A business line of credit is a revolving credit line that a business can access whenever it needs funds. The funds are repaid with interest over a specific period, usually six months to a year. There are two types of business lines of credit: secured and unsecured. Secured lines of credit require collateral, such as property or equipment, to secure the loan. Unsecured lines of credit do not require collateral but typically have higher interest rates and lower credit limits. A business line of credit differs from traditional loans in that it provides businesses with ongoing access to funds rather than a lump sum payment. Traditional loans require businesses to apply for a loan each time they need funds, and the loan is typically paid back over a fixed period, such as five or ten years. A business line of credit works by providing a predetermined credit limit to a business, which can withdraw funds as needed, up to the limit. The borrower only pays interest on the amount borrowed and can pay back the funds at any time, as long as they stay within the credit limit. To be eligible for a business line of credit, a business must have a good credit score, a solid business plan, and a track record of revenue generation. Lenders will evaluate the business's financial statements, including income statements, balance sheets, and cash flow statements, to determine if they can support the loan. The application process for a business line of credit typically involves filling out an application and providing documentation, such as financial statements and tax returns. The lender will review the application and make a decision based on the business's creditworthiness. Once approved, the lender will establish a credit limit for the business. The business can then access the funds as needed, up to the credit limit. The lender will charge interest on the amount borrowed, and the business will make payments on the loan based on the repayment schedule. The repayment process for a business line of credit is similar to that of a credit card. The business can borrow up to the credit limit and repay the funds as needed. The interest charged on the funds borrowed is based on the outstanding balance. The repayment schedule is typically six months to a year, depending on the terms of the loan. A business line of credit offers several benefits for businesses, including flexibility, access to funds, and improved cash flow management. Business lines of credit also have lower interest rates and offer the ability to establish credit. One of the main advantages of a business line of credit is its flexibility. Unlike traditional loans, which provide businesses with a lump sum payment, a business line of credit enables businesses to access funds as needed. This means businesses can borrow only what they need and repay the loan over time, making it easier to manage cash flow. A business line of credit provides businesses with access to funds that can be used for a variety of purposes, such as purchasing inventory, covering unexpected expenses, or expanding the business. This access to funds can help businesses grow and thrive. Business lines of credit typically have lower interest rates than credit cards and other forms of unsecured debt. This is because the lender has collateral to secure the loan, which reduces the risk of default. This can save businesses money on interest payments and help them manage their finances more effectively. A business line of credit can help businesses manage their cash flow more effectively. With ongoing access to funds, businesses can avoid cash flow gaps and cover expenses as they arise. This can help businesses avoid late payment fees, penalties, and other financial stressors that can negatively impact their operations. By obtaining and repaying a business line of credit, businesses can establish a credit history, which can be useful when applying for future loans or other forms of credit. Strong credit history can also help businesses negotiate better terms and interest rates when seeking additional credit. While a business line of credit offers several advantages, there are also some potential disadvantages that businesses should be aware of. One of the main disadvantages of a business line of credit is the risk of accumulating debt. Without proper budgeting and financial planning, businesses can find themselves in a cycle of borrowing and repaying funds, which can lead to high levels of debt and financial instability. If a business exceeds its credit limit or fails to make timely payments, it may be subject to overdraft fees and other penalties. These fees can quickly add up, making it more difficult for businesses to manage their finances effectively. While a business line of credit can be useful for a variety of purposes, it may not cover all of a business's financial needs. For example, some lenders may have restrictions on how funds can be used or may limit the amount of credit available to businesses in certain industries. Unsecured business lines of credit typically have higher interest rates than secured credit lines, as they pose a higher risk to lenders. This can make it more expensive for businesses to access the funds that they need and can limit the amount of credit available to them. A business line of credit requires businesses to rely on a lender for ongoing access to funds. If the lender changes its terms or requirements, or if the business experiences financial difficulties that impact its creditworthiness, the business may lose access to the funds it needs to operate effectively. A business line of credit can be a useful financial tool for businesses that need ongoing access to funds. However, it is important for businesses to understand the risks and benefits of a business line of credit and to use it responsibly. By establishing a strong credit history, managing their finances effectively, and using a business line of credit wisely, businesses can access the funds they need to grow and thrive.What Is a Business Line of Credit?

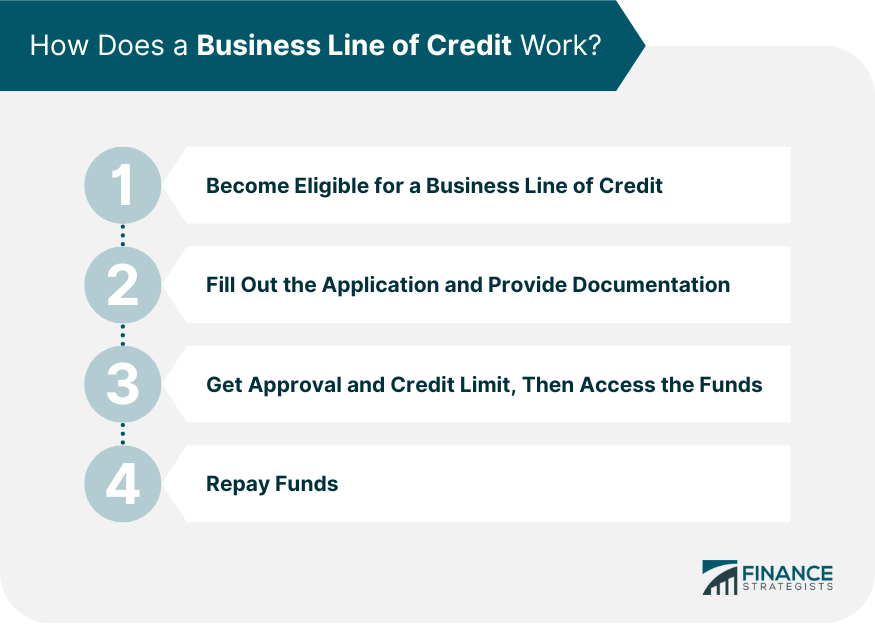

How Does a Business Line of Credit Work?

Eligibility for a Business Line of Credit

Application Process for a Business Line of Credit

Approval and Funding Process for a Business Line of Credit

Repayment Process for a Business Line of Credit

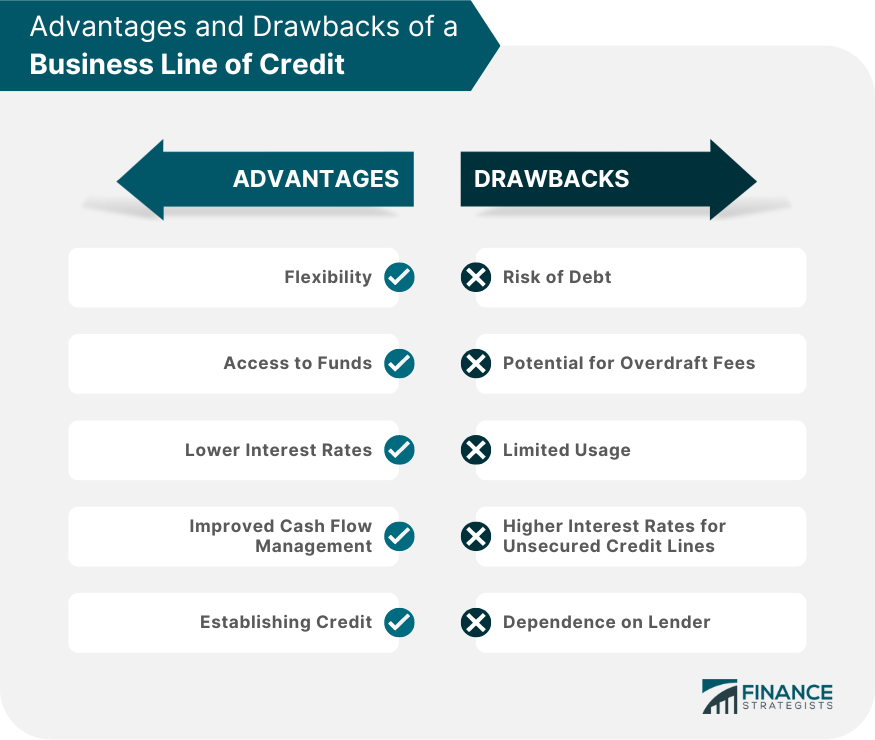

Advantages of a Business Line of Credit

Flexibility

Access to Funds

Lower Interest Rates

Improved Cash Flow Management

Establishing Credit

Disadvantages of a Business Line of Credit

Risk of Debt

Potential for Overdraft Fees

Limited Usage

Higher Interest Rates for Unsecured Credit Lines

Dependence on Lender

Conclusion

How Does a Business Line of Credit Work? FAQs

The amount you can borrow with a business line of credit depends on your business's creditworthiness and the lender's policies. Lenders typically offer credit limits ranging from $1,000 to $500,000, but some lenders may offer higher limits for businesses with excellent credit and financial stability.

The approval process for a business line of credit can vary depending on the lender and the complexity of your application. Typically, the process takes a few days to a few weeks. Some lenders may offer same-day approval for businesses with strong credit and financial statements.

No, a business line of credit is intended for business expenses only. Using funds from a business line of credit for personal expenses can result in penalties and may impact your credit score.

Business lines of credit can be secured or unsecured, depending on the lender's policies and the creditworthiness of your business. Secured lines of credit require collateral, such as property or equipment, to secure the loan, while unsecured lines of credit do not require collateral but typically have higher interest rates and lower credit limits.

The repayment process for a business line of credit is typically structured as monthly payments based on the amount borrowed and the interest charged. The repayment period varies depending on the lender's policies, but it is typically six months to a year. To avoid penalties and fees, it is important to make timely payments according to the repayment schedule.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.