An equity line of credit is a type of revolving credit that allows homeowners to borrow against the equity in their home. Homeowners can use this credit to finance major expenses, such as home renovations, college tuition, or debt consolidation. Equity is the variance between the market value of your home and the outstanding balance of your mortgage. Home equity is the portion of your home that you own outright, which you can use as collateral to secure a loan. To calculate your home equity, subtract your outstanding mortgage balance from the current market value of your home. For example, if your home is worth $300,000, and you owe $200,000 on your mortgage, your home equity is $100,000. There are two types of equity lines of credit: standard and high loan-to-value (LTV). A standard equity line of credit allows homeowners to borrow up to a certain percentage of their home equity, typically 80% to 85%. A high LTV equity line of credit allows homeowners to borrow up to 100% of their home equity, but usually with higher interest rates and fees. An equity line of credit is different from a home equity loan. With a home equity loan, the homeowner receives a lump sum of money that they repay over a fixed term. With an equity line of credit, the homeowner can borrow money as needed, up to the credit limit, and repay it over a variable term. Listed below are the mechanics of an equity line of credit: The requirements for an equity line of credit are typically stricter than those for other types of loans, as this type of loan involves using the equity of the property as collateral. One important requirement is a good credit score, demonstrating the ability of the borrower to manage their debt and pay their bills on time. Lenders typically require a credit score of at least 680 to qualify for an equity line of credit. In addition, a low debt-to-income ratio is important to lenders, as it indicates that the borrower has sufficient income to cover their debts. The debt-to-income ratio is calculated by dividing the total monthly debt payments of the borrower by their gross monthly income. Lenders generally require a debt-to-income ratio of 43% or less. Another requirement is a loan-to-value (LTV) ratio of 80% or less. This ratio compares the amount of the loan to the appraised value of the property. For example, if a homeowner has a property worth $500,000 and owes $300,000 on their mortgage, their LTV ratio is 60% ($300,000 divided by $500,000). An LTV ratio of 80% or less means that the borrower has significant equity in their home, which reduces the risk for the lender. Interest rates for an equity line of credit are typically variable, meaning they can fluctuate over time based on changes to the prime rate or another index. The prime rate is the benchmark interest rate that is utilized by many other types of loans and is set by banks to charge their most creditworthy clients. Some lenders may also offer fixed-rate options for equity lines of credit, which can provide more stability and predictability in monthly payments. In addition to interest rates, lenders may also charge fees for equity lines of credit. Common fees may include an application fee, which covers the cost of processing the loan application, an annual fee, which covers ongoing administrative costs, and closing costs, which may include appraisal fees, title search fees, and other expenses related to closing the loan. These fees can vary widely depending on the location of the lender and the borrower. The credit limit and draw period are important features of an equity line of credit. The credit limit is the maximum amount that a borrower can borrow through their equity line of credit. The credit limit is determined by the amount of equity in the home of the borrower and their creditworthiness. Equity is the difference between the current market value of the home and the amount that the homeowner owes on their mortgage. For example, if a homeowner has a property worth $500,000 and owes $300,000 on their mortgage, they have $200,000 in equity. Lenders may set the credit limit for an equity line of credit at a percentage of the total equity of the borrower, such as 80%. This means that the borrower would be able to borrow up to $160,000 ($200,000 multiplied by 80%) through their equity line of credit. The credit limit may also depend on the credit score and income of the borrower and other factors. The draw period is the period of time during which the borrower can borrow money from their equity line of credit. This period is typically 10 years but can vary depending on the lender. During the draw period, the borrower can borrow up to their credit limit as needed. Interest is charged on the amount borrowed, and the borrower is typically only required to make minimum payments, which cover the interest charges. After the draw period ends, the borrower enters the repayment period, during which they must repay both the principal and interest on the amount borrowed. The repayment period typically lasts 10 to 20 years, but it can also vary depending on the lender. Below are the advantages of equity lines of credit: One of the main benefits of an equity line of credit is that it allows homeowners to borrow money up to the credit limit as needed. This can be a flexible and convenient way to access funds when needed. Homeowners can draw on their equity line of credit whenever they need money for home improvements, education expenses, debt consolidation, or other expenses. Interest on an equity line of credit may be tax-deductible if the funds are used for home improvements or renovations. This can result in significant savings for homeowners. The tax laws regarding home equity lines of credit can be complex, so it is important to consult with a tax professional to determine if the interest on your equity line of credit is tax-deductible. Another advantage of an equity line of credit is that it typically has lower interest rates than other types of loans, such as personal loans or credit cards. This is because the loan is secured by the equity in the home, which reduces the risk of the lender. As a result, homeowners can save money on interest charges compared to other types of loans. Below are some risks associated with equity lines of credit: An equity line of credit is a secured loan that uses the home as collateral. If the homeowner defaults on the loan, the lender can foreclose and sell the property to recover the outstanding debt. This can result in the homeowner losing their home and negatively impact their credit score. Homeowners should be aware of their financial situation and ability to repay the loan before taking out an equity line of credit. Another risk associated with an equity line of credit is overspending. Because the loan is revolving, homeowners can access the credit limit as needed and may be tempted to borrow more than they can afford to repay. This can lead to high levels of debt and financial strain. Homeowners should have a clear plan for using the funds and only borrow what they can realistically repay. Additionally, it is important to monitor spending and repayment to avoid falling into a cycle of debt. The application process for an equity line of credit is similar to that of other types of loans. The homeowner must first research potential lenders and compare interest rates and fees to find the best option for their financial situation. Once a lender has been selected, the homeowner must submit an application and provide documentation to support their income and assets, such as pay stubs, bank statements, and tax returns. The lender will then review the credit history of the homeowner and underwrite the loan to determine if the homeowner is eligible for an equity line of credit. This process may take several weeks and may involve additional documentation or verification of information. If the homeowner is approved, the lender will establish the credit limit and interest rate for the equity line of credit, and the homeowner can begin drawing funds from the line of credit as needed. An equity line of credit is a revolving credit that allows homeowners to borrow against the equity in their home. The equity is calculated by subtracting the outstanding mortgage balance from the current market value of the home. To qualify for an equity line of credit, homeowners must have a good credit score, a low debt-to-income ratio, and an LTV ratio of 80% or less. Interest rates are typically variable, and lenders may charge fees. The credit limit and draw period are important features of an equity line of credit. During the draw period, the borrower can borrow up to their credit limit as needed and is only required to make minimum payments. After the draw period, the borrower enters the repayment period, during which they must repay the principal and interest on the borrowed amount. If you are considering applying for an equity line of credit, it is important to make informed decisions about your finances. Consider consulting with a financial advisor to help you navigate the process and ensure you make the best decision for your financial situation.How Does an Equity Line of Credit Work?

Mechanics of an Equity Line of Credit

Qualification Requirements for an Equity Line of Credit

Interest Rates and Fees for an Equity Line of Credit

Credit Limit and Draw Period of an Equity Line of Credit

Repayment Terms and Requirements for an Equity Line of Credit

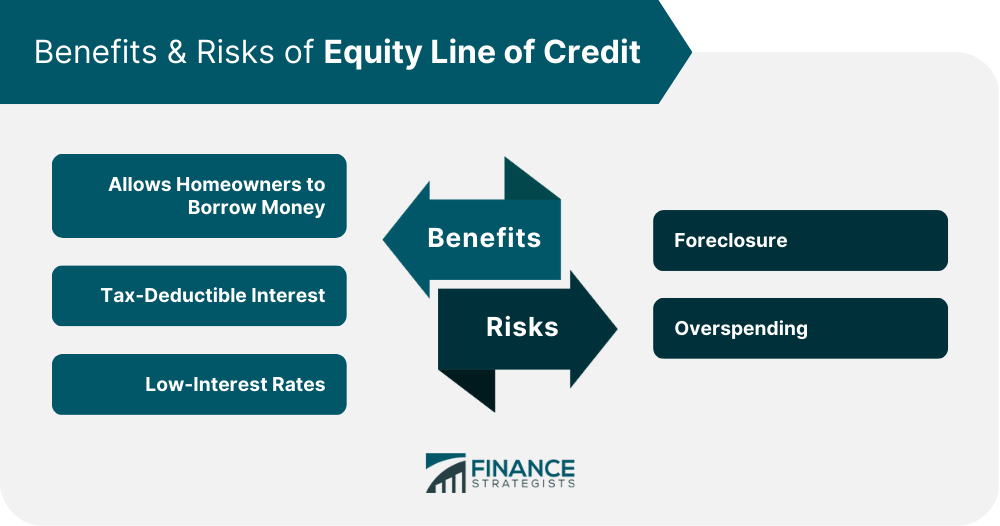

Benefits of Equity Lines of Credit

Allows Homeowners to Borrow Money

Tax-Deductible Interest

Low-Interest Rates

Risks Associated With an Equity Line of Credit

Foreclosure

Overspending

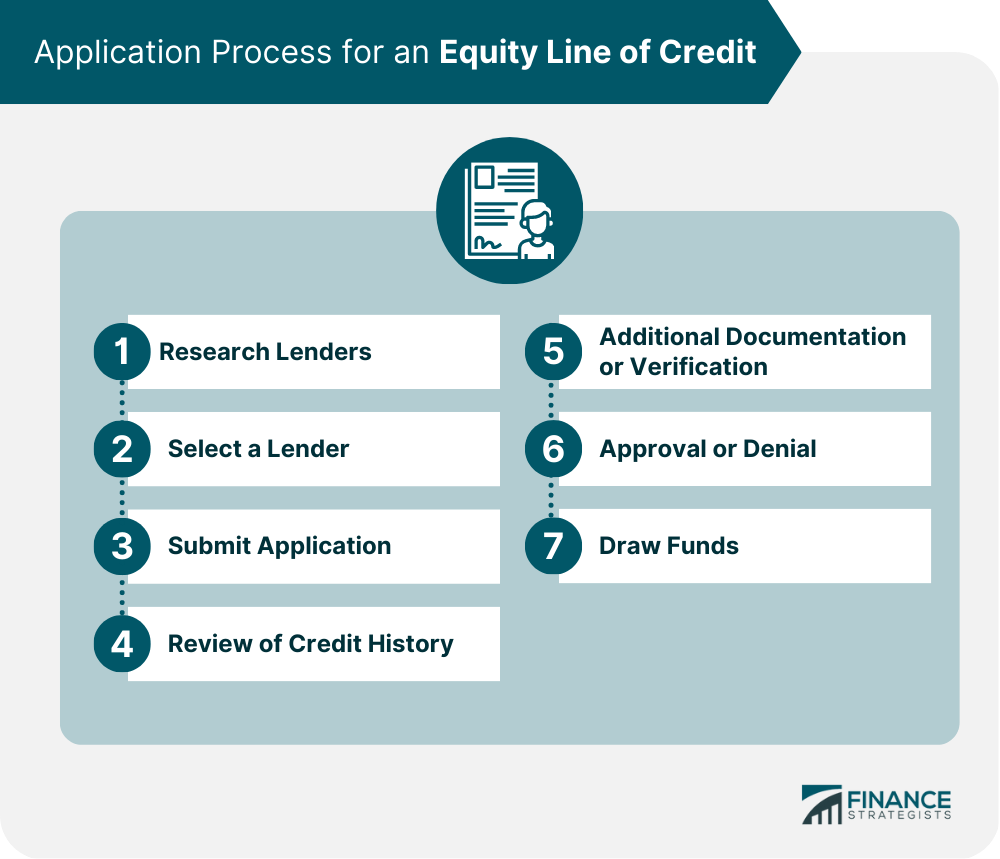

Application Process for an Equity Line of Credit

Final Thoughts

How Does an Equity Line of Credit Work? FAQs

An equity line of credit is a type of revolving credit that allows homeowners to borrow against the equity in their home. They can borrow money as needed, up to the credit limit, and repay it over a variable term.

To qualify for an equity line of credit, homeowners must have a good credit score, a low debt-to-income ratio, and a significant amount of equity in their homes. Lenders typically require a credit score of at least 680, a debt-to-income ratio of 43% or less, and a loan-to-value ratio of 80% or less.

One of the primary advantages of an equity line of credit is that it allows homeowners to borrow money up to the credit limit as needed. Additionally, interest on an equity line of credit may be tax-deductible if the funds are used for home improvements or renovations.

The main risks of an equity line of credit include the possibility of foreclosure if the homeowner defaults on the loan and the potential to overspend and accumulate debt, which can lead to financial hardship and put the homeowner at risk of defaulting on the loan.

To apply for an equity line of credit, homeowners must research potential lenders and compare interest rates and fees to find the best option for their financial situation. Once a lender has been selected, the homeowner must submit an application and provide documentation to support their income and assets, such as pay stubs, bank statements, and tax returns.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.