The Guardrails Approach is a dynamic and flexible retirement withdrawal strategy that enables retirees to manage their spending and portfolio throughout retirement. By setting specific upper and lower limits to withdrawal rates, the approach helps individuals maintain a balance between spending and preserving their assets while adapting to market fluctuations and life changes. Guardrails play a crucial role in retirement planning, as they provide a framework for managing withdrawals and ensuring financial stability throughout retirement. By adhering to a carefully constructed set of guidelines, retirees can minimize the risk of depleting their savings too quickly and maximize their ability to maintain a comfortable lifestyle. A variety of withdrawal strategies exist to help retirees manage their income during retirement, including fixed percentage withdrawal, inflation-adjusted withdrawal, time-segmentation strategy, and dynamic withdrawal strategy. Each approach has its advantages and disadvantages, and the right choice depends on an individual's financial goals, risk tolerance, and time horizon. The withdrawal rate is the percentage of a retiree's portfolio that they withdraw each year to cover living expenses. This rate is a critical component of the Guardrails Approach and must be carefully determined to ensure financial stability throughout retirement. The Guardrails Approach sets specific upper and lower limits on the withdrawal rate to provide boundaries within which retirees can manage their spending. These limits help retirees maintain a balance between spending and preserving assets while adapting to market fluctuations and life changes. Adjustment rules are guidelines for modifying the withdrawal rate within the guardrails in response to market performance and personal financial circumstances. These rules enable retirees to make necessary adjustments to their spending patterns to stay within the established limits and maintain financial stability. One of the primary benefits of the Guardrails Approach is its ability to manage the sequence of returns risk. This risk refers to the possibility that an individual will experience poor investment returns early in retirement, which can have a significant impact on their long-term financial stability. By setting limits on withdrawal rates, the Guardrails Approach helps retirees mitigate this risk and preserve their savings. The Guardrails Approach promotes a balance between spending and preserving assets by encouraging retirees to adjust their withdrawal rates based on market performance and personal financial circumstances. This flexibility helps individuals maintain their desired lifestyle while ensuring their savings last throughout retirement. Market fluctuations are inevitable, and the Guardrails Approach enables retirees to adapt their withdrawal strategies in response to these changes. By adjusting withdrawal rates within the established limits, retirees can maintain financial stability and minimize the negative impact of market downturns on their portfolios. Determining an appropriate baseline withdrawal rate is essential to the success of the Guardrails Approach. Factors to consider when setting this rate include: Time Horizon: The length of time an individual expects to be in retirement will significantly impact their withdrawal rate, as a longer retirement requires a more conservative approach to preserve assets. Risk Tolerance: An individual's risk tolerance will influence their willingness to accept market fluctuations and adjust withdrawal rates accordingly. Portfolio Composition: The allocation of assets within a retiree's portfolio will impact the potential returns and volatility, which in turn, affect the appropriate withdrawal rate. A popular guideline for setting a baseline withdrawal rate is the "4% rule," which suggests that retirees should withdraw 4% of their portfolio in the first year of retirement and adjust this amount for inflation each subsequent year. However, this rule may not be suitable for everyone and may need to be adjusted based on individual circumstances, market conditions, and other factors. Some financial experts suggest using a more conservative withdrawal rate, such as 3% or 3.5%, to account for increased longevity and market volatility. Several factors can influence the establishment of upper and lower limits for withdrawal rates within the Guardrails Approach: Desired Spending Flexibility: Retirees who want greater flexibility in their spending may opt for wider guardrails, allowing for more significant adjustments in their withdrawal rates based on market conditions and personal circumstances. Market Conditions: Current and projected market conditions may necessitate tighter or looser guardrails to ensure that the withdrawal strategy remains viable and sustainable in various market environments. Risk Tolerance: An individual's risk tolerance will impact their comfort level with fluctuations in withdrawal rates, which can influence the appropriate width of the guardrails. Regular monitoring and adjusting of the upper and lower limits within the Guardrails Approach is essential for maintaining financial stability throughout retirement. By keeping a close eye on market performance, personal financial circumstances, and spending patterns, retirees can make necessary adjustments to their guardrails and withdrawal rates to ensure their strategy remains effective and sustainable. The Guardrails Approach can be compared to other popular withdrawal strategies to determine its advantages and suitability for an individual's retirement planning needs: This strategy involves withdrawing a fixed percentage of the portfolio each year, regardless of market performance or inflation. While this approach is relatively simple to implement, it may not provide sufficient spending flexibility and may lead to a higher risk of depleting assets during periods of poor market performance. The inflation-adjusted withdrawal strategy involves withdrawing an initial percentage of the portfolio and adjusting the withdrawal amount each year based on inflation. This approach provides a more stable income stream, but it may not adapt well to market fluctuations and may still pose a risk of depleting assets too quickly. This approach divides a retiree's portfolio into different "buckets" based on the investment time horizon and risk tolerance. Each bucket is invested in a mix of assets appropriate for its time horizon, and withdrawals are made from the most conservative bucket first. While this strategy can provide a more structured approach to withdrawals, it may lack the flexibility offered by the Guardrails Approach. The dynamic withdrawal strategy adjusts withdrawal rates based on market performance and personal financial circumstances, similar to the Guardrails Approach. This approach may provide greater flexibility and adaptability compared to other strategies, but it may require more active management and monitoring. Selecting the most suitable withdrawal strategy depends on an individual's financial goals, risk tolerance, and time horizon. Evaluating these factors and comparing the advantages and disadvantages of each approach will help retirees determine which strategy is best suited for their needs. It is essential for retirees to regularly review their withdrawal rates and guardrails to ensure their retirement plan remains effective and sustainable. Market conditions, personal financial circumstances, and spending patterns can change, necessitating adjustments to withdrawal rates and limits. As retirees navigate their retirement years, life changes and evolving financial goals may require adjustments to their withdrawal strategies. The Guardrails Approach offers the flexibility to adapt to these changes, ensuring that retirees can maintain their desired lifestyle while preserving their assets. Market fluctuations and economic shifts are inevitable and can significantly impact a retiree's portfolio and withdrawal strategy. The Guardrails Approach provides a framework that allows retirees to adapt their withdrawal rates and limits in response to these changes, ensuring that their retirement plan remains sustainable and effective. The Guardrails Approach is a retirement withdrawal strategy that enables retirees to balance spending and asset preservation while adapting to market fluctuations and life changes. It comprises three key components: withdrawal rate, upper and lower limits, and adjustment rules. This approach helps retirees manage the sequence of returns risk, maintain balance, and adapt to market fluctuations. When compared to other withdrawal strategies like fixed percentage withdrawal, inflation-adjusted withdrawal, time-segmentation strategy, and dynamic withdrawal strategy, the Guardrails Approach provides flexibility and adaptability. Regular management and monitoring are essential to ensure the strategy remains effective and sustainable. Retirees should review withdrawal rates and limits regularly, adapt to life changes and financial goals, and navigate market fluctuations and economic shifts to maintain financial stability throughout retirement.What Is Guardrails Approach?

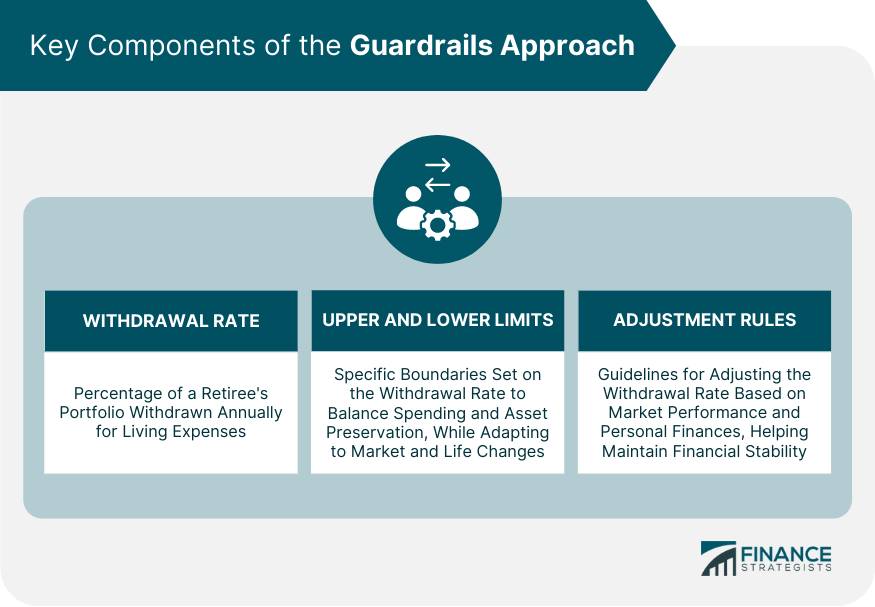

Key Components of the Guardrails Approach

Withdrawal Rate

Upper and Lower Limits

Adjustment Rules

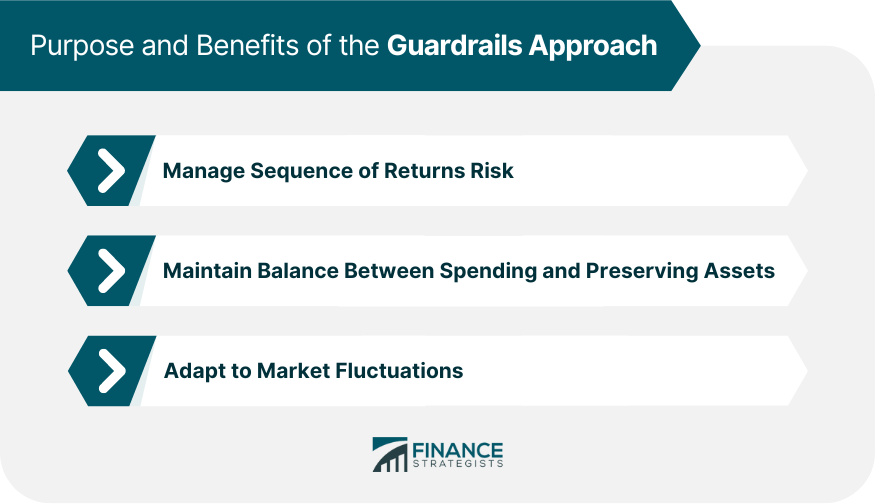

Purpose and Benefits of the Guardrails Approach

Managing Sequence of Returns Risk

Maintaining Balance Between Spending and Preserving Assets

Adapting to Market Fluctuations

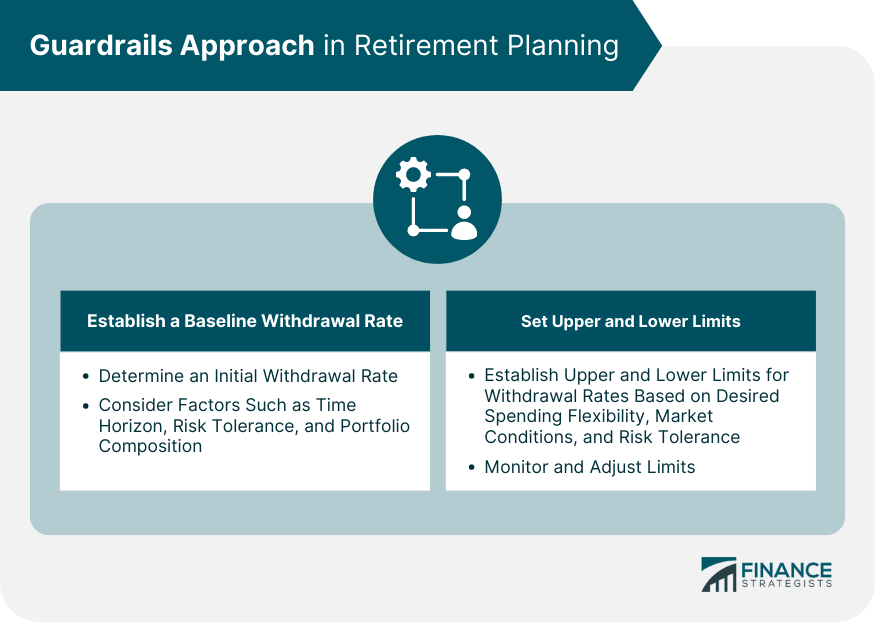

Implementing Guardrails Approach in Retirement Planning

Establishing a Baseline Withdrawal Rate

Factors to Consider

Common Withdrawal Rate Guidelines

Setting Upper and Lower Limits

Factors Influencing Limits

Importance of Monitoring and Adjusting Limits

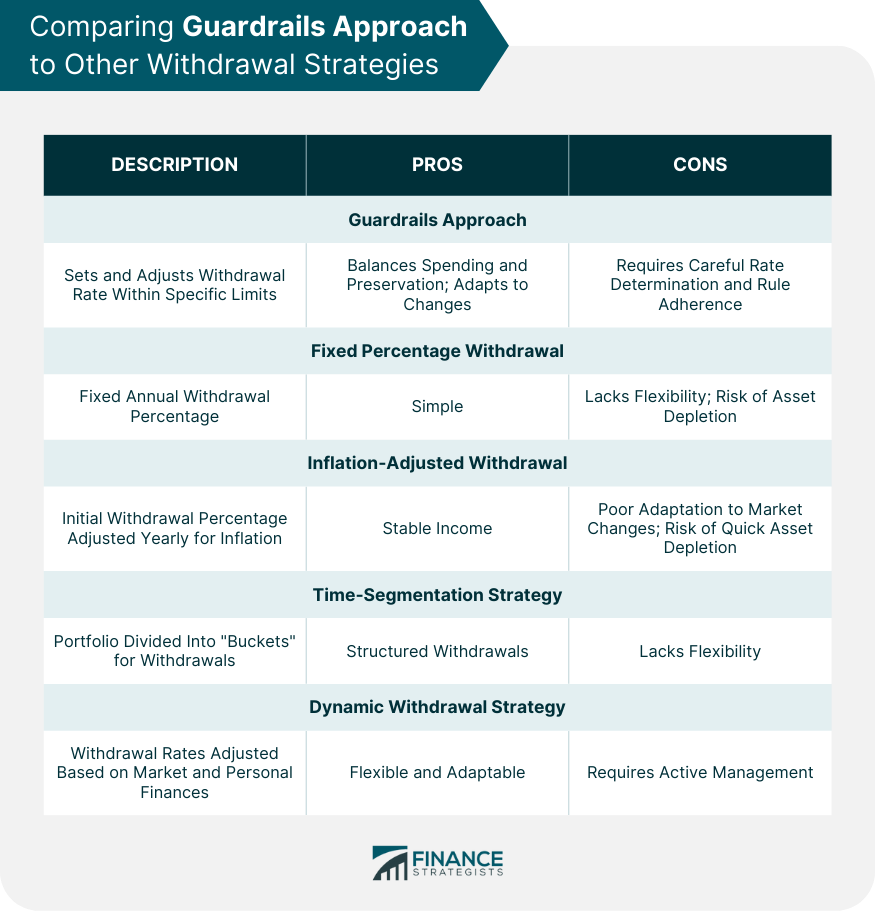

Comparing Guardrails Approach to Other Withdrawal Strategies

Fixed Percentage Withdrawal

Inflation-Adjusted Withdrawal

Time-Segmentation Strategy

Dynamic Withdrawal Strategy

Ongoing Management and Monitoring of the Guardrails Approach

Regularly Reviewing Withdrawal Rates and Limits

Adapting to Life Changes and Financial Goals

Navigating Market Fluctuations and Economic Shifts

Final Thoughts

Guardrails Approach FAQs

The Guardrails Approach is a flexible and dynamic retirement withdrawal strategy that sets specific upper and lower limits on withdrawal rates, allowing retirees to maintain a balance between spending and preserving their assets while adapting to market fluctuations and life changes.

The Guardrails Approach helps manage the sequence of returns risk by setting limits on withdrawal rates, which can be adjusted based on market performance and personal financial circumstances. This flexibility helps mitigate the impact of poor investment returns early in retirement and preserve retirees' savings.

The key components of the Guardrails Approach include the withdrawal rate, upper and lower limits on the withdrawal rate, and adjustment rules for modifying the withdrawal rate within the established guardrails based on market performance and personal financial circumstances.

To determine the appropriate upper and lower limits for the Guardrails Approach, consider factors such as desired spending flexibility, market conditions, and risk tolerance. These factors will help you establish limits that balance spending and asset preservation while adapting to market fluctuations and personal circumstances.

The Guardrails Approach is more flexible and adaptable compared to some other withdrawal strategies, such as fixed percentage withdrawal or inflation-adjusted withdrawal. This approach allows for adjustments to withdrawal rates based on market performance and personal financial circumstances, providing a better balance between spending and preserving assets throughout retirement.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.