Medicare Part C, also known as Medicare Advantage, is an alternative to Original Medicare (Part A and Part B) offered by private insurance companies. These plans provide beneficiaries with all the benefits of Part A and Part B, as well as additional services and benefits. The purpose of Medicare Part C is to provide more comprehensive coverage options and flexibility for beneficiaries. It allows them to choose a plan that better suits their individual needs and preferences, often including additional benefits such as prescription drug coverage, dental, and vision care. Medicare Part C was introduced in 1997 as part of the Balanced Budget Act. The program has evolved over time, and in 2003, it was renamed Medicare Advantage under the Medicare Prescription Drug, Improvement, and Modernization Act. This includes Part A and Part B, covers many medical expenses, such as hospitalization, doctor visits, lab tests, and preventive care. However, there are certain services that are not covered by Original Medicare, such as prescription drugs, dental, vision, and hearing care. Medicare Part D is a prescription drug coverage program that is offered by private insurance companies. It helps beneficiaries pay for prescription drugs that are not covered under Original Medicare. Some Medicare Advantage plans also offer prescription drug coverage. Original Medicare, with the exception of hospice care, does not cover dental, vision, or hearing care. However, some Medicare Advantage plans offer coverage for these services. Dental coverage may include routine exams, cleanings, and X-rays, as well as more extensive procedures such as fillings and extractions. Vision coverage may include exams, glasses, and contacts. Hearing coverage may include hearing exams and hearing aids. Original Medicare does cover hospice care, which is end-of-life care for individuals with a terminal illness. Hospice care includes medical, social, and emotional support for the patient and their family. Hospice care can be provided in the home, in a hospice facility, or in a hospital. Another benefit of Medicare Advantage plans is care coordination through provider networks. These plans typically have a network of healthcare providers, including doctors, hospitals, and other healthcare facilities. By using network providers, beneficiaries can receive coordinated care that is tailored to their individual health needs. Medicare Advantage plans may also offer care management programs, such as disease management or case management, to help beneficiaries manage their health conditions. In addition to potential lower out-of-pocket costs and care coordination, Medicare Advantage plans may offer additional benefits that are not covered by Original Medicare. These benefits may include dental, vision, and hearing care, as well as fitness programs, transportation services, and telehealth services. Another benefit of Medicare Advantage plans is the yearly out-of-pocket maximum. This means that once the beneficiary reaches a certain amount of out-of-pocket costs, the plan will cover the remaining costs for the year. The maximum out-of-pocket limit varies by plan and may change from year to year. To be eligible for a Medicare Advantage plan, an individual must be enrolled in both Medicare Part A and Part B, and live within the service area of the Medicare Advantage plan they wish to join. Enrollment in a Medicare Advantage plan can be done during the Initial Enrollment Period (IEP), the Annual Election Period (AEP), or during a Special Enrollment Period (SEP) if certain criteria are met. Beneficiaries can compare plans and enroll online, by phone, or through an insurance agent. The Annual Election Period for Medicare Advantage plans runs from October 15 to December 7 each year. During this time, beneficiaries can join, switch, or disenroll from Medicare Advantage plans. Changes made during the AEP become effective on January 1 of the following year. There are several types of Medicare Advantage plans, including Health Maintenance Organization (HMO) plans, Preferred Provider Organization (PPO) plans, Private Fee-for-Service (PFFS) plans, and Special Needs Plans (SNPs). Medicare Advantage plans may have different network options, such as HMOs requiring beneficiaries to use in-network providers, while PPOs offer more flexibility, allowing the use of both in-network and out-of-network providers, though with higher costs for the latter. Cost-sharing structures for Medicare Advantage plans can vary, with some plans requiring copayments, coinsurance, or deductibles. It is essential for beneficiaries to understand their plan's cost-sharing structure to minimize out-of-pocket expenses. The payment structure for Medicare Part C involves the Centers for Medicare & Medicaid Services (CMS) paying a fixed amount to the private insurance companies offering Medicare Advantage plans. These companies, in turn, provide coverage for beneficiaries, with the costs determined by factors such as premiums, deductibles, and copayments. When considering a Medicare Advantage plan, beneficiaries should evaluate the plan's monthly premium, deductible, copayments, and coinsurance. Additionally, they should consider the plan's out-of-pocket maximum, as this can significantly impact their overall health care expenses. When comparing Medicare Part C costs with Original Medicare, beneficiaries should consider the additional benefits provided by Medicare Advantage plans, such as prescription drug coverage and dental care. They should also consider the potential for lower out-of-pocket costs and care coordination offered by Medicare Advantage plans. Medicare Part C coverage may have certain limitations, such as the use of in-network providers or the need for referrals for specialist visits. Beneficiaries should review the plan's provider network and coverage rules to ensure they align with their health care needs and preferences. When choosing a Medicare Advantage plan, beneficiaries should consider factors such as the plan's coverage, cost, provider network, quality ratings, and customer service. They should also assess any additional benefits, such as prescription drug coverage or dental care, that may be important to them. Beneficiaries who have other health insurance options, such as employer-sponsored coverage or Veterans Affairs (VA) benefits, should carefully evaluate how these options work with Medicare Part C. In some cases, they may need to coordinate their benefits or choose a plan that complements their existing coverage. Medicare Part C, or Medicare Advantage, offers beneficiaries an alternative to Original Medicare, providing comprehensive coverage through private insurance companies. These plans often include additional benefits and may have lower out-of-pocket costs, making them an attractive option for many beneficiaries. As the Medicare program continues to evolve, Medicare Part C is likely to play an increasingly important role in providing health care coverage for beneficiaries. Changes in policy and the health care landscape may impact the offerings and costs associated with Medicare Advantage plans. When considering Medicare Part C, beneficiaries should carefully evaluate their health care needs, preferences, and financial situation. By understanding the various aspects of Medicare Advantage plans, they can make informed decisions and choose the coverage that best meets their needs.Definition of Medicare Part C (Medicare Advantage)

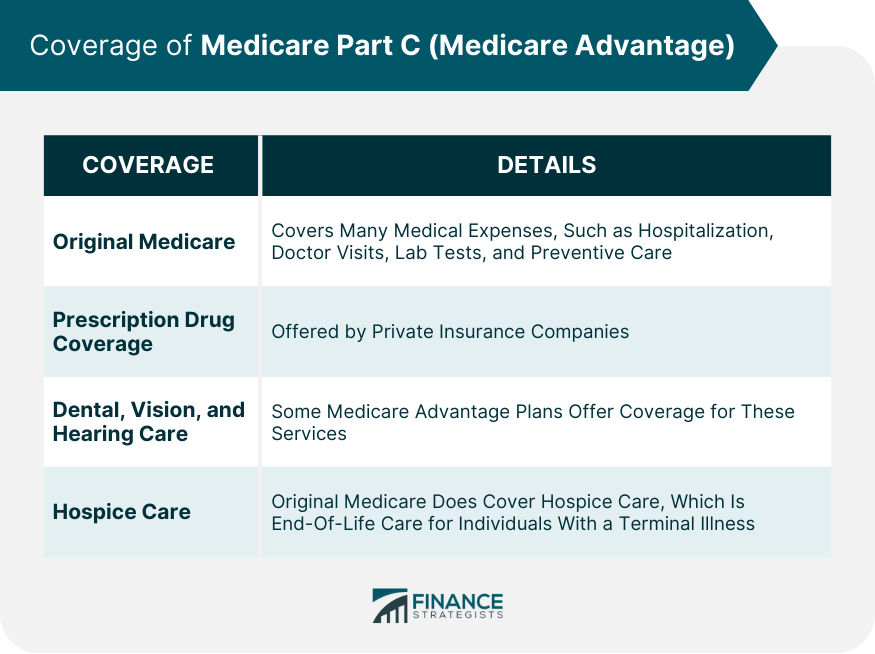

Coverage of Medicare Part C (Medicare Advantage)

Original Medicare

Prescription Drug Coverage

Dental, Vision, and Hearing Care

Hospice Care

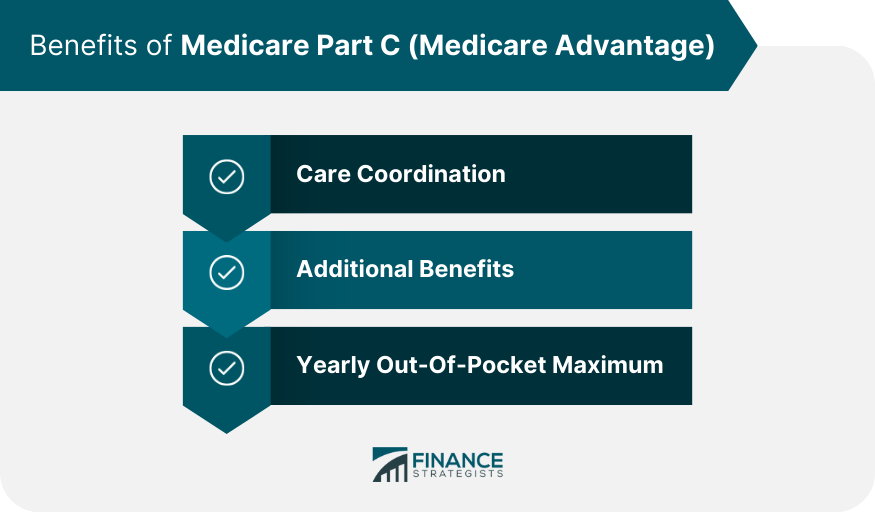

Benefits of Medicare Part C (Medicare Advantage)

Care Coordination

Additional Benefits

Yearly Out-of-Pocket Maximum

Enrollment and Eligibility of Medicare Part C (Medicare Advantage)

Eligibility Requirements for Medicare Part C

Enrollment Process for Medicare Part C

Enrollment Period for Medicare Part C

Plan Types of Medicare Part C (Medicare Advantage)

Types of Medicare Advantage Plans

Network Options for Medicare Advantage Plans

Cost-Sharing Structures for Medicare Advantage Plans

Payment and Costs of Medicare Part C (Medicare Advantage)

Medicare Part C Payment Structure

Cost Considerations for Medicare Advantage Plans

Comparing Medicare Part C Costs With Other Medicare Plans

Considerations and Limitations of Medicare Part C (Medicare Advantage)

Limitations of Medicare Part C Coverage

Factors to Consider When Choosing a Medicare Advantage Plan

Medicare Part C and Other Health Insurance Options

Conclusion

Medicare Part C (Medicare Advantage) FAQs

Medicare Part C, also known as Medicare Advantage, is a type of health insurance plan offered by private insurance companies as an alternative to traditional Medicare.

Medicare Part C covers all benefits provided by Medicare Part A and Part B, and often includes additional benefits such as vision, dental, and hearing.

The cost of Medicare Part C varies depending on factors such as the plan type, location, and individual needs. Some plans have no additional premiums, while others may have higher costs.

Many Medicare Advantage plans offer a network of doctors and healthcare providers, and may have restrictions on using providers outside of the network. However, some plans may allow you to keep your doctor.

You can enroll in Medicare Part C during the Initial Enrollment Period (IEP), the Annual Enrollment Period (AEP), or a Special Enrollment Period (SEP) if you meet certain eligibility criteria.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.