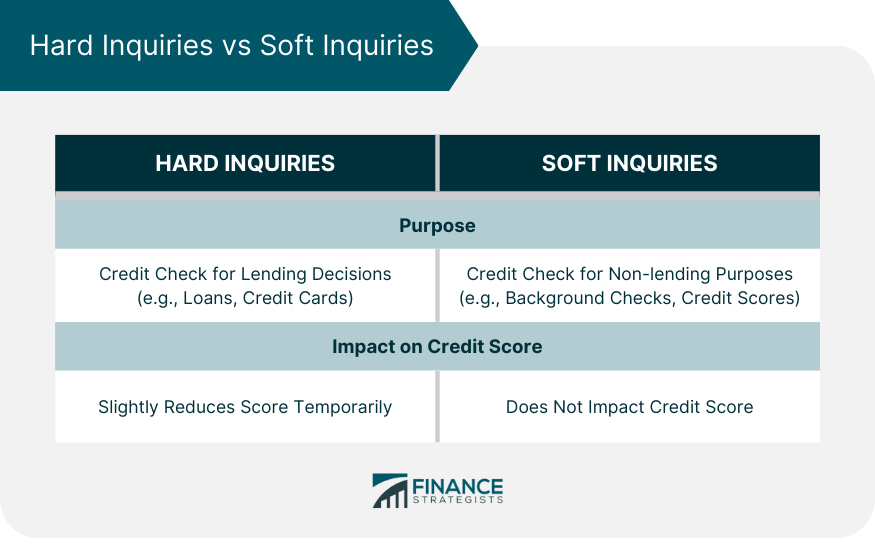

Increasing your credit limit can have both immediate and long-term effects on your credit score. In the short term, requesting a credit limit increase might lead to a slight drop in your credit score if the credit card issuer performs a hard inquiry on your credit report. However, in the long run, having a higher credit limit can benefit your credit score by lowering your credit utilization ratio, provided your spending doesn't increase proportionally. This ratio, which represents the percentage of your available credit that you're using, plays a significant role in determining your credit score. In essence, a credit limit increase can hurt your score momentarily but can be beneficial if managed responsibly. Hard inquiries and soft inquiries are two types of credit checks that can be performed on an individual's credit report, each with different implications. A hard inquiry typically occurs when a financial institution, like a lender or credit card issuer, checks your credit report to make a lending decision, such as when you apply for a mortgage, car loan, or credit card. Hard inquiries can slightly reduce your credit score for a short period of time. On the other hand, a soft inquiry happens when a person or company checks your credit report for non-lending purposes, such as background checks, or when you check your own credit score. Soft inquiries do not impact your credit score. Furthermore, while multiple hard inquiries in a short time frame can signal to lenders that you might be a high-risk borrower, soft inquiries are invisible to them and won't factor into lending decisions. It's essential to be aware of these differences, especially if you're planning significant financial moves or are conscious of maintaining or improving your credit health. The decision to request a higher credit limit depends on your personal financial situation and your reasons for wanting the increase. Here are a few scenarios where it might make sense: This represents the percentage of your total available credit that you're currently using. If you’re close to maxing out your credit cards, this can be detrimental to your score. Increasing your credit limit—without ramping up your spending—can effectively lower this ratio, potentially giving your credit score a beneficial boost. Whether it's a home renovation, a special event like a wedding, or a necessary business investment, having a higher credit limit can allow you to charge these expenses without drastically affecting your credit utilization ratio. This is especially beneficial if you have the means to pay off the balance swiftly. For those relatively new to credit or looking to rebuild after past mistakes, demonstrating responsible credit use with a higher limit can be a way to establish trust with lenders. Over time, as you maintain low balances and make payments punctually, this can be seen as evidence of your creditworthiness. Emergencies, such as medical events, car repairs, or sudden travel needs, can arise without warning. A higher credit limit can serve as a financial cushion, allowing you to address these unforeseen expenses without completely depleting savings or turning to potentially higher-interest loans. Many credit cards offer rewards, cash back, or other benefits based on the amount you spend. If you're a disciplined spender with a card that provides significant perks, a higher credit limit can enable you to leverage these rewards more effectively, especially if you're charging larger, planned expenses and paying them off promptly. Requesting a credit limit increase is a relatively straightforward process, but it requires some preparation to maximize your chances of approval. Before approaching your credit card issuer, evaluate your current financial position. You'll be in a stronger position to request an increase if: You've had a consistent history of on-time payments. Your income has increased since you were first granted credit. You've been a long-standing customer of the credit card company. Your credit utilization ratio is high, and you wish to bring it down. Different banks and credit card companies have varying processes for credit limit increase requests. Some might allow you to make the request online, while others might require a phone call or written application. Be ready with documents that might support your request, such as: Recent pay stubs or proof of income Employment verification A summary of your monthly expenses to demonstrate affordability Any other relevant financial information Online: Many credit card issuers provide an option on their website or mobile app to request a credit limit increase. Simply log in to your account, navigate to the appropriate section, and fill out the required form. Phone: Call the customer service number on the back of your credit card. Once connected, express your wish to discuss your credit limit. Be prepared to explain why you want an increase. Whether it's because of increased expenses, large upcoming purchases, or a desire to reduce your credit utilization ratio, a clear reason can make your request more compelling. Some credit card issuers might perform a hard inquiry on your credit report as part of the evaluation process. This can temporarily lower your credit score. It's essential to ask whether they will do a hard inquiry and decide if you're comfortable with that. The response might be instant, especially if you're making the request online. In other cases, the issuer might take a few days to review your request and get back to you. If your request is not approved, don't hesitate to ask for reasons. This feedback can be invaluable, helping you understand areas of improvement and increasing your chances of success in the future. Like most financial decisions, there are both upsides and downsides to consider. Improved Credit Utilization: A higher limit can lower your credit utilization ratio if your spending remains the same. Flexibility in Financial Emergencies: A higher limit can be beneficial during unexpected financial challenges. Enhanced Purchasing Power for Larger Investments: Whether it's for business expansion, significant home improvements, or other major expenses, a higher credit limit can facilitate these purchases without multiple lines of credit or loans. Temptation to Overspend: With more credit available, some people might be tempted to live beyond their means. Potential for Higher Debt: This ties into the overspending risk. More available credit can mean more accumulated debt if not managed responsibly. Impact of Hard Inquiries: In the process of requesting a credit limit increase, your card issuer may perform a hard credit inquiry. This can lead to a slight and temporary decrease in your credit score. The decision to request a credit limit increase has both immediate and long-term implications on your credit score. In the short term, there might be a slight drop in your credit score due to a hard inquiry on your credit report when requesting the increase. However, a higher credit limit can benefit your credit score by reducing your credit utilization ratio. It's crucial to understand the difference between hard and soft inquiries. Multiple hard inquiries in a short time can signal risk to lenders, while soft inquiries do not impact your credit score and are invisible to lenders. Increasing your credit limit can be advantageous for lowering credit utilization, preparing for large purchases, building credit history, handling emergencies, and leveraging rewards. However, it also carries the risk of overspending and accumulating higher debt, so responsible management is essential.Do Credit Limit Increases Hurt Your Credit Score?

Hard Inquiries vs Soft Inquiries

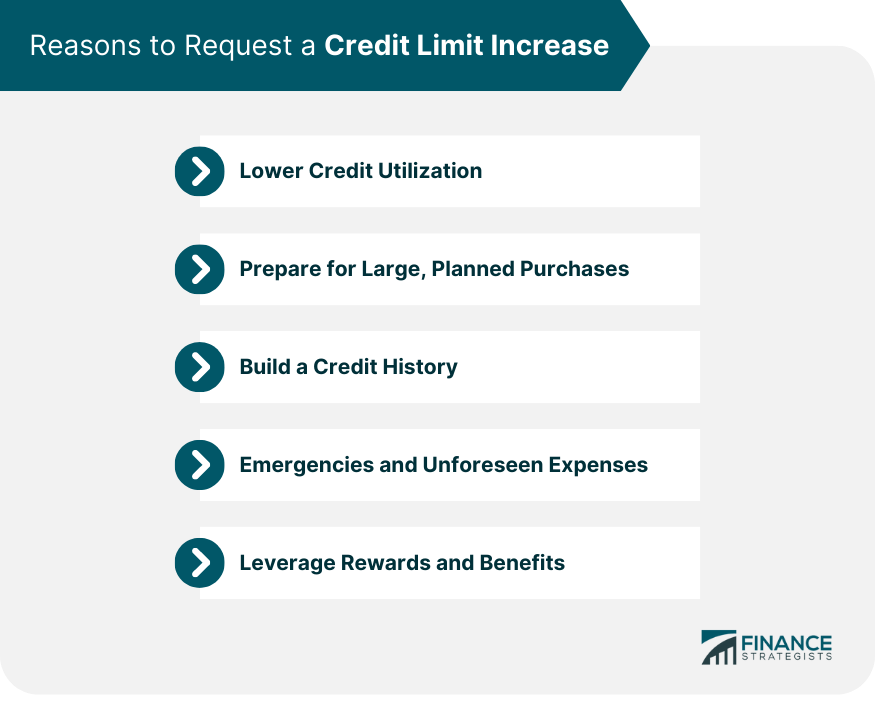

Should You Request a Credit Limit Increase

Lower Credit Utilization

Prepare for Large, Planned Purchases

Build a Credit History

Emergencies and Unforeseen Expenses

Leverage Rewards and Benefits

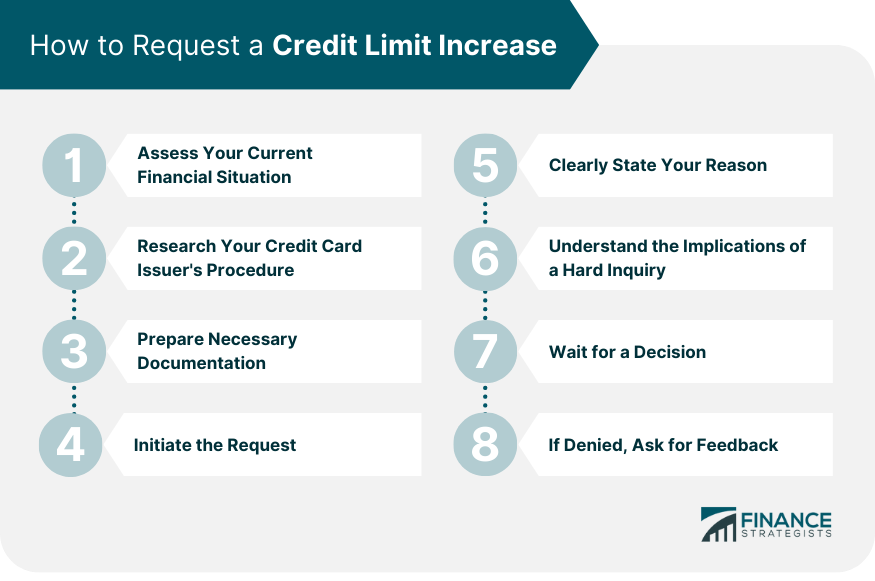

How to Request a Credit Limit Increase

Step 1: Assess Your Current Financial Situation

Step 2: Research Your Credit Card Issuer's Procedure

Step 3: Prepare Necessary Documentation

Step 4: Initiate the Request

Step 5: Clearly State Your Reason

Step 6: Understand the Implications of a Hard Inquiry

Step 7: Wait for a Decision

Step 8: If Denied, Ask for Feedback

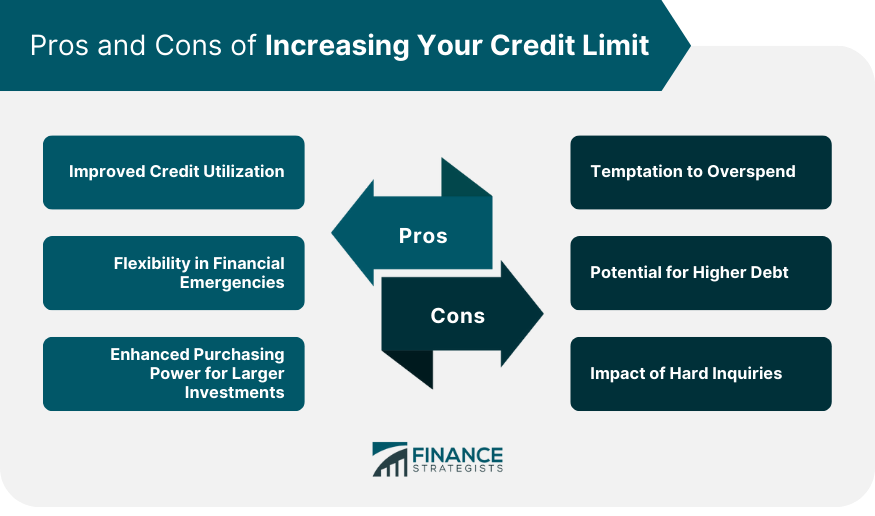

Pros and Cons of Increasing Your Credit Limit

Pros

Cons

Conclusion

Do Credit Limit Increases Hurt Your Credit Score? FAQs

Credit limit increases can lead to a temporary drop in your credit score if a hard inquiry is performed. However, in the long term, they can be beneficial for your credit score.

A higher credit limit can actually lower your credit utilization ratio if your spending doesn't increase proportionally, which can be beneficial for your credit score.

Soft inquiries, such as checking your own credit score or background checks, do not impact your credit score and are invisible to lenders.

Increasing your credit limit and responsibly managing your spending can help establish trust with lenders and improve your creditworthiness over time.

While credit limit increases can be advantageous, they also carry the risk of overspending and accumulating higher debt if not managed responsibly. Additionally, hard inquiries during the request process can cause a slight and temporary decrease in your credit score.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.