A line of credit is a type of revolving credit that allows you to borrow funds up to a certain limit. Unlike a traditional loan, which provides a lump sum of money that you repay over a fixed period of time, a line of credit gives you ongoing access to funds that you can borrow and repay as needed. For example, if you have a line of credit with a $10,000 limit, you might borrow $2,000 to pay for a car repair, then repay that $2,000 over the next few months. Once you've repaid the $2,000, you can borrow another $2,000 if you need to. You'll only pay interest on the amount you borrow, not on the entire credit limit. Having access to a line of credit can be extremely helpful in a variety of circumstances, whether you're trying to finance a major purchase, cover unexpected expenses, or establish a credit history. A line of credit is a popular type of credit product that offers flexibility, convenience, and potential cost savings compared to other types of credit. However, like any financial product, a line of credit isn't right for everyone. Having access to credit is important for a variety of reasons. For example, if you're just starting out in your career or you have a limited credit history, having a line of credit can help you establish a credit score and demonstrate your creditworthiness to lenders. Additionally, if you encounter unexpected expenses, such as a medical emergency or a major car repair, a line of credit can provide a safety net that allows you to cover those expenses without draining your savings. Finally, a line of credit can be a useful tool for managing your cash flow, particularly if you're self-employed or have irregular income. A line of credit offers flexibility, lower interest rates, improved credit score, convenient access to funds, and is useful for emergencies. It can help you manage cash flow, finance major purchases, and provide a safety net for unexpected expenses. One of the biggest advantages of a line of credit is its flexibility. A line of credit, unlike a traditional loan which requires you to borrow a fixed amount of money and repay it over a fixed period of time, gives you ongoing access to funds that you can borrow and repay as needed. This means that you can use the line of credit to cover unexpected expenses or finance a major purchase, then repay the borrowed funds over time. You'll only pay interest on the amount you borrow, not on the entire credit limit. In general, lines of credit tend to have lower interest rates than credit cards or personal loans. This is because lines of credit are secured by collateral, such as your home or a business asset. As a result, lenders view them as less risky than unsecured loans and are willing to offer lower interest rates. Additionally, because you only pay interest on the amount you borrow, a line of credit can be a cost-effective way to finance a major purchase or cover unexpected expenses. If you're trying to establish or improve your credit score, a line of credit can be a useful tool. By borrowing and repaying funds on time, you can demonstrate to lenders that you're a responsible borrower and improve your credit score over time. Additionally, because a line of credit is a type of revolving credit, it can help diversify your credit mix and demonstrate to lenders that you can handle different types of credit responsibly. With a line of credit, you'll have access to funds whenever you need them, up to your credit limit. This can be particularly useful if you have unexpected expenses, such as a car repair or medical bill, that you need to cover quickly. Additionally, because you can access the funds as needed, you can avoid the hassle of applying for a new loan every time you need to borrow money. A line of credit can provide a valuable safety net in case of emergencies. By having access to funds that you can borrow and repay as needed, you can cover unexpected expenses without having to dip into your savings or take on high-interest debt. This can give you peace of mind knowing that you have a financial cushion in case of unexpected events. A line of credit also has potential disadvantages, including the risk of overspending, higher interest rates for some borrowers, limited access to funds, potential for increasing debt, and fees and penalties. One of the biggest disadvantages of a line of credit is the risk of overspending. Because you have ongoing access to funds, it can be tempting to borrow more than you can afford to repay. This can lead to a cycle of debt that can be difficult to break. To avoid this, it is important to borrow only what you need and make a plan to repay the borrowed funds as quickly as possible. While lines of credit tend to have lower interest rates than credit cards and personal loans, this isn't always the case for all borrowers. If you have a poor credit score or a history of late payments, you may be charged a higher interest rate to offset the lender's perceived risk. Additionally, some lenders may charge higher interest rates for lines of credit that are not secured by collateral, which can make them more expensive than other types of credit. While a line of credit can be a useful tool for managing your cash flow, it is crucial to remember that the credit limit is not unlimited. If you max out your line of credit, you won't be able to borrow any more funds until you've repaid some of the borrowed amounts. This can be a disadvantage if you have ongoing expenses that exceed your credit limit, or if you need to borrow a large amount of money at once. If you're not careful, a line of credit can lead to increasing debt over time. Because you only need to make minimum payments each month, it can be easy to fall into the trap of borrowing more than you can afford to repay. This can lead to a cycle of debt that can be difficult to break. To avoid this, it is important to borrow only what you need and make a plan to repay the borrowed funds as quickly as possible. Like any financial product, lines of credit can come with fees and penalties that can add to the cost of borrowing. For example, some lenders may charge an annual fee or a transaction fee for each withdrawal. Additionally, if you miss a payment or exceed your credit limit, you may be charged a penalty fee or a higher interest rate. Before applying for a line of credit, it is essential to understand the fees and penalties associated with the product and factor them into your borrowing decision. Before applying for a line of credit, there are several crucial factors that should be carefully considered to ensure that it is the right financial decision for your specific situation. Before applying for a line of credit, it is important to check your credit score and history. Lenders use this information to determine your creditworthiness and to set the interest rate and credit limit for your line of credit. If you have a poor credit score or a history of late payments, you may not qualify for a line of credit or you may be charged a higher interest rate. It is also crucial to consider your income and expenses before applying for a line of credit. You should have a clear understanding of your monthly budget and cash flow to ensure that you'll be able to make the required monthly payments on your line of credit. If you're not sure whether you'll be able to afford the payments, it may be better to hold off on applying until you have a more stable financial situation. Before applying for a line of credit, it is essential to consider the purpose of the credit. If you're planning to use the line of credit to finance a major purchase, such as a home renovation or a new car, it may be more cost-effective than other types of credit. However, if you're planning to use the line of credit to cover ongoing expenses or to finance a lifestyle you can't afford, it may not be a good choice for your financial situation. Before applying for a line of credit, it is essential to compare interest rates and fees from different lenders. While lines of credit tend to have lower interest rates than credit cards and personal loans, the rates can vary widely depending on the lender and your creditworthiness. Additionally, you should be aware of any fees associated with the line of credit, such as annual fees or transaction fees, and factor them into your borrowing decision. Finally, before applying for a line of credit, it is crucial to understand the repayment terms. You should have a clear understanding of the minimum monthly payment required, the interest rate, and the repayment period. Additionally, you should understand the consequences of missing a payment or exceeding your credit limit, such as penalty fees or a higher interest rate. Below are the steps to take in order to apply for a line of credit: Before applying for a line of credit, it is important to research different lenders to find the best product for your financial situation. You should compare interest rates, fees, and repayment terms from different lenders to ensure that you're getting the best deal. Additionally, you should check the lender's reputation and customer reviews to ensure that they're a reputable and trustworthy lender. Once you've chosen a lender, you'll need to gather the required documentation to apply for the line of credit. This may include proof of income, employment verification, and personal identification. You should check with the lender to ensure that you have all the required documentation before submitting your application. Once you have all the required documentation, you can submit an application for the line of credit. You'll typically need to provide information about your credit score and history, income and expenses, and the purpose of the credit. The lender will use this information to determine your creditworthiness and to set the interest rate and credit limit for your line of credit. After submitting your application, you'll need to wait for approval from the lender. This may take several days or weeks, depending on the lender and the complexity of your application. During this time, the lender may request additional information or documentation to support your application. A line of credit can be a useful tool for managing your cash flow, covering unexpected expenses, and establishing or improving your credit score. However, like any financial product, it is imperative to weigh the advantages and disadvantages and determine whether it is a good choice for your financial situation. Before applying for a line of credit, you should consider your credit score and history, income, and expenses, the purpose of the credit, interest rates and fees, and repayment terms. By understanding the advantages and disadvantages of a line of credit, and carefully considering these factors, you can make an informed decision about whether it is the right choice for your financial situation. If you do decide to apply for a line of credit, be sure to research different lenders and compare interest rates, fees, and repayment terms. Gather all the required documentation before submitting your application, and be prepared to wait for approval from the lender. Once you receive the terms of the line of credit, read them carefully and understand the interest rate, repayment terms, and any fees associated with the line of credit. Ultimately, a line of credit can be a useful tool for managing your finances and achieving your financial goals. However, it is important to use it responsibly, borrow only what you need, and make a plan to repay the borrowed funds as quickly as possible. Definition of a Line of Credit

Is a Line of Credit a Good Idea?

Importance of Having Access to Credit

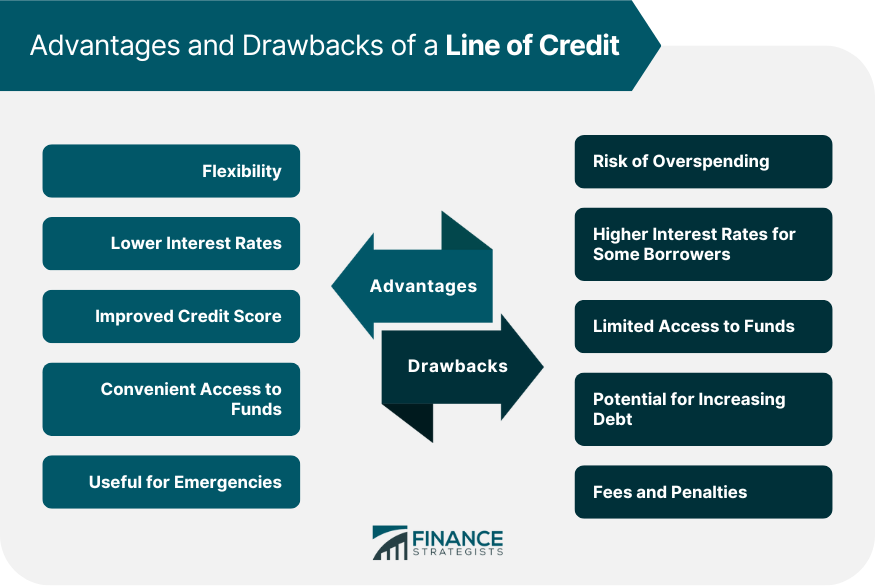

Advantages of a Line of Credit

Flexibility

Lower Interest Rates

Improved Credit Score

Convenient Access to Funds

Useful for Emergencies

Disadvantages of a Line of Credit

Risk of Overspending

Higher Interest Rates for Some Borrowers

Limited Access to Funds

Potential for Increasing Debt

Fees and Penalties

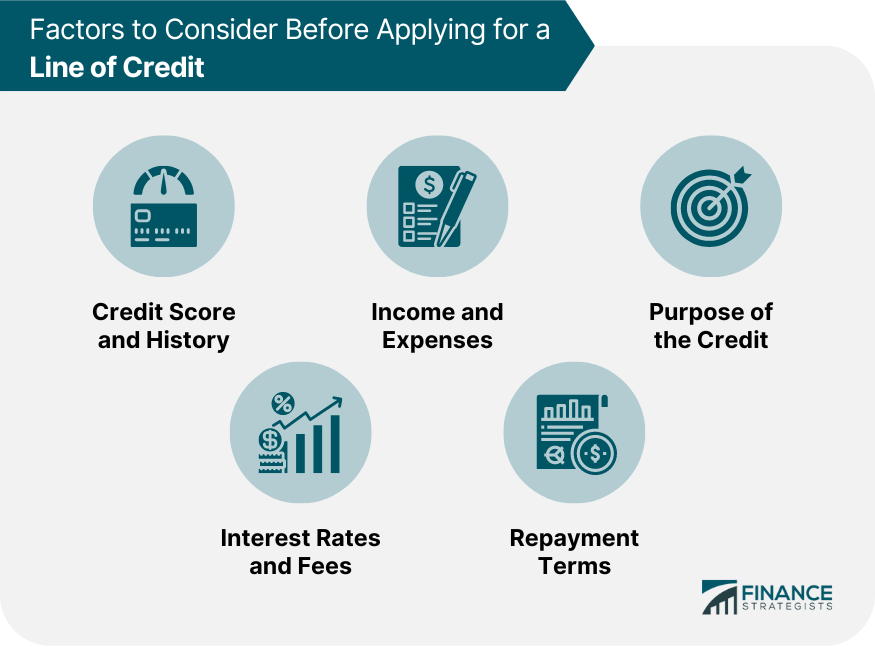

Factors to Consider Before Applying for a Line of Credit

Credit Score and History

Income and Expenses

Purpose of the Credit

Interest Rates and Fees

Repayment Terms

How to Apply for a Line of Credit

Research Different Lenders

Gather Required Documentation

Submit an Application

Await Approval

The Bottom Line

By doing so, you can use a line of credit to your advantage and achieve financial stability and success.

Is a Line of Credit a Good Idea? FAQs

A line of credit is a type of revolving credit that gives you ongoing access to funds that you can borrow and repay as needed, up to a certain credit limit. A loan, on the other hand, provides a lump sum of money that you repay over a fixed period of time, typically with a fixed interest rate.

A line of credit can affect your credit score in a few ways. First, if you use the line of credit responsibly and make on-time payments, it can help improve your credit score over time. Additionally, because a line of credit is a type of revolving credit, it can help diversify your credit mix and demonstrate to lenders that you can handle different types of credit responsibly.

Yes, you can use a line of credit to pay off credit card debt. Because lines of credit tend to have lower interest rates than credit cards, it can be a cost-effective way to consolidate and pay off high-interest debt.

If you miss a payment on your line of credit, you may be charged a penalty fee or a higher interest rate. Additionally, missing a payment can have a negative impact on your credit score, so it is important to make all payments on time.

Yes, you may be able to increase the credit limit on your line of credit over time. However, this will depend on your creditworthiness and the lender's policies. If you're interested in increasing your credit limit, you should contact your lender and inquire about the process. Keep in mind that increasing your credit limit may also increase your debt and make it more difficult to repay the borrowed funds.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.