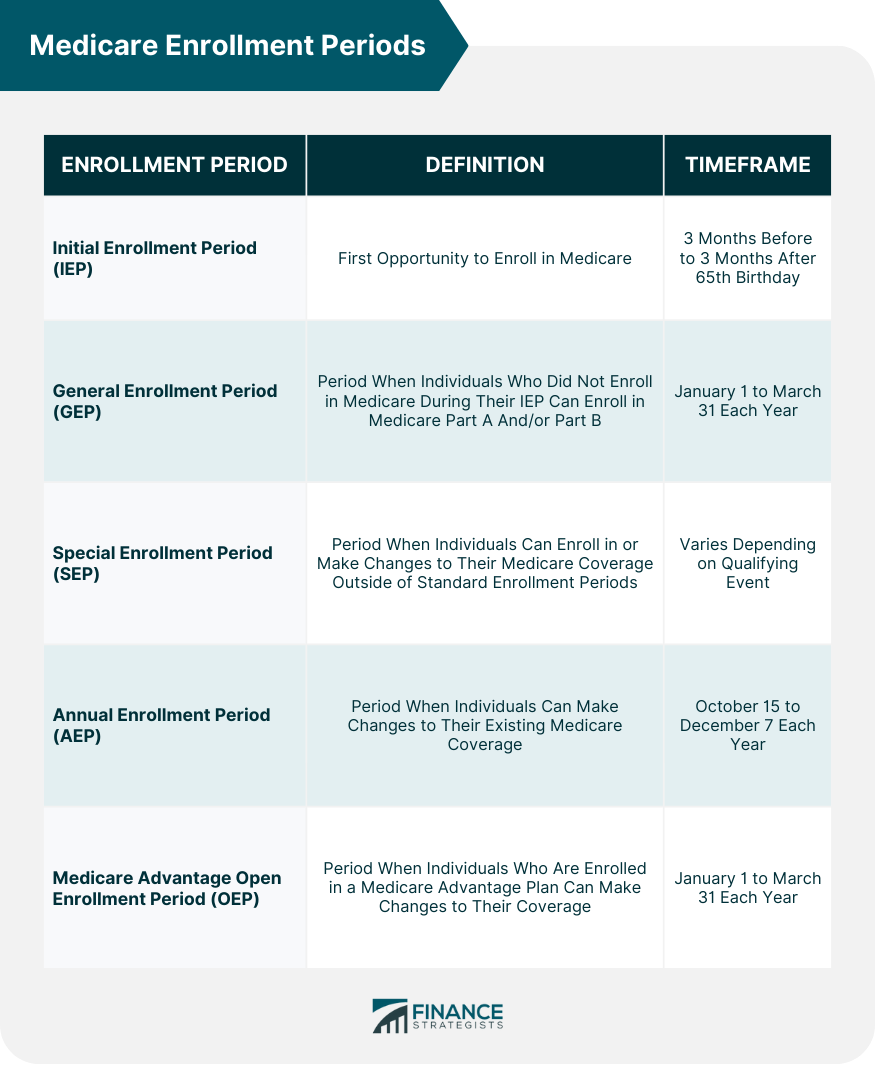

Medicare Enrollment Periods refer to the time frames during which eligible individuals can enroll in Medicare or make changes to their existing coverage. Understanding these enrollment periods is essential for beneficiaries to make informed healthcare decisions and ensure that they have the coverage they need. There are several different Medicare Enrollment Periods, each with its own timeframe, eligibility requirements, and coverage options. These enrollment periods include the Initial Enrollment Period, General Enrollment Period, Special Enrollment Period, Annual Enrollment Period, and Medicare Advantage Open Enrollment Period. Knowing the various Medicare Enrollment Periods is essential for beneficiaries to make informed healthcare decisions, avoid late enrollment penalties, and ensure that they have the coverage they need. Understanding the different enrollment periods can also help beneficiaries take advantage of available coverage options and make changes to their coverage when necessary. The Initial Enrollment Period is the first opportunity that most individuals have to enroll in Medicare. This enrollment period begins three months before an individual's 65th birthday and ends three months after their 65th birthday. The Initial Enrollment Period lasts for a total of seven months, including the three months before an individual's 65th birthday, the month of their 65th birthday, and the three months after their 65th birthday. Individuals who are turning 65 and are eligible for Medicare based on age are eligible for the Initial Enrollment Period. During the Initial Enrollment Period, individuals can enroll in Medicare Part A and Part B. They can also enroll in Medicare Advantage plans or Medicare prescription drug plans. It is important to enroll during the Initial Enrollment Period because failure to do so may result in late enrollment penalties. For example, individuals who do not enroll in Medicare Part B during their Initial Enrollment Period may be subject to a late enrollment penalty if they choose to enroll at a later date. The penalty is calculated based on the number of months that an individual was eligible for Medicare Part B but did not enroll. The GEP is a period when individuals who did not enroll in Medicare during their Initial Enrollment Period can enroll in Medicare Part A and/or Part B. The General Enrollment Period lasts from January 1st through March 31st each year. Individuals who did not enroll in Medicare during their Initial Enrollment Period and who are not eligible for a Special Enrollment Period can enroll in Medicare during the General Enrollment Period. During the General Enrollment Period, individuals can enroll in Medicare Part A and/or Part B. However, coverage does not begin until July 1st of the year in which the enrollment takes place. It is important to note that individuals who enroll in Medicare during the General Enrollment Period may be subject to late enrollment penalties, and they may also experience a gap in coverage while they wait for their coverage to begin. The Special Enrollment Period is when individuals can enroll in or make changes to their Medicare coverage outside of the standard enrollment periods. The Special Enrollment Period varies depending on the individual's circumstances. For example, individuals who move outside of their plan's service area may be eligible for a Special Enrollment Period. Individuals who experience certain qualifying events, such as a move, loss of other health coverage, or a change in income, may be eligible for a Special Enrollment Period. During the Special Enrollment Period, individuals can enroll in or make changes to their Medicare coverage, depending on their qualifying event. It is important to note that the eligibility and coverage options for the Special Enrollment Period can vary depending on the individual's circumstances. The AEP is a period when individuals can make changes to their existing Medicare coverage. This enrollment period provides an opportunity for beneficiaries to evaluate their current healthcare needs and make any necessary changes to their coverage. The Annual Enrollment Period lasts from October 15th through December 7th each year. During this time, beneficiaries can make changes to their Medicare coverage. Individuals who are already enrolled in Medicare can make changes to their coverage during the Annual Enrollment Period. This enrollment period is also an opportunity for beneficiaries to switch from Original Medicare to a Medicare Advantage plan, or vice versa. During the Annual Enrollment Period, individuals can make changes to their Medicare coverage, such as switching from Original Medicare to a Medicare Advantage plan, or changing their Medicare Advantage plan. Beneficiaries can also enroll in a Medicare prescription drug plan or make changes to their existing drug plan. It is important to note that any changes made during the Annual Enrollment Period take effect on January 1st of the following year. The Medicare Advantage Open Enrollment Period is when individuals who are enrolled in a Medicare Advantage plan can make changes to their coverage. The Medicare Advantage Open Enrollment Period lasts from January 1st through March 31st each year. During this time, beneficiaries who are enrolled in a Medicare Advantage plan can make changes to their coverage. Individuals who are already enrolled in a Medicare Advantage plan can make changes to their coverage during the Medicare Advantage Open Enrollment Period. This enrollment period provides an opportunity for beneficiaries to evaluate their healthcare needs and make any necessary changes to their coverage. During the Medicare Advantage Open Enrollment Period, individuals can make changes to their Medicare Advantage coverage, such as switching to a different Medicare Advantage plan or returning to Original Medicare. Beneficiaries can also enroll in a Medicare prescription drug plan or make changes to their existing drug plan. It is important to note that any changes made during the Medicare Advantage Open Enrollment Period take effect on the first day of the following month. Medicare Enrollment Periods are essential for beneficiaries to understand to make informed healthcare decisions and ensure that they have the coverage they need. The different enrollment periods include the Initial Enrollment Period, General Enrollment Period, Special Enrollment Period, Annual Enrollment Period, and Medicare Advantage Open Enrollment Period. Choosing the right enrollment period is essential for beneficiaries to avoid late enrollment penalties, take advantage of available coverage options, and make changes to their coverage when necessary. Working with a licensed insurance agent and consulting with healthcare providers can help beneficiaries navigate the complexities of Medicare enrollment and choose the enrollment period that is right for them. There are many resources available to assist beneficiaries with understanding Medicare Enrollment Periods and making informed healthcare decisions. These resources include the Medicare website, local State Health Insurance Assistance Programs (SHIPs), and licensed insurance agents.Definition of Medicare Enrollment Periods

Initial Enrollment Period (IEP)

Definition of IEP

Timeframe for IEP

Eligibility for IEP

Coverage During IEP

General Enrollment Period (GEP)

Definition of GEP

Timeframe for GEP

Eligibility for GEP

Coverage During GEP

Special Enrollment Period (SEP)

Definition of SEP

Timeframe for SEP

Eligibility for SEP

Coverage During SEP

Annual Enrollment Period (AEP)

Definition of AEP

Timeframe for AEP

Eligibility for AEP

Coverage During AEP

Medicare Advantage Open Enrollment Period (OEP)

Definition of OEP

Timeframe for OEP

Eligibility for OEP

Coverage During OEP

Conclusion

Medicare Enrollment Periods FAQs

The IEP is the first time you can enroll in Medicare. It starts three months before you turn 65 and lasts for seven months.

Yes, during the General Enrollment Period (GEP) or a Special Enrollment Period (SEP) if you meet certain eligibility criteria.

The AEP is from October 15 to December 7 each year. During this time, you can make changes to your Medicare coverage.

The OEP is from January 1 to March 31 each year. It allows you to switch from one Medicare Advantage plan to another or to Original Medicare.

You may face a late enrollment penalty and have to wait until the next enrollment period to sign up for Medicare. Some exceptions apply for certain special circumstances.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.