Early retirement incentives (ERIs) are strategies used by organizations to encourage eligible employees to retire before the conventional retirement age. These incentives can come in various forms, including financial and non-financial benefits. The purpose of early retirement incentives is to encourage eligible employees to retire before the standard retirement age, typically with financial incentives such as lump-sum payments or enhanced pension benefits. These incentives are often used by employers or governments to reduce labor costs, facilitate organizational restructuring, or manage their workforce without resorting to layoffs. By encouraging early retirement, organizations can create opportunities for younger employees to advance, reduce payroll costs, and reallocate resources to areas of greater need. One of the most common financial incentives offered to employees is pension enhancements. These enhancements may include increased monthly pension payouts or additional years of service credited to the employee's pension plan. Lump-sum payments are another form of financial incentive. These one-time payments are often calculated based on years of service, salary, or a combination of both. Lump-sum payments can provide a significant financial boost for retirees, enabling them to pursue their retirement goals. Severance packages are also offered as a financial incentive for early retirement. These packages may include extended salary payments, bonuses, and other financial benefits designed to make the transition to retirement more attractive. Continued health benefits for early retirees can also serve as a financial incentive. These benefits may include maintaining current health coverage, offering supplemental coverage, or providing financial assistance for healthcare expenses. Organizations can offer flexible work arrangements, such as part-time work or job sharing, as an incentive for employees to retire early. These arrangements can provide a gradual transition into retirement while maintaining some income and benefits. Retiree benefits and perks, such as discounts on products or services, travel opportunities, and social events, can make early retirement more appealing. Some organizations offer reemployment opportunities for early retirees, allowing them to return to work on a contractual or project basis. This option can provide retirees with additional income and a chance to stay engaged with their former organization. Organizations can also establish volunteer programs specifically for early retirees. These programs offer opportunities for retirees to give back to their community while staying active and engaged. The age of employees is a crucial factor in determining the success of ERIs. Older employees may be more likely to accept early retirement offers due to their proximity to traditional retirement age. Employees with more years of service might find ERIs more attractive, as they often have larger pension benefits and other financial incentives tied to their tenure. Income level can also influence an employee's decision to accept an ERI. Higher-income employees may have more financial security and be more willing to retire early. A high unemployment rate may make employees more hesitant to accept early retirement incentives, fearing difficulty finding new employment. Job market trends can also affect the success of ERIs. If there is a high demand for experienced workers in a particular industry, employees may be less likely to accept early retirement offers. Inflation and cost of living can also impact an employee's decision to retire early. High inflation and cost of living may make early retirement less financially viable. Organizations must carefully plan their workforce needs to ensure that early retirement incentives do not negatively impact their ability to meet operational goals. This includes considering the potential loss of experienced employees and the need for succession planning. Company culture plays a significant role in the success of ERIs. A supportive and inclusive culture that values employee well-being can encourage employees to consider early retirement. The financial stability of an organization is essential when offering ERIs. Companies must ensure that they can afford the costs associated with these incentives while maintaining their financial health. ERIs can help organizations save on salary and benefit costs, particularly when replacing higher-paid, experienced employees with younger, less-expensive workers. Encouraging early retirement can lead to a more youthful and agile workforce, with fresh perspectives and new ideas. ERIs can create opportunities for employees to grow and advance in their careers, as they fill positions vacated by early retirees. Early retirement can provide retirees with a better work-life balance, allowing them to pursue personal interests and hobbies. ERIs can lead to the loss of experienced employees, which can negatively impact an organization's institutional knowledge and expertise. Organizations may face challenges in transferring knowledge from retiring employees to their successors, which can hinder productivity and effectiveness. ERIs may have a negative impact on employee morale, particularly if remaining employees feel overburdened or unsupported after the departure of early retirees. Early retirement can pose financial risks for employees, especially if they have not adequately prepared for retirement or face unexpected expenses. Organizations should establish clear goals and objectives for their ERIs, ensuring that they align with overall workforce planning and financial strategies. Effective communication is crucial in the implementation of ERIs. Organizations should develop comprehensive communication plans that inform employees about the incentives, eligibility criteria, and the potential impact on their retirement benefits. Organizations should consider offering a mix of financial and non-financial incentives to appeal to a wider range of employees and increase the likelihood of ERI acceptance. Regular monitoring and evaluation are essential for ensuring the success of ERIs. Organizations should track the outcomes of their ERI programs, including cost savings, workforce changes, and employee satisfaction, to assess effectiveness and inform future decision-making. Early retirement incentives can offer numerous benefits for both organizations and employees, including cost savings, workforce rejuvenation, and improved work-life balance. However, the success of ERIs depends on careful planning, effective communication, and a strategic approach to incentive offerings. As the workforce landscape continues to evolve, organizations must remain adaptable and consider the potential benefits and drawbacks of ERIs in order to make informed decisions that align with their long-term goals and objectives. By employing best practices and learning from successful case studies, organizations can effectively implement early retirement incentives that meet the needs of their employees and support overall organizational success.What Are Early Retirement Incentives?

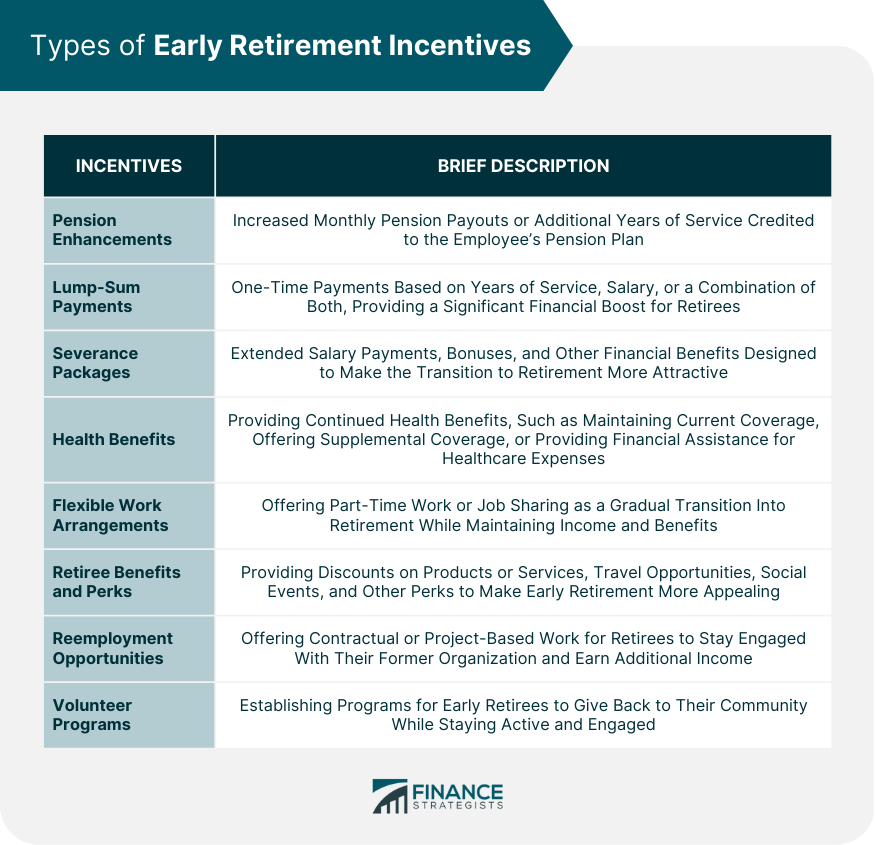

Types of Early Retirement Incentives

Financial Incentives

Pension Enhancements

Lump-Sum Payments

Severance Packages

Health Benefits

Non-financial Incentives

Flexible Work Arrangements

Retiree Benefits and Perks

Reemployment Opportunities

Volunteer Programs

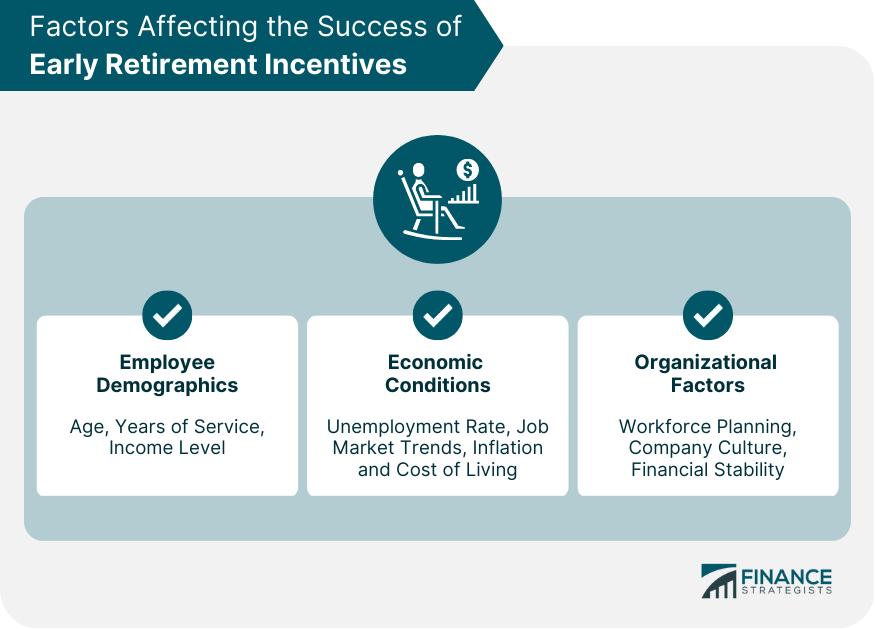

Factors Affecting the Success of Early Retirement Incentives

Employee Demographics

Age

Years of Service

Income Level

Economic Conditions

Unemployment Rate

Job Market Trends

Inflation and Cost of Living

Organizational Factors

Workforce Planning

Company Culture

Financial Stability

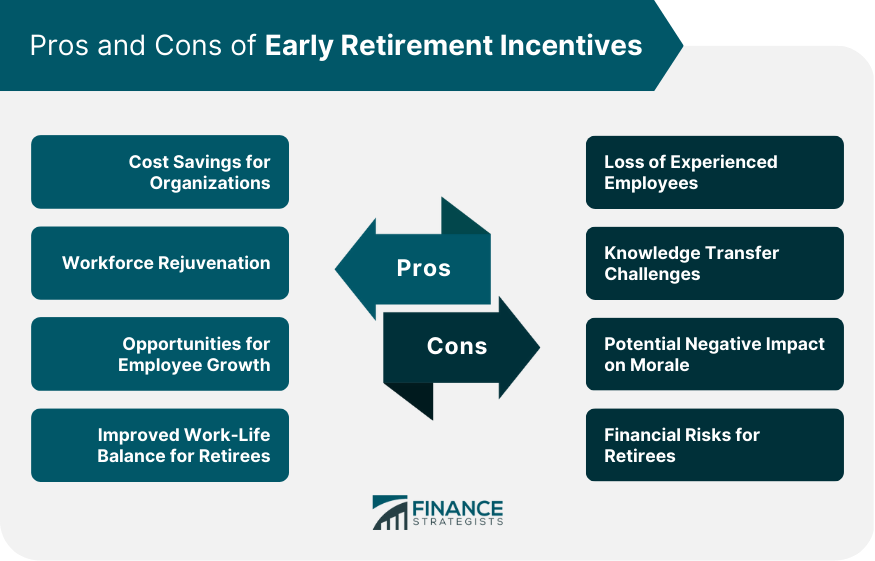

Pros and Cons of Early Retirement Incentives

Pros

Cost Savings for Organizations

Workforce Rejuvenation

Opportunities for Employee Growth

Improved Work-Life Balance for Retirees

Cons

Loss of Experienced Employees

Knowledge Transfer Challenges

Potential Negative Impact on Morale

Financial Risks for Retirees

Best Practices for Implementing Early Retirement Incentives

Clearly Defined Goals and Objectives

Comprehensive Communication Strategies

Financial and Non-financial Incentive Offerings

Monitoring and Evaluation of Program Effectiveness

Conclusion

Early Retirement Incentives FAQs

Early retirement incentives are programs offered by employers to encourage their employees to retire early by providing financial benefits, such as severance pay, pension benefits, or health insurance coverage.

Eligibility for early retirement incentives varies by employer and may depend on factors such as age, years of service, and job classification. Some employers may offer early retirement incentives to specific groups of employees, such as those in certain departments or job functions.

Employers offer early retirement incentives as a way to reduce their workforce and cut costs. By encouraging employees to retire early, employers can avoid layoffs or involuntary terminations, which can be more costly and damaging to morale.

The advantages of taking early retirement incentives include receiving financial benefits such as severance pay or pension benefits, avoiding potential layoffs or involuntary terminations, and having more time to pursue other interests or passions.

The disadvantages of taking early retirement incentives may include receiving a lower pension benefit than if you had stayed with the company longer, losing certain job-related benefits such as health insurance coverage, and potentially having to find another source of income if the early retirement incentives do not provide enough financial support.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.