A Home Equity Line of Credit, commonly abbreviated as HELOC, is a flexible borrowing option for homeowners. It is a type of loan that uses the borrower's home as collateral and allows the borrower to draw funds as needed, up to a certain limit. The limit of a HELOC is usually determined by the home’s appraised value, the outstanding mortgage balance, and the borrower's creditworthiness. During what's called the "draw period," borrowers can withdraw money as needed and only pay interest on the amount drawn. This financial tool is advantageous for expenses that are spread out over time, like home renovations, tuition fees, or as a safety net for unexpected costs. Securing a HELOC isn't an instantaneous process. It involves several steps, each of which may require a varying amount of time. It typically takes 2 - 4 weeks from application to get a home equity line of credit, or HELOC. It may take longer depending on the circumstances and complexity of the line of credit request. An easy way to keep things moving is to get your paperwork done quickly; for example, appraising your home on your own. The total time depends on a multitude of factors such as the lender's processing speed, the complexity of the borrower's financial situation, and the value and condition of the home. Understanding the timeline can help potential borrowers plan their finances better and set realistic expectations. Lenders need to evaluate a borrower’s creditworthiness, which can take time depending on the complexity of the borrower's financial situation. If a borrower has a simple, straightforward financial history and a high credit score, this stage may be quicker. However, if there are issues such as late payments, bankruptcies, or low credit scores, it may take longer. An appraisal determines the current market value of the home, while the LTV ratio compares the amount of the loan to the appraised value. These two factors determine how much a borrower can borrow. An appraisal can take anywhere from a few days to a couple of weeks, and any issues discovered during the appraisal may cause additional delays. Every lending institution has its own set of procedures, and the amount of time they take to review applications can vary. Additionally, if a lender has a high volume of applications to process, this could further slow down the timeline. The application process for a HELOC begins with the gathering of required documents. This includes items like proof of income, tax returns, and documentation of assets and debts. It's important to have these documents ready before starting the application to avoid delays. Once all the documents are ready, the borrower can submit the application. This is typically done online, although some lenders may allow in-person or over-the-phone applications. After submission, the lender will review the application to prequalify the borrower based on the provided information. After receiving the application, the lender conducts an initial review and prequalification. During this stage, the lender evaluates the borrower's creditworthiness and the likelihood of approving the loan. The lender may also provide an estimate of the loan amount, interest rate, and terms at this point. This stage usually takes a few days to a week. After the initial review, the lender moves on to a more in-depth assessment of the borrower's creditworthiness. This includes a detailed review of the borrower's credit history, income, employment stability, and financial obligations. Lenders use this information to determine whether the borrower has the capacity to repay the loan. As part of the underwriting process, the lender verifies the financial information provided by the borrower. This may involve contacting employers, banks, and other financial institutions. If discrepancies are found during the verification process, this may lead to delays. Despite a lender's best efforts, there can be delays and obstacles in the approval and underwriting process. Common issues include discrepancies in financial information, issues found during the property appraisal, or changes in the borrower's financial situation. Once the underwriting process is complete and all information has been verified, the lender issues a conditional approval. This approval may come with conditions that the borrower must meet before the loan can close, such as additional documentation or resolving certain financial issues. After any conditions have been met, the lender prepares the closing disclosure, which outlines the final terms of the HELOC, including the interest rate, repayment terms, and any fees or closing costs. Borrowers should review this document carefully to ensure they understand all the terms of the loan. Once the closing disclosure has been reviewed and agreed upon, the lender will schedule a closing date. At closing, the borrower signs the final loan documents, and the HELOC is funded. Depending on the lender, it may take a few days to a week after closing for the funds to be available. In some cases, where the borrower's financial situation is straightforward, and the lender processes applications quickly, a HELOC can be approved and funded in as little as two weeks. This is, however, the exception rather than the rule, and most borrowers should expect a longer timeline. Based on industry standards, the average timeframe for obtaining a HELOC is four to six weeks. This timeline allows for the various stages of the process, including application, approval and underwriting, and closing. However, it's important to remember that every borrower's situation is unique, and individual timelines can vary. One of the best ways to expedite the HELOC process is to organize all necessary documents beforehand. This includes income statements, tax returns, and information about debts and assets. Having these documents ready when you apply can speed up the review process and prevent delays. Another tip is to respond promptly to any requests from the lender. This could be requests for additional documentation, clarifications on your financial information, or responses to questions. Delaying these responses can slow down the process and extend the timeline. Finally, the lender you choose can make a significant difference in the timeline. Look for a lender known for their efficiency and responsiveness. You can often find this information through reviews or by asking for recommendations. An efficient lender will have streamlined processes and will be able to provide a smoother and faster application experience. How long it takes to pay off a home equity line of credit, or HELOC, depends on your interest paid, the size of your monthly payments, and the purchases you make with it. A HELOC has both a draw phase and a repayment phase, which lasts 10-20 years. During the draw phase, typically lasting 5-10 years, you can access funds and make interest-only payments, while the subsequent repayment phase requires full repayment of the principal and interest. A Home Equity Line of Credit (HELOC) is a flexible borrowing option that allows homeowners to access funds as needed, using their home as collateral. The timeline for obtaining a HELOC typically ranges from 2 to 6 weeks, depending on factors such as the applicant's financial history, property appraisal, and the lender's internal processes. The draw phase of a HELOC lasts 5 to 10 years, during which borrowers can withdraw money and make interest-only payments. The subsequent repayment phase extends from 10 to 20 years, requiring full repayment of the principal and interest. To expedite the process, potential borrowers should organize their documents beforehand, respond promptly to lender requests, and choose an efficient and responsive lender. Understanding the timeline and considering individual circumstances will help borrowers plan their finances effectively and set realistic expectations.What Is a Home Equity Line of Credit (HELOC)?

How Long Does It Take To Get a Home Equity Line of Credit?

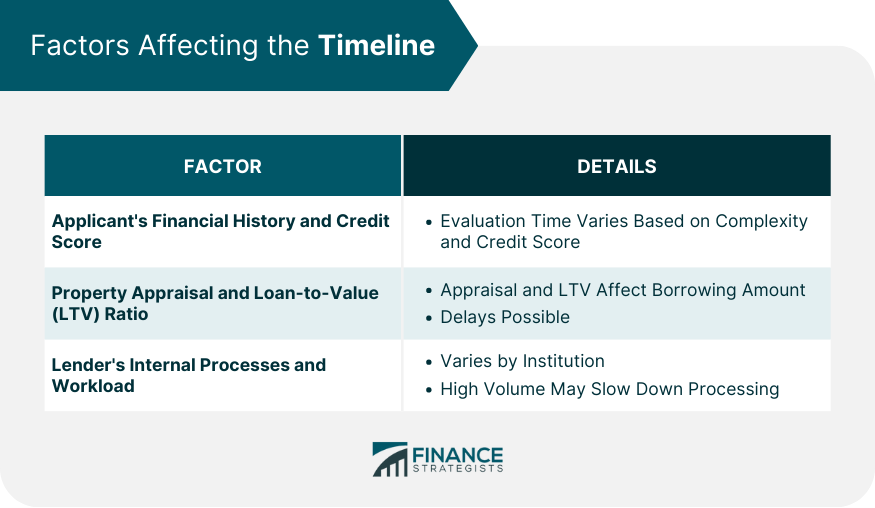

Factors Affecting the Timeline

Applicant's Financial History and Credit Score

Property Appraisal and Loan-to-Value (LTV) Ratio

Lender's Internal Processes and Workload

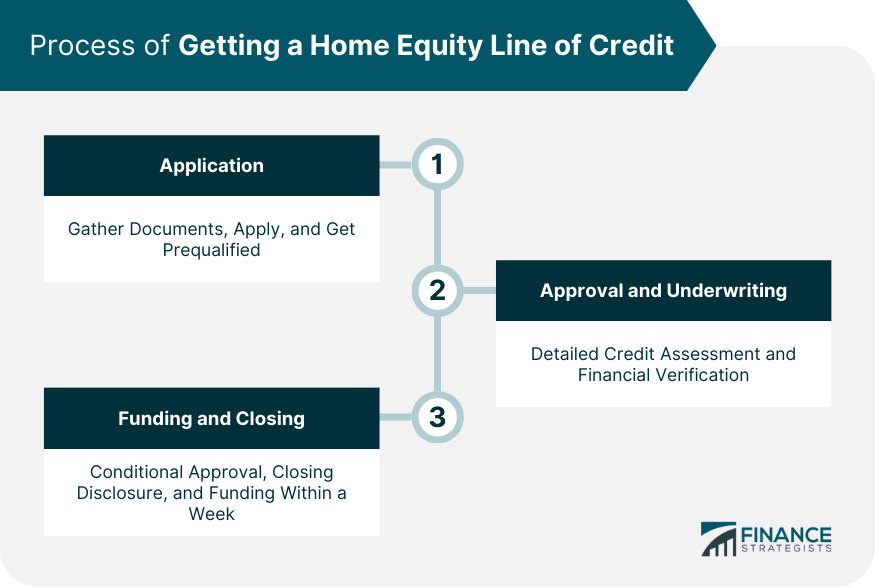

Process of Getting a Home Equity Line of Credit

Application Process

Approval and Underwriting

Funding and Closing

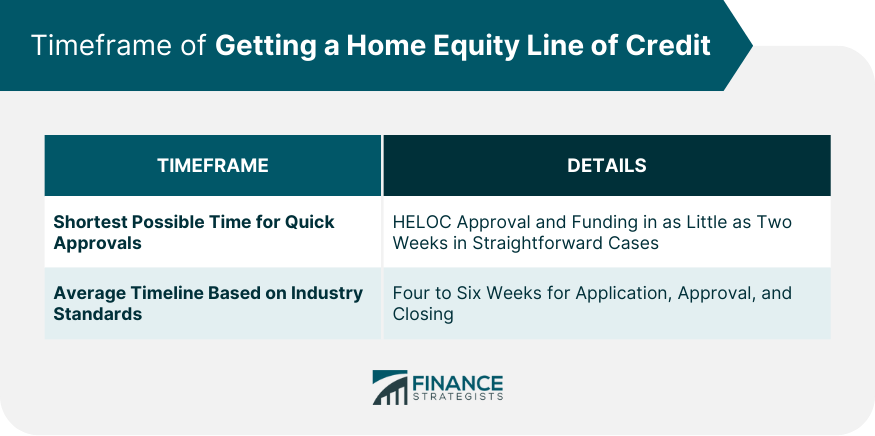

Timeframe of Getting a Home Equity Line of Credit

Shortest Possible Time for Quick Approvals

Average Timeline Based on Industry Standards

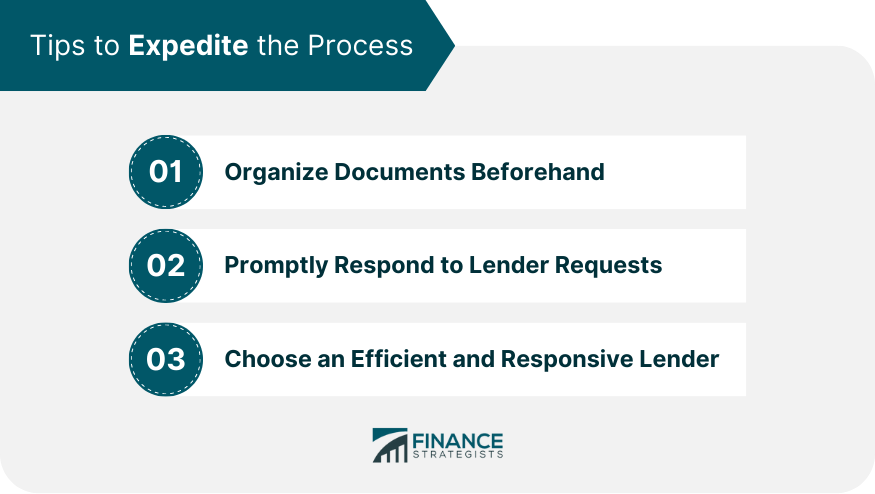

Tips to Expedite the Process

Organize Documents Beforehand

Promptly Respond to Lender Requests

Choose an Efficient and Responsive Lender

How Long Do I Have to Pay Off a Home Equity Line of Credit?

Conclusion

How Long Does It Take to Get a Home Equity Line of Credit? FAQs

The process of obtaining a home equity line of credit can typically take anywhere from 30-45 days, depending on the lender's requirements and your unique financial situation.

The speed of your home equity line of credit approval is dependent on several factors, including the financial institution you choose, the amount being requested, and whether or not all of your documents are in order.

Documents typically required for a home equity line of credit application include your driver's license, income verification documents (such as pay stubs or tax returns), and a list of debts and assets.

The amount you are eligible to borrow with a home equity line of credit is determined by your unique financial situation and the lender's policies. Generally, a home equity line of credit allows you to borrow up to 85% of the value of your home minus any outstanding mortgage balances.

Yes, most lenders will require you to pay an origination fee when applying for a home equity line of credit. Additionally, you may incur other fees such as appraisal costs or closing costs. Be sure to ask your lender about any additional fees prior to applying for a loan.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.