A commercial equity line of credit (CELOC) is an equity line of credit that is used by businesses. An equity line of credit is a line of credit that is secured by the equity in a piece of property. Often, businesses will leverage the equity in their real estate or building to take out this LOC. A CELOC is a flexible financing tool that allows businesses to tap into the equity of their commercial properties. It operates much like a home equity line of credit, but instead of personal residences, it is tied to the value of commercial real estate properties. The credit line revolves, meaning businesses can borrow, repay, and borrow again up to the established limit. Just like personal equity lines of credit, a CELOC lets borrowers draw funds as needed, instead of receiving a lump sum. This offers businesses the ability to manage cash flow more efficiently because they only need to pay interest on the money they actually borrow, not the total approved for the credit line. The operation of a commercial equity line of credit is rather straightforward. A business applies for the line of credit with a lender, typically a bank, which then assesses the value of the commercial property and the existing mortgage balance, if any. The difference between the two is the equity, which determines the credit limit. Businesses can draw on their credit line as needed, with the amount drawn subject to interest. The repayment schedule is agreed upon during the loan application process and may involve making only interest payments during the draw period. At the end of this period, the business begins to pay back both the principal and the interest. A revolving credit line, such as a CELOC, allows businesses to borrow funds, repay them, and borrow again. This makes it a highly flexible source of funding. Companies can use as much or as little as they need from their available credit, depending on their specific requirements and circumstances. The revolving nature of CELOCs makes them ideal for meeting short-term financial needs or bridging gaps in cash flow. Companies have the freedom to manage their credit lines according to their unique financial situations, and unlike term loans, funds become available again after repayment. Because a CELOC is secured against commercial property, it has collateral requirements. This means that the business must pledge its property as security for the loan. The collateral value is a major determinant of the credit limit. Generally, lenders permit a business to borrow up to a certain percentage of the property's appraised value, minus the amount of any outstanding mortgage or loans on the property. If the borrower defaults, the lender has the right to seize the property to recover its losses. The interest rate on a commercial equity line of credit varies depending on several factors, including the creditworthiness of the borrower, market rates, and the loan-to-value ratio of the property. Interest rates are typically variable, meaning they can fluctuate over the life of the credit line. The terms of the loan also vary, but CELOCs usually have a draw period of several years, during which the borrower can access funds. This is followed by a repayment period during which the borrowed principal and accrued interest must be repaid. The credit limit or borrowing capacity of a CELOC is primarily determined by the equity in the commercial property. Lenders typically set a credit limit based on a percentage of the appraised value of the property, less any existing loans or mortgages. This provides businesses with substantial borrowing capacity, which can be particularly advantageous for large projects or investments. However, it's crucial for businesses to manage their borrowing effectively, ensuring they don't overextend themselves financially. As a revolving line of credit, a CELOC offers businesses high flexibility in managing their funds. They can choose when to draw funds and how much to draw, as long as they stay within their credit limit. The accessibility of a CELOC also sets it apart. Once the line of credit has been established, businesses can easily access the funds, often through online banking, checks, or even a card linked to the credit line. This quick and easy access can be a lifesaver for businesses faced with unexpected expenses or opportunities. When compared to other forms of financing, a CELOC can be a cost-effective way to secure funding. The interest rates for CELOCs are generally lower because the loan is secured against a commercial property. Furthermore, businesses only pay interest on the amount they borrow, not the total credit limit. This means if a business does not use the line of credit, it won't incur any interest charges. This feature can significantly reduce the overall cost of borrowing, making CELOCs a cost-effective solution for businesses. In some cases, the interest paid on a CELOC may be tax-deductible. This potential tax advantage can make a CELOC an even more cost-effective financing option. However, it's important to note that tax laws can be complex and vary depending on the specific circumstances and location of the business. Therefore, businesses should consult with a tax professional before proceeding with a CELOC to understand the potential tax implications. A CELOC allows businesses to leverage their commercial property as a funding source. This can be a significant advantage for businesses that have substantial equity in their property but may not have a large amount of liquid cash on hand. By leveraging their existing assets, these businesses can access the capital they need without having to sell their property or seek other, potentially more expensive forms of financing. This use of existing resources can help businesses grow without diluting ownership or taking on burdensome debt. The value of commercial property, much like any real estate, can fluctuate over time. Changes in the real estate market, economic conditions, or specific factors affecting the property's location can impact its value. This presents a risk to businesses with CELOCs, as a decline in property value can affect the credit limit or collateral value. If the value of the property decreases significantly, it could lead to a reduced credit limit or potential default on the loan. It's important for businesses to consider this risk and assess their ability to manage fluctuations in property value. Asset depreciation is another risk associated with a CELOC, particularly when the credit line is tied to a specific property. Over time, commercial properties can experience wear and tear, requiring maintenance, repairs, or renovations. If the property's condition deteriorates, it could impact its value and the borrowing capacity associated with the CELOC. Businesses should factor in the potential costs of maintaining and improving the property to protect its value and borrowing capacity. Failure to do so may result in decreased equity and limited access to funding. Since the interest rates on CELOCs are typically variable, they can rise or fall over the life of the loan. Fluctuating interest rates can affect the affordability of the loan, potentially increasing the interest expense for businesses. To mitigate this risk, businesses should consider their ability to manage potential increases in interest rates. They may choose to set aside funds or explore other financing options that offer fixed interest rates to provide stability in their financial planning. Lastly, businesses need to be cautious about overborrowing and the potential financial strain it can create. While a CELOC offers access to significant funds, it's important for businesses to borrow responsibly and within their means. Overborrowing can lead to a higher debt burden, making it challenging to meet repayment obligations. Businesses should carefully assess their cash flow, revenue projections, and ability to service the debt before taking on a CELOC. It's crucial to maintain a sustainable debt-to-equity ratio and ensure that borrowing aligns with the business's overall financial strategy. One of the common uses of a CELOC is for working capital management. Businesses often face fluctuations in cash flow due to seasonality, payment delays, or unexpected expenses. A CELOC can serve as a revolving source of funds to cover short-term working capital needs. This helps businesses maintain smooth operations and bridge temporary gaps in cash flow. Businesses seeking to expand or pursue growth initiatives often require additional funding. A CELOC can be a valuable resource for financing expansion projects, such as opening new locations, investing in technology upgrades, or launching new product lines. By tapping into the equity of their commercial property, businesses can access the necessary capital to fuel their growth. Businesses can leverage the credit line to invest in additional properties or make improvements to existing ones. Whether it's acquiring income-generating properties or renovating commercial spaces, a CELOC provides the financing needed to pursue real estate opportunities. By consolidating multiple debts into a single credit line, businesses can streamline their debt management and potentially lower their overall interest expenses. This can provide businesses with increased financial flexibility and help them pay off their debts more efficiently. A commercial equity line of credit is a flexible financing tool that allows businesses to access funds based on the equity in their commercial property. It offers advantages such as flexibility, cost-effectiveness, potential tax advantages, and the ability to leverage existing assets. However, it is not without risks, including market fluctuations, asset depreciation, interest rate risks, and potential overborrowing. A CELOC can be used for a variety of purposes, from managing working capital to financing growth initiatives, real estate investments, or debt consolidation. When utilized responsibly, a CELOC can provide businesses with the financial flexibility they need to achieve their strategic goals.What Is a Commercial Equity Line of Credit?

How Does a Commercial Equity Line of Credit Work?

Key Features and Characteristics of CELOC

Revolving Credit Line

Collateral Requirements

Interest Rates and Terms

Credit Limits and Borrowing Capacity

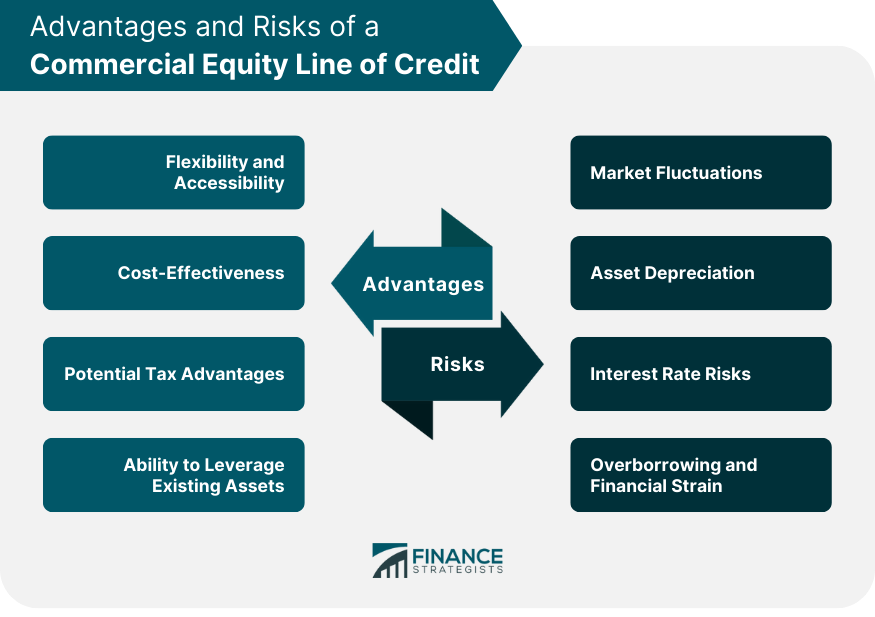

Advantages of a Commercial Equity Line of Credit

Flexibility and Accessibility

Cost-Effectiveness

Potential Tax Advantages

Ability to Leverage Existing Assets

Risks of a Commercial Equity Line of Credit

Market Fluctuations

Asset Depreciation

Interest Rate Risks

Overborrowing and Financial Strain

Common Uses of a Commercial Equity Line of Credit

Working Capital Management

Financing Expansion or Growth Initiatives

Real Estate Investment or Property Improvements

Consolidating Higher-Interest Debt

Conclusion

Commercial Equity Line of Credit FAQs

A Commercial Equity Line of Credit (CELOC) is a type of revolving line of credit offered by banks and other financial institutions that allows businesses to use their commercial property as collateral for financing needs. The CELOC provides access to large sums of capital, allowing businesses to make investments in areas such as inventory, equipment, real estate, or business expansion without having to rely on traditional bank loans.

The CELOC works similarly to a regular home equity line of credit; the borrower obtains an approved amount from the lender that can be used for qualified purchases. The borrower then repays the loan in a series of installments or draws from the line of credit. Funds can be accessed as needed, up to the approved amount, and no payments are required until the borrower begins drawing on the line of credit.

Businesses with substantial commercial property assets may opt for CELOCs to access additional capital for their operations. This type of financing is particularly useful for businesses that need to make large purchases quickly but don’t have enough liquid assets to cover them.

One main risk associated with CELOCs is that they are secured against the borrower’s commercial property. If the borrower is unable to repay the loan, the lender can repossess the collateral and may even seek additional damages in court if necessary. In addition, CELOCs typically have variable interest rates that can change over time, increasing the cost of borrowing.

To apply for a CELOC, borrowers must provide evidence of their business’s financial health as well as collateral documentation such as title deeds or lease agreements for any commercial properties they own or occupy. The application will also require information on past and current banking activities, credit scores, and personal identification documents. It is important to gather all required documents before submitting an application to ensure the process is completed quickly and efficiently.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.