A growth mutual fund is a type of investment vehicle that focuses primarily on investments in growth stocks. Growth stocks are stocks issued by companies that have the potential to grow faster than the overall market and are expected to achieve above-average revenue or earnings growth. A growth mutual fund will typically hold a diversified portfolio of growth stocks, with the aim of providing investors with capital appreciation over the long term. These mutual funds may also invest in other types of investments, such as cash, bonds, or other fixed-income securities, but most of the holdings are focused on growth stocks. Growth mutual funds may be sector-specific, meaning that the stocks they hold all belong to the same sector, such as technology or healthcare. They may also be classified based on the size of the companies they focus on, such as large-cap, mid-cap, or small-cap growth mutual funds. Large-cap growth mutual funds typically invest in large, well-established companies, while mid-cap and small-cap growth mutual funds may focus on smaller, less-established companies. Growth mutual funds are designed to provide investors with the potential for higher returns over the long term, but they also come with a higher risk of volatility and higher fees than other types of mutual funds. Before investing in a growth mutual fund, it is important to consider investment goals, time horizons, and risk tolerance. Before investing in growth mutual funds, it is important to carefully consider several factors, including: Consider your investment goals and how long you plan to invest in the fund. Growth mutual funds may be suitable for long-term investors willing to tolerate higher levels of risk for higher returns over time. Evaluate your tolerance for risk and how much volatility you are willing to accept in your investment portfolio. Growth mutual funds can be more volatile than other types of mutual funds, and investors should be prepared for potential fluctuations in the market. Review the fees and expenses associated with the growth mutual fund you are considering. These can include management fees, expense ratios, and sales charges, affecting your returns over time. Research the historical performance of the growth mutual fund you are considering and compare it to other funds in its category. Keep in mind that past performance is not a guarantee of future results. Evaluate the underlying holdings of the growth mutual fund and its focus. Some growth mutual funds may be sector-specific, concentrating on a specific industry or sector, while others may be more diversified. Consider how the fund's holdings align with your investment goals and risk tolerance. Review the fund manager's experience and track record and evaluate the investment strategy of the growth mutual fund. Consider whether the fund manager's strategy aligns with your investment goals and risk tolerance. Investing in growth mutual funds is a relatively straightforward process, and investors can typically follow these steps: Research and compare different growth mutual funds based on factors such as historical performance, fees and expenses, underlying holdings, and investment strategy. Consider consulting with a financial advisor to help you find suitable funds based on your investment goals and risk tolerance. In order to invest in mutual funds, you will need to open a brokerage account with a reputable online broker or financial institution. Many brokers offer a wide selection of mutual funds and can help you manage your investments. Once you have identified suitable growth mutual funds and opened a brokerage account, you can place an order to buy shares of the fund. You will typically need to provide the name or ticker symbol of the mutual fund you want to purchase and the amount you want to invest. After investing in growth mutual funds, monitoring your investments regularly is important. Review the fund's performance and ensure it aligns with your investment goals and risk tolerance. Consider rebalancing your portfolio periodically to ensure it remains aligned with your investment strategy. Growth mutual funds can offer several advantages for investors, including: Growth mutual funds concentrate on companies with above-average growth potential, which can offer the potential for high returns over the long term. Growth stocks may grow faster than the stock market as a whole, providing investors with average annual returns that can outstrip other types of mutual funds. Investing in growth mutual funds can provide diversification benefits for investors, as these funds typically hold stocks across various sectors. This can potentially reduce risk compared to investing in individual stocks. Growth mutual funds are professionally managed by experienced fund managers who decide on the stocks and investments to include in the portfolio. This can offer a level of comfort for investors who are not interested in managing their own portfolios or do not have the knowledge or expertise to do so. Growth stocks and growth mutual funds may offer the potential for outperformance in an expanding economy. Growth stocks tend to fare best in a growing economy, with steady job growth and high consumer confidence. As consumer spending increases, growth companies may benefit as more money pours into the economy. While growth mutual funds can offer several advantages for investors, they also come with certain disadvantages, including: Growth mutual funds are typically riskier than other types of mutual funds, as they concentrate on companies with above-average growth potential that are often in their early stages of development. These companies may be more volatile and have a higher risk of failure. During bear markets, growth stocks tend to perform worse than value stocks because weak economic activity can hinder sales growth, which is the primary driver of growth stocks' price appreciation. In contrast, mature companies tend to fare better during economic downturns due to their established position within their industry, loyal customer base, brand recognition, and stronger financial position, including larger cash reserves. Mature companies also have an advantage in raising capital during tough economic times because of their proven credit and financial stability, making it easier to obtain loans. In contrast, growth companies may face more difficulty securing financing because of their less established financials. To overcome this challenge, growth companies may need to rely on funding from venture capital firms or angel investors, which can be crucial to their survival during economic downturns. Growth mutual funds can be more sensitive to market fluctuations due to the types of companies they invest in. These funds often hold stocks of companies in their early stages of development and are focused on innovation and growth rather than generating profits. As a result, these companies may be more sensitive to changes in the economy, industry trends, or shifts in consumer preferences. This can lead to higher levels of market volatility and potentially result in significant losses during market downturns. Growth mutual funds can also come with higher fees and expenses compared to other types of mutual funds. These fees can include management fees, expense ratios, and sales charges, which can eat into an investor's returns over time. Because growth mutual funds require more research and analysis to identify potential growth stocks, they can be more expensive to manage than other types of mutual funds. In addition, growth mutual funds may also have higher trading costs due to their higher turnover rate. This can occur because fund managers may need to frequently buy and sell stocks to keep the portfolio aligned with the fund's investment strategy. These costs can further reduce an investor's returns over time. Growth mutual funds and value mutual funds are two distinct investment styles that offer unique advantages and disadvantages for investors. Below are the key differences between these two types of mutual funds. Growth mutual funds concentrate on investing in companies' stocks expected to grow faster than the overall market. These companies typically reinvest their earnings back into the business rather than paying dividends to shareholders. Growth mutual funds often hold stocks of companies in their early stages of development and are focused on innovation and growth rather than generating profits. In contrast, value mutual funds focus on investing in stocks of companies that are considered undervalued by the market. These companies may have a strong financial position, pay higher dividends, or have other characteristics that make them attractive investments. Value mutual funds typically seek to identify stocks trading below their intrinsic value and having the potential for long-term growth. Growth mutual funds are generally considered more volatile and carry higher levels of risk than value mutual funds. This is because growth stocks are often more sensitive to changes in the economy, industry trends, or shifts in consumer preferences. However, growth mutual funds also have the potential for higher returns over the long term, as these companies have the potential for faster earnings growth. Value mutual funds are typically less volatile than growth mutual funds and may offer more stability during economic downturns. However, they may also offer lower returns over the long term than growth mutual funds. Growth mutual funds can be more expensive to manage than value mutual funds due to the need for more research and analysis to identify potential growth stocks. As a result, growth mutual funds may have higher fees and expenses compared to value mutual funds. Both growth and value mutual funds can offer diversification benefits for investors, as they typically hold stocks of multiple companies in different industries. However, growth mutual funds may be more concentrated in a specific industry or sector, which can increase their risk if that industry experiences a downturn. A growth mutual fund is an investment vehicle that invests in stocks with above-average growth potential. While it offers the potential for high returns, it also comes with certain disadvantages, such as higher risk, potential for market volatility, and higher fees. Before investing in growth mutual funds, investors must consider investment goals, risk tolerance, and fund fees and expenses. Despite the challenges, growth mutual funds offer several advantages, such as the potential for high returns, diversification benefits, and professional management. Furthermore, growth stocks tend to perform better in expanding economies, making growth mutual funds a compelling option for long-term investors. When investing in growth mutual funds, investors should identify suitable funds, open a brokerage account, and place an order to buy or sell mutual fund shares. After investing, monitoring the investment regularly and reviewing the fund's performance to ensure it aligns with the investment goals and risk tolerance is crucial. Finally, investors should understand the key differences between growth mutual funds and value mutual funds. While growth mutual funds focus on companies with above-average growth potential, value mutual funds focus on undervalued companies with the potential for long-term growth. Investors should consider their investment goals, risk tolerance, and fees before deciding between these two types of mutual funds. Growth mutual funds offer a promising investment opportunity for those willing to accept the higher risk and volatility associated with them. If you need assistance managing your investments, consulting with a professional wealth management service provider is highly recommended. They can help you navigate the investment landscape and provide guidance on selecting suitable mutual funds aligned with your investment goals and risk tolerance.What Is a Growth Mutual Fund?

Factors to Consider Before Investing in Growth Mutual Funds

Investment Goals and Time Horizon

Risk Tolerance

Fund Fees and Expenses

Historical Performance

Underlying Holdings and Fund Focus

Fund Manager and Investment Strategy

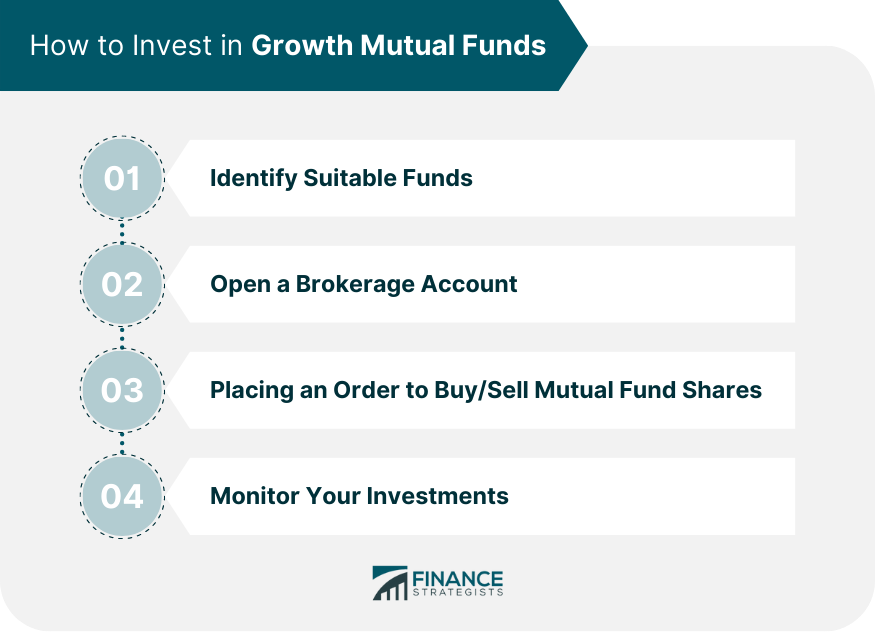

How to Invest in Growth Mutual Funds

Step 1: Identify Suitable Funds

Step 2: Open a Brokerage Account

Step 3: Placing an Order to Buy/Sell Mutual Fund Shares

Step 4: Monitor Your Investments

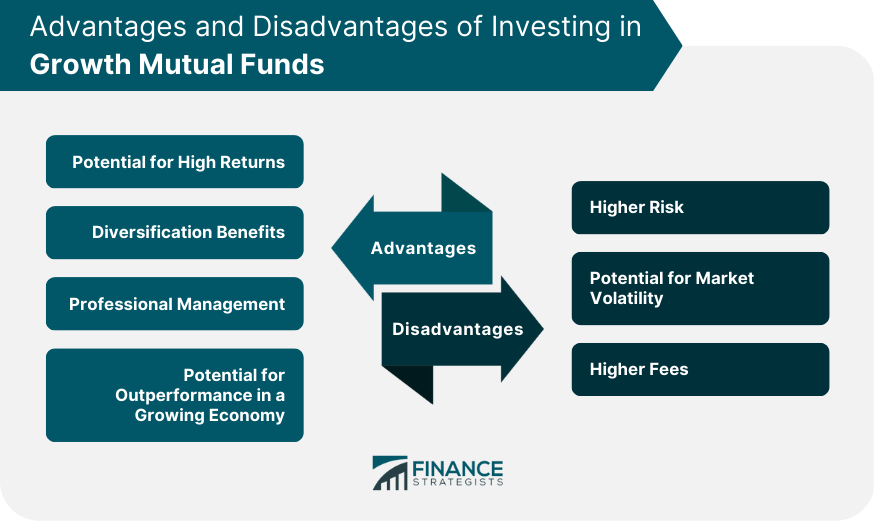

Advantages of Investing in Growth Mutual Funds

Potential for High Returns

Diversification Benefits

Professional Management

Potential for Outperformance in a Growing Economy

Disadvantages of Investing in Growth Mutual Funds

Higher Risk

Potential for Market Volatility

Higher Fees

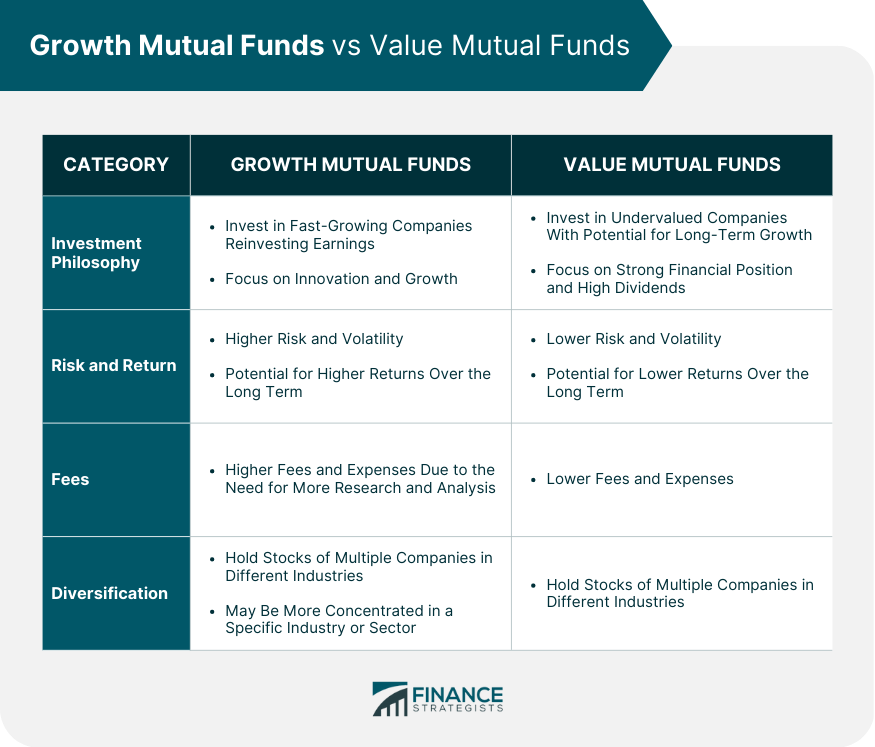

Growth Mutual Funds vs Value Mutual Funds

Investment Philosophy

Risk and Return

Fees

Diversification

Final Thoughts

Growth Mutual Fund FAQs

A growth mutual fund is an investment vehicle that focuses primarily on investments in growth stocks issued by companies that have the potential to grow faster than the overall market.

Growth mutual funds offer the potential for high returns, diversification benefits, professional management, and the potential for outperformance in a growing economy.

Growth mutual funds come with a higher risk of volatility and higher fees than other types of mutual funds, as well as the potential for market volatility and higher fees.

Investors should consider their investment goals, time horizon, risk tolerance, fund fees and expenses, historical performance, underlying holdings and fund focus, and fund manager and investment strategy before investing in growth mutual funds.

A growth mutual fund focuses on investing in companies with above-average growth potential, while a value mutual fund invests in companies considered undervalued by the market. Growth mutual funds are generally considered more volatile and carry higher levels of risk than value mutual funds, but they also have the potential for higher returns over the long term. Value mutual funds are typically less volatile than growth mutual funds. They may offer more stability during economic downturns, but they may also offer lower returns over the long term than growth mutual funds.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.