The Ontario Teachers' Pension Plan Board (OTPPB) manages the assets and pension benefits of Ontario's teachers. It oversees a large and diversified portfolio of investments to secure members' financial future. The OTPPB was established in 1990, driven by collaboration between the Government of Ontario, Ontario Teachers' Federation (OTF), and the education community. It aimed to address the pension plan's complexity and size, and separate its management from the government. The OTPPB has evolved its governance and investment strategies to adapt to changing financial landscapes. Its primary purpose is to fully fund the pension plan and deliver promised benefits. The OTPPB is committed to excellent member service, responsible investment, and innovative pension management for long-term sustainability. The OTPPB is governed by a board of directors comprising individuals appointed by the Government of Ontario and the Ontario Teachers' Federation (OTF). The board includes a diverse mix of professionals with expertise in various fields, such as finance, investments, governance, and education. The board's primary responsibilities include overseeing the OTPPB's operations, setting strategic direction, and ensuring that the organization adheres to its fiduciary duties. Board members are appointed for fixed terms, usually three years, with the possibility of reappointment for additional terms. The appointment process is designed to ensure that the board maintains a balance of skills, experience, and perspectives. Term limits help promote diversity and foster new ideas while preventing the potential for entrenchment or conflicts of interest. The OTPPB's executive leadership and management team is responsible for implementing the board's strategic direction and overseeing the day-to-day operations of the organization. The team comprises professionals with extensive experience in various areas of pension management, including investments, actuarial science, policy, and member services. The team works closely with the board to ensure that the OTPPB remains agile, innovative, and responsive to the needs of its members. The OTPPB's board establishes various committees to support its oversight functions and decision-making processes. These committees typically focus on specific areas of responsibility, such as investment, audit, governance, and human resources. Each committee comprises board members with relevant expertise and experience who work closely with the management team to review policies, monitor performance, and provide guidance on key initiatives. Membership in the OTPPB is open to all certified teachers employed by publicly funded school boards in Ontario, as well as certain other education-sector workers. To become a member, eligible individuals must contribute a percentage of their earnings to the plan, which is matched by their employer. Membership is typically mandatory for full-time teachers, while part-time and occasional teachers can choose to opt in or out of the plan. The OTPPB serves both active members who are currently employed and contributing to the pension plan and retirees who have retired and are receiving pension benefits. The number of retirees continues to grow, reflecting the aging population and changing demographics in the education sector. Members of the OTPPB contribute a percentage of their salary to the pension plan, which is matched by their employers (i.e., the school boards and the Government of Ontario). The contribution rates are set by the plan's sponsors and are periodically reviewed and adjusted to ensure that the plan remains fully funded. The matching contributions by the employers help to support the long-term sustainability of the pension system and ensure that members receive their promised benefits. The OTPPB provides a range of benefits and services to its members, including: Defined Benefit Pensions: Members receive a monthly pension upon retirement, which is calculated based on their years of service, average salary, and age at retirement. Inflation Protection: The OTPPB's pension benefits are partially indexed to inflation, ensuring that retirees' purchasing power is maintained over time. Survivor and Disability Benefits: In addition to retirement pensions, the OTPPB provides benefits for members who become disabled or pass away, ensuring financial support for their families and dependents. Member Education and Support: The OTPPB offers various resources and tools to help members understand their pension benefits, plan for retirement, and make informed decisions about their financial future. The OTPPB's investment strategy is guided by a set of principles and guidelines, which are designed to achieve the plan's long-term objectives and manage risks. Key principles include: Long-Term Focus: The OTPPB takes a long-term approach to investing, recognizing that short-term market fluctuations are less relevant to the plan's ultimate success. Diversification: The OTPPB invests in a diverse range of asset classes, industries, and geographies to reduce risks and enhance returns. Active Management: The OTPPB believes that active management can add value and improve performance and therefore employs a mix of internal and external managers to implement its investment strategies. Risk Management: The OTPPB is committed to managing risks prudently and continuously monitors its investment portfolio and risk exposures. The OTPPB's investment portfolio is highly diversified across various asset classes, including public equities, private equities, real estate, infrastructure, fixed income, and other alternative investments. The plan's asset allocation is determined based on its long-term risk and return objectives, as well as its liability profile. The allocation is periodically reviewed and adjusted to ensure that the plan remains well-positioned to meet its future obligations. The OTPPB has developed a comprehensive risk management framework, which is designed to identify, assess, and manage the various risks associated with its investment activities. The framework includes processes for monitoring and reporting on risk exposures, as well as setting risk limits and guidelines. The OTPPB also conducts regular stress tests and scenario analyses to evaluate the potential impact of various economic and market events on its investment portfolio and funding status. The OTPPB measures its investment performance against a set of custom benchmarks, which are designed to reflect the plan's strategic asset allocation and risk-return objectives. The plan's performance is regularly reported to the board of directors, plan sponsors, and members, providing transparency and accountability for the plan's performance. Over the past several years, the OTPPB has consistently achieved strong investment returns, which have contributed to the plan's overall funding health and long-term sustainability. The OTPPB is committed to maintaining a high level of transparency in its financial reporting. Each year, the organization publishes its annual financial statements and reports, which provide detailed information on its investment performance, asset allocation, risk management practices, and funding status. The financial statements are prepared in accordance with Canadian accounting standards for pension plans and are subject to review by external auditors. In addition to the annual financial statements, the OTPPB undergoes regular external audits and actuarial valuations to ensure the accuracy of its financial information and the adequacy of its funding levels. The external auditors are responsible for verifying the plan's financial statements, while the actuarial valuations assess the plan's liabilities and funding status, taking into account factors such as member demographics, economic conditions, and investment returns. The OTPPB places a strong emphasis on communication and engagement with its plan members and stakeholders. The organization provides regular updates on its investment activities, financial performance, and strategic initiatives through various channels, including newsletters, webinars, and annual meetings. Additionally, the OTPPB offers a range of online resources and tools to help members understand their pension benefits and make informed decisions about their financial future. As a large pension plan, the OTPPB is subject to various regulatory requirements and oversight by government authorities. The organization is committed to maintaining compliance with all applicable laws and regulations and works closely with regulators to ensure the plan's continued stability and sustainability. The Ontario Teachers' Pension Plan Board (OTPPB) is a vital organization responsible for managing pension assets and ensuring the long-term financial security of Ontario's teachers. With robust governance structures and a diverse investment strategy, the OTPPB aims to deliver sustainable pension benefits for its members. The plan's membership encompasses both active teachers and retirees, offering a range of benefits and services to help secure their financial future. The OTPPB's investment strategy and management approach are focused on diversification, risk management, and long-term performance, enabling the organization to navigate economic uncertainties and market volatility. As you consider your retirement planning needs, it is essential to be informed and proactive in securing your financial future. It may be beneficial to seek professional retirement planning services to ensure you are well-prepared for your retirement years and can enjoy the financial security you deserve.What Is the Ontario Teachers' Pension Plan Board (OTPPB)?

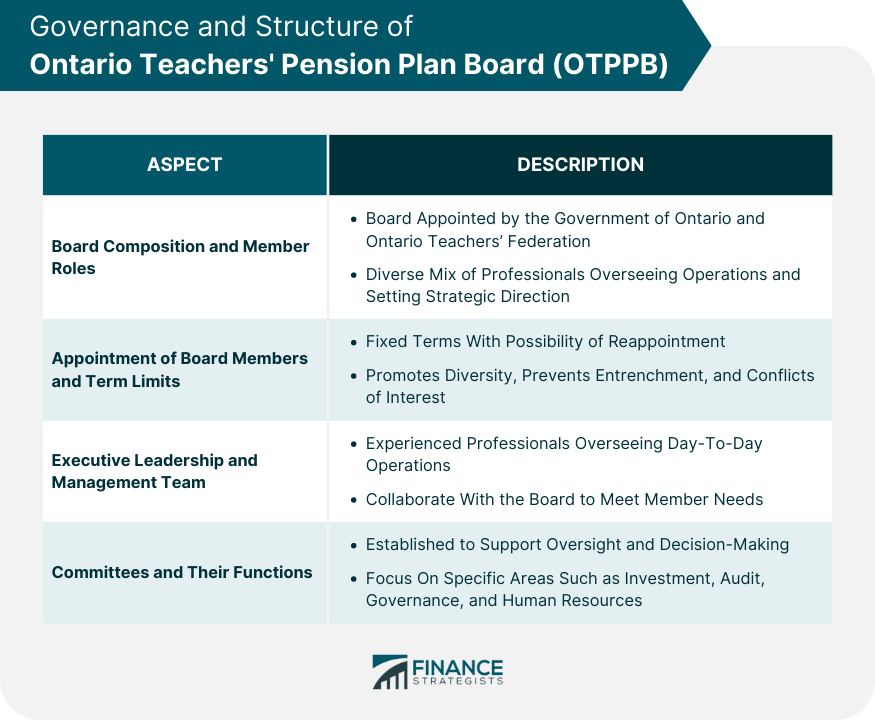

Governance and Structure of OTPPB

Board Composition and Member Roles

Appointment of Board Members and Term Limits

Executive Leadership and Management Team

Committees and Their Functions

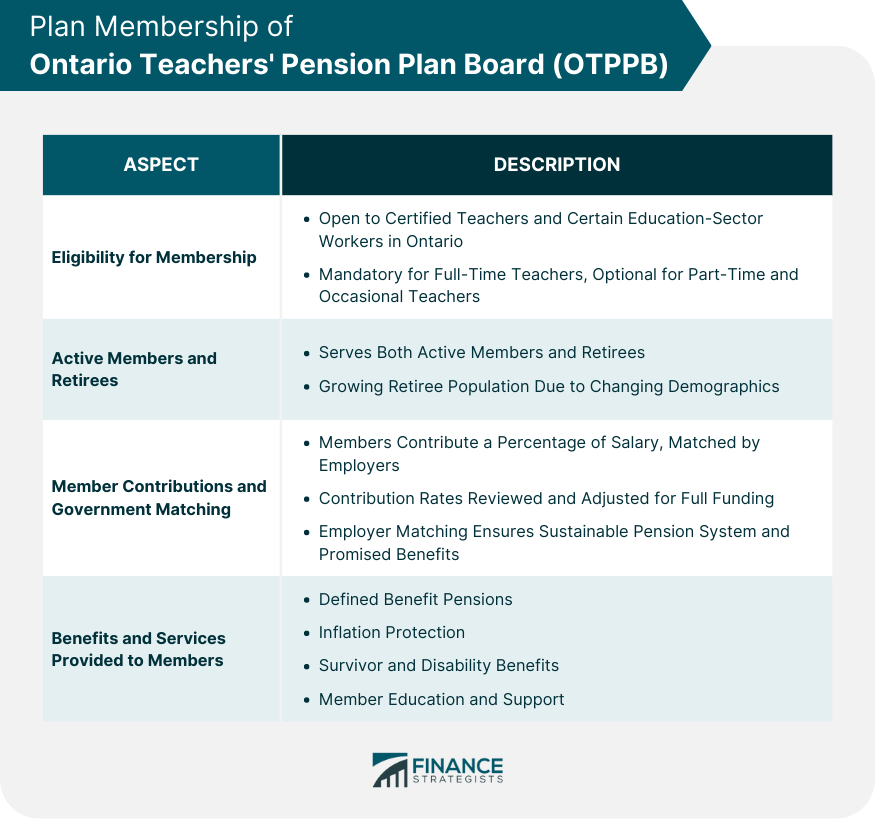

Plan Membership of OTPPB

Eligibility for Membership

Active Members and Retirees

Member Contributions and Government Matching

Benefits and Services Provided to Members

The pension benefits are designed to provide a stable and secure source of income for retirees throughout their lifetime.

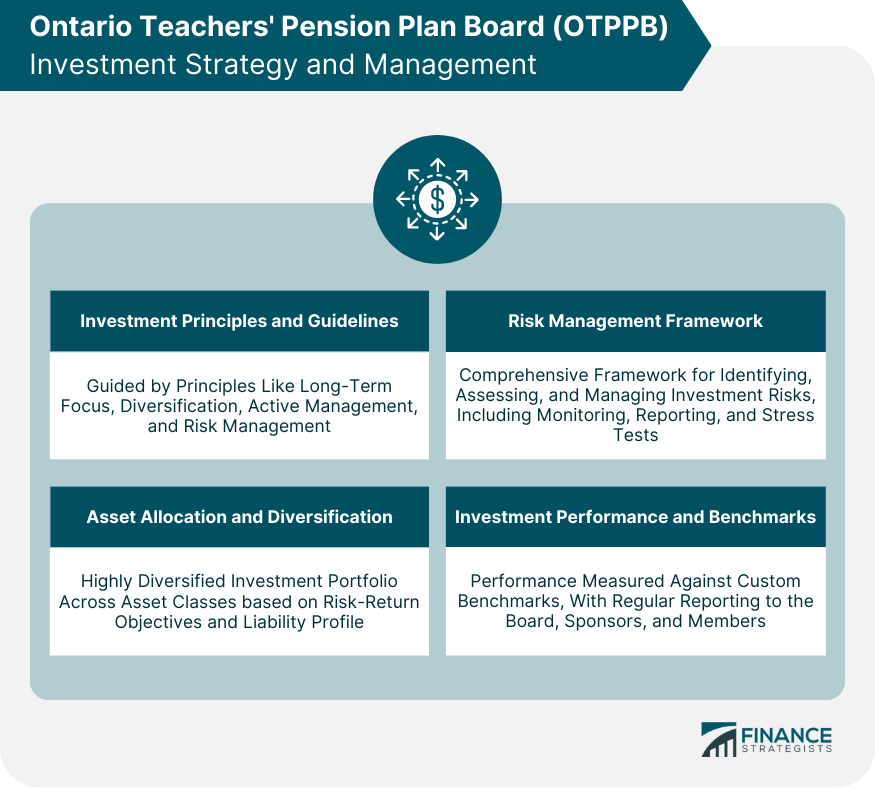

OTPPB Investment Strategy and Management

Investment Principles and Guidelines

Asset Allocation and Diversification

Risk Management Framework

Investment Performance and Benchmarks

Financial Reporting and Transparency of OTPPB

Annual Financial Statements and Reports

External Audits and Actuarial Valuations

Communication With Plan Members and Stakeholders

Regulatory Compliance and Oversight

Final Thoughts

Ontario Teachers' Pension Plan Board (OTPPB) FAQs

The Ontario Teachers' Pension Plan Board (OTPPB) is an independent organization responsible for managing pension assets and administering the pension benefits of Ontario's teachers. The OTPPB's primary objective is to ensure the long-term financial sustainability of the pension plan and provide retirement, survivor, and disability benefits to its members.

Membership in the OTPPB is open to teachers employed in publicly funded elementary and secondary schools in Ontario, Canada. Both full-time and part-time teachers are eligible to join the pension plan, and membership is automatic upon commencing employment.

The OTPPB follows a diversified investment strategy, allocating assets across various classes, including public equities, private equities, real estate, infrastructure, fixed income, and other alternative investments. The plan's investment approach is guided by principles such as long-term focus, diversification, active management, and risk management.

The OTPPB offers several benefits to its members, including defined benefit pensions, inflation protection, survivor and disability benefits, and access to educational resources and support. The pension benefits are designed to provide a stable and secure source of income for retirees throughout their lifetime.

OTPPB prioritizes financial transparency and compliance through annual statements, external audits, and adherence to laws. It communicates investment activities and collaborates with authorities for plan stability.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.