Asset management in finance involves overseeing the assets within an investor's portfolio, typically handled by a financial services firm. The primary aim is to enhance wealth over time through the strategic acquisition, maintenance, and trading of investments with growth potential. At its core, this practice revolves around understanding the financial objectives of clients and then crafting strategies to fulfill those objectives through effective portfolio management. This entails increasing the value of the portfolio while being vigilant about minimizing risks. On the corporate front, asset management offers businesses a systematic approach to monitor all their assets, including equipment, vehicles, and investments. Maintaining a comprehensive overview of each asset facilitates smoother operations, especially during asset disposal or sale. Asset management services are provided by large corporate entities, independent financial advisors, and portfolio managers that specialize in working with high network individuals, corporations, governments, or other institutions with substantial investment portfolios. The main services that asset management firms offer include: Portfolio management entails selecting the appropriate mix of investments to be held in a portfolio and determining the allocation of those investments. It involves ongoing oversight to ensure that the chosen investments align with the investor's long-term financial goals and risk tolerance. Estate planning involves making decisions about how an individual's assets will be maintained, managed, and distributed after their passing or in the event of their incapacity. This may include drafting a will, establishing trusts, making charitable contributions to minimize estate taxes, appointing an executor and beneficiaries, and making arrangements for funeral services. Mortgage planning is a meticulous process of evaluating various mortgage options available to individuals and selecting the most suitable strategies. The objective is to develop and implement a personalized mortgage plan, regularly reviewing it through an annual mortgage and housing assessment to provide updates on interest rates and the housing market. Asset protection encompasses strategies aimed at safeguarding the wealth of individuals and businesses. It involves implementing techniques to shield assets from creditor claims within the bounds of debtor-creditor laws. For businesses, this may entail utilizing separate legal structures such as partnerships, corporations, or trusts, tailored to the nature of the assets owned and the potential creditors. Tax management involves adherence to income tax regulations, encompassing matters such as filing, penalties, tax appeals, and settlements. It ensures that individuals and businesses comply with tax laws promptly and accurately, minimizing tax liabilities. Asset management firms also offer other financial services that are not directly related to managing assets. These services include financial planning, retirement planning, insurance planning, and risk management. Asset management companies serve the investment needs of high-net-worth individuals and institutions. They often handle credit cards, check-writing privileges, debit cards, brokerage services, and margin loans. Deposited money of individuals is typically placed into money market funds that offer greater returns than a regular savings account. Account holders can either choose between Federal Deposit Insurance Company-backed (FDIC) funds or non-FDIC funds. Financial institutions can also meet the banking and investing needs of account holders. The asset management process usually consists of the following steps: This is the first step in managing assets, where the manager needs to identify what assets are available and what needs to be done with them. After identifying the assets, the manager will then evaluate each asset to determine its value and conditions. This is done by analyzing financial statements and other relevant information. The next step is classifying the assets according to their risk level, liquidity, and return potential. This will help the manager formulate the best investment strategy for each asset. After classifying the assets, the manager will then select the appropriate asset to be included in the portfolio. This is done by considering the objectives, risk tolerance, and time horizon of the investor. Once the assets are selected, the manager will then monitor and review the performance of the assets on a regular basis. Asset managers also analyze asset lifecycle and efficiency to determine maintenance costs. Depreciation rates of assets and their overall impact are also evaluated, and the potential risk associated with each asset is quantified. This is done to ensure that the assets perform according to expectations and necessary adjustments are made when needed. This is the final step in managing assets, where the manager will anticipate to the best of their ability the future value of the assets. This is done by analyzing trends in the market, economic indicators, and other relevant information. Asset managers also predict the lifespan and salvage value of assets, and establish a disposal strategy when the assets reach the end of their useful life. Because there are different types of assets and different investment objectives, there are various ways of managing assets. Financial asset management involves investing money in financial instruments like stocks, bonds, and mutual funds. It demands expertise in finance and accounting to make informed investment choices. Fixed asset management focuses on overseeing and maintaining physical assets such as land, buildings, and machinery. Establishing robust systems for tracking these assets is crucial to prevent losses from theft, damage, or obsolescence. Information technology asset management entails monitoring and controlling IT assets like software, hardware, and electronic data. It plays a vital role in safeguarding against data loss or theft and ensuring the continuous operation of critical systems. Infrastructure asset management involves overseeing the physical assets comprising a country's infrastructure, such as roads, bridges, and airports. It aims to uphold the safety and efficiency of national infrastructure systems. Real estate asset management focuses on optimizing the value of real estate holdings through activities like property development, renovations, and leasing. Effective decision-making in this field requires a deep understanding of the real estate market. Digital asset management involves tracking and managing digital assets such as images, videos, and documents. It is essential for preserving the integrity of digital assets and preventing loss or theft. Enterprise asset management is concerned with effectively managing both physical and financial assets to maximize their value and benefits to the business. It encompasses proactive and reactive measures to ensure assets are properly maintained and utilized for business success. Here are some of the best asset management companies (AMCs) in the United States that are handling the assets of high network individuals, governments, corporations, or other institutions with substantial investment portfolios: BlackRock is one of the largest global financial institutions and the world's largest asset manager. The company has influenced the growth of exchange-traded funds (ETFs) through its iShares products. BlackRock recorded an asset under management (AUM) of $9.10 trillion as of October 13, 2023. The company offers a wide variety of investing, risk management, and consulting services for intermediaries, institutions, foundations, and people worldwide. It is a major publicly traded company with a market capitalization of about $114.99 billion as of January 31, 2024. BlackRock offers investment and technology services to both retail and institutional clients globally. Vanguard is the second largest AMC in the world, with an AUM of $8.1 trillion as of 2022. They offer low-cost mutual funds, brokerage and trust services, exchange-traded funds, asset and wealth management, financial planning, variable and fixed annuities, and educational account services. The shareholders own the different funds of Vanguard, and the company is owned by its funds. Therefore, the true owners of Vanguard are its shareholders. Fidelity Investments is a privately held investment company with assets under management worth $4.24 trillion. Fidelity has 35.6 million active brokerage accounts and 200 investor centers across the U.S. It has offices in Germany, Canada, Belgium, France, Italy, Ireland, United Kingdom, Spain, and Switzerland and provides services to about 40 million individual investors. For businesses, asset management allows organizations to maximize the value of their assets throughout the various stages of the asset lifecycle. The benefits do not just consist in reducing the risk, streamlining the process, and improving the bottom line, but also include the following: Asset management allows firms to account for all of their existing assets, whether fixed or liquid. They will know where assets are placed, how they are being utilized, and whether there have been changes made to them. This leads to higher returns because the recovery and tracking of assets can be made more efficiently. Asset management ensures that financial statements record the assets properly since they are checked regularly. This also provides the company with an accurate assessment of the value of its assets. Asset management identifies and manages risks that could arise from using and owning certain assets. This means that a business will always be prepared to manage risks that come its way. There are cases where assets that are lost, damaged, or stolen are mistakenly recorded on the books. Strategic asset management allows business owners to recognize assets that have been lost and will be able to eliminate them in the books for a more accurate handling of the accounting. As should always be the case for anyone getting involved in your finances, any individual or entity offering asset management services should be researched extensively to make sure they are trustworthy professionals who are excellent at their jobs. These are some common pitfalls that can be encountered while working with asset managers: Asset managers may not understand some important expenses of a company that keeps it afloat. These expenses should not be overlooked or disregarded, as these can impact the company in the future. Asset managers may have difficulty communicating with clients. They should ensure that they keep their clients updated on the status of their assets and the changes made to them. In cases where several individuals are working on a problem, such as future spending patterns, a lack of input from one team member could jeopardize the end goal or the solution. Trying to manage too many assets can be detrimental to a company. This can lead to a lack of focus and attention on the most important assets. As a result, this could lead to the mismanagement of assets and the potential loss of value. Business owners must make sure that there are no hidden charges when it comes to asset managers. Incentives should also be aligned with the goals of the business. Cost for asset managers and asset management strategies differ. For instance, the cost of an active investing model is greater than the passive, index-based investing model. This is because active investing requires more research, analysis, and time to generate higher returns. Whereas, passive investing is a more hands-off approach that tracks a market index. To understand better, here are the breakdown costs of the most common asset management. Active investment management fees differ depending on the asset manager and the number of assets in an investment portfolio. Usually, asset managers charge an annual fee of 1%, which means that a $100,000 investment portfolio would cost an advisory fee of $1,000 annually. The passive investment model used by asset managers costs less on an annual basis. Thus, this means that they put client money index funds that reflect major benchmarks, the same as the S&P 500. Fees for common passive management on an annual basis range between 0.20% and 0.50% annually, that equals to $200 to $500 each year for a $100,000 portfolio. Asset managers in robo-advisor investment firms use specific algorithms to manage portfolios instead of humans. Robo-advisor management fees typically range between 0.25% and 0.50% of managed assets annually. This is calculated to be $250 to $500 per year for a $100,000 portfolio. Brokers who make trades on behalf of a financial client may charge a per-trade transaction fee, which can be as low as zero and as high as $50 per trade, which depends on the broker and the kind of service provided. There are asset managers that may also charge annual account fees, which could range from $25 to $100 on an annual basis. Asset managers may also charge a closing fee ranging between $25 and $150 per account when a client closes an account. Asset management is the process of handling and supervising assets throughout their life cycles. This includes identifying, acquiring, allocating, maintaining, and disposing of assets to maximize their value to the business. Asset management services can be provided by asset managers, who are usually part of financial institutions or specialized firms. The cost of asset management varies depending on the type of services provided. Overall, asset management is a beneficial process that can lead to higher returns and more efficient utilization of assets.What Is Asset Management?

Asset Management Services

Portfolio Management

Estate Planning

Mortgage Planning

Asset Protection

Tax Management

Other Financial Services

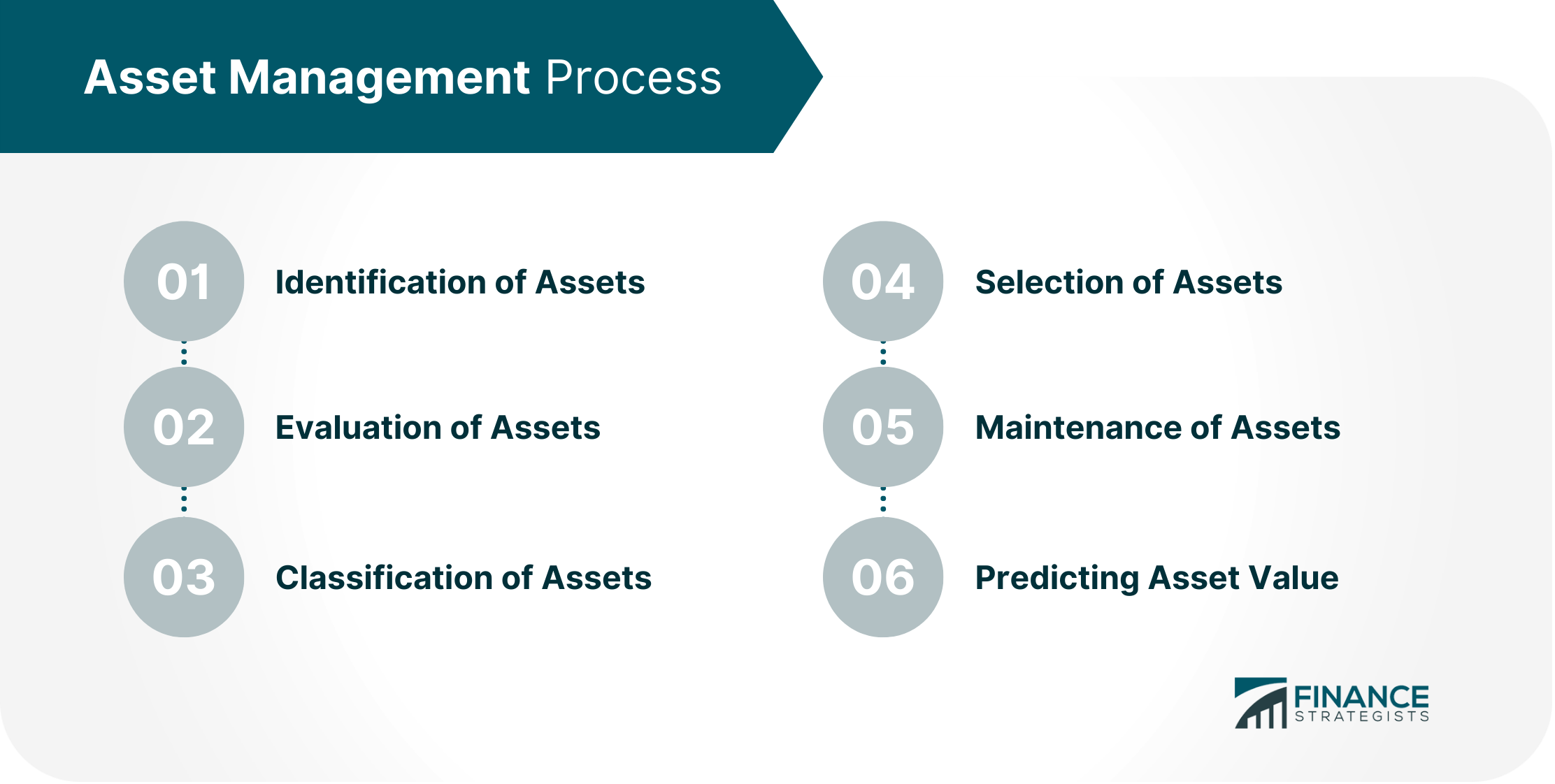

Asset Management Process

Step 1: Identification of Assets

Step 2: Evaluation of Assets

Step 3: Classification of Assets

Step 4: Selection of Assets

Step 5: Maintenance of Assets

Step 6: Predicting Asset Value

Types of Asset Management

Financial Asset Management

Fixed Asset Management

Information Technology Asset Management

Infrastructure Asset Management

Real Estate Asset Management

Digital Asset Management

Enterprise Asset Management

Examples of Asset Management

BlackRock Inc.

The Vanguard Group

Fidelity Investments

Benefits of Asset Management

Tracking of All Assets

Accurate Amortization Rates

Identification and Management of Risks

Elimination of Ghost Assets

Potential Limitations of Asset Management

Lack of Understanding

Poor Communication

Too Much Management

Fees and Incentives

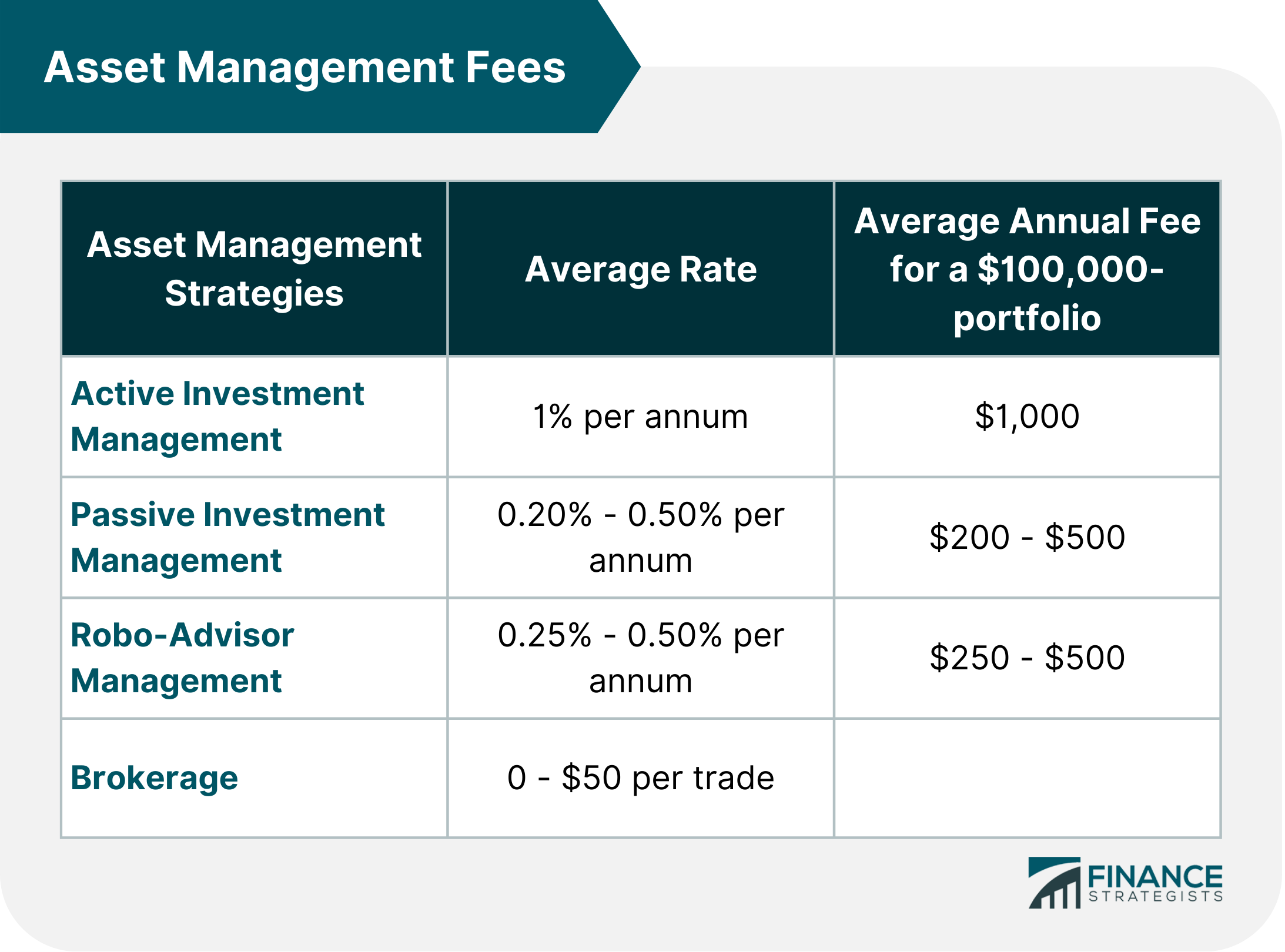

How Much Does Asset Management Cost?

Active Investment Management Fees

Passive Management Fees

Robo-Advisor Management Fees

Brokerage Fees

Additional Fees

The Bottom Line

Asset Management FAQs

Asset management is a prestigious, lucrative, and selective career. However, it requires a specific set of skills. Professionals who are more quantitatively inclined but not natural-born salespeople and prioritize a healthy work-life balance can probably excel as asset managers.

Asset management companies (AMC) invest pooled funds of clients and put the capital to work through various investments, including bonds, stocks, real estate, and master limited partnerships.

An asset manager focuses on specific asset investments, such as exchange-traded funds, real estate, fixed-income securities, or stock. The goal of asset managers is to improve returns from investments of clients and restructure them when needed to gain more profit for their clients. An investment manager focuses on estate planning, tax planning, and retirement planning. Its goal is to create a steady flow of profit by adopting various investment strategies for its clients.

Asset management is important because it helps businesses get the most value out of their assets. Asset management can also help to improve returns and save money by avoiding unnecessary costs associated with assets.

Types of asset managers include financial asset managers, fixed asset managers, infrastructure asset managers, real estate asset managers, IT asset managers, digital asset managers, and enterprise asset managers.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.