Liquidity is an estimation of how readily an asset or security can be converted into cash at a price that reflects its intrinsic value. Ready cash is considered to be the most liquid possible asset, since it requires no conversion and is spendable as is. Tangible assets, such as real estate, collectibles, fine art, and so on, are considered relatively illiquid since they can take a while to find a buyer at the appropriate price and process/finalize the transaction. Securities like stocks or other publicly traded financial assets fall somewhere along the middle of the liquidity spectrum. Liquidity is foundational for the smooth operation of any business. Operational costs such as payroll, raw material purchases, and utility bills require liquid assets. Without sufficient liquidity, businesses can run into disruptions, leading to potential setbacks or even failures. A strong liquidity position acts as a financial cushion during downturns. Companies with ample liquid assets are better equipped to navigate economic recessions, industry slowdowns, or unforeseen challenges. In contrast, those with minimal liquidity might be compelled to seek costly external financing or make unfavorable decisions under duress. Beyond mere survival, liquidity offers businesses the strategic flexibility to capitalize on opportunities. This could involve seizing a lucrative investment, funding a promising R&D project, or even acquiring a competitor. High liquidity ensures that firms can make these moves promptly without resorting to lengthy financing processes. Funding liquidity pertains to the availability of credit or funding for institutions, particularly financial ones like banks. It denotes an entity's ability to secure immediate financing without resorting to desperate measures or selling assets at a steep discount. A financial crisis might be exacerbated when institutions lack funding liquidity, as they might resort to selling assets en masse, further driving down prices and creating a vicious cycle. Market liquidity refers to liquidity within an entire market, such as the stock market or real estate market. If a market has high market liquidity, then commodities in that market can be bought and sold at relatively stable, transparent prices. The stock market, for instance, is characterized by high liquidity, at least when trade volume is high and not dominated by selling. Accounting liquidity refers to the ability of a company or individual to meet their short term debt obligations with the assets they have at hand. Individuals and companies with plenty of free cash or easily sellable assets like stocks have high accounting liquidity. On the other hand, an individual or business that has their cash tied up in tangible assets may be relatively illiquid. The current ratio, calculated as a company's current assets divided by its current liabilities, is a popular metric to gauge a company's financial health in the short term. If the ratio is greater than one, it signifies that the company possesses more assets than liabilities, suggesting better liquidity. A ratio less than one may indicate potential difficulties in meeting short-term obligations, which could raise red flags for investors and creditors. The quick ratio, or acid-test ratio, refines the current ratio by excluding inventories from current assets. It's calculated by subtracting inventories from current assets and then dividing by current liabilities. This metric offers a more stringent assessment of a company's short-term liquidity, as inventories may not be as readily convertible to cash as other assets. A high quick ratio indicates that a company can meet its immediate obligations even without relying on the sale of its inventory. Among the most conservative liquidity measures, the cash ratio is determined by dividing a company's cash and cash equivalents by its current liabilities. This ratio purely focuses on the firm's most liquid assets and disregards other assets that might take longer to convert to cash. A high cash ratio suggests a strong liquidity position, although it might also hint at missed investment opportunities if a company hoards too much cash. Cash flow management is paramount in maintaining liquidity. This involves diligent monitoring of inflows and outflows, ensuring timely collections, delaying unnecessary expenses, and leveraging technology for cash flow forecasting. Establishing and maintaining credit facilities, like revolving credit lines or overdrafts, can provide a financial buffer. These tools grant companies the ability to draw funds when needed, enhancing their liquidity position without holding excess cash reserves. Effective working capital management—encompassing accounts receivable, accounts payable, and inventory management—can substantially impact liquidity. Promptly collecting receivables, negotiating favorable payment terms with suppliers, and optimizing inventory levels can free up cash, enhancing liquidity. High liquidity affords companies the flexibility to tackle unexpected expenses, invest in growth opportunities, and reduce their reliance on external financing. This financial freedom can be especially advantageous in volatile markets or uncertain economic conditions. Companies with ample liquidity are less exposed to financial risks. They can comfortably meet their obligations, reducing the threat of bankruptcy or insolvency. This stability can be reassuring for investors, creditors, and other stakeholders. Liquid firms can swiftly capitalize on promising investment opportunities without the lengthy process of securing external funds. This agility can lead to competitive advantages, allowing businesses to stay ahead of the curve. While liquidity is valuable, excessive liquidity can limit a company's investment options. Funds that remain idle or in low-yield accounts can hinder a company's growth potential and overall financial performance. Holding excessive liquid assets might come with an opportunity cost. The returns from alternative investments, which the company might have overlooked due to its focus on liquidity, could surpass the benefits derived from holding liquid assets. Conversely, insufficient liquidity can lead a company towards bankruptcy. If a firm consistently struggles to meet its short-term obligations and cannot secure additional financing, it may be forced into insolvency. Liquidity refers to an asset's convertibility into cash at a fair value. Notably, liquidity plays a pivotal role in supporting day-to-day business operations by facilitating prompt payment of obligations and expenses. Moreover, maintaining a robust liquidity position safeguards financial stability during economic downturns, bolstering a company's resilience against unforeseen challenges. Liquidity isn't just about survival; it empowers strategic agility, enabling timely capitalization on growth prospects and investment opportunities. Different types of liquidity, such as funding, market, and accounting liquidity, offer diverse perspectives on an entity's financial health. Various liquidity measures like the current ratio, quick ratio, and cash ratio help assess a company's short-term liquidity position. While the advantages of liquidity encompass flexibility, risk reduction, and seizing opportunities, potential risks include limited investment options and opportunity costs. Achieving a balanced liquidity strategy is essential to navigate the complex interplay between stability, growth, and risk management in the dynamic world of finance.Liquidity Definition

Significance of Liquidity

Supporting Business Operations

Safeguarding Financial Stability

Enabling Strategic Flexibility

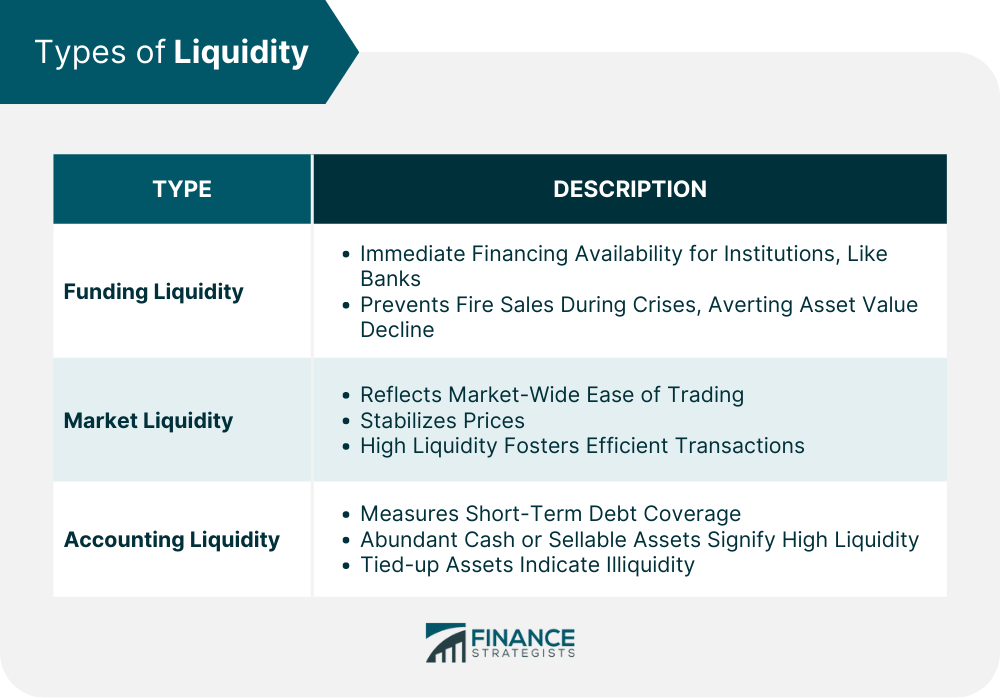

Types of Liquidity

Funding Liquidity

Market Liquidity

Accounting Liquidity

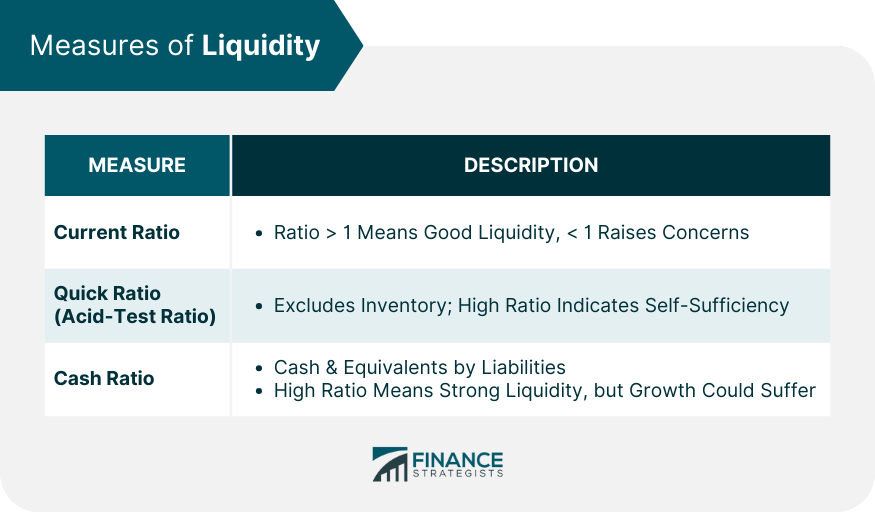

Measures of Liquidity

Current Ratio

Quick Ratio (Acid-Test Ratio)

Cash Ratio

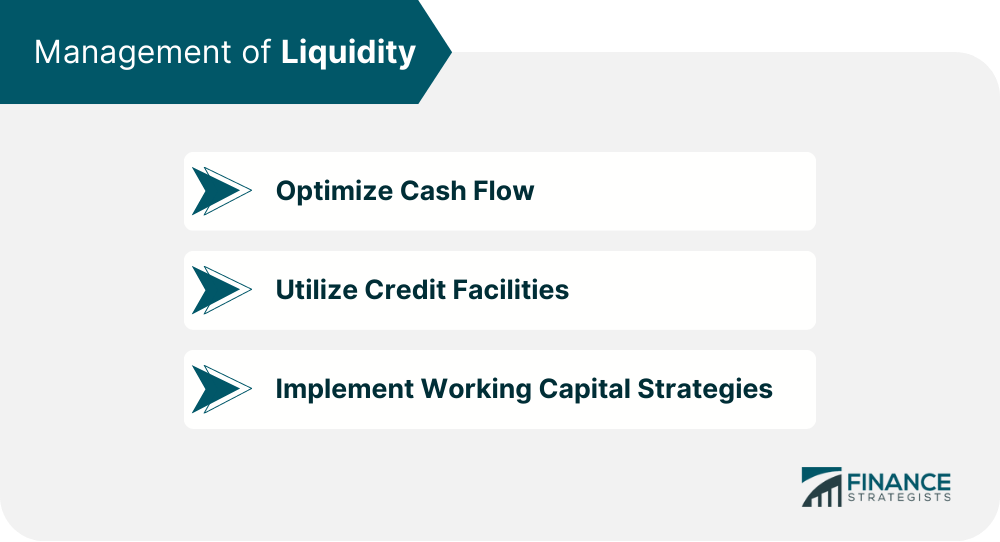

Management of Liquidity

Optimize Cash Flow

Utilize Credit Facilities

Implement Working Capital Strategies

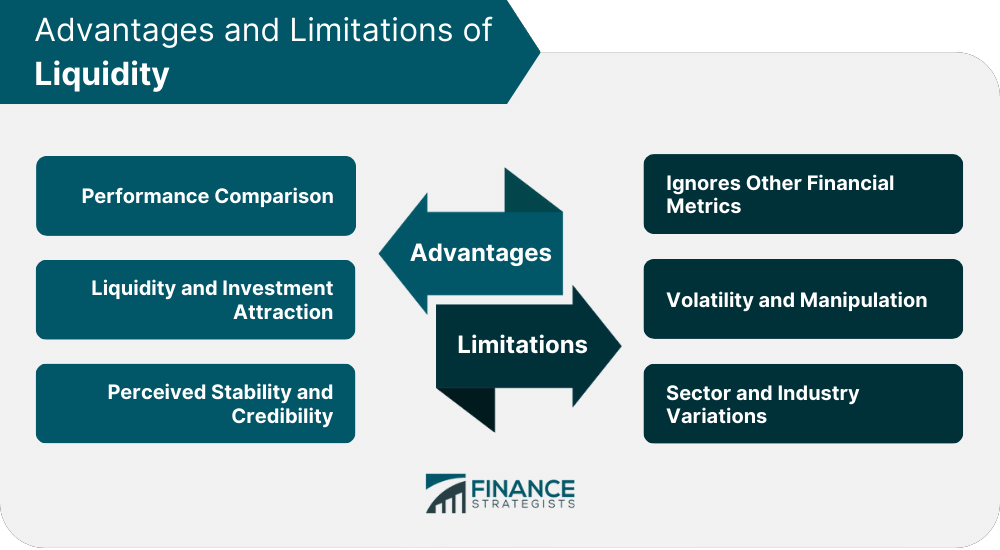

Advantages of Liquidity

Enhanced Financial Flexibility

Reduced Financial Risk

Seizing Investment Opportunities

Risks of Liquidity

Limited Investment Options

Opportunity Cost

Potential Bankruptcy

Conclusion

Liquidity FAQs

Liquidity is an estimation of how readily an asset or security can be converted into cash at a price that reflects its intrinsic value.

Market liquidity refers to liquidity within an entire market, such as the stock market or real estate market.

Accounting liquidity refers to the ability of a company or individual to meet their short term debt obligations with the assets they have at hand.

Ready cash is considered to be the most liquid asset possible, since it requires no conversion and is spendable as is.

Tangible assets, such as real estate, collectibles, fine art, and so on, are considered relatively illiquid since it can take a while to find a buyer at the appropriate price and process/finalize the transaction.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.