A credit line increase refers to an increase in the amount of credit that a lender, typically a bank or credit card issuer, extends to a borrower. Essentially, it means raising the limit on your credit card or credit account. When a credit line increases, it enhances the borrower's purchasing power, allowing them to make larger transactions or take on additional debt. However, it's essential to remember that a credit line increase also implies a higher potential debt level. Borrowers need to manage their credit responsibly to avoid falling into unmanageable debt. How much of a credit line increase you should ask for depends on many factors. These factors may include your income level, spending habits, debt-to-income ratio, and financial goals. It's crucial to avoid seeking an increase that could lead to overspending or financial strain. In general, it does not do your credit any favors to increase your limit unless the increase is definitely needed. You should be aware that increasing the limit on one card may impact your ability to increase your others. Before requesting a credit line increase, take a close look at your current financial situation. Start by reviewing your income and expenses. You need to understand how much money you have coming in, where it's going, and how much is left over. Your income includes all your sources of regular income, such as salaries, wages, and any side businesses. Your expenses, on the other hand, include all your regular spending, including mortgage or rent payments, utilities, groceries, entertainment, and any debt payments. Once you have a clear picture of your income and expenses, you can better assess your capacity to handle a larger credit limit. The debt-to-income (DTI) ratio is a crucial financial metric that lenders often consider when evaluating your creditworthiness. It measures the portion of your monthly income that goes towards debt payments, including mortgages, auto loans, student loans, and credit card payments. A high DTI ratio can signal financial stress and could make lenders hesitant to extend additional credit. By contrast, a low DTI ratio indicates you have a good balance between your debt and income, making you a more attractive borrower. If you're considering a credit line increase, understanding and improving your DTI ratio can help you make a more compelling case to your lender. Your credit score and credit history are critical factors that lenders consider when deciding whether to grant a credit line increase. A high credit score and a clean credit history signal that you're a responsible borrower, making lenders more likely to approve your request. Therefore, before requesting a credit line increase, make sure you understand your credit score and credit history. Review your credit reports for any errors and address any issues that could negatively impact your score. Remember that responsible credit management, such as making payments on time and maintaining a low credit utilization ratio, can help boost your credit score. Your short-term financial needs can influence your decision about whether to request a credit line increase and how much to request. If you're planning a large purchase, for instance, a credit line increase could provide the necessary financial flexibility. However, it's essential to weigh the benefits against the potential costs. If the increase leads to higher interest payments or causes you to overspend, it may not be worth it. Always consider alternatives, such as saving up for the purchase or exploring other financing options. Your long-term financial goals should also play a role in your decision about a credit line increase. If you're aiming to buy a home, start a business, or achieve other major financial goals, maintaining a strong credit profile is crucial. A credit line increase, if managed responsibly, can help improve your credit score and boost your borrowing power. Yet, it's important not to lose sight of the potential risks. Taking on too much debt now could compromise your ability to achieve your long-term goals. Always consider your future financial needs and goals when deciding on a credit line increase. Credit utilization ratio is a measure of how much of your available credit you're currently using. It's calculated by dividing your total credit card balances by your total credit card limits. For example, if you have a credit card with a $5,000 limit and you've charged $2,500 to it, your credit utilization ratio is 50%. This ratio is a key factor in your credit score. A high credit utilization ratio can signal to lenders that you're over-reliant on credit and may struggle to repay your debts, potentially leading to a lower credit score. On the other hand, a low credit utilization ratio indicates responsible credit use and can contribute to a higher credit score. To calculate your credit utilization ratio, add up the balances on all your credit cards and then add up the credit limits on all those cards. Then divide the total balance by the total limit. Multiply the result by 100 to get your credit utilization ratio as a percentage. Keep in mind that credit scoring models usually consider both your overall credit utilization ratio (across all your cards) and your per-card ratio. Thus, even if your overall ratio is low, having a high ratio on a single card could potentially hurt your credit score. Increasing your credit line can lower your credit utilization ratio, provided your spending doesn't increase proportionally. For instance, if you have a $2,500 balance on a $5,000 limit card (50% utilization), and you increase your limit to $7,500, your new utilization ratio would be 33%, assuming you don't add to the balance. Lowering your credit utilization ratio can have a positive impact on your credit score. However, it's essential to continue managing your credit responsibly. Don't view the increase as an invitation to spend more. Instead, aim to maintain or reduce your balances to further improve your credit utilization ratio. Different credit card issuers have different policies and criteria when it comes to credit line increases. Some issuers might automatically increase your credit limit based on your payment history and creditworthiness. Others might require you to request an increase and provide updated income information. Make sure to research your credit card issuer's policy before making a request. Understanding their criteria and process can increase your chances of getting approved and help you make an informed decision. It's also worth comparing the benefits and terms of different credit cards before deciding to request a credit line increase. Some cards offer rewards, such as cash back or travel points, which can add value and offset some of the costs associated with a higher limit. However, be sure to weigh these benefits against the terms of the card, including interest rates, fees, and penalties. Sometimes, instead of seeking a credit line increase on your existing card, it may be more beneficial to apply for a new card that offers better terms or rewards. While a credit line increase can potentially improve your credit score by lowering your credit utilization ratio, it can also have negative effects. For example, if your lender performs a hard credit inquiry as part of their decision process, it can cause a temporary dip in your score. Moreover, if a larger credit limit leads to higher balances and increased credit utilization, it can negatively impact your score. It's crucial to understand these potential effects and manage your credit responsibly to protect and enhance your credit health. A credit line increase can sometimes come with changes to your credit card's interest rates. For instance, some card issuers may increase your rate if you accept a higher credit limit. Higher interest rates can increase the cost of carrying a balance on your card, potentially outweighing the benefits of the increased limit. Before accepting a credit line increase, make sure you understand whether and how it might affect your interest rates. Read the fine print and ask your lender about any potential changes. Finally, be aware that some lenders may charge fees for a credit line increase. For example, they might apply a one-time charge or adjust other fees associated with your account. These costs can add up and might make the increase less advantageous than it seems at first glance. Always ask about any potential fees or charges before requesting a credit line increase. And remember to factor in these costs when assessing the overall benefits and drawbacks of a higher credit limit. When determining how much of a credit line increase to request, it's essential to set realistic expectations based on your income and expenses. The larger the increase, the more potential there is for spending—and debt—to get out of control. A good rule of thumb is to request an amount that aligns with your financial capacity and spending habits. Consider how much you typically spend on your credit card each month and how much you can comfortably repay. Don't forget to account for potential emergencies and unexpected expenses. Your future financial needs and goals should also play a role in determining the appropriate credit line increase amount. If you're planning major expenses or life changes, such as home renovations, a wedding, or further education, you might need additional credit to help cover these costs. However, it's important not to let short-term needs overshadow long-term financial health. Make sure to consider the potential impacts of a higher credit limit on your long-term goals, such as saving for retirement or buying a home. The goal is to strike a balance between your current and future credit utilization. You want a credit limit that provides the flexibility you need, without encouraging overspending or leading to high credit utilization. Consider how a credit line increase might affect your credit utilization ratio both now and in the future. Ideally, you want to keep this ratio low, even with a higher credit limit. This approach can help maintain or improve your credit score while providing the financial flexibility you need. When you're ready to request a credit line increase, it's essential to gather the necessary financial documents. Most lenders will want to see proof of income, such as recent pay stubs or tax returns. They might also ask for information about your monthly expenses and other debts. Having these documents ready can make the process smoother and faster. Plus, it shows the lender that you're serious and organized, which can help your case. The next step is to contact your credit card issuer. You can often request a credit line increase online or by phone. Make sure to ask about the issuer's policies and requirements, as well as any potential impacts on your credit score or account terms. When making the request, be prepared to provide your current income, employment information, and the amount of the increase you're seeking. Remember to be respectful and professional throughout the conversation. Explain why you believe you can handle a higher credit limit, citing your income, expenses, and financial management practices. Also, discuss how the increase aligns with your financial goals and needs. Remember that lenders are not obligated to approve your request. If they decline, ask for feedback and use it to improve your financial habits and creditworthiness for future requests. Generally, you can increase your credit limit on a personal line of credit simply by requesting one. Depending on the increase requested, you may be granted one without heavy scrutiny. Some banks may also provide you a credit increase automatically if your credit habits are good. A credit line increase is a financial tool that can provide flexibility and potentially improve your credit score. However, it comes with potential risks and costs, including higher spending potential, possible interest rate increases, and potential fees. Determining the appropriate credit line increase amount involves a careful consideration of various factors, including your income and expenses, debt-to-income ratio, credit score, and financial goals. Always strive for a balance that provides the flexibility you need, without encouraging overspending or high credit utilization. Evaluating your current financial situation is crucial before requesting a credit line increase. Make sure you understand your income and expenses, debt-to-income ratio, and credit score. Also, assess your short-term financial needs and long-term financial goals. With careful planning and responsible credit management, a credit line increase can be a beneficial financial tool.What Is a Credit Line Increase?

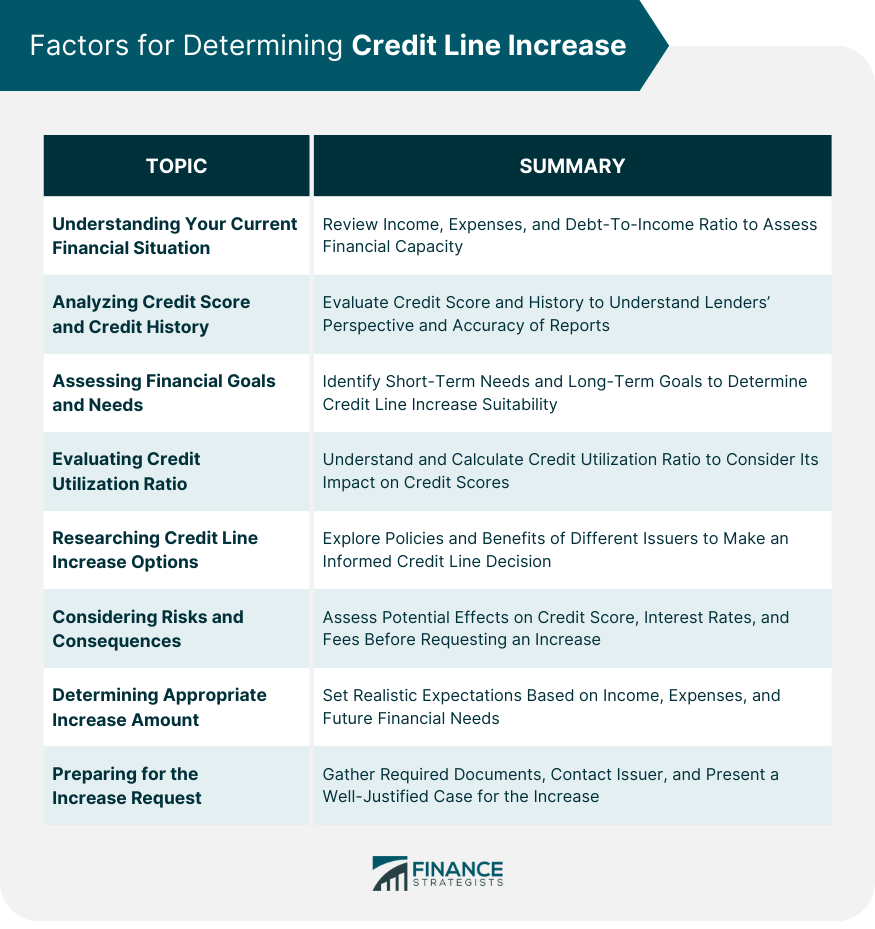

Factors to Consider When Determining the Credit Line Increase Amount

Understanding Your Current Financial Situation

Reviewing Your Income and Expenses

Evaluating Your Debt-to-Income Ratio

Analyzing Your Credit Score and Credit History

Assessing Your Financial Goals and Needs

Identifying Short-Term Financial Needs

Considering Long-Term Financial Goals

Evaluating Your Credit Utilization Ratio

Understanding the Concept of Credit Utilization Ratio

Calculating Your Current Credit Utilization Ratio

Determining the Impact of Credit Line Increase on Credit Utilization Ratio

Researching Credit Line Increase Options

Exploring Different Credit Card Issuers' Policies

Comparing Credit Card Benefits and Terms

Considering Potential Risks and Consequences

Understanding Potential Impact on Credit Score

Assessing Potential Interest Rate Changes

Evaluating Potential Fees and Charges

Determining the Appropriate Credit Line Increase Amount

Setting Realistic Expectations Based on Income and Expenses

Considering Future Financial Needs and Goals

Balancing Between Current and Future Credit Utilization

Preparing for the Credit Line Increase Request

Gathering Necessary Financial Documents

Contacting the Credit Card Issuer

Presenting Your Case and Justification for the Requested Amount

How to Increase Your Line of Credit

The Bottom Line

How Much of a Credit Line Increase Should I Ask For? FAQs

Generally, asking for too large of an increase may trigger a review of your account resulting in the lender denying the request or reducing it to a smaller amount than requested. It is recommended to make reasonable requests that are within your capability to pay back.

Yes, if you do not manage your payments on the increased credit line responsibly, it could affect your credit score negatively. Additionally, if you are increasingly reliant on higher amounts of debt to make ends meet, it is important to review your financial budget to ensure you can make your payments on time.

You can usually request a credit line increase multiple times, although the frequency of requests may vary from lender to lender. Requesting increases too often could lead to your application being declined or reduced in amount due to a review of your account.

Yes, lenders use your credit score and other factors to determine the amount they are willing to offer you as a credit line increase. Generally, higher credit scores tend to get larger increases than those with lower scores.

When you apply for the increase, your loan provider will make a ‘hard inquiry’ which may result in a minor dip in your score. However, if you manage your payments on the increased credit limit responsibly and pay them back on time, it will have a positive effect on your credit score.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.