Medicare cost-sharing refers to the expenses that a Medicare beneficiary is responsible for paying out of pocket when receiving healthcare services. These costs are typically shared between the beneficiary and the Medicare program. Medicare is a federal health insurance program that provides coverage for eligible individuals who are 65 years or older, have certain disabilities, or have end-stage renal disease. Medicare is divided into several parts, each of which covers specific services. Medicare cost sharing refers to the amount that Medicare beneficiaries are responsible for paying out of pocket for healthcare services. Medicare coverage does not cover all healthcare costs, and beneficiaries are responsible for paying certain deductibles, copayments, and coinsurance amounts. The purpose of cost sharing is to help reduce healthcare costs and promote responsible use of healthcare services. Understanding the various types of Medicare cost sharing and the associated costs is essential for beneficiaries to make informed healthcare decisions and manage their healthcare expenses effectively. While Medicare provides significant health insurance benefits, it does not cover all healthcare costs. To help address this gap in coverage, Medicare uses cost-sharing, which requires beneficiaries to pay a portion of their healthcare expenses. Understanding the various types of cost-sharing associated with Medicare is essential for individuals to make informed healthcare decisions and manage their healthcare costs effectively. A deductible is a cost-sharing amount that beneficiaries must pay out of pocket before Medicare coverage begins. Deductibles can vary by Medicare plan and can change each year. For example, in 2024, the Medicare Part A hospital deductible is $1,632 per benefit period. The Medicare Part B annual deductible is $240 per year. The Medicare Part D prescription drug deductible can vary by plan, with some plans offering no deductible at all. It is important to understand your plan's deductible amount and factor it into your healthcare budget. Once the deductible is met, Medicare coverage can help cover the remaining costs of healthcare services. A copayment is a fixed dollar amount that beneficiaries must pay out of pocket for specific healthcare services. Copayments can vary by the type of service and Medicare plan. For example, the Medicare Part B copayment for doctor's office visits is typically 20% of the Medicare-approved amount for the service. The copayment for certain preventative services, such as mammograms and flu shots, may be waived entirely. It is important to understand your plan's copayment requirements and factor them into your healthcare budget. Copayments can add up quickly, especially for individuals who require frequent healthcare services. Coinsurance is a cost-sharing amount that beneficiaries are responsible for paying out of pocket. Coinsurance typically applies after a deductible has been met and is usually a percentage of the cost of a healthcare service. For example, in 2024, the Medicare Part A coinsurance for inpatient hospital stays is $408 per day for days 61-90 and $816 per day for days 91 and beyond. The Medicare Part B coinsurance is typically 20% of the Medicare-approved amount for the service. It is important to understand your plan's coinsurance requirements and factor them into your healthcare budget. Coinsurance can significantly impact healthcare expenses, especially for individuals with high healthcare costs. Medicare Part A covers inpatient hospital stays, and beneficiaries are responsible for paying a deductible for each benefit period. The deductible amount can change each year and is typically higher for longer hospital stays. After the deductible is met, beneficiaries are responsible for paying coinsurance for inpatient hospital stays. The coinsurance amount can change each year and is typically a percentage of the total hospital bill. Medicare Part A also covers skilled nursing facility stays, and beneficiaries are responsible for paying coinsurance for each benefit period. The coinsurance amount can change each year and is typically a percentage of the total cost of care. Medicare Part B covers outpatient services, and beneficiaries are responsible for paying an annual deductible before Medicare begins to cover the cost of care. The deductible amount can change each year. After the deductible is met, beneficiaries are responsible for paying a percentage of the cost of outpatient services. The coinsurance amount can change each year and is typically 20% of the Medicare-approved amount for the service. Some healthcare providers may charge more than the Medicare-approved amount for a service, resulting in excess charges. Beneficiaries are responsible for paying any excess charges out of pocket. Medicare Part D covers prescription drug costs, and beneficiaries may be responsible for paying a deductible before Medicare begins to cover the cost of medications. The deductible amount can change each year. After the deductible is met, beneficiaries are responsible for paying copayments or coinsurance for each prescription medication. The amount of copayment or coinsurance can vary by the medication and Medicare plan. Once a beneficiary reaches a certain level of total drug costs, they may enter the Medicare Part D coverage gap, commonly known as the "donut hole." During this gap in coverage, beneficiaries may be responsible for paying a higher percentage of their medication costs. Medicare Supplement Insurance, also known as Medigap, is private health insurance that can be purchased to help cover some of the out-of-pocket costs associated with Medicare. Medigap plans are standardized and offer various levels of coverage. There are ten standardized Medigap plans available, each labeled with a different letter. Each plan offers a different level of coverage, with Plan A offering the least amount of coverage and Plan F offering the most comprehensive coverage. It is essential to compare the different Medigap plans to determine which plan best meets your healthcare needs and budget. A licensed insurance agent can provide information about available plans and help you make an informed decision. Medicare Supplement Insurance can provide significant benefits for beneficiaries who require frequent healthcare services or have significant out-of-pocket costs. Medigap plans can help cover Medicare deductibles, coinsurance, and copayments, and may also provide coverage for services not covered by Medicare. In addition, Medigap plans provide peace of mind by limiting the amount beneficiaries may be required to pay out of pocket for healthcare services. This financial protection can be especially important for those on a fixed income or with limited resources. Medicare cost-sharing is an essential aspect of the Medicare program, as it requires beneficiaries to contribute to their healthcare costs. Deductibles, copayments, and coinsurance are all forms of cost-sharing that can impact healthcare expenses. Understanding the various types of cost-sharing associated with Medicare can help beneficiaries make informed healthcare decisions and manage their healthcare costs effectively. Understanding Medicare cost-sharing is essential for beneficiaries to make informed healthcare decisions and manage their healthcare costs effectively. Medicare Supplement Insurance can provide additional financial protection for beneficiaries who require frequent healthcare services or have significant out-of-pocket costs. Working with a licensed insurance agent and consulting with healthcare providers can help beneficiaries navigate the complexities of Medicare cost-sharing and develop a healthcare plan that meets their needs and budget.What Is Medicare Cost-Sharing?

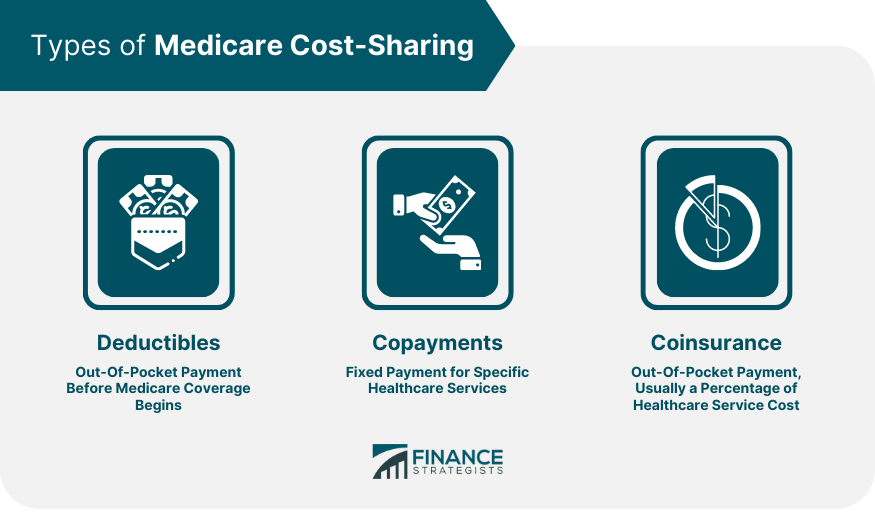

Types of Medicare Cost-Sharing

Deductibles

Copayments

Coinsurance

Medicare Part A Cost-Sharing

Hospital Deductible

Hospital Coinsurance

Skilled Nursing Facility Coinsurance

Medicare Part B Cost-Sharing

Annual Deductible

Coinsurance

Excess Charges

Medicare Part D Cost-Sharing

Deductible

Copayments/Coinsurance

Coverage Gap

Medicare Supplement Insurance

Overview of Medicare Supplement Insurance

Comparison of Medicare Supplement Plans

Benefits of Medicare Supplement Insurance

Final Thoughts

Medicare Cost-Sharing FAQs

Medicare cost-sharing is the portion of healthcare costs that beneficiaries are responsible for paying out-of-pocket, such as deductibles and copayments.

Medicare cost-sharing includes deductibles, copayments, and coinsurance for various medical services, depending on the specific part of Medicare.

Medicare Part A cost-sharing includes hospital deductibles, hospital coinsurance, and skilled nursing facility coinsurance, which beneficiaries are responsible for paying out-of-pocket.

Medicare Part D cost-sharing includes deductibles, copayments or coinsurance, and a coverage gap for prescription drugs.

Yes, Medicare supplement insurance, also known as Medigap, can help cover certain out-of-pocket costs, such as deductibles and coinsurance, that are not covered by Medicare Parts A and B.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.