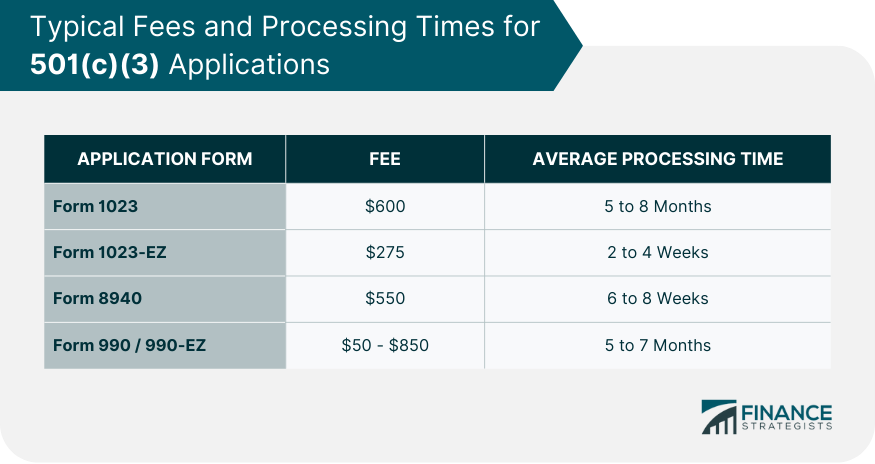

The amount of time it will take to get an application for 501(c)(3) status approved depends on the size and complexity of the operation. Typically, the Internal Revenue Service (IRS) can issue a decision within 3 to 5 months, but it is not unheard of for larger operations to take up to 12 months. Organizations seeking tax-exempt status must fill out and submit Form 1023 - Application for Recognition of Exemption Under Section 501(c)(3) to the IRS. This form is the primary document used by the IRS when determining an organization’s eligibility for tax-exempt status. Before starting the process, organizations should review the Form 1023-EZ Eligibility Worksheet to determine if they meet all requirements for filing this shorter version of Form 1023. Organizations that do not meet certain criteria must file Form 1023 instead. Form 1023 can be found on the IRS website. All questions on this form must be answered properly in order for it to be accepted by the IRS, so it is important to make sure they have been filled out accurately and include any necessary documents or attachments. Instructions can also be found on the website along with a list of required documents that organizations must provide in order to receive approval from the IRS. The completed form should then be mailed with any required paperwork to the address provided in section 7 of Form 1023. It is essential to note that processing after submission may take several weeks, even if no errors occur during filing. Organizations must provide supporting documentation such as Articles of Incorporation, bylaws, financial statements, and other forms depending on specific criteria met by individual organizations in order to receive approval from the IRS. A full list of necessary documents can be found on page 6 of Form 1023 Instructions. When filing for charitable status under Section 501(c)(3) of the Internal Revenue Code, organizations must pay fees to the IRS. The fees vary based on the type and size of the organization. Fees for Form 1023 are a flat rate of $600, while the fee for Form 1023-EZ is at $275. Organizations that are recognized exempt from Federal income tax may use Form 8940 to claim an exemption from filing an annual return. The fee for this form is $550 as of 2024, but this is subject to change periodically by the IRS. Organizations filing Form 990 (Annual Return of Organization Exempt From Income Tax) or Form 990-EZ are required to pay an annual filing fee that ranges from $50 - $850, depending on the total assets held by the organization. The specific fee associated with each form can be found on the IRS website. When applicable, organizations may also be subject to additional user fees when processing paperwork electronically through Pay.gov or other payment systems such as Electronic Federal Tax Payment System (EFTPS). Organizations can pay their filing fees by check, credit card, debit card, bank wire transfer, or EFTPS direct payment voucher. Forms must be sent with payment to the address in section 8 of Form 1023 Instructions. Instructions can also be found on page 7 of the same document regarding how to file documents and which forms should accompany payments when submitting via mail or in person at an IRS office. Organizations seeking tax-exempt status under Section 501(c)(3) of the Internal Revenue Code must fill out Form 1023 and submit it to the IRS. The amount of time it takes for processing varies depending on the type and size of the organization. Form 1023 usually takes five months to process from the date it is received by the IRS, but it can take longer if there are mistakes or additional information is needed. Organizations that are exempt from Federal income tax may file Form 8940 instead, which may take 6 to 8 weeks for processing. Form 990 or Form 990-EZ typically takes 5 to 7 months to process after submission to the IRS. This timeline may be extended if additional information is required or errors occur during filing. Organizations can check their status online using the IRS "Where’s My Exemption Application?" tool once they have submitted their paperwork, or contact a customer service representative at (877) 829-5500 with any questions about processing. When applying for tax-exempt status under Section 501(c)(3) of the Internal Revenue Code, organizations should take into account other considerations such as filing deadlines, state regulations and requirements, financial information, and record keeping. Organizations must submit their paperwork to the IRS by the deadline. This can be done through mail or electronically through Pay.gov. It is important to keep track of all documentation related to the organization’s application in order to meet any potential deadlines or requirements that may arise during processing. Each state has its own rules and requirements for charitable organizations, so organizations should check with their local Secretary of State’s office for more information on what is required for operating in that particular state. Financial statements are often required when filing Form 1023 or Form 8940 and should include both current and historical information about the organization’s income, expenses, donors, and investments. Record-keeping is also crucial for 501(c)(3) organizations to maintain tax-exempt status for future years. Records should include annual reports, financial statements, documents related to activities or events organized by the organization, board meeting minutes, and other relevant information that may demonstrate the organization’s good standing throughout the year. It can take anywhere from three months to a year to get a 501(c)(3) status approved by the IRS. This process is quite lengthy and requires a lot of paperwork and patience, but it is possible for organizations to go through the process successfully. With the help of an experienced tax accountant, organizations can navigate the complexities of setting up their non-profit structure and getting approved for 501(c)(3) status. How Long Does It Take for a 501(c)(3) To Be Approved?

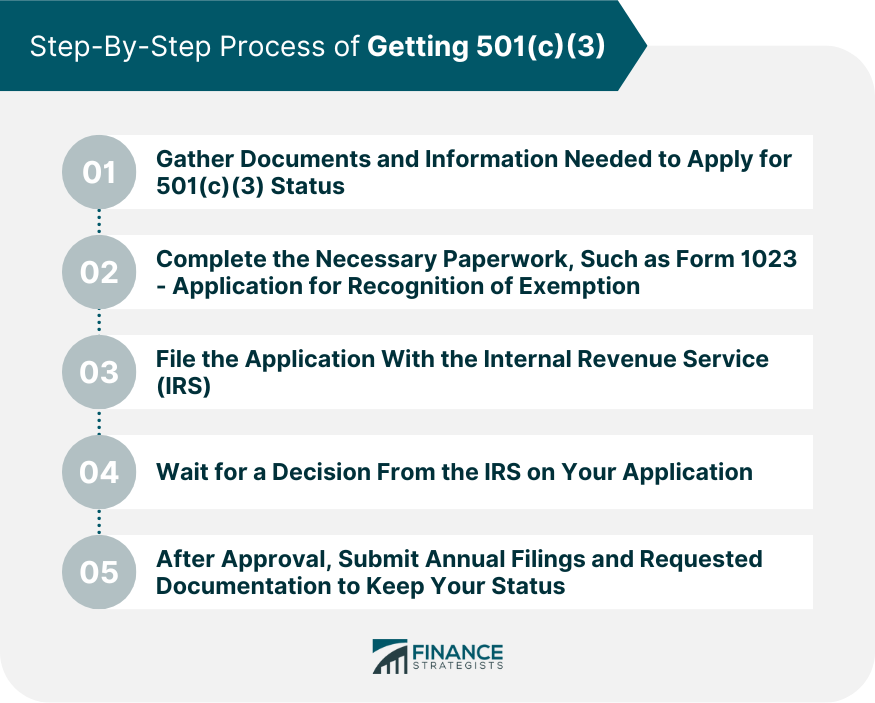

Understanding the 501(c)(3) Application Process

The Form 1023-EZ Eligibility Checklist

Requirements for Form 1023 and Instructions

Completing Form 1023

Obtaining Documentation Required for Submission

Determining Filing Fees and Payment Options

Processing Times for 501(c)(3) Applications

Other Considerations

Conclusion

How Long Does It Take To Get a 501(c)(3)? FAQs

A 501(c)(3) organization is a non-profit organization with tax exempt status that is dedicated to the general well-being of society.

Typically the IRS can issue a decision within 3 to 5 months, but it is not unheard of for larger operations to take up to 12 months.

A 501(c)(3) organization is tax exempt so long as it remains true to its stated mission and remains compliant with the IRS.

501(c)(3) is the internal revenue code (IRC) section for organizations with tax exempt status. 501(c)(3) falls under internal revenue code 501(c).

Generally yes, most organizations will need to set up their accounting system in accordance with 501(c)(3) requirements before being granted exemption status; this includes maintaining accurate financial records and creating certain procedures for handling donations or grants received by the organization.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.