Distributions in kind refer to the process of distributing assets or investments from a retirement account to the account owner without converting them into cash. With this strategy, the retiree can choose to take assets such as stocks, mutual funds, or other investment assets directly from their retirement account as their payment. Distributions in kind can be a good option for retirees who want to maintain their current investment portfolio and avoid selling assets at an unfavorable time. It also allows retirees to defer taxes on the transferred assets until they are sold in the future. However, it is important to consult with a financial advisor before making any decisions about distributions in kind to ensure that it aligns with your long-term financial goals and overall retirement plan. Stock dividends are a form of distribution in kind that retirees can choose to receive as part of their retirement plan. Instead of receiving cash, the investor receives additional shares of stock. This can be a tax-efficient way to increase one's investment in a particular company. Real estate is another type of distribution in kind that can provide retirees with a stream of income. Investors can choose to receive rental income from a property or receive a lump sum payment by selling the property. Retirees can also receive distributions in kind in the form of partnership interests. This type of investment allows investors to own a percentage of a business and receive a share of the profits. Finally, annuities are another form of distribution in kind. Annuities are insurance products that provide a guaranteed stream of income for a set period or for the rest of the investor's life. Annuities can provide a stable source of income in retirement and may be a good choice for risk-averse investors. When choosing distributions in kind for retirement planning, investors need to consider their risk tolerance. Assets such as stocks and partnership interests can be riskier than annuities and real estate. Retirees who are risk-averse may want to consider annuities as a way to receive guaranteed income in retirement. Retirees also need to consider their income needs when choosing distributions in kind. Annuities can provide a stable source of income, but they may not be the best choice for retirees who need access to their retirement funds. Real estate or stock dividends may be a better choice for retirees who need more flexibility in their retirement income. Investors also need to consider their liquidity needs when choosing distributions in kind. If retirees anticipate unexpected expenses in retirement, they may want to avoid illiquid assets such as real estate or partnership interests. Instead, they may want to consider assets such as stocks or annuities, which can be sold or surrendered for cash. Finally, investors need to consider tax implications when choosing distributions in kind. Assets such as real estate or partnership interests may have different tax implications than stocks or annuities. Retirees should consult with tax professionals to determine the tax implications of their chosen assets. Distributions in kind can provide tax benefits for retirees. When investors receive distributions in cash, they are required to pay taxes on the distribution. However, when they receive distributions in kind, they are not required to pay taxes until they sell the asset. Distributions in kind can also provide diversification benefits for investors. By receiving assets instead of cash, investors can diversify their investment portfolios and reduce their exposure to market risk. Distributions in kind can also result in reduced fees. When investors receive cash distributions, they may be required to pay transaction fees and other expenses associated with managing their retirement accounts. However, when they receive distributions in kind, they may be able to avoid these fees. Finally, distributions in kind can help retirees manage risk. By diversifying their investment portfolios and receiving guaranteed income from annuities, retirees can mitigate their exposure to market risk and ensure a stable source of retirement income. One of the main disadvantages of distributions in kind is illiquidity. When investors receive assets instead of cash, they may not be able to sell the asset quickly or easily. This can be a problem if they need cash for unexpected expenses. Another disadvantage of distributions in kind is concentration risk. If investors receive a large percentage of their retirement income from a single asset, such as a rental property or a stock, they may be exposed to concentration risk. If the value of the asset declines, their retirement income may be at risk. Valuing assets can also be a challenge for retirees receiving distributions in kind. Assets such as real estate or partnership interests can be difficult to value, which can make it hard for retirees to determine the fair market value of their retirement assets. Finally, distributions in kind can also be subject to legal issues. Investors may need to consult with legal professionals to ensure that their retirement plan is in compliance with federal and state laws. Distributions in kind can provide retirees with an alternative way to receive retirement income. Assets such as stocks, real estate, partnership interests, and annuities can provide tax benefits, diversification, reduced fees, and risk management. However, retirees also need to consider the disadvantages of distributions in kind, including illiquidity, concentration risk, difficulty in valuation, and legal issues. When choosing distributions in kind for retirement planning, investors need to consider their risk tolerance, income needs, liquidity needs, and tax implications. By carefully considering these factors, retirees can choose the distributions in kind that are best suited for their retirement needs.What Are Distributions in Kind?

Types of Distributions in Kind

Stock Dividends

Real Estate

Partnership Interests

Annuities

Factors to Consider in Choosing Distributions in Kind in Retirement Planning

Risk Tolerance

Income Needs

Liquidity Needs

Tax Considerations

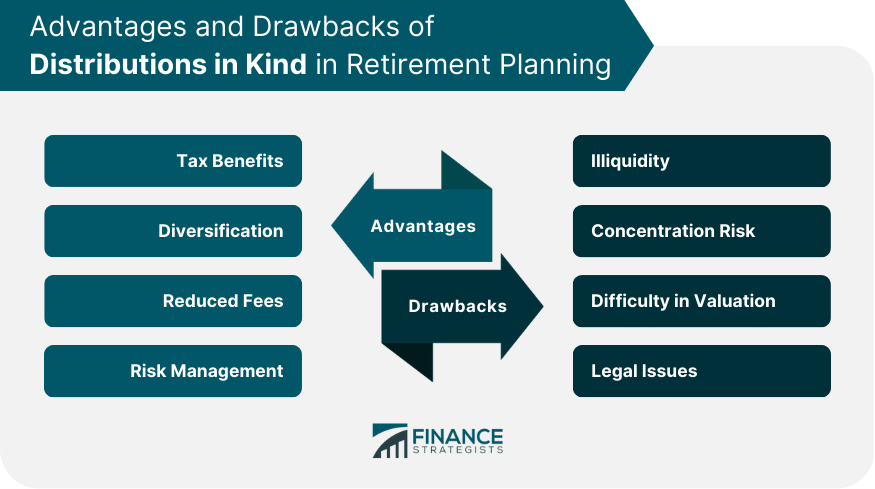

Advantages of Distributions in Kind in Retirement Planning

Tax Benefits

Diversification

Reduced Fees

Risk Management

Drawbacks of Distributions in Kind in Retirement Planning

Illiquidity

Concentration Risk

Difficulty in Valuation

Legal Issues

Conclusion

Distributions in Kind FAQs

Distributions in kind are an alternative way to receive retirement benefits in the form of assets, such as stocks, real estate, partnership interests, and annuities, rather than cash.

Distributions in kind can provide tax benefits, diversification, reduced fees, and risk management benefits for retirees.

Disadvantages of distributions in kind include illiquidity, concentration risk, difficulty in valuation, and potential legal issues.

Investors need to consider their risk tolerance, income needs, liquidity needs, and tax implications when choosing distributions in kind for their retirement planning.

Yes, distributions in kind can help retirees manage their exposure to market risk by diversifying their investment portfolios and providing guaranteed income from annuities.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.