Post-retirement planning refers to the process of developing a financial plan to meet one's needs and goals after retiring from the workforce. This involves determining sources of income, estimating expenses, creating a budget, and managing risks that may affect one's financial security during retirement. Proper post-retirement planning is crucial for ensuring financial stability and maintaining the desired quality of life during retirement. By carefully assessing income sources and expenses, retirees can create a realistic budget, allowing them to enjoy their retirement years without worrying about outliving their savings or facing unexpected financial hardships. The first step in post-retirement planning is assessing your current financial situation. Take stock of your income sources, such as Social Security benefits, pensions, retirement savings, and any additional sources of income. Consider your expenses, including healthcare costs, housing expenses, and other living expenses. By having a clear understanding of your financial position, you can make informed decisions regarding your retirement plan. After assessing your financial situation, set realistic and achievable financial goals for your retirement years. Consider factors such as the desired lifestyle, travel plans, healthcare needs, and any legacy you want to leave behind. Your goals will serve as a compass, guiding your decision-making process throughout your retirement journey. One of the key aspects of post-retirement planning is maximizing your retirement savings. Start by contributing as much as possible to retirement accounts such as 401(k)s, IRAs, and annuities. Take advantage of catch-up contributions if you're 50 or older. Additionally, consider diversifying your investment portfolio to manage risk and optimize returns. Carefully evaluate your expenses to ensure they align with your retirement income. Healthcare costs can be a significant expense, so consider factors such as Medicare coverage, long-term care insurance, and potential out-of-pocket expenses. Review your housing costs, including property taxes, insurance, maintenance, and utilities. Adjust your lifestyle expenses accordingly to ensure your retirement income can adequately cover your needs. In post-retirement planning, explore different income streams beyond traditional sources. This may include part-time work, rental income, or income from investments. Consider your skills, interests, and how you can leverage them to generate additional income during retirement. Exploring diverse income streams can provide financial security and enhance your retirement experience. Post-retirement planning is not a one-time event but an ongoing process. Regularly review your plan, making necessary adjustments as your circumstances evolve. Monitor your investments, revisit your goals, and assess whether your retirement income is sufficient to meet your needs. By staying proactive and adaptable, you can ensure that your financial plan remains on track. Social Security is a government program that provides retirement benefits to eligible workers in the United States. These benefits are based on an individual's lifetime earnings and work history, and they typically serve as a critical source of income during retirement. The amount of Social Security benefits a retiree receives depends on factors such as their age at retirement, lifetime earnings, and the year of birth. Many employers offer retirement plans, such as 401(k)s or pensions, as part of their benefits packages. These plans allow employees to save for retirement by contributing a portion of their salary, often with matching contributions from the employer. Upon retirement, individuals can receive income from these plans in the form of regular payments or lump-sum distributions, depending on the plan's rules and the retiree's preferences. IRAs are tax-advantaged savings accounts that individuals can establish to save for retirement. There are several types of IRAs, including Traditional IRAs, Roth IRAs, and SEP IRAs, each with its own rules and tax benefits. Upon retirement, individuals can withdraw funds from their IRAs to supplement their income, with taxes and penalties depending on the type of IRA and the individual's age at the time of withdrawal. In addition to the primary sources of retirement income mentioned above, retirees may also receive income from other sources such as personal savings, investments, annuities, rental properties, or even part-time work. These additional sources can help retirees diversify their income streams and provide a safety net in case one source is insufficient or unexpectedly reduced. Housing is often one of the most significant expenses for retirees. It's essential to consider factors such as mortgage or rent payments, property taxes, insurance, and maintenance costs when estimating post-retirement housing expenses. Some retirees may choose to downsize or relocate to a more affordable area to reduce their housing costs during retirement. Healthcare costs can be a considerable expense for retirees, as they often increase with age. It's essential to consider the cost of premiums for Medicare or other health insurance plans. This includes out-of-pocket expenses for medications, medical equipment, and other healthcare services. Planning for healthcare costs is critical to avoid unexpected financial burdens during retirement. Even during retirement, individuals may still be responsible for paying federal and state income taxes, depending on their sources of income. Social Security benefits, pension payments, and withdrawals from certain retirement accounts may be taxable, while others, such as Roth IRA withdrawals, may be tax-free. Understanding the tax implications of various income sources can help retirees plan for their tax obligations and minimize their overall tax burden. Retirees should also account for other expenses, such as groceries, utilities, transportation, and entertainment, when estimating their post-retirement expenses. Additionally, it's essential to plan for unexpected costs, such as home repairs or emergency medical expenses, by setting aside funds in an emergency savings account or allocating a portion of the budget for contingencies. By accounting for these expenses, retirees can create a more accurate and comprehensive post-retirement budget. One strategy to maximize retirement income is to delay retirement, allowing individuals to continue earning a salary and contributing to their retirement accounts. By postponing retirement, individuals can also increase their Social Security benefits, as the benefit amount grows for each year they delay claiming benefits up to a certain age. Some retirees may choose to work part-time during retirement to supplement their income from other sources. Part-time work can provide additional income and help maintain a sense of purpose and social connections, contributing to overall well-being during retirement. Downsizing refers to the process of reducing one's living expenses by moving to a smaller, less expensive home or by selling possessions. This strategy can help retirees free up funds to cover other expenses, reduce housing costs, and simplify their lives during retirement. Relocating to a more affordable area or a region with lower taxes can help retirees maximize their retirement income by reducing their cost of living. Some states have lower income tax rates, property taxes, and housing costs, making them more attractive for retirees seeking to stretch their retirement dollars further. Investing during retirement can help individuals grow their wealth and provide an additional source of income. Retirees should consider their risk tolerance, investment goals, and time horizon when determining their investment strategies. Working with a financial advisor can help retirees make informed decisions about their investment portfolios during retirement. The first step in creating a post-retirement budget is to identify all sources of income, including Social Security benefits, employer-sponsored retirement plans, IRAs, and other sources such as investments, annuities, or part-time work. Understanding the various sources of income will help retirees create a realistic budget and ensure they have enough money to cover their expenses during retirement. Once income sources are identified, retirees should estimate their post-retirement expenses, including housing, healthcare, taxes, and other daily living costs. This process may involve tracking current spending habits and adjusting them based on anticipated changes in lifestyle during retirement. Estimating expenses accurately is crucial for creating a budget that reflects retirees' financial needs and goals. After developing a post-retirement budget, it's essential to track spending regularly to ensure that expenses align with the budget and make adjustments as necessary. Monitoring spending habits can help retirees identify areas where they may be overspending, allowing them to make changes to maintain their financial stability during retirement. Inflation is the general increase in the cost of goods and services over time, which can erode the purchasing power of retirees' savings and income. To manage inflation risk, retirees should consider investing in assets that have the potential to grow over time, such as stocks or real estate, and adjust their budget for anticipated increases in living expenses. As mentioned earlier, healthcare costs can be a significant risk for retirees, as they often increase with age. Planning for healthcare expenses and choosing appropriate insurance coverage can help retirees manage this risk and avoid unexpected financial burdens. Long-term care, such as nursing home care or in-home assistance, can be a significant expense for retirees who require these services. Planning for long-term care costs and considering long-term care insurance can help retirees manage this risk and ensure they have the financial resources to cover these expenses if needed. Investment risks, such as market fluctuations or poor investment decisions, can negatively impact retirees' financial security. To manage investment risks, retirees should diversify their investment portfolios, consider their risk tolerance, and work with a financial advisor to make informed decisions about their investments. Regularly reviewing and adjusting investment strategies can also help retirees respond to changes in the market and protect their financial well-being. Post-retirement planning is essential for ensuring financial stability and maintaining the desired quality of life during retirement. By identifying sources of income, estimating expenses, creating a budget, and managing risks, retirees can successfully navigate their retirement years with confidence and financial security. Proper post-retirement planning requires careful consideration and ongoing management. It's crucial for retirees to regularly review their financial plan, track their spending, and adjust their strategies as needed to account for changes in their circumstances or the economic environment. Consulting with a financial advisor can provide valuable guidance and support throughout this process, helping retirees make informed decisions and achieve their retirement goals.What Is Post-Retirement Planning?

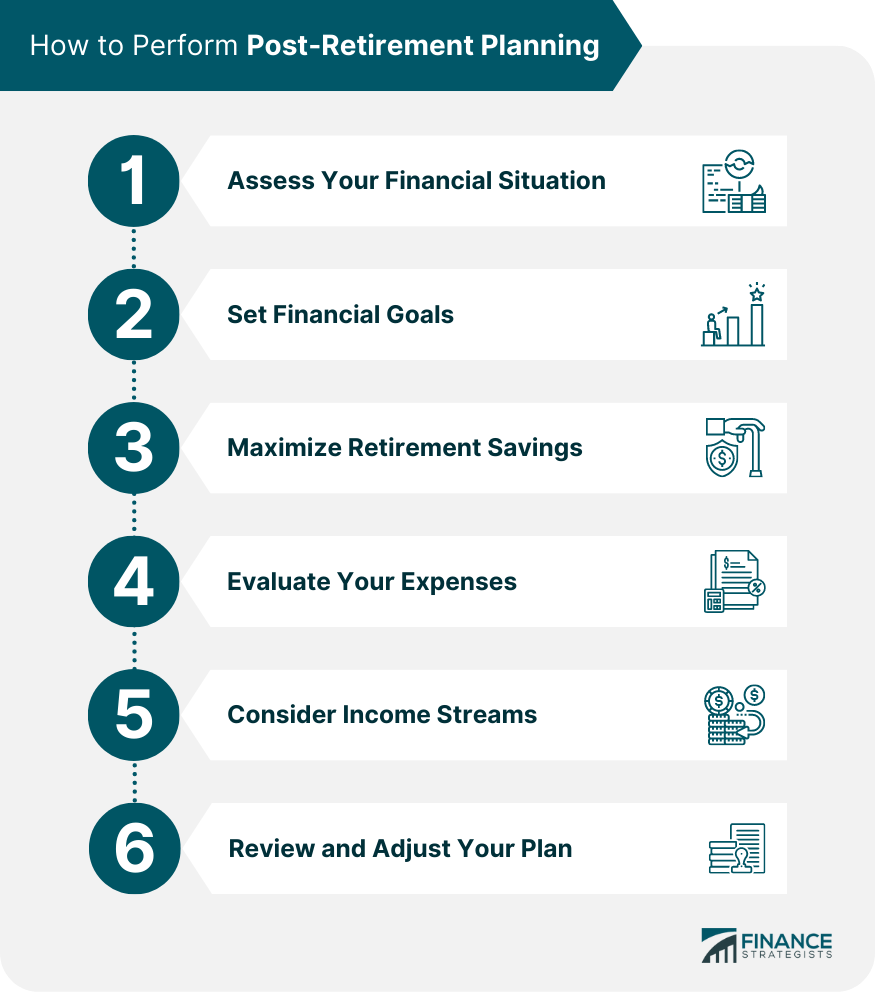

How to Perform Post-Retirement Planning

Assess Your Financial Situation

Set Financial Goals

Maximize Retirement Savings

Evaluate Your Expenses

Consider Income Streams

Review and Adjust Your Plan

Income Sources to Consider During Post-Retirement Planning

Social Security Benefits

Employer-Sponsored Retirement Plans

Individual Retirement Accounts (IRAs)

Other Sources of Retirement Income

Expenses to Consider During Post-Retirement Planning

Housing

Healthcare

Taxes

Other Expenses

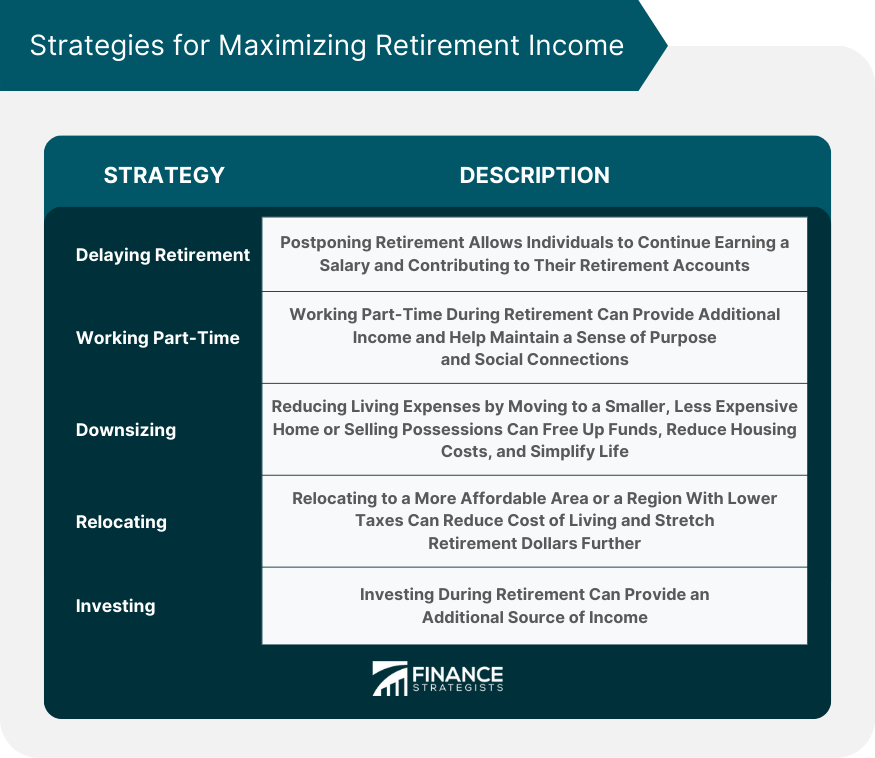

Maximizing Income During Post-Retirement Planning

Delaying Retirement

Working Part-Time

Downsizing

Relocating

Investing

Budget Creation During Post-Retirement Planning

Identifying Income Sources

Estimating Expenses

Tracking Spending

Risk Management During Post-Retirement Planning

Inflation

Healthcare Costs

Long-Term Care

Investment Risks

Bottom Line

Post-Retirement Planning FAQs

Post-retirement planning refers to the process of preparing financially for life after retirement by identifying sources of income and expenses.

Post-retirement planning is crucial to ensure a secure and comfortable retirement by evaluating income sources, expenses, and making necessary adjustments to meet financial goals.

Factors such as income sources (e.g., pensions, Social Security benefits), healthcare costs, housing expenses, and lifestyle choices should be considered in post-retirement planning.

Retirees can take steps such as creating a budget, projecting future expenses, and making necessary adjustments to increase savings or reduce expenses in order to maintain a comfortable lifestyle during retirement.

Estate planning involves creating a plan for how a retiree's assets will be distributed after they pass away, typically through the creation of a will, designation of beneficiaries, and establishment of trusts.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.