A Registered Education Savings Plan (RESP) is a tax-sheltered investment account designed to help Canadian parents, grandparents, and other adults save for a child's post-secondary education. The unique feature of an RESP is that contributions to the plan may attract government grants, and the investment income earned in the plan is tax-deferred until it is withdrawn for the child's education expenses. The primary purpose of an RESP is to provide a savings mechanism for future post-secondary education expenses. With the rising costs of education, having a dedicated savings plan like an RESP can make a significant difference. The RESP program was introduced by the Canadian government in 1972. Over the years, the government has enhanced the RESP program by introducing additional grants and making the rules more flexible. An RESP is a contract between an individual (the subscriber) and a person or organization (the promoter). The subscriber makes contributions to the RESP, which earns income over time. The government may also contribute to the RESP through grants. When the beneficiary enrolls in a qualifying educational program, they can receive educational assistance payments (EAPs) from the RESP. Any Canadian resident with a Social Insurance Number (SIN) can open an RESP for a beneficiary. This includes parents, grandparents, other relatives, and even friends. Organizations can also open an RESP for a beneficiary. A beneficiary of an RESP must be a Canadian resident with a SIN. There can be one or more beneficiaries, but the specific rules depend on the type of RESP (individual, family, or group). An individual RESP has one beneficiary. The beneficiary does not have to be related to the subscriber. This makes individual RESPs a good option for adults who want to save for their own education. A family RESP can have multiple beneficiaries, but they must be related to the subscriber by blood or adoption. This includes children, grandchildren, brothers, and sisters. Family RESPs offer more flexibility in allocating assets among the beneficiaries. Group RESPs pool the contributions of multiple subscribers. The amount the beneficiary receives depends on the total amount of money in the pool and the number of students of the same age who are in post-secondary education at the same time. There is no annual limit for contributions to an RESP, but there is a lifetime limit of $50,000 per beneficiary. Contributions are not tax-deductible, but the investment income earned in the RESP is tax-deferred. While there is no annual limit for RESP contributions, the Canada Education Savings Grant (CESG) has an annual limit. If the total contributions for a beneficiary exceed the lifetime limit of $50,000, the excess is subject to a penalty of 1% per month until it is withdrawn. Contributions can be made to an RESP until the end of the calendar year in which the beneficiary turns 31. However, to maximize the CESG, it's beneficial to start contributing early and consistently. The CESG is a grant from the Canadian government that matches 20% of the first $2,500 contributed to an RESP each year, up to a maximum of $500 per year and a lifetime limit of $7,200 per beneficiary. Lower-income families may be eligible for an additional CESG. The A-CESG provides additional matching funds for lower-income families. The matching rate can be 10% or 20% on the first $500 contributed each year, depending on the family's income. The CLB is a grant for children of lower-income families born in 2004 or later. The government provides an initial amount of $500 and an additional $100 each year the family is eligible, up to a maximum of $2,000. No contributions are required to receive the CLB. Some provinces offer additional education savings incentives. For example, the Quebec Education Savings Incentive matches up to 10% of contributions made to an RESP, up to a maximum of $250 per year. The British Columbia Training and Education Savings Grant provides a one-time grant of $1,200 to eligible RESPs. Educational Assistance Payments are the amounts paid to the beneficiary (the student) from the RESP to finance their post-secondary education. EAPs consist of investment earnings and government grants in the RESP. The beneficiary must provide proof of enrollment in a qualifying educational program to receive EAPs. The Return of Contributions is the amount that can be withdrawn tax-free by the subscriber at any time. This amount represents the original contributions made to the RESP. However, withdrawing contributions may require returning some or all of the government grants, depending on the circumstances. Accumulated Income Payments represent the investment earnings in the RESP that are not paid out as EAPs. AIPs can be withdrawn by the subscriber under certain conditions, but they are subject to tax and an additional 20% penalty. EAPs are taxable to the beneficiary, but they are often tax-free or taxed at a very low rate because students typically have little or no other income. ROCs are not taxable because the contributions were made with after-tax dollars. AIPs are taxable to the subscriber and subject to an additional 20% penalty. The RESP plays a crucial role in education funding. It provides a dedicated savings vehicle for education expenses, and its tax advantages and government grants can significantly enhance the growth of the savings. The RESP can be used in conjunction with other savings vehicles, such as the Tax-Free Savings Account (TFSA) and the Registered Retirement Savings Plan (RRSP). While these accounts do not offer the same education-specific benefits as the RESP, they can provide additional savings and tax advantages. The RESP can reduce the need for student loans, thereby reducing the financial burden on students after graduation. However, RESP savings may affect the student's eligibility for need-based financial aid. If the beneficiary does not go to post-secondary education, the subscriber has several options. They can change the beneficiary, transfer the RESP to another type of registered plan, or close the RESP. However, the government grants may have to be returned, and the investment earnings may be subject to tax and a penalty. The subscriber should carefully choose the RESP provider. Some providers charge high fees, have restrictive rules, or offer poor investment options. It's important to read the contract carefully and understand all the terms and conditions. Like any investment, the RESP carries risks. The value of the investments can go up or down, depending on market conditions. The subscriber should consider their risk tolerance and investment objectives when choosing the investments for the RESP. The Registered Education Savings Plan is a tax-advantaged account designed to help Canadians save for post-secondary education. It allows for tax-deferred growth of contributions, which can be supplemented by government grants. Withdrawals from an RESP come in the form of Educational Assistance Payments, Return of Contributions, and Accumulated Income Payments, each with its own tax implications. While the RESP plays a crucial role in education funding, it can also be used in conjunction with other savings vehicles like the TFSA and RRSP. However, it's important to be aware of the potential risks and challenges associated with an RESP, such as what happens if the beneficiary doesn't go to post-secondary education, RESP provider risks, and investment risks. Given the complexities of RESP rules and the importance of education planning, it may be beneficial to seek advice from a financial advisor. What Is a Registered Education Savings Plan (RESP)?

Understanding the RESP

How Does an RESP Work?

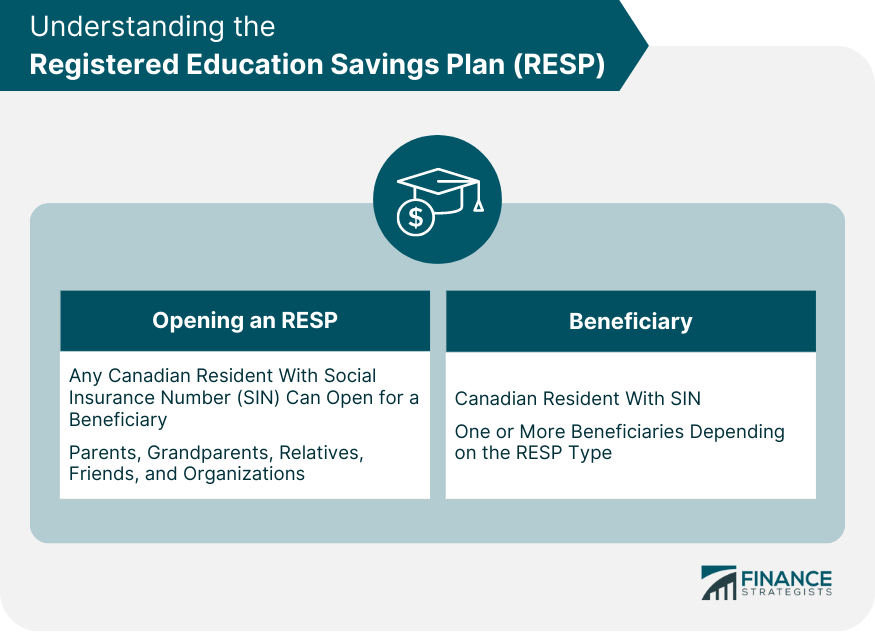

Who Can Open an RESP?

Who Can Be a Beneficiary?

Types of RESPs

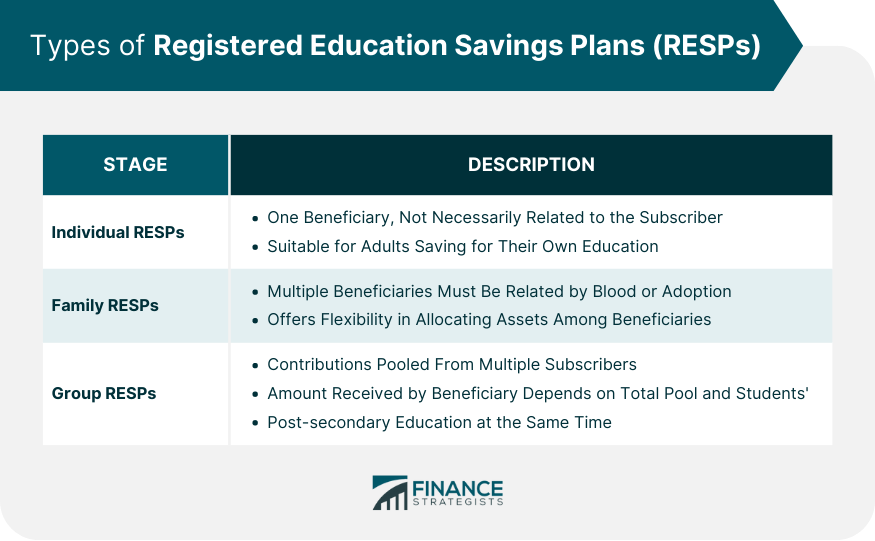

Individual RESPs

Family RESPs

Group RESPs

Contributions to RESP

How Much Can Be Contributed?

Contribution Limits

Over-Contribution Penalties

Timing of Contributions

Government Grants

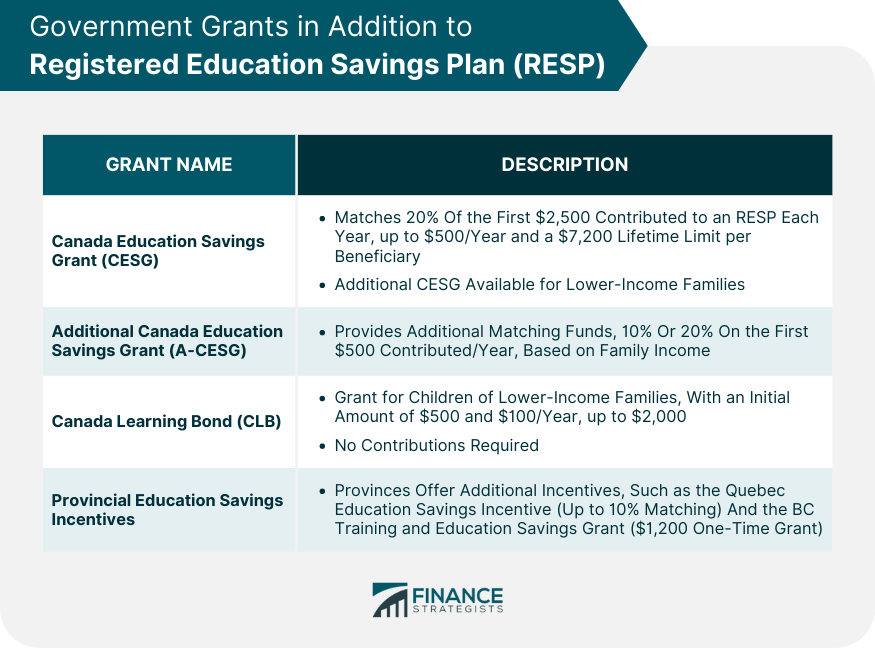

Canada Education Savings Grant (CESG)

Additional Canada Education Savings Grant (A-CESG)

Canada Learning Bond (CLB)

Provincial Education Savings Incentives

Withdrawals From RESP

Educational Assistance Payments (EAPs)

Return of Contributions (ROC)

Accumulated Income Payments (AIPs)

Tax Implications of Withdrawals

RESP and Financial Planning

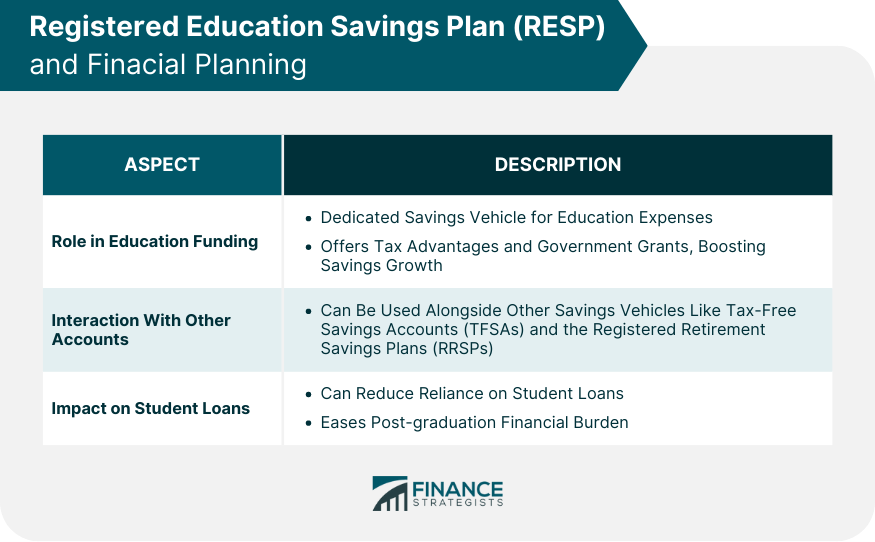

Role of RESP in Education Funding

RESP and Other Savings Vehicles

RESP and Student Loans

Potential Risks and Challenges

What Happens if the Beneficiary Doesn't Go to Post-Secondary Education?

RESP Provider Risks

Investment Risks

Final Thoughts

Registered Education Savings Plan (RESP) FAQs

A Registered Education Savings Plan (RESP) is a tax-sheltered investment account in Canada designed to help parents, grandparents, and other adults save for a child's post-secondary education. The government may contribute to the RESP through grants, and the investment income earned in the plan is tax-deferred until it is withdrawn for the child's education expenses.

Any Canadian resident with a Social Insurance Number (SIN) can open an RESP and make contributions for a beneficiary. This includes parents, grandparents, other relatives, and even friends. Organizations can also open an RESP for a beneficiary.

There is no annual limit for contributions to an RESP, but there is a lifetime limit of $50,000 per beneficiary. The Canada Education Savings Grant (CESG) matches 20% of the first $2,500 contributed each year, up to a maximum of $500 per year and a lifetime limit of $7,200 per beneficiary.

If the beneficiary does not go to post-secondary education, the subscriber has several options. They can change the beneficiary, transfer the RESP to another type of registered plan, or close the RESP. However, the government grants may have to be returned, and the investment earnings may be subject to tax and a penalty.

Educational Assistance Payments (EAPs), which consist of the investment earnings and government grants in the RESP, are taxable to the beneficiary when withdrawn. However, students typically have little or no other income, so EAPs are often tax-free or taxed at a very low rate. The original contributions can be withdrawn tax-free by the subscriber at any time.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.