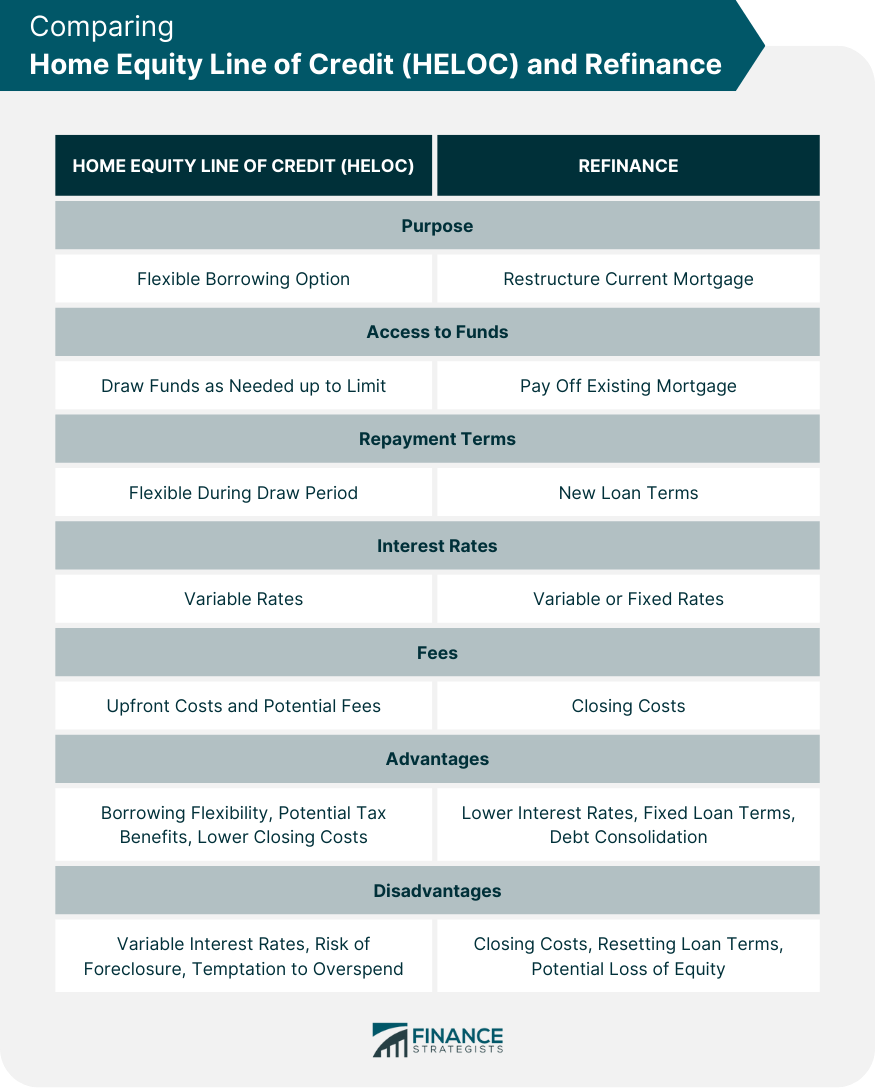

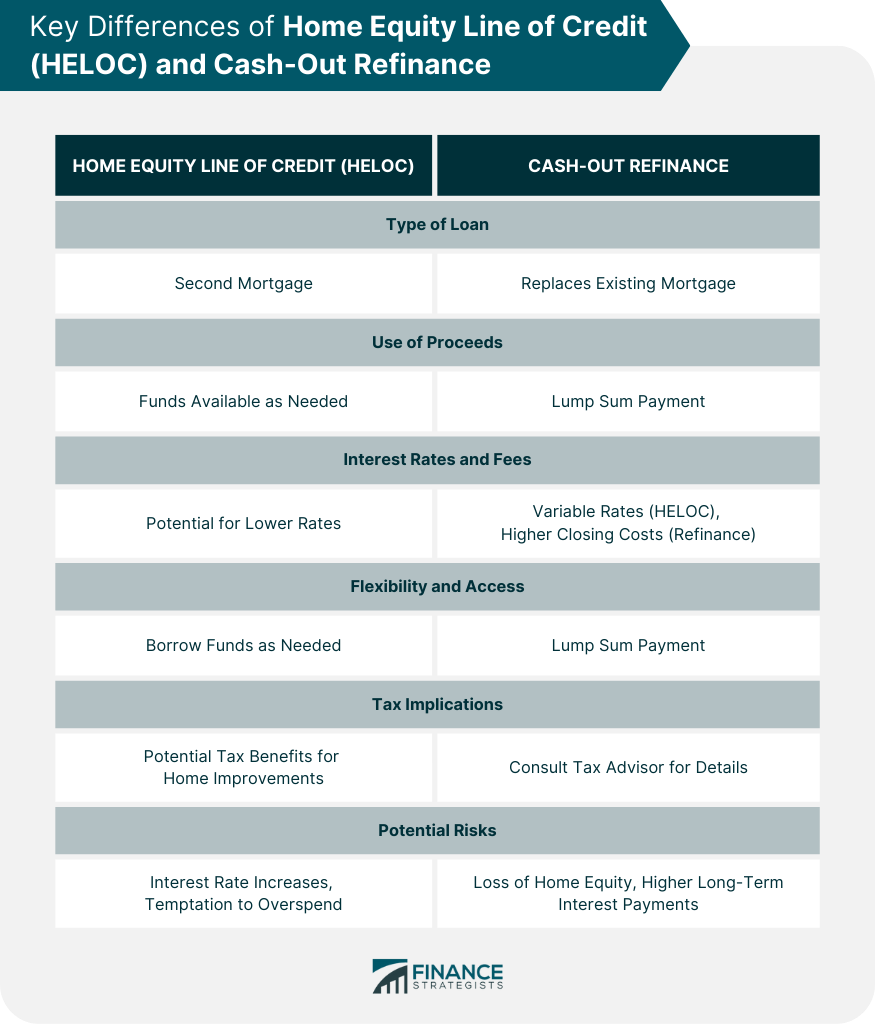

A home equity line of credit, or HELOC, is a type of second mortgage, while a refinancing is where the terms of the existing debt are renegotiated. A refinancing pays off the existing mortgage and opens a new loan with new terms, whereas a HELOC leverages the equity in your home to open a line of credit. A home equity line of credit, or HELOC, is a type of loan that gives homeowners a flexible option to borrow money. To better understand, let's discuss its nature and its function. A HELOC is a form of credit where a homeowner uses the equity in their home as collateral. Equity refers to the difference between the home's market value and any outstanding mortgage balance. In a sense, a HELOC is like a credit card where you have a credit limit, and you can draw funds as needed up to that limit. Unlike a regular mortgage or home equity loan, a HELOC does not require the homeowner to borrow the entire amount upfront. The operations of a HELOC involve particular processes. These include accessing funds, repaying the borrowed amount, and managing associated interest rates and fees. Once a HELOC is established, homeowners can draw funds as they need them, similar to a credit card. You can access this credit line for a certain period known as the "draw period," which usually lasts for 5 to 10 years. This flexibility allows homeowners to control how much they borrow and when, making a HELOC a handy tool for managing fluctuating costs or unexpected expenses. On the other hand, after the draw period ends, the repayment period begins. During this time, homeowners can no longer draw from their line of credit. Instead, they must start repaying what they've borrowed along with any accrued interest. Repayment terms for a HELOC can be quite flexible. During the draw period, many lenders only require the homeowner to make payments towards the interest on the drawn amount. However, homeowners may choose to pay towards the principal during this period as well, which can reduce the total amount owed and potentially lower future payments. Once the repayment period begins, homeowners must start repaying the principal in addition to the interest. The length of the repayment period can vary, but it's typically between 10 to 20 years. Interest rates on a HELOC are typically variable, meaning they can fluctuate over time. These rates are often based on an index like the U.S. prime rate or the London Interbank Offered Rate (LIBOR), plus a margin determined by the lender. It's important for homeowners to understand these terms, as changes in the index can significantly impact the amount of interest paid over time. In terms of fees, there are often upfront costs associated with establishing a HELOC. These may include appraisal fees, application fees, and points, which are a percentage of the credit limit. Additionally, some HELOCs have annual fees or transaction fees for each time a draw is made. A HELOC presents a number of benefits, ranging from borrowing flexibility to potential tax benefits and lower closing costs. A key advantage of a HELOC is the flexibility it offers. Unlike a conventional loan that provides a lump sum upfront, a HELOC allows homeowners to draw funds as needed, up to the credit limit. This feature can be beneficial for homeowners who have ongoing projects or costs and are unsure of the exact amount they'll need. Plus, interest is only charged on the amount that is actually borrowed, not on the full credit line. Moreover, homeowners can choose how they want to repay their HELOC, allowing them to manage their monthly payments in a way that best fits their financial situation. They can opt to make interest-only payments during the draw period or pay down the principal as well. Depending on the homeowner's individual tax situation and how the funds are used, the interest paid on a HELOC may be tax-deductible. This potential tax benefit can reduce the overall cost of borrowing and is a significant advantage for many homeowners. However, tax laws are complex and can change, so homeowners should consult with a tax advisor to understand how a HELOC might impact their taxes. Closing costs for a HELOC are generally lower than those for a traditional mortgage. These costs can include fees for appraisals, title searches, and home insurance, among others. Lower closing costs can make a HELOC a more affordable option for homeowners who need to borrow a substantial sum of money. While HELOCs offer many benefits, they are not without their drawbacks, including variable interest rates, risk of foreclosure, and the temptation to overspend. One of the major disadvantages of a HELOC is the uncertainty associated with variable interest rates. These rates can change over time based on fluctuations in the prime rate or other rate indexes, making it challenging for homeowners to predict their future payments. If interest rates rise significantly, the homeowner may find themselves facing higher monthly payments than they initially anticipated. HELOCs are secured by the homeowner's property, which means that if the homeowner fails to make the necessary payments, they risk losing their home to foreclosure. This risk is heightened in periods of economic downturn or if the homeowner's financial situation changes significantly, such as losing a job or encountering unexpected medical bills. Thus, it's crucial for homeowners to consider their ability to repay a HELOC before borrowing. Given the easy access to funds that a HELOC provides, some homeowners may be tempted to borrow more than they need or can afford to repay. Overspending can lead to a higher debt load and potential financial stress in the future. Therefore, homeowners need to exercise fiscal discipline when using a HELOC and borrow responsibly. In a refinance, the homeowner obtains a new loan to pay off the current mortgage. This can be beneficial for a variety of reasons, such as securing a lower interest rate, changing the loan term, or converting from a variable-rate to a fixed-rate loan. Depending on the homeowner's financial goals and market conditions, refinancing can be a strategic tool for managing mortgage debt. Refinancing involves a process similar to the one used when obtaining the original mortgage. This includes credit checks, an appraisal, and closing costs. It's important to note that refinancing doesn't mean eliminating debt; it simply restructures it, often in a more favorable way for the homeowner. The process of refinancing consists of several steps. These steps include paying off the existing mortgage, obtaining new loan terms, and considering closing costs. The primary purpose of a refinance is to pay off an existing mortgage with the proceeds from a new loan. The new loan is typically the same size as the remaining balance of the old mortgage. However, in a "cash-out" refinance, the new loan is larger, allowing the homeowner to take out cash for other purposes. This process can help homeowners who have improved their credit score since getting their original mortgage, as they may now qualify for lower interest rates. Alternatively, it can help those struggling with monthly payments to extend the loan term and reduce the monthly cost. Refinancing allows homeowners to negotiate new terms for their loan. For instance, they might switch from an adjustable-rate mortgage, which has variable interest rates, to a fixed-rate mortgage, which offers more predictability. Or they might opt for a shorter loan term to pay off their mortgage faster and save on interest payments. Refinancing involves closing costs, just like the original mortgage. These costs typically range from 2% to 6% of the loan amount and include fees for appraisal, credit checks, title search, and more. Therefore, homeowners must consider these costs when deciding whether to refinance. In some cases, these costs may outweigh the potential savings from a lower interest rate or shorter loan term. Refinancing can provide significant benefits, including the potential for lower interest rates, fixed loan terms, and debt consolidation. One of the primary reasons homeowners choose to refinance is to secure a lower interest rate on their mortgage. A lower rate can result in substantial savings over the life of the loan and can reduce the homeowner's monthly payments. Refinancing can allow homeowners to switch from a variable-rate to a fixed-rate loan. This shift can provide more predictability in monthly payments, protecting homeowners from potential interest rate increases in the future. Refinancing can also provide an opportunity to consolidate high-interest debt into a lower-interest mortgage. By using the proceeds of a cash-out refinance to pay off credit card debt or other loans, homeowners may be able to lower their overall monthly payments and simplify their financial situation. Despite its benefits, refinancing also has potential drawbacks. These include closing costs, resetting loan terms, and potential loss of equity. As previously mentioned, refinancing requires closing costs, which can be a significant expense. Homeowners must weigh these costs against the potential savings from refinancing to ensure it's a financially beneficial decision. When homeowners refinance, they essentially start their loan term over. This means if they've been paying their original 30-year mortgage for ten years and refinance to another 30-year loan, they'll be making mortgage payments for a total of 40 years. This can result in more interest paid over time, even if the new loan has a lower interest rate. In a cash-out refinance, homeowners borrow more than their existing mortgage balance, which reduces their home equity. If home prices drop, they could end up owing more on their mortgage than their home is worth—a situation known as being "underwater" on the mortgage. This could make it difficult to sell the home or refinance again in the future. A home equity line of credit, or HELOC, is a type of second mortgage, vs a cash out refinance which replaces your existing mortgage with a new loan of a greater amount. The proceeds from that loan pay off your existing mortgage and the remaining funds go to you. In choosing between a HELOC and refinance, homeowners must consider factors like interest rates, flexibility and access to funds, tax implications, and potential risks. Both HELOCs and refinances offer the potential for lower interest rates than other types of credit, such as credit cards or personal loans. However, the specific rates and fees can vary greatly. HELOCs typically have variable rates, while refinances can have either fixed or variable rates. Also, the upfront costs of a refinance are generally higher than those of a HELOC. A HELOC offers more flexibility in borrowing, as homeowners can draw funds as needed. In contrast, a refinance provides a lump sum upfront. For ongoing expenses, a HELOC may be more beneficial, while a refinance might be preferable for a large, one-time cost. Both HELOCs and refinances have potential tax benefits if the funds are used for home improvement. The interest paid may be tax-deductible, but homeowners should consult a tax advisor for details. Both options come with risks. With a HELOC, homeowners face potential interest rate increases and the temptation to overspend. With a refinance, homeowners risk losing home equity and paying more in interest over the long term. In comparing a Home Equity Line of Credit (HELOC) and a Cash-Out Refinance, homeowners must carefully consider various factors. HELOCs provide flexibility in borrowing, allowing homeowners to draw funds as needed, while cash-out refinances offer a lump sum upfront. Both options have the potential for lower interest rates compared to other forms of credit. However, HELOCs typically have variable rates, while refinances can have fixed or variable rates. Upfront costs are generally higher for refinances than for HELOCs. Tax benefits may be available for both options, specifically for home improvement purposes, but homeowners should consult a tax advisor for personalized advice. Risks include potential interest rate increases and overspending with HELOCs, while refinances pose the risk of losing home equity and potentially paying more in long-term interest. Ultimately, homeowners should weigh these factors and choose the option that aligns with their specific financial goals and circumstances.Overview of Home Equity Line of Credit and Refinance

What Is a Home Equity Line of Credit?

How Does a Home Equity Line of Credit Work

Accessing Funds

Repayment Terms

Interest Rates and Fees

Advantages of Home Equity Line of Credit

Flexibility in Borrowing

Potential Tax Benefits

Lower Closing Costs

Disadvantages of Home Equity Line of Credit

Variable Interest Rates

Risk of Foreclosure

Temptation to Overspend

What Is a Refinance?

How Does a Refinance Work

Paying off Existing Mortgage

Obtaining New Loan Terms

Closing Costs

Advantages of a Refinance

Lower Interest Rates

Fixed Loan Terms

Consolidating Debt

Disadvantages of a Refinance

Closing Costs

Resetting Loan Terms

Potential Loss of Equity

Home Equity Line of Credit vs Cash Out Refinance

Interest Rates and Fees

Flexibility and Access to Funds

Tax Implications

Potential Risks

Conclusion

Home Equity Line of Credit vs Refinance FAQs

A Home Equity Line of Credit (HELOC) allows you to borrow secured funds against the equity you have in your home without having to refinance your mortgage. A Refinance lets you replace your existing mortgage with a new loan, typically one that offers a lower interest rate or different payment terms.

Yes, both options can offer potential tax benefits depending on how much money is borrowed, and whether it's used for home improvements or debt consolidation. With HELOCs, interest payments may be eligible for deductibility under certain conditions as specified by the Internal Revenue Service (IRS). Borrowers may also be able to deduct certain fees related to their refinance transaction.

Both options can carry a significant financial risk if borrowers don't make payments on time and in full as required by their loan agreement. Taking out a larger loan than you can afford increases the risk that you could default on your loan, which could result in foreclosure proceedings being initiated against your property. Additionally, when refinancing, homeowners should confirm they are not paying more in closing costs than they will save from a lower interest rate over the life of their new loan.

The payback timeline for both options is typically determined by the borrower's loan agreement. A HELOC may have a draw period of up to 10 years and repayment terms spanning anywhere from 15-30 years thereafter. When refinancing, borrowers can generally choose between a longer fixed-rate mortgage with regular monthly payments over 15, 20, or 30 years, or an adjustable rate option where their payments could change based on market conditions.

Both a Home Equity Line of Credit (HELOC) and Refinance offer potential financial benefits when utilized responsibly. Taking out a HELOC can provide access to cash without having to refinance your existing mortgage, while a Refinance could help you lower your monthly payments and save money on interest over the life of your loan. Additionally, both options can potentially offer tax benefits depending on how the funds are used. It's important to weigh all of your financial options carefully before making a decision.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.