A retirement counselor is a financial professional who specializes in helping individuals plan and manage their finances, assets, and lifestyle during retirement. They work with their clients to create customized retirement plans that will help them achieve their retirement goals and ensure they can live comfortably during their golden years. Retirement counselors may work independently or as part of a financial planning firm and often hold advanced degrees in finance, accounting, or financial planning. Retirement can be a stressful and uncertain time, and it is easy to feel overwhelmed by the myriad of decisions that need to be made. A retirement counselor can help alleviate these worries by providing expert advice and guidance. They can help clients set realistic retirement goals, develop a plan to achieve those goals, and adjust the plan as needed. Additionally, retirement counselors can offer support during times of financial stress or uncertainty, providing clients with peace of mind knowing they have a trusted advisor in their corner. When selecting a retirement counselor, it is important to consider their qualifications. Here are some of the essential qualifications that a retirement counselor should have: Most retirement counselors hold at least a bachelor's degree in finance, accounting, or a related field. Some retirement counselors may have a master's degree or even a Ph.D. in finance or financial planning. It is essential to ensure that the retirement counselor you choose has a solid educational background in financial planning and management. Retirement counselors who hold professional certifications demonstrate their knowledge and expertise in retirement planning. Earning certifications such as Certified Financial Planner (CFP), Chartered Financial Analyst (CFA), or Retirement Income Certified Professional (RICP) demonstrate the retirement counselor's rigorous training and education in retirement planning and are highly regarded in the industry. It is essential to select a retirement counselor who has experience in retirement planning. Look for a counselor who has worked with clients in similar situations and has a track record of success in helping clients achieve their retirement goals. An experienced retirement counselor will be able to provide you with valuable insights and advice based on their past experiences. Retirement counselors who belong to professional organizations such as the National Association of Personal Financial Advisors (NAPFA) or the Financial Planning Association (FPA) must adhere to strict ethical standards and are committed to ongoing professional development. Look for retirement counselors who hold credentials and affiliations that demonstrate their commitment to ethical behavior and continued education. Retirement counselors provide a wide range of services to their clients. Here are some of the most common services offered by retirement counselors: One of the primary services provided by a retirement counselor is financial planning and management. This includes developing a customized retirement plan that considers the client's retirement goals, income, assets, and expenses. The retirement counselor will help the client identify potential sources of retirement income, such as Social Security benefits or pensions, and help them develop a strategy to maximize their retirement income. Retirement counselors can also provide investment advice, helping clients make informed investment decisions that align with their retirement goals and risk tolerance. The counselor can review the client's investment portfolio and recommend appropriate changes or adjustments to optimize their investment strategy. Retirement counselors can help clients navigate the complex tax laws that apply to retirement income and savings. They can provide guidance on tax-efficient investment strategies and help clients plan for Required Minimum Distributions (RMDs) from retirement accounts. Additionally, retirement counselors can help clients prepare and file their tax returns, ensuring that they take advantage of all applicable tax deductions and credits. Retirement counselors can help clients develop an estate plan that ensures their assets are distributed according to their wishes and minimize tax implications. They can provide guidance on creating a will, establishing trusts, and designating beneficiaries. Retirement counselors can also help clients plan and manage their lifestyle during retirement. They can help clients determine how much they need to save to maintain their desired lifestyle and develop a budget to achieve their goals. Additionally, retirement counselors can provide guidance on health care, long-term care, and other lifestyle-related expenses that may impact their retirement income. There are many benefits to hiring a retirement counselor. Here are some of the most significant benefits: Working with a retirement counselor can help you set realistic retirement goals and develop a plan to achieve those goals. A retirement counselor can provide you with valuable insights and advice based on their experience, helping you make informed decisions that can improve your retirement outcomes. Retirement can be a stressful and uncertain time, but working with a retirement counselor can help alleviate some of that stress and anxiety. A retirement counselor can provide you with peace of mind knowing that you have a trusted advisor to guide you through the complexities of retirement planning and management. A retirement counselor will work with you to develop a customized retirement plan that aligns with your goals and values. They will take the time to understand your unique situation and tailor their advice to meet your specific needs. Retirement counselors have access to a wide range of resources and tools that can help you make informed decisions about your retirement. They can provide you with expert advice on investment strategies, tax planning, estate planning, and other retirement-related topics. Choosing the right retirement counselor is essential to achieving your retirement goals. Here are some tips to help you choose the right retirement counselor for your needs: Ask friends, family members, and colleagues for recommendations on retirement counselors they have worked with in the past. Word-of-mouth referrals can be an excellent way to find a retirement counselor who has a track record of success. Do your research and due diligence when selecting a retirement counselor. Check their credentials, affiliations, and certifications to ensure that they have the expertise and experience necessary to provide you with the guidance and support you need. Take the time to interview potential retirement counselors before making a final decision. Ask about their experience, qualifications, and approach to retirement planning. Make sure you feel comfortable with their communication style and that they are someone you can trust. Consider the cost of working with a retirement counselor and evaluate the value you will receive in return. A good retirement counselor can provide significant value in terms of improved retirement outcomes and peace of mind, but it is essential to ensure that the cost is reasonable and aligns with your budget. Retirement counseling is an essential part of planning and managing your retirement. A retirement counselor can help you set realistic retirement goals, develop a plan to achieve those goals, and provide ongoing guidance and support throughout your retirement years. When choosing a retirement counselor, it is important to consider their qualifications, services provided, and approach to retirement planning. By selecting the right retirement counselor, you can improve your retirement outcomes, reduce stress and anxiety, and enjoy a secure and fulfilling retirement. Remember that retirement counseling is an investment in your future, and it is worth taking the time to find the right counselor for your needs.Definition of Retirement Counselor

Importance of Having a Retirement Counselor

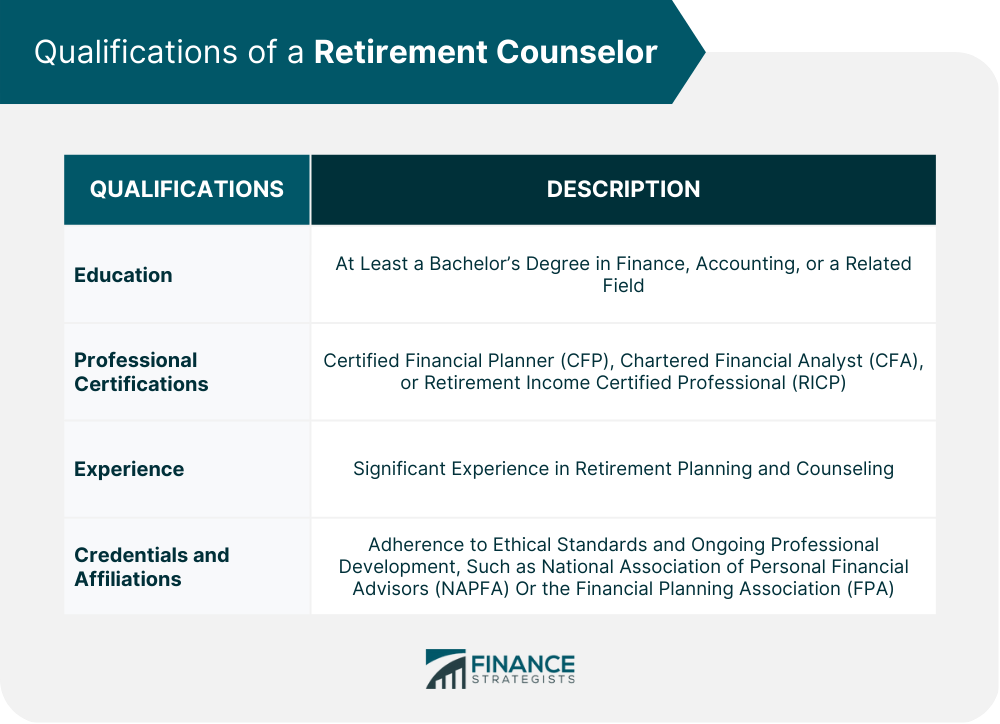

Qualifications of a Retirement Counselor

Educational Requirements

Professional Certifications

Experience

Credentials and Affiliations

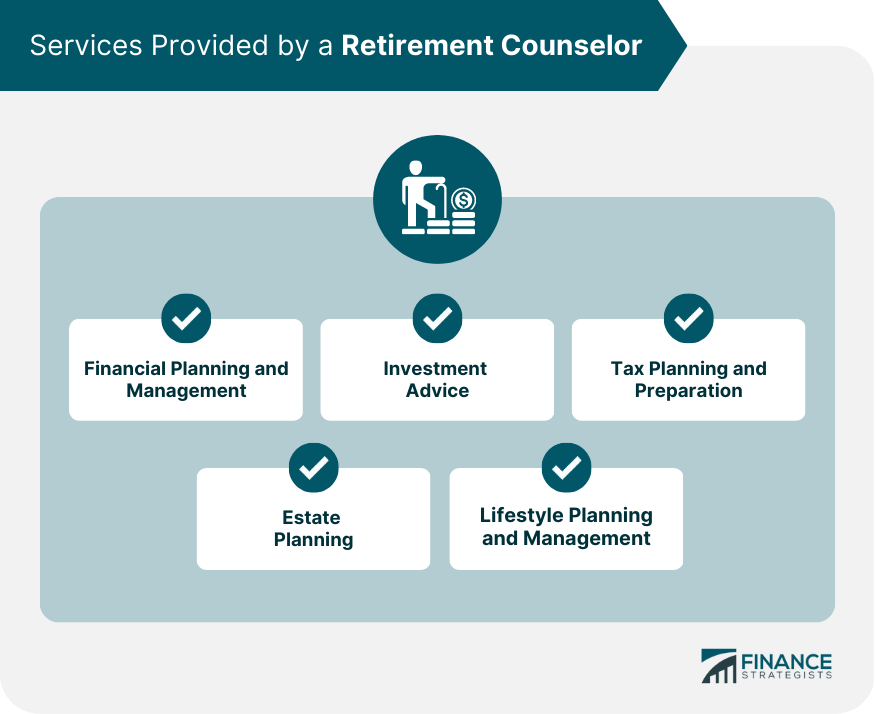

Services Provided by a Retirement Counselor

Financial Planning and Management

Investment Advice

Tax Planning and Preparation

Estate Planning

Lifestyle Planning and Management

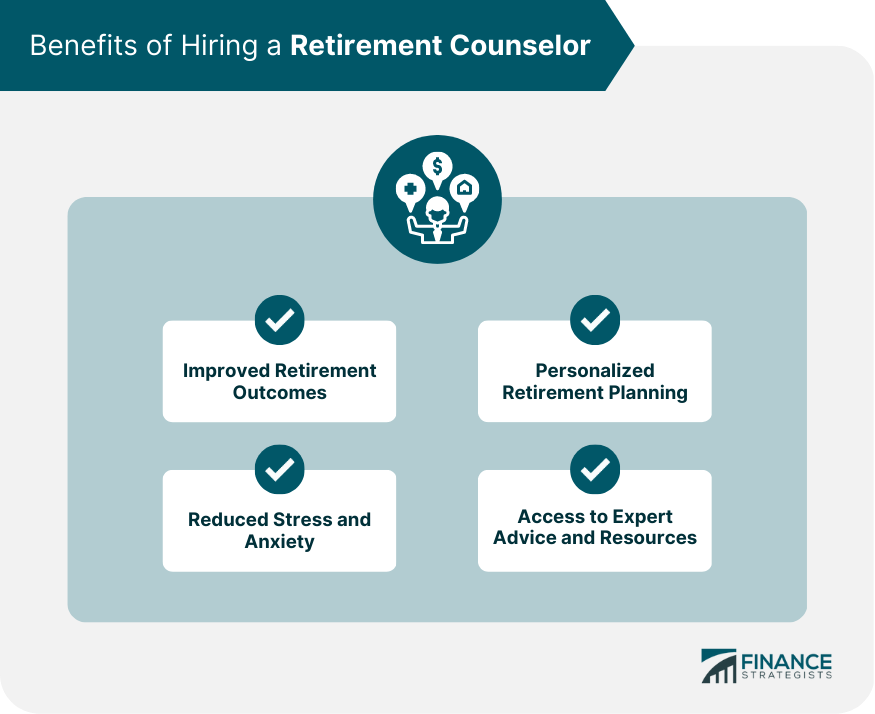

Benefits of Hiring a Retirement Counselor

Improved Retirement Outcomes

Reduced Stress and Anxiety

Personalized Retirement Planning

Access to Expert Advice and Resources

How to Choose a Retirement Counselor

Referrals and Recommendations

Research and Due Diligence

Interviewing Potential Counselors

Evaluating Cost and Value

Final Thoughts

Retirement Counselor FAQs

A retirement counselor is a financial professional who specializes in guiding individuals towards a secure and fulfilling retirement by providing guidance and support in planning and managing finances, assets, and lifestyle during retirement. Their service is necessary as it helps individuals alleviate the stress and uncertainties that come with retirement by providing expert advice and guidance.

When selecting a retirement counselor, it is essential to consider their educational background, professional certifications, experience in retirement planning, and credentials and affiliations. It is also important to ensure that the retirement counselor you choose has a solid educational background in financial planning and management.

Retirement counselors provide a wide range of services to their clients, including financial planning and management, investment advice, tax planning and preparation, estate planning, and lifestyle planning and management. These services are designed to help clients set realistic retirement goals, develop a plan to achieve those goals, and adjust the plan as needed.

Hiring a retirement counselor can provide several benefits, including improved retirement outcomes, reduced stress and anxiety, personalized retirement planning, and access to expert advice and resources. A retirement counselor can help clients make informed decisions about their retirement and provide guidance and support throughout their retirement years.

Choosing the right retirement counselor is essential to achieving your retirement goals. To find the right retirement counselor, consider getting referrals and recommendations, doing your research and due diligence, interviewing potential counselors, and evaluating the cost and value of their services. It is important to select a retirement counselor who has the expertise and experience necessary to provide you with the guidance and support you need.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.