Goal-Based Planning is a financial planning approach that involves identifying specific financial objectives or goals and developing a plan to achieve them. This approach focuses on creating a roadmap for achieving specific financial outcomes rather than simply accumulating wealth. In goal-based planning, the financial planning process is tailored to the individual's unique circumstances and objectives, taking into account factors such as age, income, risk tolerance, and time horizon. The primary objective of goal-based planning is to help individuals achieve their specific financial goals. Some common financial goals include buying a house, saving for retirement, paying for college education, starting a business, or creating a sustainable income stream. Goal-based planning helps individuals prioritize their financial goals and create a plan that is personalized to their unique circumstances. The first step in goal-based planning is to identify specific financial goals. This includes determining the amount of money needed, the time frame for achieving the goal, and the level of risk that an individual is willing to take. Once specific goals have been identified, it is important to prioritize them based on their importance and urgency. This helps to ensure that the most critical goals are addressed first. Once goals have been identified and prioritized, a plan can be created to achieve them. This involves determining the amount of money that needs to be saved, the investment strategies that will be used, and the timeline for achieving each goal. Goal-based planning requires ongoing monitoring of progress towards achieving each goal. This helps to ensure that adjustments can be made as needed to keep the plan on track. As circumstances change, goals may need to be revised. This may involve adjusting the timeline for achieving a goal or changing the amount of money that needs to be saved. Goal-based planning takes a holistic approach to financial planning by considering an individual's entire financial situation. This includes factors such as income, expenses, debts, assets, and liabilities. Goal-based planning involves considering an individual's risk tolerance when creating a plan. This helps to ensure that the investment strategies used are appropriate for the individual's comfort level with risk. The first step in goal-based planning is to identify specific financial goals. These could include buying a home, saving for retirement, paying for education, starting a business, or building an emergency fund. It is important to make sure that each goal is specific, measurable, achievable, relevant, and time-bound (SMART). After setting financial goals, it is important to prioritize them based on their importance and urgency. This helps to ensure that the most critical goals are addressed first. Prioritization also helps to ensure that resources are allocated effectively, so that each goal receives the attention it deserves. Once goals have been prioritized, they need to be defined in more detail. This includes determining the amount of money needed, the timeline for achieving the goal, and the level of risk that an individual is willing to take. This information will be used to create a plan to achieve each goal. The next step is to create an action plan to achieve each goal. This involves determining the amount of money that needs to be saved, the investment strategies that will be used, and the timeline for achieving each goal. It is important to make sure that the action plan is realistic and achievable, and that it takes into account the individual's risk tolerance. Goal-based planning requires ongoing monitoring of progress towards achieving each goal. This helps to ensure that adjustments can be made as needed to keep the plan on track. If circumstances change, goals may need to be revised. This may involve adjusting the timeline for achieving a goal or changing the amount of money that needs to be saved. Goal-based planning provides a clear focus on specific financial objectives. This helps individuals to prioritize their financial goals and work towards achieving them in a systematic and organized manner. With a clear focus on specific objectives, individuals can avoid wasting time and money on non-priority activities, and instead direct their resources towards achieving their desired outcomes. Goal-based planning helps to increase motivation to achieve financial goals. When individuals have clear and specific financial goals, they are more likely to feel motivated to work towards achieving them. This motivation can help individuals to overcome obstacles and stay committed to their financial goals even when faced with challenges. Goal-based planning helps individuals to make better financial decisions. With a clear understanding of their financial goals, individuals can make more informed decisions about their spending, investments, and other financial activities. This helps to ensure that financial resources are being used effectively, and that decisions are aligned with long-term financial objectives. Goal-based planning can help to minimize financial stress. When individuals have a clear financial plan, they are less likely to feel overwhelmed or uncertain about their financial future. This can help to reduce stress and anxiety related to financial matters, and provide a greater sense of control and security. Goal-based planning can lead to improved financial well-being. By achieving specific financial objectives, individuals can improve their financial position and increase their financial security. This can provide greater peace of mind and enable individuals to enjoy a higher quality of life. One potential drawback of goal-based planning is that it can be inflexible. This approach assumes that individuals have a clear understanding of their long-term financial goals, and that these goals will remain constant over time. However, financial circumstances can change unexpectedly, which may require individuals to adjust their goals or priorities. If an individual's financial goals are too rigid, it may be difficult to adapt to changing circumstances. Goal-based planning tends to be focused on achieving specific financial objectives over a relatively short time horizon. While this can be useful for achieving short-term goals, it may not be effective for achieving long-term financial security. Individuals who focus solely on short-term goals may not adequately prepare for unexpected events or long-term financial needs, such as retirement. Another potential drawback of goal-based planning is that it may lead to overconfidence. Individuals who have a clear financial plan may feel confident that they are on track to achieve their goals, which may lead them to take on more risk than they should. This can result in losses or missed opportunities. Setting unrealistic financial goals can also be a potential drawback of goal-based planning. If individuals set goals that are too ambitious or unrealistic, they may become discouraged or frustrated if they are unable to achieve them. This can lead to a lack of motivation and a feeling of failure. Goal-based planning tends to focus narrowly on achieving specific financial objectives, which may not take into account other important aspects of an individual's life. For example, individuals may focus solely on saving for retirement, while neglecting their health, relationships, or personal development. Goal-based planning is an effective financial planning approach that can help individuals achieve their specific financial objectives. It involves identifying specific financial goals, prioritizing them, creating an action plan, monitoring progress, and revising goals as needed. By taking a personalized and structured approach to financial planning, individuals can improve their financial well-being and minimize financial stress. While goal-based planning offers a wide range of benefits, there are also potential drawbacks that individuals should be aware of. These include limited flexibility, short-term focus, risk of overconfidence, setting unrealistic expectations, and a narrow focus. Despite these potential drawbacks, goal-based planning remains an important approach to financial planning. By setting clear and specific financial goals, individuals can increase their chances of achieving their desired financial outcomes and improve their overall financial well-being. It is important for individuals to prioritize goal-based planning in their financial planning and seek professional advice when necessary to ensure they are on track to achieve their financial goals.What Is Goal-Based Planning?

Key Principles of Goal-Based Planning

Identifying Specific Goals

Prioritizing Goals

Creating a Plan

Monitoring Progress

Revising Goals as Needed

Taking a Holistic Approach

Considering Risk

Steps Involved in Goal-Based Planning

Setting Financial Goals

Prioritizing Financial Goals

Defining Financial Goals

Creating an Action Plan

Monitoring Progress and Revising Goals

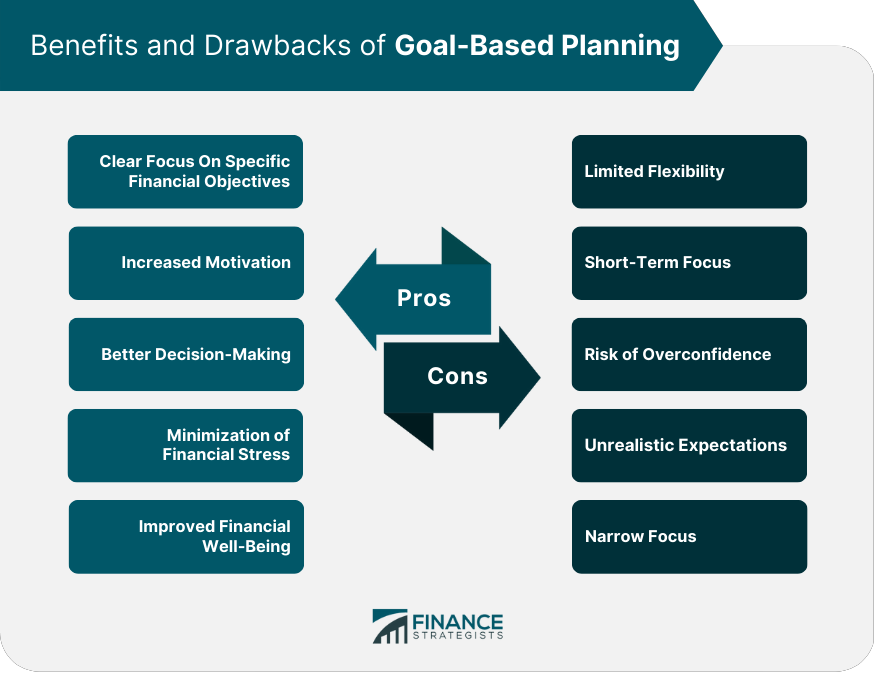

Benefits of Goal-Based Planning

Clear Focus On Specific Financial Objectives

Increased Motivation

Better Decision-Making

Minimization of Financial Stress

Improved Financial Well-Being

Drawbacks of Goal-Based Planning

Limited Flexibility

Short-Term Focus

Risk of Overconfidence

Unrealistic Expectations

Narrow Focus

Final Thoughts

Goal-Based Planning FAQs

Goal-based planning is a financial planning approach that involves identifying specific financial objectives or goals and developing a plan to achieve them. This approach focuses on creating a roadmap for achieving specific financial outcomes rather than simply accumulating wealth.

Traditional financial planning often focuses on accumulating wealth without clear objectives. Goal-based planning, on the other hand, starts with specific financial objectives and then creates a plan to achieve them. This approach is more personalized and structured, which can lead to better outcomes.

Goal-based planning provides a clear focus on specific financial objectives, increased motivation to achieve financial goals, better decision-making, minimized financial stress, and improved financial well-being. By creating a roadmap for achieving specific financial outcomes, individuals can avoid wasting time and money on non-priority activities and direct their resources towards achieving their desired outcomes.

Yes, goal-based planning can be used for both short-term and long-term financial goals. By prioritizing long-term financial goals and creating a plan to achieve them, individuals can ensure that they are adequately prepared for their future financial needs.

To get started with goal-based planning, begin by identifying specific financial goals and prioritizing them based on their importance and urgency. Then, create a plan to achieve each goal, taking into account factors such as income, expenses, debts, assets, and liabilities. Finally, monitor progress towards achieving each goal and revise goals as needed to ensure that the plan remains on track. Consider seeking professional advice from a financial advisor or planner to help you get started with goal-based planning.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.