A credit score is a numerical representation that reflects an individual's creditworthiness, essentially indicating their likelihood of repaying debts in a timely manner. Lenders, landlords, and sometimes employers use this score as a risk assessment tool when considering extending credit, renting properties, or even offering employment. This score is calculated based on several key factors, including payment history, credit utilization, length of credit history, the types of credit in use, and recent credit inquiries. A good credit score can mean better interest rates on loans and credit cards, greater likelihood of loan approval, and even advantages when applying for rental properties. Conversely, a poor score can make it difficult to secure loans, result in higher interest rates, and limit housing options. It's important to regularly check your credit score, which can be done once a year for free through each of the major credit bureaus, to ensure its accuracy and take steps to improve or maintain it. Online credit reporting agencies have become the go-to method for many individuals to keep tabs on their credit scores. Among the most reputable and widely used are the big three credit bureaus: Experian, TransUnion, and Equifax. Experian gathers information from lenders, creditors, and public records, updating their databases continually. Their scoring model, known as the Experian Risk Model, factors in your payment history, credit usage, and other significant elements to generate a score ranging from 300 to 850. Similar to its competitors, its data collection process involves pulling data from public records and financial institutions. Their scoring model, known as the TransUnion New Account Score, can range from 300 to 850, considering factors like repayment history, debt load, and the length of credit history. Equifax is one of the oldest credit reporting agencies. Their scoring system, which is again out of 850, contemplates elements like your credit history's age, your debt types, and your payment track record. Here's an overview of different types of institutions and some specific examples of entities that may provide such services: Banks not only offer various financial products like checking and savings accounts, loans, and credit cards, but they also provide services for customers to check their credit scores. The banks usually provide this service through their online banking portals or mobile apps, allowing customers to conveniently access their credit scores at any time. Being more member-centric, many credit unions also offer credit score-checking services as a part of their member benefits. Credit unions operate on a not-for-profit basis and prioritize the financial well-being of their members. As they primarily operate digitally, many of them offer comprehensive financial management tools, including credit score checks. These digital banks, taking advantage of modern tech infrastructure, often integrate advanced features like credit score simulators or real-time score monitoring. Many standalone credit card companies, apart from traditional banks that issue cards, have also started offering credit score services, especially since a good score is vital for credit card approval and management. These issuers recognize that responsible card usage can boost a credit score, so they often provide tools to help cardholders understand score changes and factors. These platforms, harnessing the power of technology and data analytics, often provide a more detailed breakdown of credit components, offering suggestions for improvement. Some retailers that offer financing options for their products might also provide credit score services, especially if they issue store credit cards. This helps customers understand their eligibility for store financing options and promotes responsible credit usage within the retailer ecosystem. The U.S. Federal Law mandates that each individual is entitled to a complimentary credit report from each of the three primary credit bureaus once a year. The official portal to access this free report is AnnualCreditReport.com. It's a consolidated platform where you can request reports from any or all of the major bureaus. While the primary objective is to provide a comprehensive view of one's credit history, the credit score might not always be a part of the report. Payment History (35%): This reflects how consistently you've met your financial obligations, including credit cards, mortgages, and loans. Late or missed payments can hurt your score, while a history of on-time payments boosts it, showcasing your reliability as a borrower. Credit Utilization Ratio (30%): Representing the percentage of your credit limit you're currently using, a ratio below 30% is ideal. High utilization can decrease your score, implying potential over-reliance on credit. Length of Credit History (15%): This is the average age of your credit accounts. Longer histories, especially with positive records, improve your score. However, even with a shorter history, timely payments can positively impact your score. Types of Credit Used (10%): This measures the diversity of your credit accounts. A mix of account types, like credit cards, mortgages, and loans, is favorable, but it's essential to avoid accumulating unnecessary debts. Recent Credit Inquiries (10%): Multiple inquiries in quick succession can signal financial desperation, but grouped inquiries for mortgages or auto loans are often considered a single check. The following ranges can vary slightly among credit bureaus and scoring models but generally serve as a standard reference. Higher scores often result in favorable financial terms, including reduced interest rates. Poor: 300-579 Fair: 580-669 Good: 670-739 Very Good: 740-799 Excellent: 800-850 Arguably, the most detrimental action for your credit score is missing a payment or paying late. Timely payments are paramount in credit scoring models, and even a single missed payment can have a significant negative impact, especially if it's recent. Having a high credit utilization ratio – that is, using a large portion of your available credit – can be a sign that you're over-reliant on credit, which can negatively impact your score. Experts often recommend keeping your utilization ratio below 30%. Every time you apply for credit, an inquiry is made to your credit report. Numerous inquiries within a short time frame can lower your score, as it might indicate financial desperation or poor financial management. Diversity in your credit accounts and a longer credit history can be beneficial for your score. If all your accounts are recent, lenders might view you as a higher risk compared to someone with older, well-managed accounts. A credit score serves as a pivotal indicator of an individual's financial trustworthiness, used by lenders, landlords, and occasionally employers. Calculated through key parameters like payment consistency, credit utilization, credit history's length, credit types, and recent credit checks, it can open or close doors to financial opportunities. Higher scores, ranging between 670 to 850, often attract more favorable financial terms, including lower loan interest rates. On the flip side, scores between 300 to 669 might impose limitations. Major credit bureaus like Experian, TransUnion, and Equifax facilitate credit score checks, but the ease of access has expanded through online platforms, banks, credit unions, and fintech. Regularly reviewing your credit score, ideally annually through sources like AnnualCreditReport.com, ensures its accuracy and offers insights into potential improvement areas.What Is a Credit Score?

Ways to Check Your Credit Score

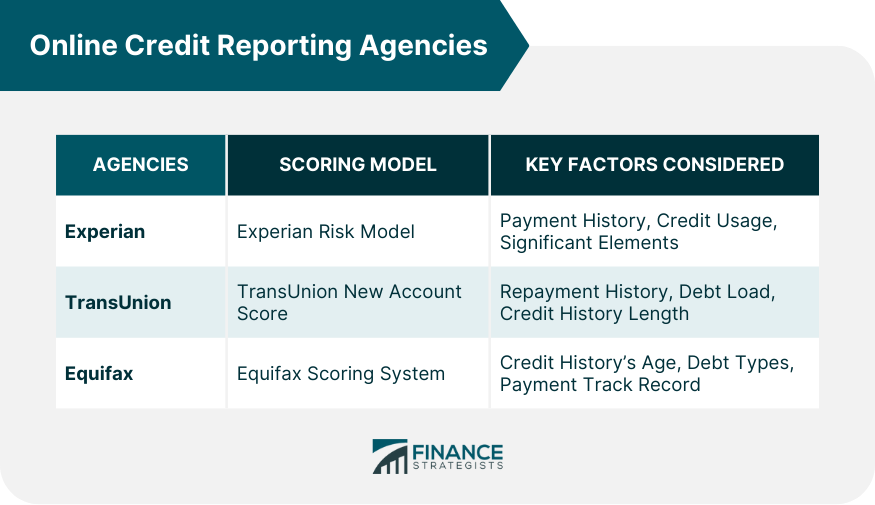

Online Credit Reporting Agencies

Experian

TransUnion

Equifax

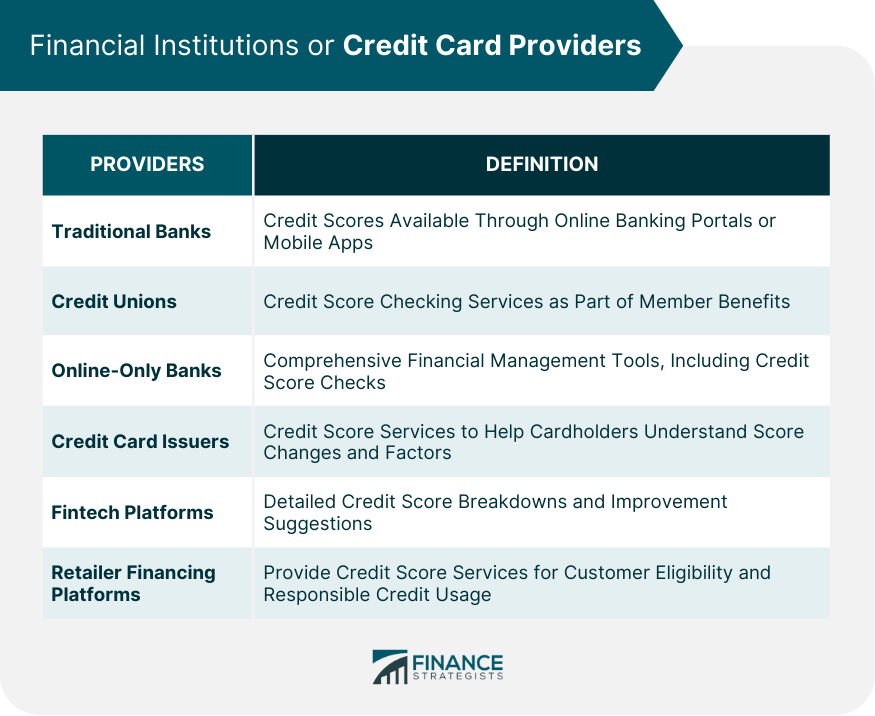

Financial Institutions or Credit Card Providers

Traditional Banks

Credit Unions

Online-Only Banks

Credit Card Issuers

Fintech Platforms

Retailer Financing Platforms

Annual Credit Report Services

Understanding Your Credit Score

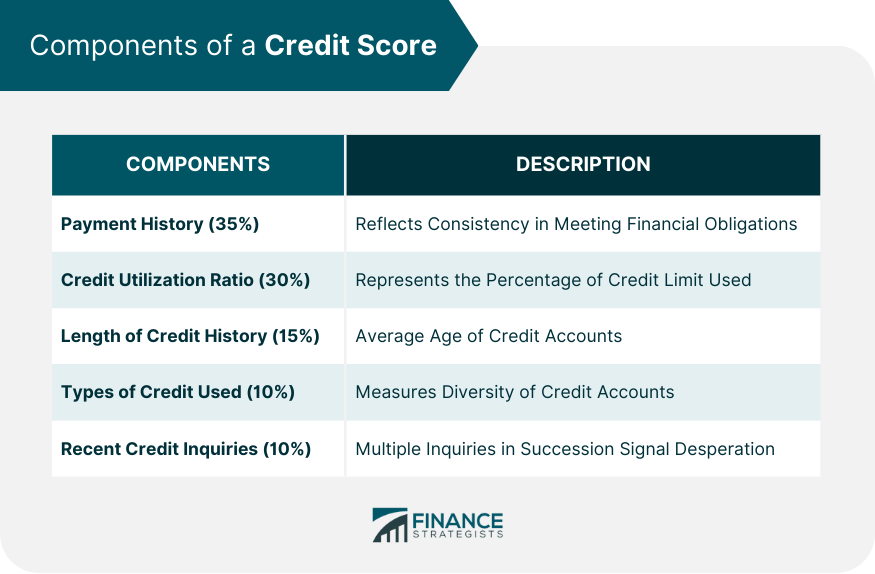

Components of a Credit Score

Credit Score Ranges

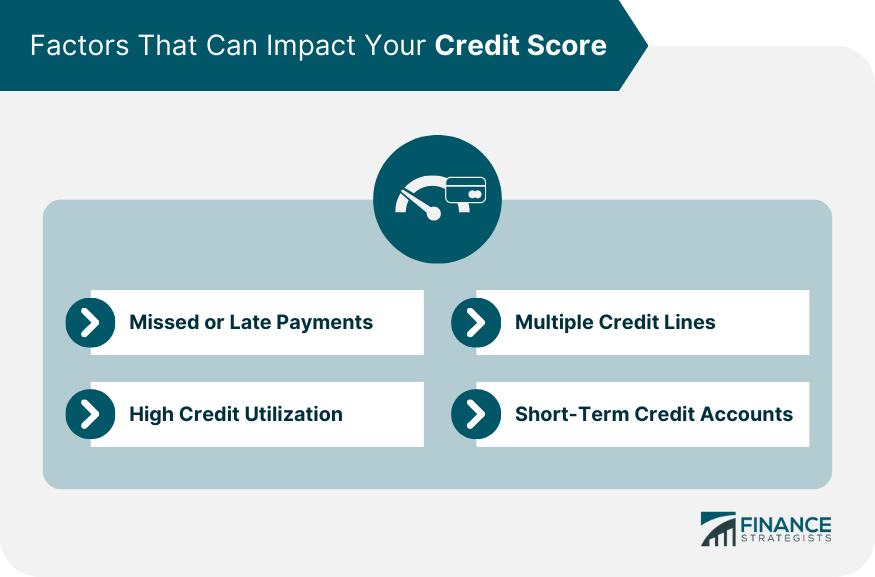

Factors That Can Impact Your Credit Score

Missed or Late Payments

High Credit Utilization

Multiple Credit Lines

Short-Term Credit Accounts

Conclusion

How to Check Your Credit Score FAQs

You can check your credit score once a year through each of the major credit bureaus via AnnualCreditReport.com. Additionally, many financial institutions and fintech platforms now offer periodic access to your score as part of their services.

It's essential to check your credit score regularly to ensure its accuracy, monitor for any signs of identity theft or fraud, and understand your financial standing when considering credit-related decisions.

Many reputable online credit reporting agencies and fintech platforms offer reliable methods to check your credit score. However, always ensure the platform's legitimacy and be wary of hidden fees or services.

When you personally check your credit score, it's considered a "soft inquiry," which doesn't impact your score. Only "hard inquiries," which occur when lenders check your score for lending decisions, may have an effect.

Many banks, credit unions, and credit card issuers offer their customers access to their credit scores either through online portals, mobile apps, or monthly statements. This service is often provided as a free perk to help customers understand and manage their financial health.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.