A line of credit (LOC) is a flexible financial tool offered by banks and other financial institutions that allows individuals or businesses to borrow up to a predetermined amount. It operates much like a credit card, providing a source of funds that can be accessed as needed without exceeding the limit set by the lender. A line of credit offers revolving credit, meaning once the borrowed funds are paid back, they become available again for use. The borrower is only charged interest on the amount they borrow rather than the total credit line available. This flexibility makes LOCs an attractive borrowing option for many individuals and businesses. A line of credit provides the borrower with the freedom to draw funds up to the agreed credit limit. The borrower can access these funds at any time, as long as they have not exceeded the credit limit and are meeting the terms of the credit agreement, such as making timely minimum payments. Interest is charged only on the portion of the credit line that has been borrowed, and any unpaid interest is added to the outstanding balance. Payments made towards the borrowed amount free up equivalent credit on the line, making it available for future use. This revolving nature of a line of credit sets it apart from term loans, which provide a lump sum that is paid down over a set period. The credit limit is the maximum amount that a borrower can draw from their line of credit. This limit is set by the lender based on the borrower's creditworthiness, income, and repayment ability. Borrowers are free to draw up to this limit but must avoid exceeding it to avoid penalties. Interest rates on lines of credit are usually variable, meaning they can change over time based on prevailing market rates. The rate is applied only to the portion of the line that has been borrowed, not the total credit limit. The actual rate a borrower is offered depends on several factors, including their credit score, the lender's policies, and market conditions. Lines of credit have distinct repayment terms, which include a draw period and a repayment period. During the draw period, the borrower can access funds up to the credit limit and is typically required to make minimum payments towards the borrowed amount and accrued interest. The repayment period begins when the draw period ends. During this time, borrowers can no longer draw funds and must start repaying the principal and interest. The specific terms can vary greatly, depending on the lender and the type of line of credit. Lines of credit offer a variety of ways to access funds. Some lenders provide checks or a card linked to the credit line, while others allow transfers to a checking account. This flexibility can make a line of credit a convenient tool for managing cash flow and unexpected expenses. The draw period is the phase during which the borrower can draw funds from the line of credit. This period can last several years, and during this time, the borrower usually makes payments towards the interest and a small portion of the principal. After the draw period comes the repayment period, which typically lasts several years. During the repayment period, the borrower can no longer draw funds from the line of credit and must begin repaying the principal and the remaining interest. The repayment period's length and terms can vary depending on the type of LOC and the lender's policies. The qualification criteria for a line of credit can vary widely among lenders. Common factors considered include the borrower's credit score, income, employment stability, and debt-to-income ratio. A higher credit score and stable income generally increase the chances of approval and may result in a higher credit limit and more favorable terms. The specifics can vary by lender, and the type of line of credit, but common requirements include proof of income (such as recent pay stubs or tax returns), proof of identity (such as a driver's license or passport), and proof of address. Businesses applying for a line of credit may also need to provide financial statements and business plans. During the credit evaluation process, the lender examines the borrower's credit history, income, and other factors to assess their creditworthiness and ability to repay the borrowed amount. This evaluation helps the lender determine the credit limit, interest rate, and other terms of the line of credit. A thorough credit evaluation can protect both the borrower and the lender from potential financial risks. Once the lender has evaluated the borrower's creditworthiness, they will make an approval decision. If approved, the lender will establish the terms of the line of credit, including the credit limit, interest rate, and repayment terms. The borrower should review these terms carefully before accepting the line of credit to ensure they understand their obligations and the potential costs. One of the primary benefits of a line of credit is its flexibility. Unlike a traditional term loan, a line of credit allows borrowers to draw funds as needed, up to their credit limit. This flexibility can be especially beneficial for managing unpredictable expenses or irregular cash flow, as it allows borrowers to access funds exactly when they need them. Lines of credit typically have lower interest rates than credit cards, making them a more cost-effective option for borrowing over the long term. Moreover, because interest is charged only on the portion of the credit line that is used, a line of credit can be a more economical choice for borrowers who need ongoing access to funds but won't necessarily use the full credit limit. A line of credit can be an effective tool for managing cash flow, particularly for businesses that have cyclical or seasonal revenue streams. It allows businesses to cover expenses during slow periods and repay the borrowed amount when revenues are higher. This can help businesses maintain operations and continue growth despite cash flow fluctuations. For businesses, a line of credit can provide essential financing for a range of operations, including purchasing inventory, financing receivables, or covering payroll. Because it offers quick access to funds and flexible repayment terms, a line of credit can be an efficient way for businesses to manage their working capital needs. A specific type of line of credit, known as a home equity line of credit (HELOC), allows homeowners to borrow against the equity in their homes. This can provide a source of funds for major expenses such as home improvements or repairs, which can ultimately increase the home's value. While the flexibility of a line of credit is a key benefit, it also poses a risk of overborrowing. Because funds can be accessed so easily, borrowers may be tempted to draw more than they need or can afford to repay, leading to increased debt and potential financial hardship. Although lines of credit typically have lower interest rates than credit cards, the costs can still add up, particularly for those who carry a high balance over a long period. The variable interest rate on most lines of credit also means that costs could increase if market rates rise. Borrowing from a line of credit can impact the borrower's credit score. High utilization of the credit line, late payments, or defaulting on the line of credit can negatively affect the borrower's credit score, making it harder to obtain credit in the future. If a borrower fails to meet the repayment terms of the line of credit, they risk defaulting on the loan. This can lead to serious consequences, including damage to the borrower's credit score, legal action by the lender, and, in the case of secured lines of credit, loss of the collateral. While it might be tempting to accept a high credit limit, borrowers should consider their repayment capacity and potential future income and expenses to ensure they won't borrow more than they can afford to repay. Making payments on time is crucial to avoid penalties, protect your credit score, and keep the line of credit available for future use. Late or missed payments can lead to higher interest charges, fees, and potential damage to your credit score. Keeping an eye on credit utilization - the percentage of the credit line that has been borrowed - can help borrowers manage their debt effectively. A lower credit utilization ratio is generally better for your credit score and indicates responsible use of credit. Reviewing the line of credit statements regularly can help borrowers track their spending, identify any errors, and stay aware of their outstanding balance and interest charges. Regular review can also help borrowers spot any unauthorized transactions or signs of fraud early. Planning for repayment should begin as soon as funds are drawn from the line of credit. This can include setting a budget, saving for future payments, and making more than the minimum payment when possible to reduce the balance faster. A line of credit is a flexible financial tool that allows borrowers to access funds up to a predetermined limit as needed. Interest is charged only on the borrowed amount, and the revolving nature of a line of credit allows repaid funds to be borrowed again. Despite its benefits, a line of credit also carries potential risks, including overborrowing and negative impacts on credit scores. The key to using a line of credit effectively lies in responsible borrowing. This includes setting a realistic credit limit, making timely payments, monitoring credit utilization, regularly reviewing statements, and planning for repayment. By following these strategies, borrowers can maximize the benefits of a line of credit while minimizing potential risks. A line of credit can offer significant benefits, including flexible borrowing, lower interest rates than credit cards, and the ability to manage cash flow and finance various needs. However, it also carries risks, such as potential overborrowing, interest costs, impacts on credit scores, and the consequences of default. What Is a Line of Credit?

How Does a Line of Credit Work

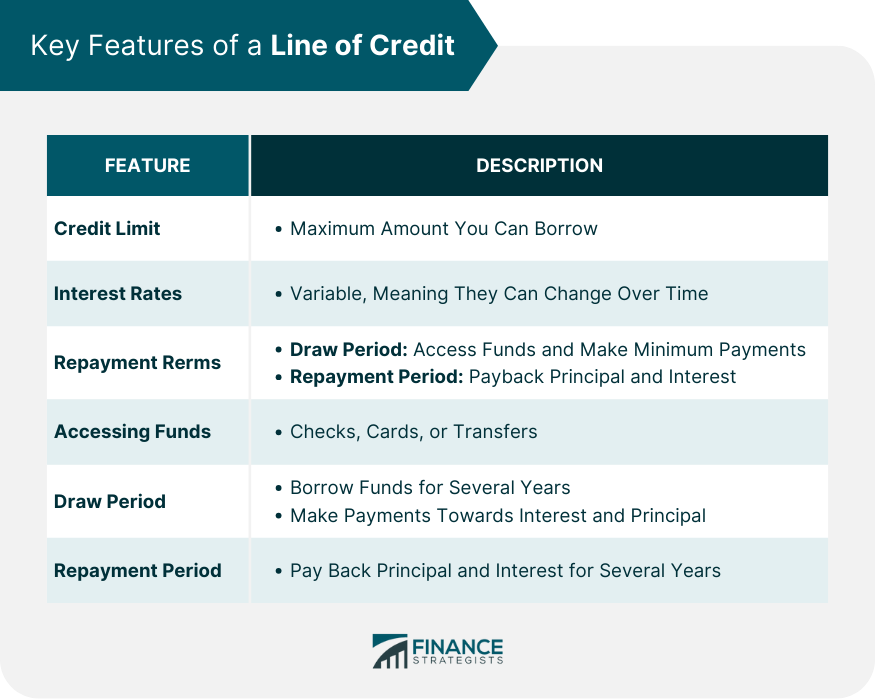

Key Features of a Line of Credit

Credit Limit

Interest Rates

Repayment Terms

Accessing Funds

Draw Period

Repayment Period

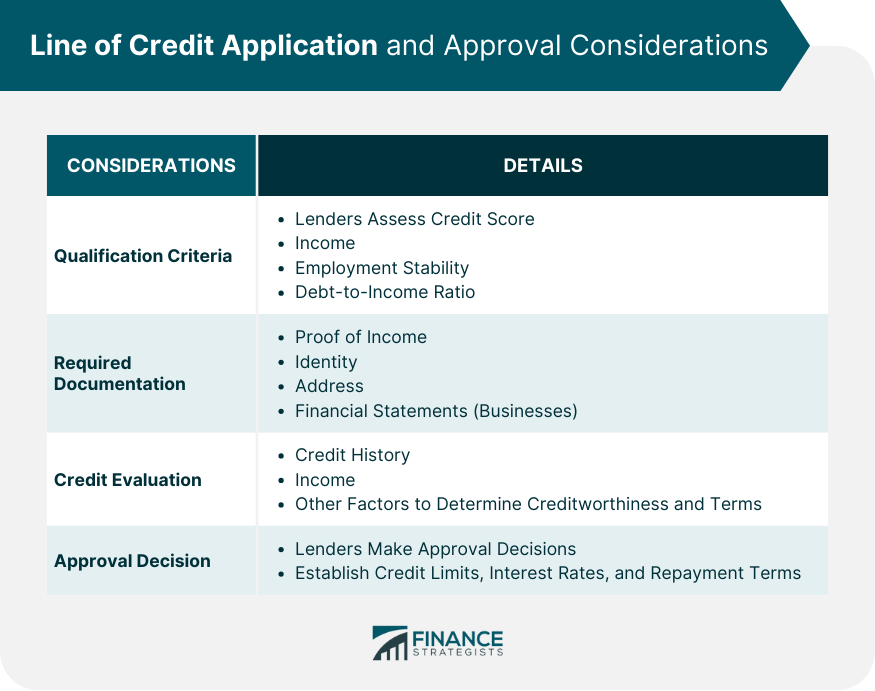

Application and Approval Considerations

Qualification Criteria

Required Documentation

Credit Evaluation

Approval Decision

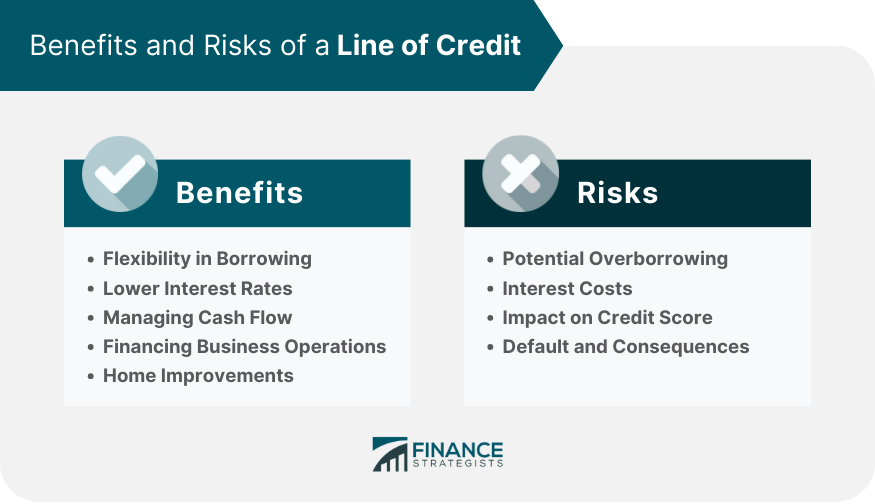

Benefits of a Line of Credit

Flexibility in Borrowing

Lower Interest Rates

Managing Cash Flow

Financing Business Operations

Home Improvements

Risks of a Line of Credit

Potential Overborrowing

Interest Costs

Impact on Credit Score

Default and Consequences

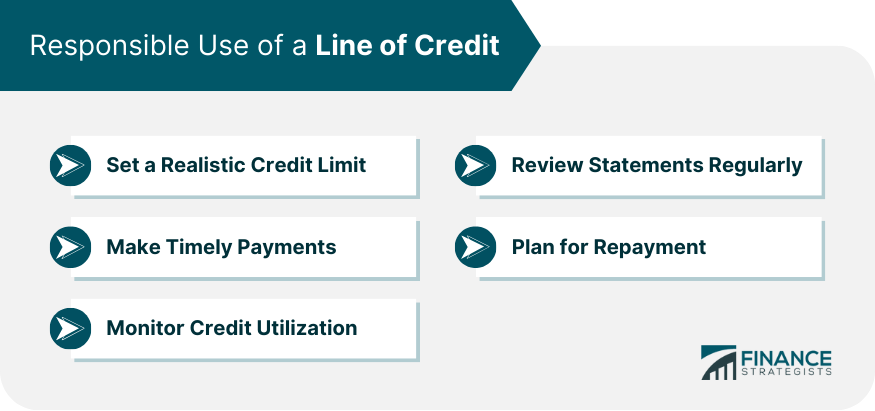

Responsible Use of a Line of Credit

Set a Realistic Credit Limit

Make Timely Payments

Monitor Credit Utilization

Review Statements Regularly

Plan for Repayment

Conclusion

How Does a Line of Credit Work? FAQs

A line of credit is a flexible borrowing option that allows individuals or businesses to borrow up to a predetermined limit as needed. It operates similarly to a credit card and offers revolving credit.

A line of credit allows you to draw funds as needed, up to the approved credit limit. Interest is charged only on the borrowed amount, and as you pay off the borrowed funds, they become available for use again.

A line of credit offers flexibility in borrowing, typically has lower interest rates than credit cards, and can be used to manage cash flow or finance various needs. It's particularly useful for businesses with fluctuating cash flow or for individuals facing unpredictable expenses.

Risks include potential overborrowing, accumulating interest costs, negative impacts on your credit score if not managed responsibly, and severe consequences in case of default, such as legal action by the lender and loss of collateral in case of secured lines of credit.

Responsible use involves setting a realistic credit limit, making timely payments, monitoring your credit utilization, reviewing your statements regularly, and planning for repayment.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.