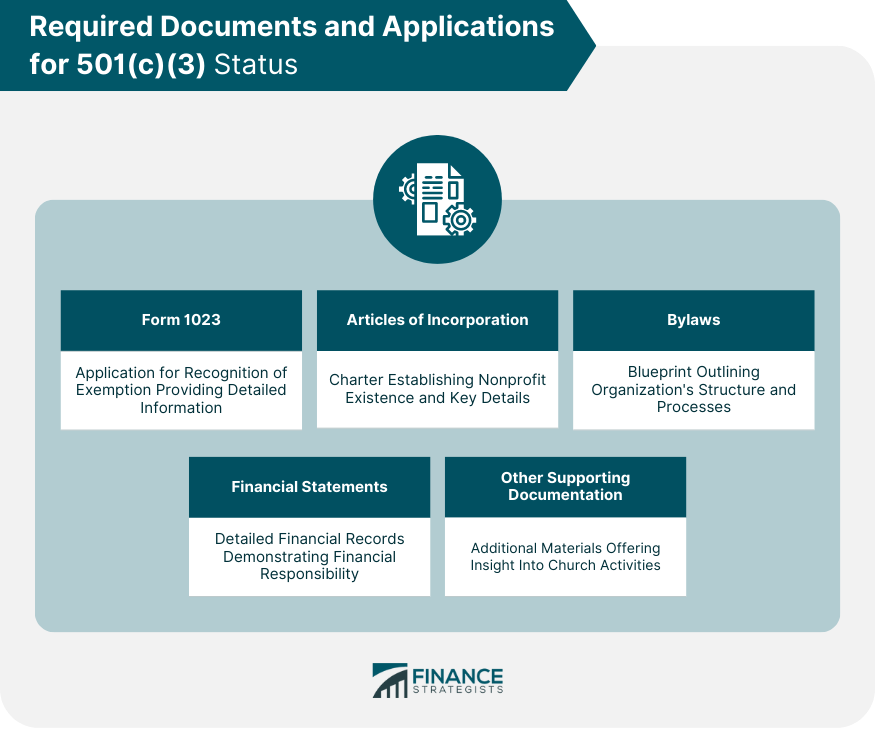

501(c)(3) churches are required to adhere to all of the IRS protocols outlined in section 501(c)(3) of the Internal Revenue Code. In particular, 501(c)(3) organizations must not engage in political activity or lobbying or else risk their tax exempt status. Having a 501(c)(3) status is vital for churches as it underscores their commitment to serving public interests. This status not only provides the church with exemption from federal income tax but also encourages donors' generosity, as their contributions become tax-deductible. This status builds a bridge of trust between the church, the state, and potential benefactors. Securing a 501(c)(3) status requires fulfilling certain organizational and operational prerequisites. These essential elements serve as the bedrock of your church's eligibility for tax-exempt status. A 501(c)(3) church must operate primarily for religious, educational, or charitable purposes. This is often articulated in the organization's mission statement, underscoring the church's commitment to serving a public interest. The church's articles of incorporation must include a dissolution clause stating that upon dissolution, the organization's assets will be distributed for an exempt purpose, to the federal government, or to a state or local government for a public purpose. This clause safeguards the church's assets from being used for private interests. The church must comply with federal laws regarding nondiscrimination. This policy implies that the church should not discriminate on the basis of race, color, national origin, sex, age, or disability in its programs, activities, and employment practices. Applying for 501(c)(3) status demands an assemblage of required documents that portray the church's structure, operations, and financial activities. Form 1023, the Application for Recognition of Exemption, is a crucial document for obtaining 501(c)(3) status. It provides the IRS with detailed information about the church's organizational structure, activities, finances, governance, and compliance with tax laws. Articles of Incorporation serve as a charter that establishes the existence of your nonprofit in your state. They typically include essential details such as the organization's name, address, purpose, dissolution clause, and information about the initial board of directors. The bylaws of your church serve as a blueprint guiding your operations. They detail the structure of your organization, including board roles, decision-making processes, meeting procedures, and more. Your church must provide financial statements outlining your financial activities. These documents, including balance sheets and income statements, help demonstrate your church's financial responsibility and integrity. Other documents, such as a detailed business plan or fundraising plan, might be required. These materials provide the IRS with a clearer understanding of your church's activities, strategies, and financial sustainability. Compliance with IRS regulations is imperative to maintaining your 501(c)(3) status. There are several obligations and restrictions to keep in mind. 501(c)(3) organizations are required to file an annual information return, Form 990, with the IRS. However, churches are generally exempt from this requirement unless they have unrelated business income. Certain activities are prohibited for 501(c)(3) organizations, including participation in political campaigns on behalf of or in opposition to any candidate for public office. Violation of these prohibitions can result in the revocation of tax-exempt status. To maintain tax-exempt status, a church must ensure that its earnings do not inure to the benefit of any private individual or shareholder. Furthermore, the organization must not operate for the benefit of private interests. While 501(c)(3) organizations may engage in some lobbying, it must not constitute a substantial part of their activities. Additionally, direct or indirect participation in political campaigns on behalf of or in opposition to any candidate for public office is strictly prohibited. Income from a regularly carried-on trade or business that is not substantially related to the organization's exempt purpose may be subject to unrelated business income tax (UBIT). However, there are several exceptions and exclusions to this rule. Effective budgeting and financial planning allow your church to allocate resources wisely, ensure financial sustainability, and achieve your strategic objectives. They also contribute to the transparency and accountability of your organization. Internal controls and oversight mechanisms ensure the accuracy of your financial records, protect assets, and prevent fraud. They include procedures for authorization, record keeping, asset custody, and reconciliation. Transparent reporting of your church's financial activities builds trust with members, donors, and the public. Regular financial reports, including those to the IRS, should be accurate, timely, and in compliance with applicable laws and standards. A 501(c)(3) status demonstrates a church's commitment to serving public interests and allows for tax-deductible donations. Eligibility requirements include organizational purposes that emphasize religious, educational, or charitable activities, a dissolution clause to protect assets, and compliance with nondiscrimination policies. Necessary documents such as Form 1023, articles of incorporation, bylaws, and financial statements must be provided during the application process. Compliance with IRS regulations is essential, including annual reporting obligations, avoidance of prohibited activities, prevention of private benefit and inurement, limitations on lobbying and political activities. Effective record-keeping, financial management, and transparency contribute to the church's integrity and accountability. By adhering to these requirements, churches can maintain their tax-exempt status, foster trust with stakeholders, and continue serving their communities with financial responsibility and impact.What Are the 501(c)(3) Church Requirements?

Eligibility Requirements of a 501(c)(3) Church

Organizational Purposes

Dissolution Clause

Nondiscrimination Policy

Required Documents and Applications

Form 1023

Articles of Incorporation

Bylaws

Financial Statements

Other Supporting Documentation

Compliance With IRS Regulations

Annual Reporting Obligations

Prohibited Activities

Private Benefit and Inurement

Lobbying and Political Activities

Unrelated Business Income

Record-Keeping and Financial Management

Budgeting and Financial Planning

Internal Controls and Oversight

Reporting and Transparency

Conclusion

501(c)(3) Church Requirements FAQs

A 501(c)(3) organization is a non-profit organization with tax exempt status that is dedicated to the general well-being of society.

501(c)(3) churches must adhere to all of the IRS protocols outlined in section 501(c)(3) of the Internal Revenue Code. In particular, they must not engage in political activity or lobbying or else risk their tax exempt status.

A 501(c)(3) organization is tax exempt so long as it remains true to its stated mission and remains compliant with the IRS.

501(c)(3) is the internal revenue code (IRC) section for organizations with tax exempt status. 501(c)(3) falls under internal revenue code 501(c).

To maintain their tax-exempt designation, churches must adhere to all applicable laws, including filing annual informational returns with the IRS and maintaining accurate financial records. Additionally, churches should ensure that their activities are consistent with their stated mission and purpose, and that they do not engage in any prohibited activities (such as supporting political candidates)

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.