A 501(c)(3) application form is a detailed and comprehensive document that non-profit organizations must submit to the Internal Revenue Service (IRS) to apply for tax-exempt status. The form requires organizations to provide information about their structure, activities, and finances, and is essential for organizations that rely on donations and other forms of support to fund their operations. There are two different application forms that an organization can use to apply for 501(c)(3) status: Form 1023 and Form 1023-EZ. Form 1023 is the standard application form for 501(c)(3) status. This form is longer and more detailed than Form 1023-EZ, and it requires a significant amount of information about the organization's activities, structure, and finances. The sections of Form 1023 are as follows: This section asks for basic information about the organization, including its name, address, and employer identification number. This section asks for information about the organization's structure, including its legal form (such as a corporation or trust) and the names and addresses of its officers, directors, and trustees. This section requires the organization to provide certain provisions in its organizing documents (such as its articles of incorporation or bylaws) to qualify for 501(c)(3) status. This section requires the organization to provide a detailed description of its activities, including how it will achieve its charitable purpose and how it will benefit the public. This section requires the organization to provide information about its compensation arrangements for its officers, board of directors, and trustees, as well as information about any financial arrangements that may pose a conflict of interest. This section asks for any additional information that the organization believes is relevant to its application. This section requires the organization to sign the application form and declare under penalty of perjury that the information provided is true and correct to the best of its knowledge. Form 1023-EZ is a simplified version of the application form for 501(c)(3) status. This form is shorter and less detailed than Form 1023, and it is designed for smaller organizations with less complex structures and activities. The sections of Form 1023-EZ are as follows: This section provides an overview of the form and explains the eligibility requirements. This section asks the organization to confirm that it meets the eligibility requirements for Form 1023-EZ. This section asks for basic information about the organization, including its name, address, and employer identification number, as well as information about its charitable purpose and activities. To be eligible for 501(c)(3) status, an organization must meet certain requirements. These requirements include: The organization must be organized and operated exclusively for charitable, educational, religious, scientific, literary, or other specified purposes that fall under the definition of a charitable organization. This means that the organization's activities must be geared towards the public good and not for the benefit of any private individual. The organization must be organized and operated as a non-profit entity. This means that any surplus funds generated by the organization must be reinvested in the organization's activities and not distributed to any individuals or shareholders. The organization must provide a benefit to the public, rather than to any private individuals or groups. The organization must not engage in any activities that are prohibited by the IRS, such as engaging in political campaigning or lobbying activities. Filling out the 501(c)(3) application form can be a complex and time-consuming process. Here are some tips to help organizations successfully complete the application form: Review the instructions carefully: The IRS provides detailed instructions for completing both Form 1023 and Form 1023-EZ. Complete all sections fully: Each section of the application form is important, and it is essential to complete all sections fully. Incomplete or inaccurate information can delay the processing of the application or even result in its rejection. Be clear and concise: The application form requires a significant amount of information, but it is important to be clear and concise in the responses. Provide enough information to fully answer the questions but avoid unnecessary details that may confuse the IRS. Attach required documentation: The application form requires certain documentation, such as the organization's organizing documents and financial statements. Be sure to attach all required documentation to the application to avoid delays in processing. Seek professional help if necessary: Filling out the 501(c)(3) application form can be a complex process, and some organizations may benefit from seeking professional help. There are many attorneys and consultants who specialize in helping organizations apply for tax-exempt status, and they can provide valuable guidance and support. 501(c)(3) status can be crucial for non-profit organizations that rely on donations and other forms of support to fund their activities. To apply for this status, organizations must fill out a detailed application form and provide information about their structure, activities, and finances. By understanding the eligibility requirements, the parts of the application form, and tips for filling out the form successfully, organizations can increase their chances of successfully obtaining 501(c)(3) status and ensuring their ability to operate effectively.What Is a 501(c)(3) Application Form?

Parts of the 501(c)(3) Application Form

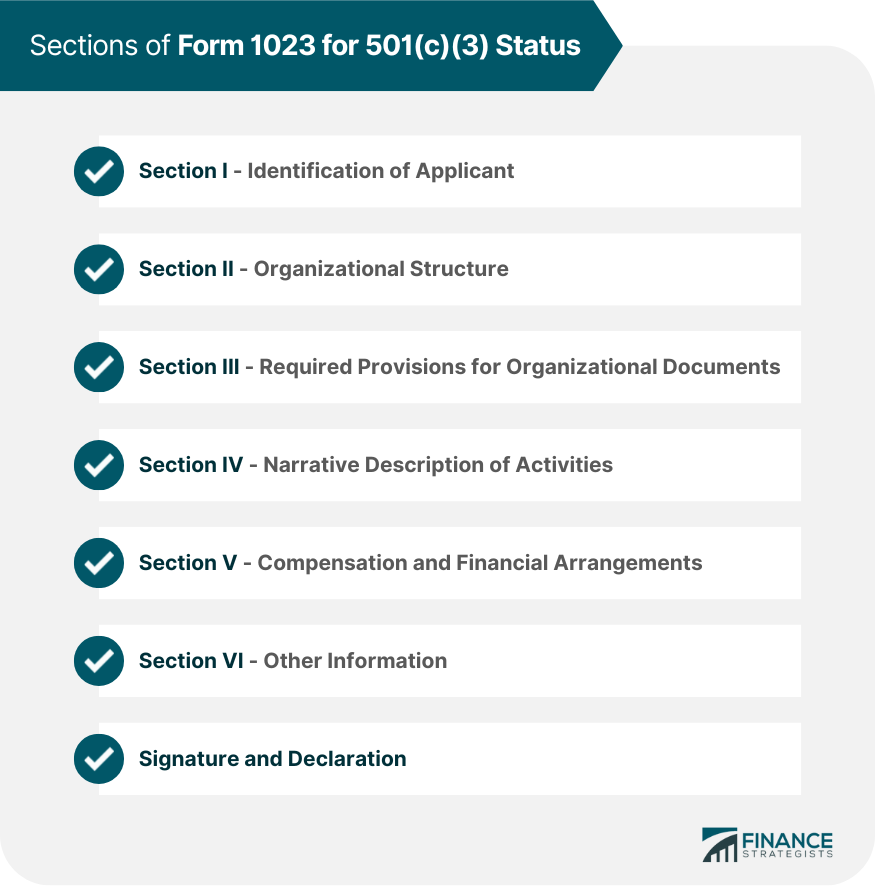

Form 1023

Section I - Identification of Applicant

Section II - Organizational Structure

Section III - Required Provisions for Organizational Documents

Section IV - Narrative Description of Activities

Section V - Compensation and Financial Arrangements

Section VI - Other Information

Signature and Declaration

Form 1023-EZ

Overview of Form 1023-EZ

Eligibility for Form 1023-EZ

Filling out Form 1023-EZ

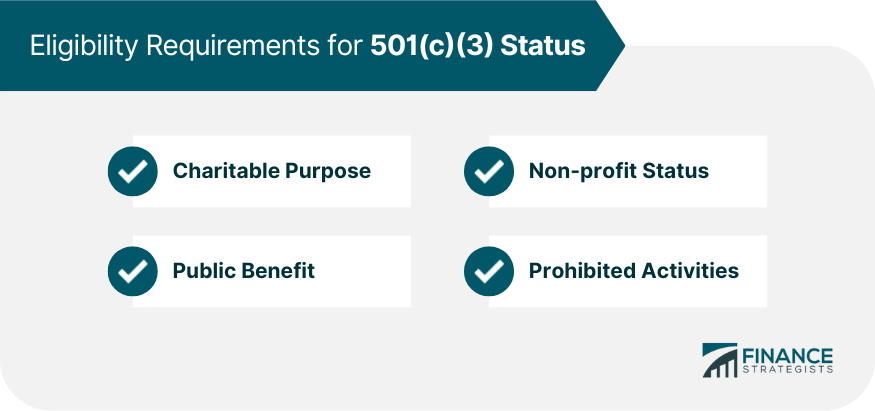

Eligibility Requirements for 501(c)(3) Status

Charitable Purpose

Non-profit Status

Public Benefit

Prohibited Activities

Tips for Filling Out the 501(c)(3) Application Form

It is essential to review these instructions carefully and follow them closely to ensure that the application is filled out correctly.Conclusion

501(c)(3) Application Form FAQs

501(c)(3) status is a type of tax-exempt status granted by the Internal Revenue Service (IRS) to qualifying non-profit organizations. This status allows organizations to accept tax-deductible donations and can be crucial for their ability to fundraise and operate effectively.

To be eligible for 501(c)(3) status, an organization must be organized and operated exclusively for charitable, educational, religious, scientific, literary, or other specified purposes that fall under the definition of a charitable organization. The organization must also be structured as a non-profit entity and provide a public benefit.

Form 1023 is the standard application form for 501(c)(3) status and is more detailed and complex than Form 1023-EZ. Form 1023-EZ is a simplified version of the application form that is designed for smaller organizations with less complex structures and activities.

Both Form 1023 and Form 1023-EZ require certain documentation to be submitted with the application. This documentation may include the organization's articles of incorporation, bylaws, financial statements, and other relevant documents.

Yes, it is possible for organizations that have been operating as non-profits to apply for 501(c)(3) status retroactively. This process is known as retroactive reinstatement and requires the organization to provide documentation and information about its activities and finances during the period when it was not recognized as tax-exempt.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.