Stamp investments refer to the practice of purchasing and holding postage stamps and other philatelic materials with the intention of selling them at a profit in the future. As an alternative investment option, stamp investing has attracted collectors and investors alike due to its potential for financial returns, historical significance, and the sheer enjoyment of collecting. Stamp collecting, or philately, dates back to the 1840s when the first postage stamps were issued. The hobby grew rapidly in the 19th century, and by the early 20th century, stamps had already become a popular investment vehicle. Throughout the years, stamp investments have continued to evolve, and today they represent a diverse and sophisticated market. As financial markets become increasingly volatile, many investors are turning to alternative investments such as stamps to diversify their portfolios and hedge against risk. Stamps have proven to be a relatively stable investment, often maintaining or increasing in value over time, even during periods of economic turmoil. Commemorative stamps are issued to honor a specific person, event, or theme. These stamps are typically produced in limited quantities, which can make them highly sought after by collectors and investors. Definitive stamps are issued for everyday use and are typically printed in large quantities. While not as rare as commemorative stamps, certain definitive stamps can still have significant investment potential, especially if they feature errors or are part of a popular series. Revenue stamps are used to collect taxes or fees on certain goods and services. Due to their limited use and specialized nature, revenue stamps can be a niche market with high potential for profit among knowledgeable investors. Error stamps are those that feature printing or production mistakes. These errors can range from minor color shifts to major design flaws, and can significantly increase the value of a stamp. First Day Covers are envelopes that bear stamps canceled on the first day of issue. Collectors and investors often seek out FDCs for their historical significance and limited availability. Philatelic rarities are stamps that are exceptionally rare or valuable due to their age, limited production, or unique characteristics. These stamps often command high prices and can be a key component of a successful stamp investment portfolio. Rarity is a key factor in determining a stamp's value. The fewer examples of a particular stamp that exist, the more valuable and desirable it is to collectors and investors. Centering refers to the alignment of a stamp's design within its borders. Stamps with perfect or near-perfect centering are generally more valuable than those with poor centering. The gum is the adhesive on the back of a stamp. Stamps with their original gum intact and in pristine condition are typically more valuable than those with disturbed or missing gum. Perforations are the small holes between stamps that allow them to be easily separated. Stamps with clean, even perforations are generally more valuable than those with damaged or irregular perforations. The color of a stamp can have a significant impact on its value. Stamps with vibrant, true colors are generally more desirable than those with faded or altered colors. Stamps with historical significance, such as those commemorating important events or featuring notable individuals, often command higher prices due to their connection to the past and their appeal to collectors. Market demand plays a crucial role in determining the value of a stamp. Stamps that are popular among collectors and investors will generally have higher values, while those with limited demand may struggle to appreciate in value. Having stamps expertized and certified by reputable organizations can help to verify their authenticity and condition, increasing their value and appeal to potential buyers. Investing in stamps from various countries can help to spread risk and capitalize on different market trends and opportunities. Collecting stamps based on different themes, such as animals, transportation, or famous people, can also help to diversify a portfolio and appeal to a wider range of collectors and investors. Determining an appropriate budget for stamp investments is essential to achieving a balanced and successful portfolio. Investors should carefully consider their financial goals and risk tolerance before making any purchases. Stamp investments can be approached from both long-term and short-term perspectives. Long-term investors typically focus on stamps with strong historical significance and potential for steady appreciation, while short-term investors may target opportunities in market fluctuations or specific events. Understanding and managing the various risks associated with stamp investments, such as market volatility, counterfeits, and changes in collector preferences, is critical to achieving long-term success. Stamp dealers are professionals who buy and sell stamps, often specializing in specific areas or themes. They can be valuable sources of expert advice and quality material for investment purposes. Auction houses provide a platform for buying and selling stamps, often featuring rare and valuable pieces. Attending stamp auctions can offer investors access to unique investment opportunities and a chance to gauge market trends. Online platforms, such as eBay and specialized philatelic websites, offer a wide variety of stamps for purchase. These platforms provide investors with easy access to a global market, but it is essential to verify the authenticity and condition of stamps before buying. Stamp shows and exhibitions bring together collectors, dealers, and investors to buy, sell, and exchange stamps. These events can be an excellent opportunity to network, learn about the market, and discover investment opportunities. Understanding market trends and timing the sale of stamps can be crucial to maximizing returns on investment. Investors should keep a close eye on market conditions and news that may impact stamp values. Identifying the right buyer, whether it be a collector, dealer, or another investor, can significantly impact the sale price of a stamp. Networking and building relationships within the philatelic community can be helpful in this regard. Leveraging auction houses and online platforms can help investors reach a wider audience and increase the chances of selling their stamps at the best possible price. Being well-informed about market prices and negotiating effectively can help investors maximize their returns when buying and selling stamps. Utilizing price guides, tracking auction results, and consulting with experts can provide valuable insights into current market conditions and trends. As with any investment, stamp values can be subject to market fluctuations. Investors should be prepared for the possibility of short-term losses and have a long-term perspective to weather potential market downturns. Counterfeit and forged stamps can pose significant risks to investors. Ensuring the authenticity of purchased stamps through expertization and certification can help mitigate these risks. Proper storage and preservation are essential to maintaining the value of stamps. Factors such as temperature, humidity, and exposure to light can impact the condition of stamps over time. Investing in proper storage solutions and regular maintenance is crucial for protecting stamp investments. The philatelic market is influenced by collector demographics and preferences, which can change over time. Keeping up-to-date with market trends and adapting investment strategies accordingly is essential for long-term success in stamp investing. Stamp investments offer a unique and potentially rewarding alternative investment option. By understanding the various factors that impact stamp values, building a diverse and well-researched portfolio, and staying informed about market trends, investors can position themselves for success. Although the philatelic market will continue to evolve, stamps' historical significance and enduring appeal suggest that they will remain an attractive investment option for collectors and investors alike. Ultimately, each investor's approach to stamp investing will depend on their individual goals, risk tolerance, and interests. By carefully considering these factors and staying informed about the market, investors can craft a stamp investment strategy that aligns with their unique objectives and preferences. Consult a wealth management professional or qualified financial advisor for further guidance on stamp investments.What Are Stamps Investments?

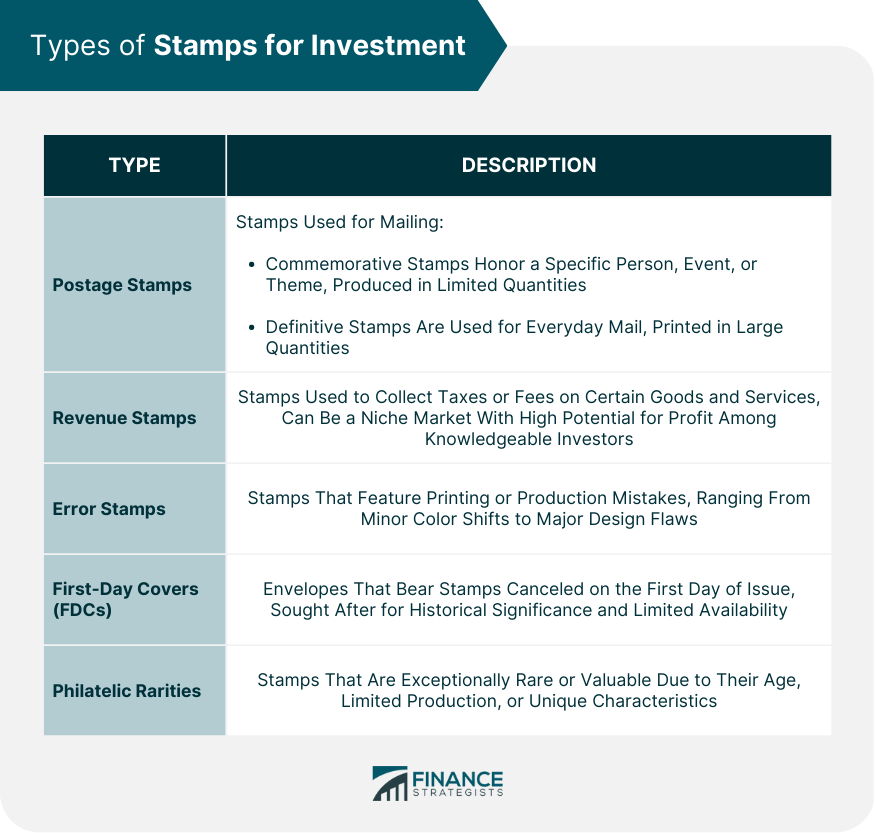

Types of Stamps for Investment

Postage Stamps

Commemorative Stamps

Definitive Stamps

Revenue Stamps

Error Stamps

First-Day Covers (FDCs)

Philatelic Rarities

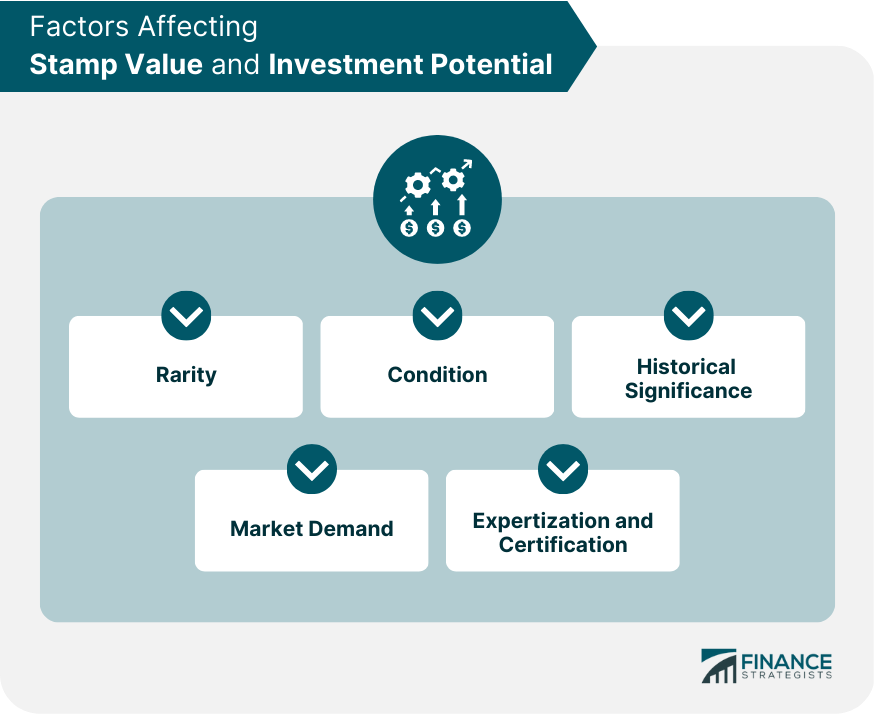

Factors Affecting Stamp Value and Investment Potential

Rarity

Condition

Centering

Gum

Perforations

Color

Historical Significance

Market Demand

Expertization and Certification

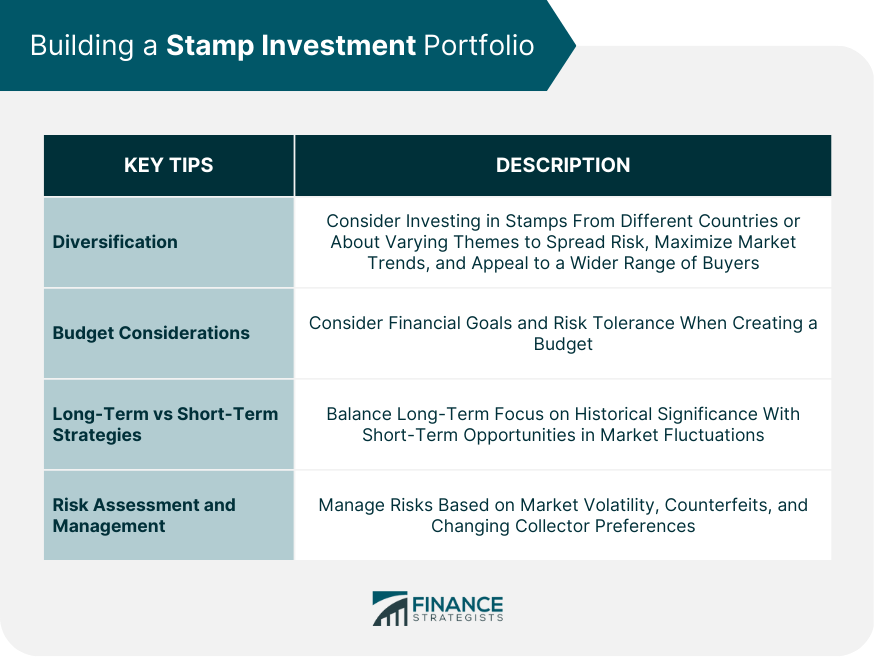

Building a Stamp Investment Portfolio

Diversification

Geographical Diversification

Thematic Diversification

Budget Considerations

Long-Term vs Short-Term Investment Strategies

Risk Assessment and Management

Buying and Selling Stamps for Investment

Purchasing Stamps

Stamp Dealers

Auction Houses

Online Platforms

Stamp Shows and Exhibitions

Selling Strategies

Timing the Market

Finding the Right Buyer

Utilizing Auction Houses and Online Platforms

Negotiating and Understanding Market Prices

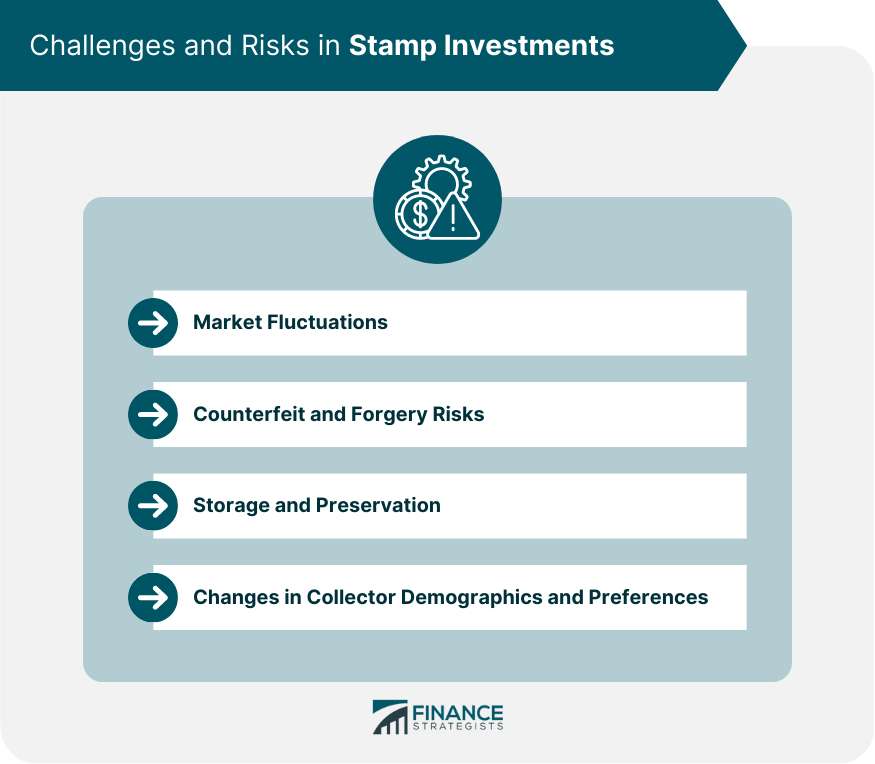

Challenges and Risks in Stamp Investments

Market Fluctuations

Counterfeit and Forgery Risks

Storage and Preservation

Changes in Collector Demographics and Preferences

Final Thoughts

Stamps Investments FAQs

When choosing stamps for investment, consider factors such as rarity, condition, historical significance, market demand, and expertization or certification. These factors can significantly impact the value and potential return on investment for stamps.

To build a diversified portfolio in stamps investment, consider geographical diversification (investing in stamps from various countries) and thematic diversification (collecting stamps based on different themes, such as animals, transportation, or famous people).

The main risks and challenges in stamps investment include market fluctuations, counterfeit and forgery risks, storage and preservation issues, and changes in collector demographics and preferences.

You can buy and sell stamps through various sources, such as stamp dealers, auction houses, online platforms, and stamp shows or exhibitions. Each source has its advantages and disadvantages, so it is essential to carefully research and verify the authenticity and condition of stamps before making a purchase or sale.

Some examples of successful stamps investment cases include the British Guiana 1c Magenta, the Inverted Jenny, the Penny Black, the Mauritius "Post Office" stamps, and the U.S. Zeppelin stamps. These cases demonstrate the potential for significant returns in the world of stamp investing.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.