501(c)(3) Board of Directors Rules are a set of regulations and guidelines that dictate the responsibilities and obligations of the board of directors for nonprofit organizations that have received tax-exempt status under section 501(c)(3) of the Internal Revenue Code. These rules cover various aspects of the board's operations, such as its composition, duties, financial oversight, legal compliance, and fundraising activities. The IRS typically requires at least three individuals to serve on the board of directors of a given 501(c)(3) organization. They also require at least one annual meeting with all members present. The IRS does not dictate term length or any additional members or meetings. Adhering to these rules is essential for ensuring good governance and maintaining the organization's tax-exempt status. The Board of Directors of a 501(c)(3) organization has several roles and responsibilities. These include: Board members have a fiduciary duty to act in the best interests of the organization. This duty includes: Duty of Care: Board members must exercise reasonable care when making decisions on behalf of the organization. This includes being informed about the organization's operations and finances, asking questions when necessary, and making decisions based on careful consideration of all available information. Duty of Loyalty: Board members must act in the best interests of the organization, rather than their own personal interests or the interests of others. Duty of Obedience: Board members must ensure that the organization operates in compliance with its mission and in accordance with all applicable laws and regulations. The Board of Directors is responsible for overseeing the organization's operations and finances. This includes: Approving the organization's budget and financial statements Reviewing and approving major transactions, such as contracts and leases Ensuring that the organization is operating in compliance with all applicable laws and regulations Monitoring the organization's financial performance and ensuring that the organization is using its resources effectively and efficiently Ensuring that the organization is fulfilling its mission and making progress toward its goals The Board of Directors is responsible for setting the organization's strategic goals and objectives. This includes: Developing a strategic plan that outlines the organization's mission, vision, and goals Identifying Key Performance Indicators (KPIs) to measure the organization's progress toward its goals Monitoring the organization's progress toward its goals and making adjustments as necessary The Board of Directors is responsible for hiring, evaluating, and terminating the CEO/Executive Director. This includes: Developing a job description and job qualifications for the CEO/Executive Director Conducting a search for qualified candidates Interviewing and selecting the CEO/Executive Director Evaluating the CEO/Executive Director's performance on an annual basis Terminating the CEO/Executive Director if necessary The Board of Directors is responsible for fundraising and donor relations. This includes: Developing and implementing a fundraising plan that aligns with the organization's strategic goals and objectives Identifying potential donors and developing relationships with them Ensuring that the organization is using its resources effectively and efficiently to achieve its fundraising goals Ensuring that the organization is in compliance with all applicable laws and regulations related to fundraising and donor relations The Board of Directors is responsible for community engagement and advocacy. This includes: Building relationships with the community that the organization serves Advocating for the organization's mission and goals Ensuring that the organization is addressing the needs of the community that it serves The Board of Directors of a 501(c)(3) organization must meet regularly to fulfill its roles and responsibilities. The following are some important considerations for meetings and decision-making: The Board of Directors should meet regularly, with the frequency of meetings depending on the needs of the organization. Typically, Boards meet quarterly, but they can meet more or less frequently if needed. The notice requirements for Board meetings vary by state law and the organization's bylaws. In general, Boards are required to provide notice of their meetings to all Board members and the public in advance of the meeting. A quorum is the minimum number of Board members required to conduct official business. The quorum requirements are specified in the organization's bylaws. Typically, a majority of Board members must be present to constitute a quorum. Voting procedures are also specified in the organization's bylaws. Generally, a simple majority vote is required to approve Board decisions. In some cases, a supermajority vote may be required for major decisions, such as amending the organization's bylaws or approving a major financial transaction. The Board of Directors should keep minutes of its meetings, which document the decisions made and the discussions that took place. These minutes should be maintained in the organization's records and made available to the public upon request. The Board of Directors may delegate some of its authority to committees and officers. This can help to streamline decision-making and ensure that the organization's operations are running smoothly. However, the Board of Directors retains ultimate responsibility for the organization's operations and decisions. 501(c)(3) organizations should adopt governance policies to ensure that the organization is operating in compliance with all applicable laws and regulations and that the Board of Directors is fulfilling its roles and responsibilities. The following are some important governance policies: Bylaws are the rules and procedures that govern the operation of the organization. Bylaws should be adopted and enforced by the Board of Directors. Bylaws typically include provisions related to the composition of the Board, the roles and responsibilities of Board members, meeting procedures, and decision-making procedures. 501(c)(3) organizations should adopt a code of ethics and conduct that outlines the ethical principles and standards of behavior that are expected of Board members and employees. The code of ethics and conduct should be enforced by the Board of Directors and should include provisions related to conflicts of interest, confidentiality, and integrity. A conflict of interest policy requires Board members to disclose any potential conflicts of interest and to recuse themselves from decision-making in situations where they have a conflict of interest. The conflict of interest policy should be adopted and enforced by the Board of Directors. A whistleblower policy provides protections for individuals who report suspected violations of the law or ethical misconduct. The whistleblower policy should be adopted and enforced by the Board of Directors. A document retention and destruction policy outlines the procedures for retaining and destroying the organization's records. The policy should be adopted and enforced by the Board of Directors and should comply with all applicable laws and regulations. 501(c)(3) organizations must comply with all applicable laws and regulations. The Board of Directors is responsible for ensuring that the organization is in compliance with all applicable laws and regulations. The following are some important legal and regulatory compliance considerations: 501(c)(3) organizations must comply with state and federal laws and regulations related to non-profit organizations. These laws and regulations govern various aspects of non-profit organizations, including fundraising, tax-exempt status, and governance. 501(c)(3) organizations are exempt from federal income tax, but they must comply with certain requirements to maintain their tax-exempt status. These requirements include filing annual tax returns and ensuring that the organization's activities are consistent with its tax-exempt purposes. Board members can be held liable for the actions of the organization. To protect Board members from liability, 501(c)(3) organizations should adopt appropriate insurance policies and ensure that Board members are fulfilling their fiduciary duties. 501(c)(3) organizations should obtain appropriate insurance coverage to protect the organization and its Board members from liability. Insurance coverage can include general liability insurance, directors and officers liability insurance, and property insurance. The composition of the Board is important in ensuring that the organization is able to carry out its mission effectively. Generally, the Board of Directors should be composed of individuals who are passionate about the organization's mission and have expertise in areas relevant to the organization's operations. The IRS does not specify the minimum or maximum number of Board members that a 501(c)(3) organization must have. However, it is generally recommended that the Board be large enough to provide adequate oversight and diversity of thought, while still being small enough to allow for efficient decision-making. A typical Board size is between five and fifteen members. The qualifications of Board members vary depending on the organization's mission and operations. However, there are some general qualities that are important for Board members to possess. These include: Passion for the organization's mission Expertise in areas relevant to the organization's operations Ability to make sound judgments and decisions Ability to work collaboratively with other Board members Willingness to commit time and resources to the organization It is important for the Board of Directors to be diverse and inclusive. Diversity in the Board ensures that the organization benefits from a range of perspectives, experiences, and backgrounds. Inclusivity ensures that all members of the community served by the organization are represented in its leadership. The Board should consider diversity in terms of race, ethnicity, gender, age, socioeconomic status, and other factors. The Board should also be inclusive of individuals with disabilities, as well as individuals from underrepresented communities. Board members are responsible for making decisions that are in the best interests of the organization. Conflicts of interest can arise when Board members have personal or financial interests that conflict with the interests of the organization. To address conflicts of interest, 501(c)(3) organizations should adopt a conflict of interest policy. The policy should require Board members to disclose any potential conflicts of interest and recuse themselves from decision-making in situations where they have a conflict of interest. The Board of Directors is an essential component of 501(c)(3) organizations. They are responsible for the overall management and control of the organization, ensuring that the organization operates in compliance with the law and in line with its mission. The Board members are subject to several rules, roles, and responsibilities that they must uphold at all times. Their organization must adopt governance policies as well as ensure that they are in compliance with all applicable laws and regulations. The qualifications may vary depending on their organization’s mission and operations, but it is essential for the Board of Directors to be diverse and inclusive in their membership. It is also crucial that there be no personal or financial conflicts of interest within the members of the Board. By following the rules that govern the Board of Directors, 501(c)(3) organizations can ensure that they are fulfilling their mission and serving their communities effectively.501(c)(3) Board of Directors Rules Overview

Roles and Responsibilities of 501(c)(3) Board of Directors

Fiduciary Duties of Board Members

Oversight of the 501(c)(3) Organization's Operations and Finances

Setting and Implementing Strategic Goals and Objectives

Hiring, Evaluating, and Terminating the CEO/Executive Director

Fundraising and Donor Relations

Community Engagement and Advocacy

Meetings and Decision-Making of 501(c)(3) Board

Frequency and Notice Requirements for Board Meetings

Quorum Requirements and Voting Procedures

Minutes and Record-Keeping Requirements

Delegation of Authority to Committees and Officers

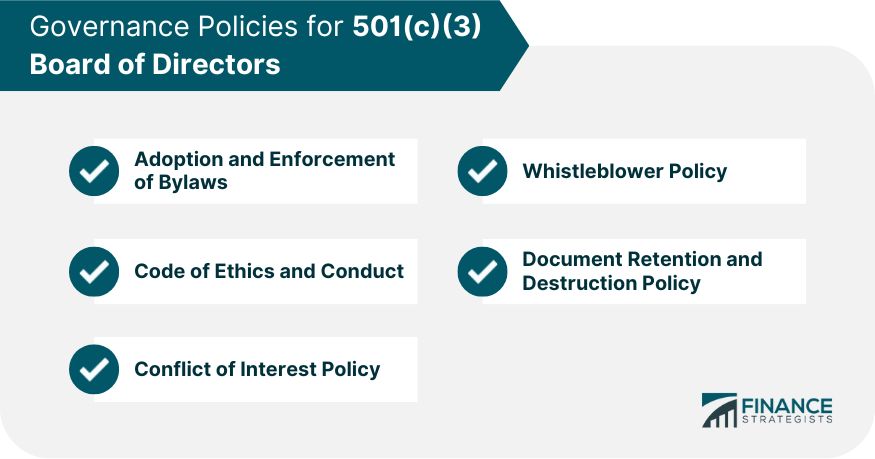

Governance Policies of 501(c)(3) Board

Adoption and Enforcement of Bylaws

Code of Ethics and Conduct

Conflict of Interest Policy

Whistleblower Policy

Document Retention and Destruction Policy

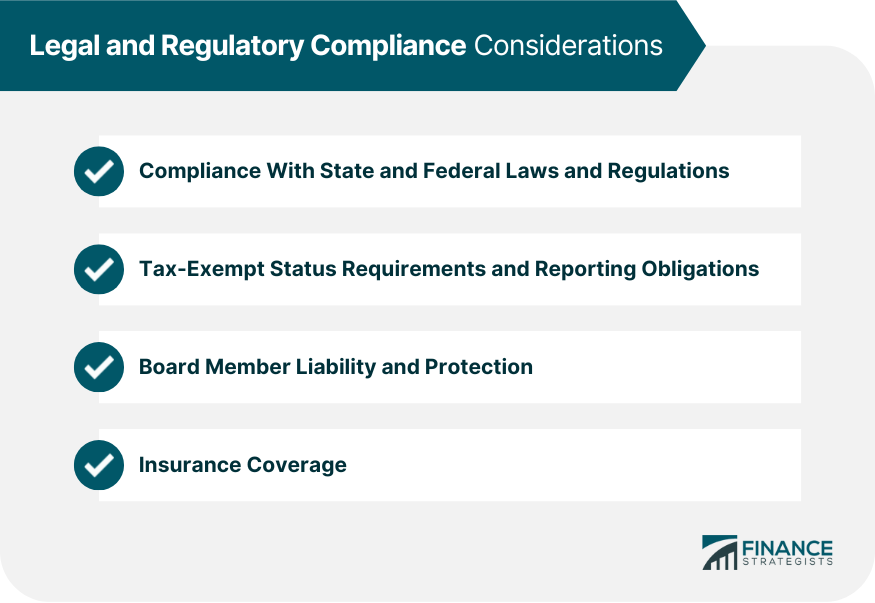

Legal and Regulatory Compliance of 501(c)(3) Board

Compliance with State and Federal Laws and Regulations

Tax-Exempt Status Requirements and Reporting Obligations

Board Member Liability and Protection

Insurance Coverage

Composition of the 501(c)(3) Board of Directors

Qualifications of Board Members

Diversity and Inclusivity Considerations

Conflicts of Interest and Disclosure Requirements

Conclusion

501(c)(3) Board of Directors Rules FAQs

There is no specific minimum or a maximum number of Board members required for a 501(c)(3) organization. However, it is recommended that the Board be large enough to provide adequate oversight and diversity of thought, while still being small enough to allow for efficient decision-making. A typical Board size is between five and fifteen members.

Board members should possess a passion for the organization's mission, expertise in areas relevant to the organization's operations, the ability to make sound judgments and decisions, the ability to work collaboratively with other Board members, and the willingness to commit time and resources to the organization.

A conflict of interest policy requires Board members to disclose any potential conflicts of interest and to recuse themselves from decision-making in situations where they have a conflict of interest. It is important for a 501(c)(3) organization to adopt a conflict of interest policy to ensure that Board members are acting in the best interests of the organization and not their own personal or financial interests.

A whistleblower policy provides protections for individuals who report suspected violations of the law or ethical misconduct. It is important for a 501(c)(3) organization to adopt a whistleblower policy to encourage employees and volunteers to report suspected violations without fear of retaliation.

501(c)(3) organizations must comply with state and federal laws and regulations related to non-profit organizations. These laws and regulations govern various aspects of non-profit organizations, including fundraising, tax-exempt status, and governance. Board members are responsible for ensuring that the organization is in compliance with all applicable laws and regulations.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.