Medicare Part B is a component of the Medicare program that provides coverage for medically necessary and preventive services, including doctor visits, outpatient care, medical equipment, and some home health care services. Medicare is a federal health insurance program designed for individuals aged 65 and older, as well as certain younger individuals with disabilities. The program consists of four parts: Part A (hospital insurance), Part B (medical insurance), Part C (Medicare Advantage), and Part D (prescription drug coverage). Medicare Part B is the medical insurance component of the Medicare program, covering a range of outpatient services, such as doctor visits, preventive care, and durable medical equipment. Understanding the eligibility, enrollment, coverage, and costs associated with Part B is essential for beneficiaries to make informed decisions about their health care. To be eligible for Medicare Part B, individuals must meet certain criteria. Individuals who are aged 65 or older are eligible for Medicare Part B, provided they are U.S. citizens or legal residents who have lived in the United States for at least five years. This is the most common way people become eligible for Medicare Part B. Younger individuals with disabilities may also qualify for Medicare Part B if they have received Social Security Disability Insurance (SSDI) benefits for at least 24 months or have been diagnosed with Amyotrophic Lateral Sclerosis (ALS). This allows people who are disabled but under 65 years old to receive Medicare Part B benefits. Another way to be eligible for Medicare Part B is if someone has End-Stage Renal Disease (ESRD) requiring regular dialysis or a kidney transplant. In this case, the person can enroll in Medicare Part B regardless of their age. Once an individual is determined to be eligible for Medicare Part B, they can enroll in the program during certain enrollment periods. The Initial Enrollment Period (IEP) for Medicare Part B is a seven-month window beginning three months before an individual's 65th birthday, including their birth month, and extending three months after their birth month. Enrolling during the IEP ensures timely coverage without penalties. If an individual misses their Initial Enrollment Period, they can enroll in Medicare Part B during the General Enrollment Period, which runs from January 1 to March 31 each year. However, late enrollment may result in penalties and delayed coverage. Certain life events or circumstances, such as loss of employer-sponsored coverage, may qualify an individual for a Special Enrollment Period (SEP). During an SEP, beneficiaries can enroll in Medicare Part B without incurring penalties or experiencing a delay in coverage. Medicare Part B provides coverage for the following: Medicare Part B covers various preventive services, including screenings, vaccinations, and annual wellness visits, to help beneficiaries maintain their health and detect potential health issues early. Part B covers medically necessary doctor services, including office visits, consultations, and diagnostic tests. It also covers some telehealth services, allowing beneficiaries to access care remotely. Medicare Part B provides coverage for outpatient care, including outpatient hospital services, ambulatory surgical centers, and urgent care centers. It also covers mental health services, such as therapy and counseling. Part B covers durable medical equipment (DME), such as wheelchairs, walkers, and oxygen equipment, as well as prosthetics and orthotics. These items must be deemed medically necessary by a physician and meet specific coverage criteria. There are several costs involved in Medicare Part B. Most Medicare Part B beneficiaries pay a monthly premium, which is determined by their income. Higher-income individuals may pay a higher premium, known as an Income-Related Monthly Adjustment Amount (IRMAA). Each year, beneficiaries must meet a deductible for Medicare Part B services before coverage begins. After the deductible is met, Medicare covers a portion of the costs, and the beneficiary is responsible for the remaining amount. Medicare Part B generally covers 80% of the approved amount for services, leaving beneficiaries responsible for the remaining 20% coinsurance. In some cases, beneficiaries may also be responsible for copayments for certain services or outpatient care. If an individual does not enroll in Medicare Part B during their Initial Enrollment Period or a Special Enrollment Period, they may face a late enrollment penalty. This penalty results in a higher monthly premium for as long as the beneficiary remains enrolled in Part B. Medicare Part B is a component of the Medicare program that provides coverage for medically necessary and preventive services, including doctor visits, outpatient care, and some home health care services. Eligibility for Medicare Part B is based on age, disability, or end-stage renal disease, and beneficiaries can enroll during certain enrollment periods. Medicare Part B provides coverage for preventive services, doctor services, outpatient care, and medical equipment and supplies. There are several costs involved in Medicare Part B, including a monthly premium, deductible, coinsurance, and copayments. Understanding the eligibility, enrollment, coverage, and costs associated with Part B is essential for beneficiaries to make informed decisions about their health care. By being knowledgeable about Medicare Part B, individuals can maximize their coverage, minimize out-of-pocket costs, and avoid late enrollment penalties. Additionally, it is important to note that there may be limits to the coverage provided by Medicare Part B, and beneficiaries should be aware of these limits when making decisions about their health care. Overall, understanding the various aspects of Part B can help individuals better navigate the Medicare program and ensure access to the health care services they need.What Is Medicare Part B?

Eligibility for Medicare Part B

Age Requirement

Disability Requirement

End-Stage Renal Disease Requirement

Enrollment in Medicare Part B

Initial Enrollment Period

General Enrollment Period

Special Enrollment Period

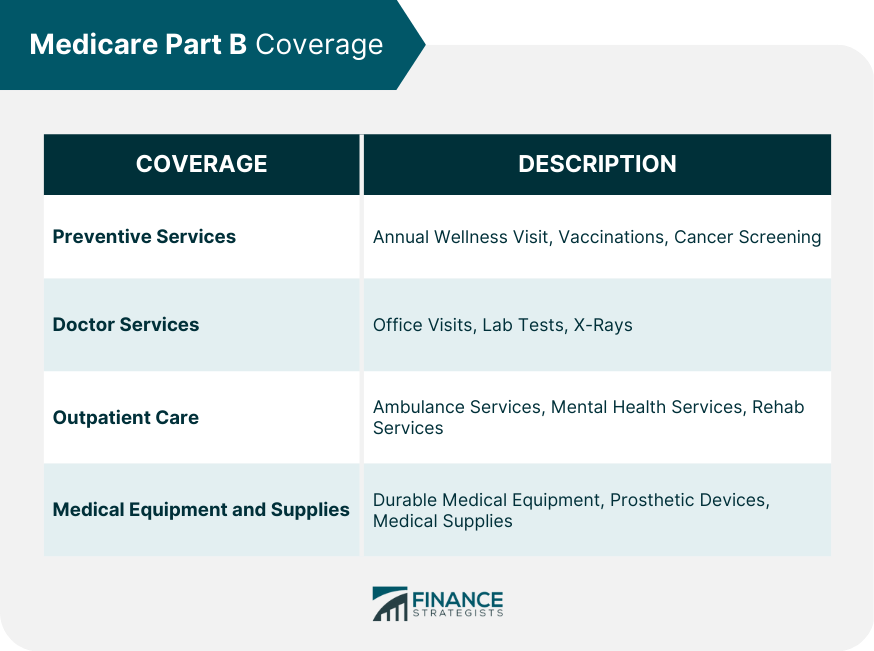

Medicare Part B Coverage

Preventive Services

Doctor Services

Outpatient Care

Medical Equipment and Supplies

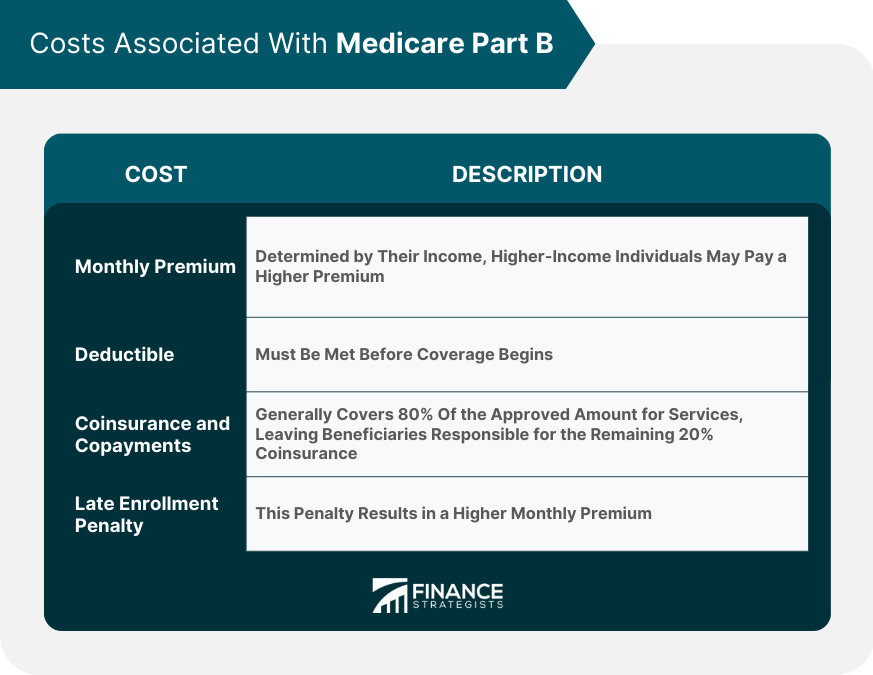

Costs Associated With Medicare Part B

Monthly Premium

Deductible

Coinsurance and Copayments

Late Enrollment Penalty

Bottom Line

Medicare Part B FAQs

Medicare Part B is a federal health insurance program that covers doctor visits, outpatient care, preventive services, and medical equipment.

Individuals who are 65 or older, or those who have a qualifying disability, may be eligible for Medicare Part B.

Medicare Part B covers doctor visits, outpatient care, preventive services, and medical equipment, such as wheelchairs and walkers.

Most people pay a monthly premium for Medicare Part B, which varies based on income. There may also be deductibles, coinsurance, and copayments.

Yes, there are limits to the coverage provided by Medicare Part B. For example, there may be limits on the number of physical therapy sessions or durable medical equipment items covered.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.