The Certificate in Investment Performance Measurement (CIPM) is a globally recognized certification program designed to enhance the skills and knowledge of investment professionals in the area of investment performance measurement. The CIPM program is offered by the CFA Institute, the same organization that offers the Chartered Financial Analyst (CFA) program. To obtain the CIPM designation, candidates must meet certain education and experience requirements and pass two levels of examinations. To be eligible for the CIPM program, candidates must have one of the following: A bachelor's degree or equivalent education/work experience Four years of relevant work experience A combination of education and work experience that totals at least four years The CIPM program consists of two levels of examinations: Level I and Level II. The Level I examination consists of 100 multiple-choice questions and is administered in a computer-based format. The exam covers four broad topic areas: Introduction to Investment Performance Measurement Performance Attribution and Appraisal Risk Measurement and Management Manager Selection, Monitoring, and Evaluation The Level II examination is a case study-based exam that assesses the candidate's ability to apply the concepts covered in Level I to real-world situations. The exam consists of two 90-minute sessions and covers the following topic areas: Performance Evaluation and Attribution Risk Evaluation and Management Manager Selection, Due Diligence, and Monitoring Registration Process and Fees Obtaining the CIPM designation can provide many benefits to investment professionals. Some of these benefits include: Obtaining the CIPM designation can open up new career opportunities in the finance industry. Many employers view the CIPM as a valuable credential indicating a candidate's investment performance measurement expertise. The CIPM designation is recognized worldwide and can enhance the credibility and marketability of investment professionals. Employers and clients are more likely to trust professionals who have obtained the CIPM designation. CIPM holders have access to a global network of investment performance professionals. This network can provide collaboration, professional development, and career advancement opportunities. The CIPM curriculum covers a range of topics related to investment performance measurement. The program is designed to provide candidates with the skills and knowledge necessary to accurately measure and evaluate investment performance. The following are the topic areas covered in the CIPM curriculum: The introduction to investment performance measurement covers the basic concepts and terminology related to investment performance measurement. The topic area includes the following subtopics: The Definition and Purpose of Investment Performance Measurement The Types of Investment Performance Measurement The Importance of Benchmarking The Difference Between Time-Weighted and Dollar-Weighted Returns The performance attribution and appraisal topic area covers the methods used to evaluate investment performance and the techniques used to attribute performance to various factors. The following are the subtopics covered in this area: The components of investment performance The methods used to evaluate investment performance, such as the Sharpe ratio, Treynor ratio, and Jensen's alpha The techniques used to attribute performance to various factors, such as asset allocation, security selection, and timing The importance of performance measurement in the investment management process The risk measurement and management topic area covers the methods used to measure and manage investment risk. The following are the subtopics covered in this area: The types of investment risk, such as market risk, credit risk, and liquidity risk The methods used to measure investment risks, such as standard deviation, beta, and Value at Risk (VaR) The techniques used to manage investment risks, such as diversification, hedging, and risk budgeting The importance of risk management in the investment management process The manager selection, monitoring, and evaluation topics cover the techniques used to select, monitor, and evaluate investment managers. The following are the subtopics covered in this area: The types of investment managers, such as active and passive managers The techniques used to select investment managers, such as quantitative and qualitative analysis The techniques used to monitor investment managers, such as performance monitoring and risk monitoring The techniques used to evaluate investment managers, such as performance attribution and peer group analysis Preparing for the CIPM exam can be challenging, but candidates can increase their chances of success with the right study materials and strategies. The following are some preparation and study tips for the CIPM exam: The CFA Institute offers study materials for the CIPM program, including the CIPM Candidate Body of Knowledge (CBOK) and the CIPM Study Guide. Candidates can also use third-party study materials, such as textbooks, online courses, and study groups. Effective study strategies and techniques can help candidates learn and retain the information covered in the CIPM curriculum. Some effective systems and methods include: Creating a study schedule and sticking to it Using active learning techniques, such as practice questions and flashcards Taking breaks and getting enough rest Reviewing the material regularly and testing oneself Time management is essential when preparing for the CIPM exam. The following are some time management tips that candidates can use to make the most of their study time: Prioritizing the most important topics and allocating more study time to them Setting realistic study goals and deadlines Using time-saving techniques, such as speed reading and summarizing notes Avoiding distractions and staying focused during study sessions Obtaining the CIPM designation can open up many career opportunities in the finance industry. The following are some potential job titles and roles that CIPM holders can pursue: Investment Performance Analyst Portfolio Manager Risk Manager Investment Consultant Investment Performance Auditor Job search resources and strategies for CIPM holders can include online job boards, professional networking, and industry events. The CFA Institute also offers career resources for CIPM holders, such as job postings and career development tools. The CIPM designation is one of several finance certifications available to investment professionals. The following is a comparison of the CIPM with other popular finance certifications: The Chartered Financial Analyst designation is also offered by the CFA Institute and is one of the most well-known and respected designations in the finance industry. The program covers more topics than the CIPM program, including ethics, economics, and financial statement analysis. The CFA program also requires passing three levels of exams, which can take several years to complete. The CAIA Association offers the Chartered Alternative Investment Analyst (CAIA) designation and focuses on alternative investments, such as hedge funds, private equity, and real estate. This program covers risk management, portfolio management, and legal and regulatory issues. The CAIA program requires passing two levels of exams. The Financial Risk Manager (FRM) designation is offered by the Global Association of Risk Professionals (GARP) and focuses on risk management. The FRM program covers quantitative analysis, financial markets and products, and risk management tools and techniques. The FRM program requires passing two levels of exams. The following are some advantages and disadvantages of the CIPM designation compared to other finance certifications: Focuses specifically on investment performance measurement, making it a valuable credential for investment professionals in this area Recognized worldwide, providing opportunities for global career advancement Requires passing only two levels of exams, making it a faster certification to obtain than some other finance certifications Covers a narrower range of topics than some other finance certifications, such as the CFA Not as well-known as some other finance certifications, which may limit its marketability in some regions or industries The Certificate in Investment Performance Measurement is a valuable certification program for investment professionals looking to enhance their skills and knowledge in investment performance measurement. Obtaining the CIPM designation can provide many benefits, such as career advancement opportunities, enhanced credibility and marketability, and access to a global network of investment performance professionals. Candidates can prepare for the CIPM exam using recommended study materials and effective strategies and techniques. While the CIPM is one of several finance certifications available to investment professionals, it has unique advantages and disadvantages compared to other certifications. Suppose you are looking to invest in the stock market. In that case, hiring a financial advisor who can guide investment performance measurement and other financial planning matters may be beneficial. Feel free to seek help from a qualified financial advisor to achieve your financial goals.What Is Certificate in Investment Performance Measurement (CIPM)?

Requirements for Obtaining the CIPM Designation

Education and Experience Requirements

Examination Structure and Content

Level I Examination

Level II Examination

Benefits of Obtaining the CIPM Designation

Career Advancement Opportunities

Enhanced Credibility and Marketability

Access to a Global Network of Investment Performance Professionals

CIPM Curriculum

Introduction to Investment Performance Measurement

Performance Attribution and Appraisal

Risk Measurement and Management

Manager Selection, Monitoring, and Evaluation

Preparation and Study Tips for CIPM Exam

Recommended Study Materials

Effective Study Strategies and Techniques

Time Management Tips for Exam Preparation

Career Opportunities With CIPM Designation

CIPM vs. Other Finance Certifications

CFA

CAIA

FRM

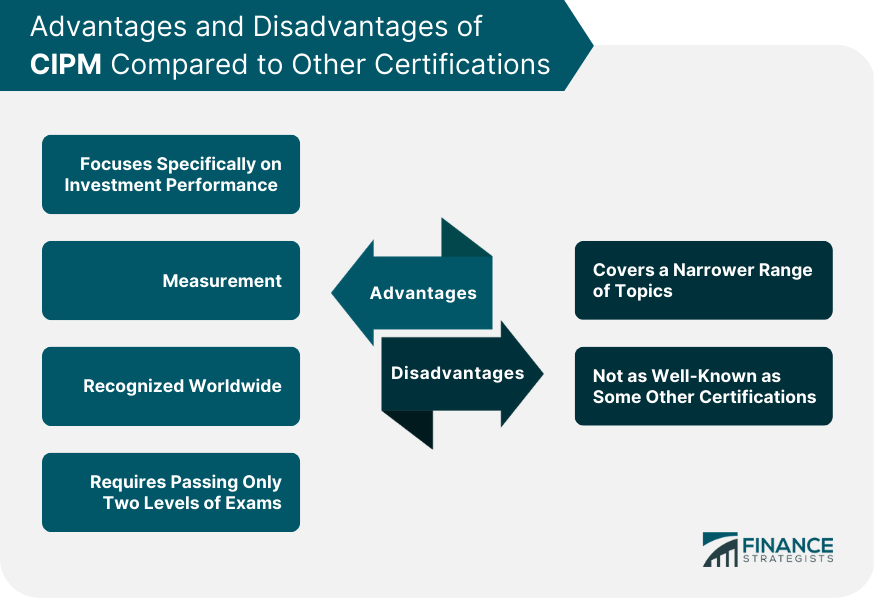

Advantages and Disadvantages of CIPM Compared to Other Certifications

Advantages

Disadvantages

Conclusion

Certificate in Investment Performance Measurement (CIPM) FAQs

The Certificate in Investment Performance Measurement (CIPM) is a globally recognized certification program offered by the CFA Institute. It is designed to enhance the skills and knowledge of investment professionals in the area of investment performance measurement.

Obtaining the CIPM designation can provide many benefits, including career advancement opportunities, enhanced credibility and marketability, and access to a global network of investment performance professionals.

The CIPM curriculum covers various topics related to investment performance measurement, including performance attribution, risk measurement and management, and manager selection, monitoring, and evaluation.

To obtain the CIPM designation, candidates must meet certain education and experience requirements and pass two levels of examinations. Candidates must have a bachelor's degree or equivalent education/work experience, four years of relevant work experience, or a combination of education and work experience that totals at least four years.

Candidates can prepare for the CIPM exam using recommended study materials, such as the CIPM Candidate Body of Knowledge (CBOK) and the CIPM Study Guide, and using effective study strategies and techniques. Time management is also essential when preparing for the exam.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.