A condo association is a legal entity responsible for the management of a condominium complex. Composed of condo unit owners, it handles the maintenance of shared spaces, enforces rules, collects monthly or annual fees, and addresses concerns raised by unit owners. The primary goal of these associations is to uphold the quality of life in the condominium and protect property values. Each condo owner automatically becomes a member of the condo association upon the purchase of a unit. Typically, a board of directors elected from the members governs the condo association. This board makes decisions about the building's maintenance, financial management, and dispute resolution among owners. Although condo associations and homeowners associations are often incorporated as non-profits, it is far more rare for the IRS to recognize one as a 501(c)(3) and grant it tax exempt status. To clarify, condo associations, despite their nonprofit status, are not classified as 501(c)(3) organizations. This misconception likely stems from a misunderstanding of the term "nonprofit." While condo associations operate on a nonprofit basis, serving the collective interests of condo owners, their activities do not meet the requirements for a 501(c)(3) designation, which necessitates serving a broader public interest. Instead of serving a broad public interest, they cater to a specific group—condo owners within a particular complex. 501(c)(3)s, in addition to being non-profit, must also benefit social welfare. A 501(c)(3) organization is typically formed for charitable, religious, educational, scientific, or literary purposes. It is rooted in the mission of public good, delivering value to society at large. These organizations can range from hospitals and schools to research institutions and relief agencies. Such organizations also afford contributors tax benefits, wherein the donor can deduct the contribution under federal and state tax regulations. One of the key restrictions applied to a 501(c)(3) organization involves its engagement in political activities. Such entities are prohibited from participating in or intervening in any political campaign on behalf of (or in opposition to) any candidate for public office. This restriction extends to contributions to political campaign funds and public statements of position made on behalf of the organization. This test mandates that a substantial portion of the organization's revenue must come from a broad base of public support, rather than a single source or a narrow group of donors. The intention behind this requirement is to prevent undue influence by a single donor or small group and ensure the nonprofit serves a broad public interest. Failure to meet this test can result in the loss of the 501(c)(3) status and the associated tax benefits. The classification of condo associations, both legally and for tax purposes, influences their operational dynamics and obligations. In terms of legal status, a condo association is typically formed as a nonprofit corporation under state law. This status empowers the association to enter into contracts, sue or be sued, and own property in its name. It's worth noting that the term "nonprofit" in this context refers to the organization's operational purpose, not its tax status. It implies that the condo association operates to serve the collective interests of condo owners, rather than to generate profit. While condo associations are generally established as nonprofit corporations, their tax status is distinct. Under the U.S. federal tax code, most condo associations qualify as 501(c)(4) organizations, also known as social welfare organizations. As such, they are exempt from federal income tax on income derived from their members for the purpose of maintaining the property. However, income from non-member sources or unrelated business activities is typically taxable. Unlike 501(c)(3) organizations, 501(c)(4) entities do not offer tax-deductible contributions. Compared to 501(c)(3) nonprofit corporations, condo associations follow a different operational model and tax treatment. Unlike 501(c)(3) entities that serve a broad public interest, condo associations cater to a specific group—condo owners within a particular complex. Moreover, while both are nonprofit entities, their tax-exempt statuses differ, with condo associations typically qualifying as 501(c)(4) organizations. Diverse in their structure and scope, condo associations can take several forms, each catering to distinct types of condominium complexes. Standard condo associations, the most common type, manage traditional condominium complexes. They handle the upkeep of common areas, enforce bylaws, and collect dues from unit owners. These associations cater to standalone condominium projects with a singular, well-defined community of condo owners. In contrast to standard associations, master condo associations oversee large condo developments comprising multiple buildings or complexes, each with its own condo association. The master association, also referred to as an umbrella association, manages shared facilities, such as clubhouses or golf courses, and handles issues that affect the broader community. Conversion condo associations pertain to condominiums that were originally built for a different purpose, like rental apartments or commercial buildings, and later converted into condos. These associations have unique responsibilities related to the conversion process, such as ensuring compliance with building codes and handling legacy issues. Condo associations are not considered 501(c)(3) nonprofit corporations. While condo associations operate on a nonprofit basis, their activities do not meet the requirements for a 501(c)(3) designation, which necessitates serving a broader public interest. 501(c)(3) nonprofit corporations are formed for charitable, religious, educational, scientific, or literary purposes, benefiting society at large. Condo associations, on the other hand, serve a specific group—condo owners within a particular complex. They typically qualify as 501(c)(4) social welfare organizations, enjoying certain tax exemptions on income derived from their members for property maintenance. Understanding the distinction between condo associations and 501(c)(3) nonprofits is crucial for both legal and tax purposes, ensuring appropriate classification and compliance. Different types of condo associations, including standard, master, and conversion associations, cater to specific types of condominium complexes, each with its own management structure and responsibilities.What Are Condo Associations?

Are Condo Associations Considered 501(c)(3) Nonprofit Corporations?

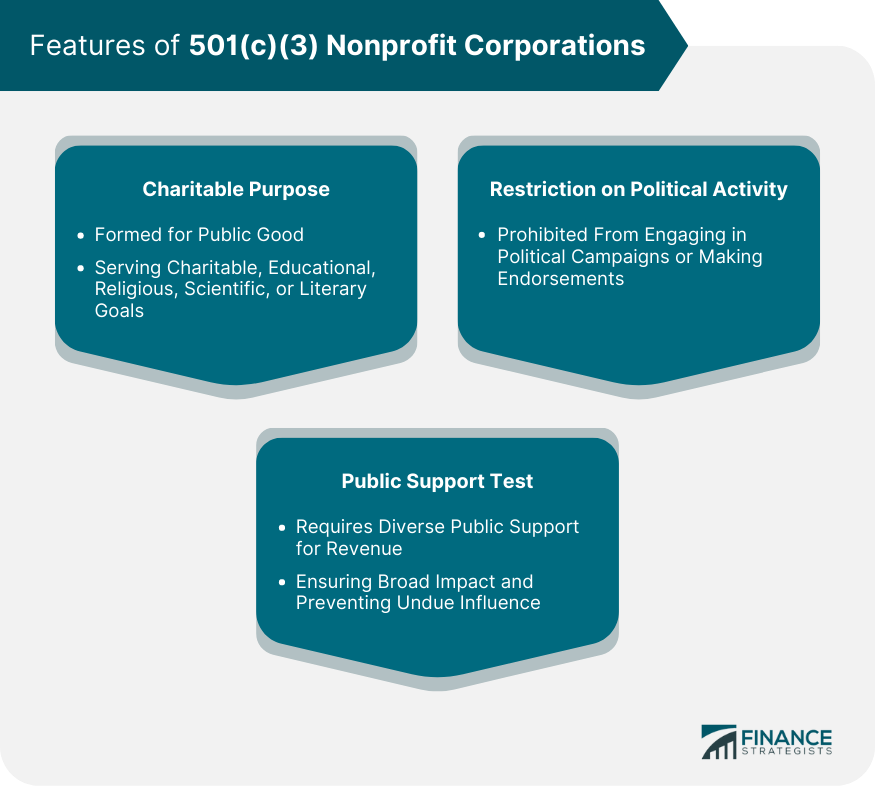

Features of 501(c)(3) Nonprofit Corporations

Charitable Purpose

Restriction on Political Activity

Public Support Test

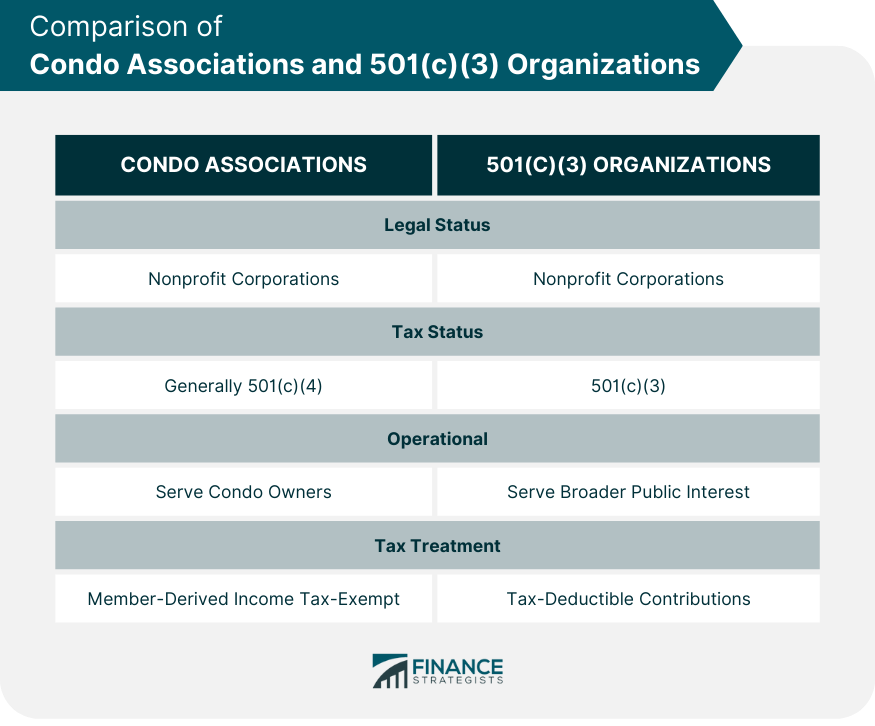

Classification of Condo Associations

Legal Status of Condo Associations

Tax Status of Condo Associations

Comparison With 501(c)(3) Nonprofit Corporations

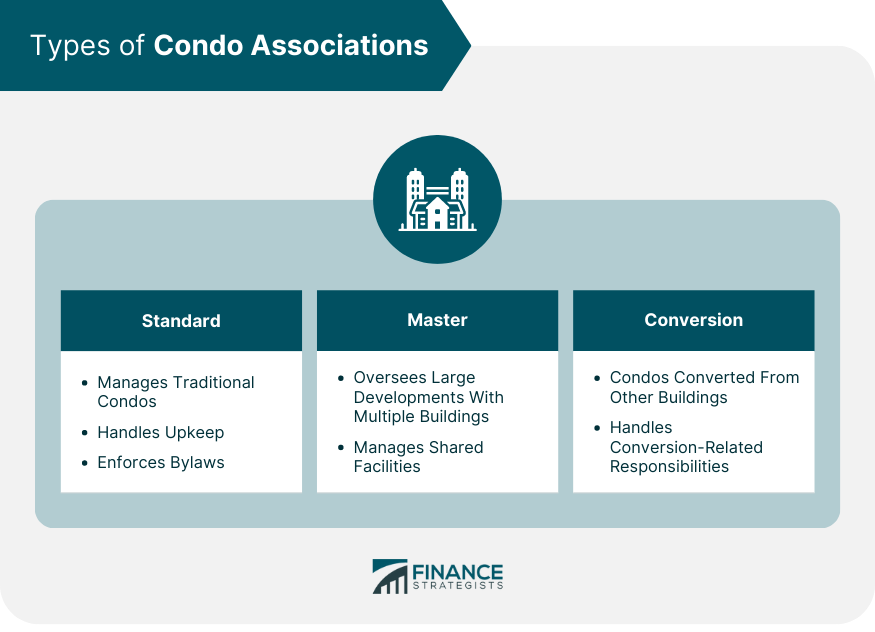

Different Types of Condo Associations

Standard

Master

Conversion

Conclusion

Are Condo Associations Considered 501(c)(3) Nonprofit Corporations? FAQs

A 501(c)(3) organization is a non-profit organization with tax exempt status that is dedicated to the general well-being of society.

Although condo associations and homeowners associations are often incorporated as non-profits, it is far more rare for the IRS to recognize one as a 501(c)3 and grant it tax exempt status.

A 501(c)(3) organization is tax exempt so long as it remains true to its stated mission and remains compliant with the IRS.

501(c)(3) is the internal revenue code (IRC) section for organizations with tax exempt status. 501(c)(3) falls under internal revenue code 501(c).

A condo association is an entity that governs the ownership, operation, and maintenance of condominium units. It is typically organized and operated as a nonprofit corporation, but its primary purpose is to manage the condominium complex and protect property values in the residential area. A 501(c)(3) nonprofit corporation, on the other hand, is organized and operated for charitable purposes which may include religious, educational, scientific, literary or other exempt activities as defined by the IRS.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.