Longevity planning is the process of preparing for an extended life span, considering various financial, health, and lifestyle factors. It aims to ensure financial security, peace of mind, and a fulfilling life during retirement as life expectancies continue to increase. Longevity planning involves aligning retirement strategies with the challenges of longer life spans, such as increased healthcare costs, inflation, and the risk of outliving retirement savings. Longevity planning is not a one-time event but an ongoing process that requires periodic review and adjustments. It is essential to stay informed about changes in laws, regulations, and financial markets that may impact retirement plans. Regularly reassessing financial goals, healthcare needs, and overall lifestyle preferences can ensure that longevity plans remain relevant and effective. Understanding and optimizing Social Security benefits can significantly affect retirement income. Factors to consider include the optimal age for claiming benefits, spousal benefits, and strategies for maximizing lifetime benefits. If you have access to a pension plan, it is essential to understand the plan's payout options and the implications of these options on your retirement income. Annuities can provide a guaranteed income stream for life, reducing the risk of outliving your retirement savings. Explore various types of annuities, such as immediate, deferred, fixed, and variable, to determine which suits your needs best. Dividend-paying stocks, bonds, and mutual funds can help supplement retirement income and hedge against inflation. Owning rental properties can provide a stable income stream during retirement while also building equity in the property. A well-diversified investment portfolio can help reduce risk and maintain steady growth throughout retirement. Assess your risk tolerance and adjust your investment strategy accordingly to ensure your portfolio aligns with your financial goals and risk tolerance. As you approach and enter retirement, adjusting your asset allocation to more conservative investments may be necessary to protect your savings. Regularly rebalancing your investment portfolio ensures that your asset allocation remains in line with your financial goals and risk tolerance. Long-term care costs can be significant, so it's essential to understand and plan for these expenses in your longevity plan. Long-term care insurance can help cover care costs, but it's important to assess the policies' features before purchasing, such as the waiting period, coverage amount, and inflation protection. Some alternatives to traditional long-term care insurance include hybrid life insurance policies with long-term care riders and self-insuring through investments. Understanding Medicare coverage options and enrollment periods can help you optimize your healthcare benefits in retirement. Consider purchasing supplemental health insurance, such as Medigap or Medicare Advantage plans, to cover costs that Medicare does not. Contributing to a Health Savings Account (HSA) during your working years can provide tax-advantaged savings for medical expenses in retirement. Creating a will and establishing trusts can help ensure that your assets are distributed according to your wishes after your death. Review and update beneficiary designations on retirement accounts, insurance policies, and other financial assets to avoid unintended consequences. Work with an estate planning attorney or financial professional to implement strategies that minimize estate taxes and preserve wealth for your heirs. Consider your housing needs in retirement, including downsizing, relocating, or aging in place with necessary modifications. Evaluate how you want to spend your retirement, balancing work and leisure activities that align with your passions and interests. Identify hobbies and passions you want to pursue in retirement and factor these into your financial planning. Engaging in community activities and volunteering can provide a sense of purpose and fulfillment during retirement. Traditionally, retirement planning involves saving and investing throughout one's working life to ensure a comfortable and secure retirement. Common strategies include contributing to retirement accounts, such as 401(k)s and IRAs, and building a diverse investment portfolio. With increased life expectancy, traditional retirement planning strategies may no longer suffice to cover the financial needs of retirees throughout their entire lives. Longer life spans can increase healthcare costs, inflation, and the risk of outliving retirement savings. It is crucial to align retirement planning with longevity planning to address the challenges of increased life expectancy. This involves reassessing income strategies, asset management, long-term care planning, and lifestyle planning to ensure financial stability and fulfilling retirement. Inflation can erode your purchasing power in retirement, so it is crucial to understand its impact and develop strategies to combat it. Treasury Inflation-Protected Securities (TIPS) and other inflation-protected investments can help preserve your purchasing power in retirement. Ensure that your income sources, such as Social Security benefits and annuities, provide cost of living adjustments to help keep pace with inflation. Adopt flexible spending strategies in retirement, such as adjusting withdrawal rates based on market conditions and inflation. Recognize the various risks associated with longevity, including financial, health, and lifestyle risks. Working longer can help increase your retirement savings and reduce the risk of outliving your assets. Transitioning to part-time work or consulting can ease into retirement while maintaining some income. Pursue part-time work opportunities in retirement to supplement your income and stay engaged. Reverse mortgages can provide an additional income stream by tapping into your home equity. Longevity annuities can provide guaranteed income later in life, reducing the risk of outliving your assets. Longevity planning is crucial in ensuring financial stability and fulfilling life as life expectancies continue to rise. By aligning retirement planning with longevity, individuals can better prepare for the challenges of extended life spans. Key components of longevity planning include optimizing income strategies, managing assets, planning for long-term care and healthcare expenses, creating a comprehensive estate plan, and considering lifestyle factors. In addition, understanding the impact of inflation on purchasing power and managing longevity risks is vital for a successful retirement plan. By engaging in longevity planning and implementing a comprehensive approach, individuals can enhance their financial security, maintain their well-being, and enjoy a fulfilling and satisfying retirement, even as life expectancies continue to increase.What Is Longevity Planning?

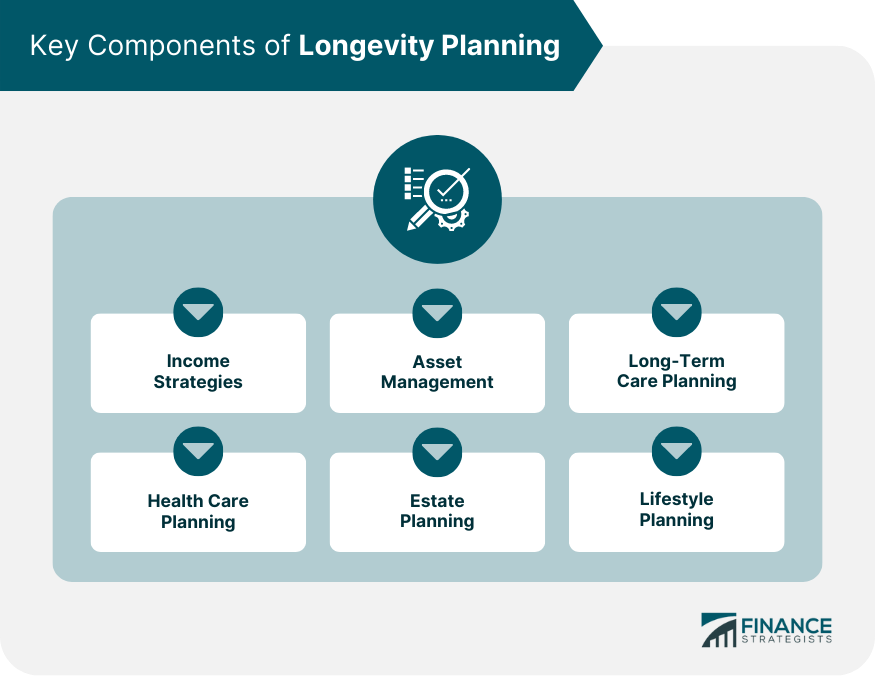

Key Components of Longevity Planning

Income Strategies

Social Security Benefits Optimization

Pension Plans

Annuities

Dividend-Paying Investments

Rental Income

Asset Management

Diversification

Risk Tolerance Assessment

Asset Allocation Adjustments

Portfolio Rebalancing

Long-Term Care Planning

Understanding Long-Term Care Costs

Long-Term Care Insurance

Alternatives to Traditional Long-Term Care Insurance

Health Care Planning

Medicare Planning

Supplemental Health Insurance

Health Savings Accounts (HSAs)

Estate Planning

Wills and Trusts

Beneficiary Designations

Strategies for Minimizing Taxes and Preserving Wealth

Lifestyle Planning

Housing Options

Work and Leisure Balance

Hobbies and Passions

Community Involvement

Retirement and Longevity Planning

Traditional Retirement Planning Strategies

Challenges Posed by Increased Life Expectancy

Aligning Retirement Planning With Longevity

Inflation and Longevity Planning

Understanding the Impact of Inflation on Purchasing Power

Strategies to Combat Inflation in Retirement

TIPS and Other Inflation-Protected Investments

Cost of Living Adjustments

Flexible Spending Strategies

Risk Management and Longevity Planning

Identifying and Assessing Longevity Risks

Strategies for Managing Longevity Risks

Delaying Retirement

Phased Retirement

Part-Time Work

Reverse Mortgages

Longevity Annuities

Conclusion

Longevity Planning FAQs

Longevity planning is the process of preparing financially and emotionally for a longer life expectancy. It involves assessing your current financial situation, considering potential healthcare costs, and developing strategies to ensure you have enough savings and investments to support a longer retirement.

Longevity planning is important because people live longer, meaning they need more money to support themselves in retirement. Proper planning can prevent running out of money during retirement, which could be financially devastating.

It's always early enough to start longevity planning. You should start planning for retirement as soon as possible, even if you're in your 20s or 30s. The earlier you start, the more time you have to save and invest, and the less you'll have to save each month to reach your retirement goals.

Strategies for longevity planning include saving more money, investing in a diversified portfolio, purchasing long-term care insurance, delaying Social Security benefits, and downsizing your home. It's important to consult with a financial advisor to determine which strategies are best for your unique situation.

You can assess your longevity planning needs by considering your current assets, your expected retirement expenses, your health status and family history, and your goals for retirement. A financial advisor can help you conduct a more thorough assessment and create a personalized longevity plan.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.