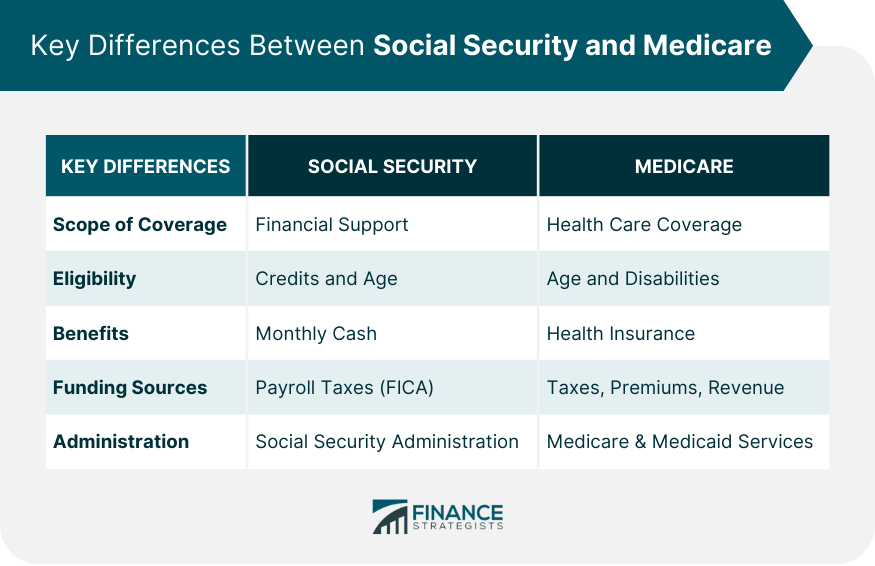

Social Security and Medicare are federal programs that provide a safety net for American citizens. Though they are often discussed together, each serves different purposes. While Social Security offers monetary support for retirees, disabled individuals, and families of deceased workers, Medicare provides health insurance coverage primarily for individuals aged 65 and over and for certain disabled individuals. In practice, the link between these two programs is significant as enrollment in Medicare is often facilitated by the receipt of Social Security benefits. The interaction between Social Security and Medicare has profound implications for financial planning and health care in retirement. The timing of when one starts receiving Social Security benefits can affect Medicare premiums, and the reverse is also true. Understanding these connections can help individuals make informed decisions about their retirement and healthcare strategies. Established in 1935, Social Security is a federal program designed to provide economic security for American citizens. It provides benefits to retirees, disabled individuals, and the surviving spouses and children of deceased workers. Social Security benefits are based on the earnings of the individual, with those who've earned more during their working years generally receiving larger benefit checks. Social Security is often viewed as a cornerstone of retirement income for many Americans. While it was not intended to be a person's only source of income in retirement, it can provide a significant portion of their financial support. The certainty of receiving these benefits monthly makes it a reliable and critical part of retirement planning. Medicare is a national health insurance program established in 1965 to provide health coverage to people aged 65 and over and to some disabled individuals. The program is divided into several parts, each offering different types of coverage. Part A covers hospital insurance, Part B provides medical insurance, Part D is for prescription drugs, and Part C, also known as Medicare Advantage, offers an alternative way to receive Medicare benefits through private insurance companies. Medicare plays a crucial role in ensuring the health and well-being of older Americans. It allows them to access a variety of health services, including preventive care, hospital stays, and prescription medications. Though it doesn't cover all health-related expenses, it significantly reduces the potential financial burden of health care in retirement. While both Social Security and Medicare are designed to support Americans, they do so in distinct ways. Social Security provides financial support, helping individuals and families to cover basic living expenses. Medicare, on the other hand, focuses on health care coverage. Its benefits help pay for medical expenses like doctor visits, hospital stays, and prescription drugs. Eligibility for Social Security and Medicare are also distinct. For Social Security, benefits depend on the number of credits earned through work and the age at which you start receiving benefits. Meanwhile, Medicare is primarily available to those aged 65 and over, although certain disabled individuals and those with specific medical conditions can also qualify. In terms of benefits, Social Security provides a monthly cash benefit based on a person's earnings history and age at retirement. Medicare, on the other hand, provides health insurance coverage. Its benefits are primarily in the form of payments to healthcare providers for covered services rather than direct payments to individuals. Social Security and Medicare are funded through distinct mechanisms as well. Social Security is financed primarily through payroll taxes under the Federal Insurance Contributions Act (FICA). Medicare is also financed in part through payroll taxes, but other sources like premiums and general federal revenues contribute significantly to its funding. Social Security is administered by the Social Security Administration (SSA), while Medicare is overseen by the Centers for Medicare & Medicaid Services (CMS). Although both are federal agencies, they have different structures and administrative processes. When it comes to Social Security and Medicare, there is a coordination of benefits that individuals need to be aware of. For those who are eligible for both programs, Social Security benefits can be used to help cover Medicare costs. The Social Security Administration (SSA) automatically enrolls individuals in Medicare Part A (hospital insurance) when they become eligible for Social Security benefits. This coordination ensures that individuals receive the necessary healthcare coverage through Medicare while utilizing their Social Security benefits to offset some of the costs. It is important for individuals to understand how these benefits interact and how they can make the most of their coverage options. One significant interaction between Social Security and Medicare is the impact of Social Security benefits on Medicare premiums. Most Medicare beneficiaries have their Medicare Part B (medical insurance) premiums deducted directly from their Social Security benefits. The standard Part B premium is typically deducted, but individuals with higher incomes may have to pay an additional income-related monthly adjustment amount (IRMAA). It's crucial for individuals to understand how their Social Security benefits can affect their Medicare premiums and to plan accordingly. Changes in Social Security benefits, such as cost-of-living adjustments (COLA), can also have implications for Medicare premiums, making it essential to stay informed about any potential changes or updates to ensure accurate budgeting and financial planning. Given their different purposes, it's not a question of choosing between Social Security and Medicare but rather understanding how each can serve your needs. Social Security serves as a reliable source of income in retirement or in case of disability, while Medicare provides essential health insurance coverage. Both programs are crucial components of retirement planning. A typical strategy involves claiming Social Security benefits while also enrolling in Medicare for health coverage. However, the timing and sequence of these actions can significantly impact the benefits you receive. As such, it's important to consider your personal circumstances, health status, and financial needs when making decisions about Social Security and Medicare. Social Security provides financial support, serving as a cornerstone of retirement income. It offers monthly benefits based on earnings history, ensuring a reliable source of income. On the other hand, Medicare focuses on health insurance coverage, providing access to various medical services for individuals aged 65 and over, as well as certain disabled individuals. While Social Security helps cover basic living expenses, Medicare helps pay for medical expenses like hospital stays and prescription drugs. It's important to note that the timing and sequence of claiming Social Security benefits and enrolling in Medicare can impact the benefits you receive. By considering your personal circumstances, health status, and financial needs, you can make informed decisions about utilizing Social Security and Medicare to secure your future.Overview of Social Security and Medicare

What Is Social Security?

What Is Medicare?

Key Differences Between Social Security and Medicare

Scope of Coverage

Eligibility Requirements

Benefits Provided

Funding Sources

Administration and Management

Interactions Between Social Security and Medicare

Coordination of Benefits

Impact Of Social Security On Medicare Premiums

Which One Is Right for You?

Conclusion

What Is the Difference Between Social Security and Medicare? FAQs

Yes, you can receive Social Security and enroll in Medicare at the same time. Typically, if you're already receiving Social Security benefits when you turn 65, you'll be automatically enrolled in Medicare.

Enrollment in Medicare does not affect your Social Security benefits. However, if you're enrolled in Medicare, your Part B premiums can be deducted from your Social Security benefits.

Delaying Social Security benefits won't affect your eligibility for Medicare. However, it's important to enroll in Medicare when you're first eligible to avoid late enrollment penalties.

While Social Security benefits are not directly used to pay for Medicare, your Part B and Part D premiums can be deducted from your Social Security benefits.

If you're still working and have health coverage through your employer when you turn 65, you might be able to delay enrolling in Medicare without penalty. However, you should check with your employer and Medicare to understand your options.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.