Depression after retirement refers to a type of depression that some individuals experience after they retire from work or when they are planning to retire soon. This type of depression can be caused by several factors, including a loss of identity, decreased social interaction, financial concerns, and changes in physical health. Depression after retirement can significantly impact an individual's mental health, social relationships, and economic stability. Depression is a mental health condition characterized by sadness, hopelessness, and loss of interest in activities that once brought joy. Depression after retirement is a significant concern among many individuals who have recently retired or are planning to retire soon. According to research, depression after retirement is common, with up to one-third of retirees experiencing depressive symptoms. The causes of depression after retirement are multifaceted and often involve major life changes, including loss of identity and purpose, decreased social interaction, and financial concerns. Retirement is a significant life change that can affect an individual's sense of identity and purpose, especially for those whose work has been a significant part of their lives. Loss of purpose and identity can lead to feelings of hopelessness and depression. Social isolation is another factor that can contribute to depression after retirement. For many individuals, work provides a sense of social connection and support. However, these connections may be lost after retirement, leading to a sense of loneliness and isolation. Financial concerns are also common among retirees and can contribute to feelings of anxiety and depression. Risk factors for depression after retirement include age, gender, and pre-existing mental health conditions. Older adults are at an increased risk of developing depression after retirement, with studies showing that retirees over the age of 65 are more likely to experience depressive symptoms than those who are younger. Women are also at a higher risk of developing depression after retirement, possibly due to societal and cultural factors that can lead to greater stress and social isolation. Individuals with pre-existing mental health conditions, such as anxiety or depression, are also at an increased risk of developing depression after retirement. Depression can significantly impact an individual's physical and mental health, social relationships, and economic stability. The physical effects of depression after retirement can include decreased energy levels, difficulty sleeping, and changes in appetite. These symptoms can lead to other health concerns, such as cardiovascular disease and diabetes, which can further impact an individual's quality of life. Depression after retirement can also impact an individual's social relationships and support systems. Retirees may find it challenging to maintain social connections, leading to a sense of loneliness and isolation. Depression can also impact an individual's ability to maintain healthy relationships with friends and family, further contributing to social isolation and reduced social support. Economically, depression after retirement can lead to increased healthcare costs, decreased productivity, and financial strain. Individuals with depression may require medical treatment and therapy, which can be costly. Additionally, depression can impact an individual's ability to work or engage in other productive activities, leading to decreased economic stability. There are several resources available to help individuals cope with depression after retirement. These resources include online and support groups, local and community resources, and national organizations and hotlines. Online resources and support groups are a convenient and accessible way for individuals to find information and support for depression after retirement. Online support groups and discussion forums provide a platform for individuals to connect with others who are experiencing similar challenges. These resources may also include educational materials and resources to help individuals understand depression after retirement and learn coping strategies. Local support groups and community resources provide social and emotional support for retired individuals. These resources may include community centers, senior centers, and other organizations that offer activities and events to promote social connection and engagement. These resources may also provide counseling services or support groups tailored explicitly for retired individuals experiencing depression. National organizations and hotlines offer help and assistance for individuals experiencing depression and other mental health concerns. These organizations may provide online chat services, phone hotlines, and information about local mental health services. Some examples of national organizations include the National Alliance on Mental Illness (NAMI) and the Substance Abuse and Mental Health Services Administration (SAMHSA). There are several strategies individuals can use to reduce the risk of depression after retirement. Lifestyle changes, such as regular exercise and maintaining social connections, can help reduce feelings of loneliness and isolation. Engaging in hobbies and other meaningful activities can also help keep a sense of purpose and identity after retirement. Therapy options for depression after retirement include talk therapy and cognitive-behavioral therapy. Talk therapy involves discussing feelings and experiences with a trained therapist, while cognitive-behavioral therapy focuses on identifying negative thoughts and behaviors and replacing them with positive ones. Medication options for depression treatment may also be considered, including antidepressants and mood stabilizers. Alternative therapies, such as meditation, mindfulness practices, and acupuncture, may also help manage depressive symptoms. For individuals experiencing depression after retirement. Coping strategies can help manage symptoms and improve overall well-being. Self-care strategies, such as exercise, healthy eating, and getting enough sleep, can improve physical health and reduce symptoms of depression. Seeking social support from friends and family members can also help alleviate feelings of loneliness and isolation. For family members and caregivers supporting a retired loved one experiencing depression, it is essential to provide empathy and understanding. Encouraging the individual to seek professional help and engage in healthy activities can also be beneficial. Depression after retirement is a complex issue that affects many individuals and can significantly impact their mental, physical, and economic well-being. While retirement can be an exciting time, it can also be challenging, and it is essential to take steps to prevent and manage depression. By engaging in healthy lifestyle choices, seeking professional help when needed, and maintaining social connections, retirees can improve their overall quality of life and reduce the risk of depression. As retirement also comes with financial considerations that can impact mental health, hiring an expert in retirement planning is highly recommended. A retirement planner can guide and advise on navigating retirement and ensure that retirees make informed financial decisions supporting their overall well-being.What Is Depression After Retirement?

Understanding Depression After Retirement

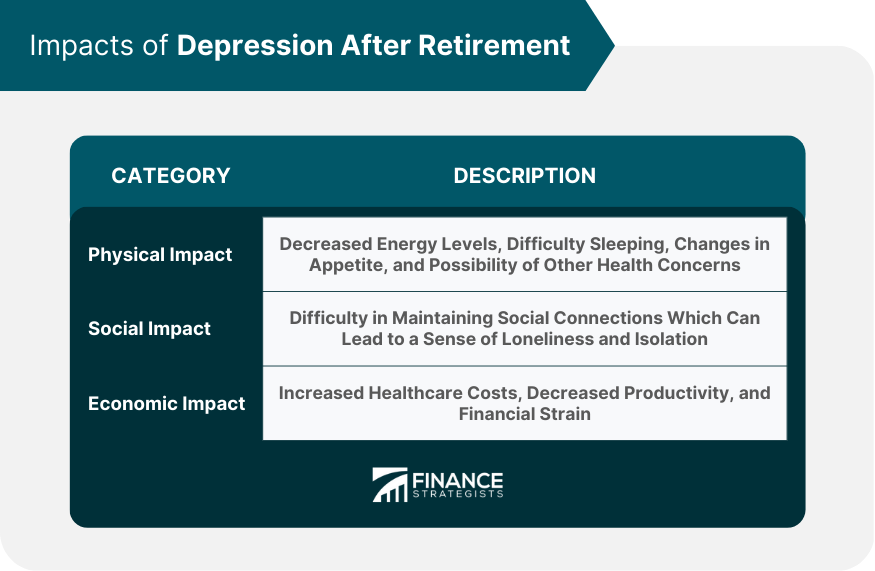

Impacts of Depression After Retirement

Resources for Support

Online Resources and Support Groups

Local Support Groups and Community Resources

National Organizations and Hotlines

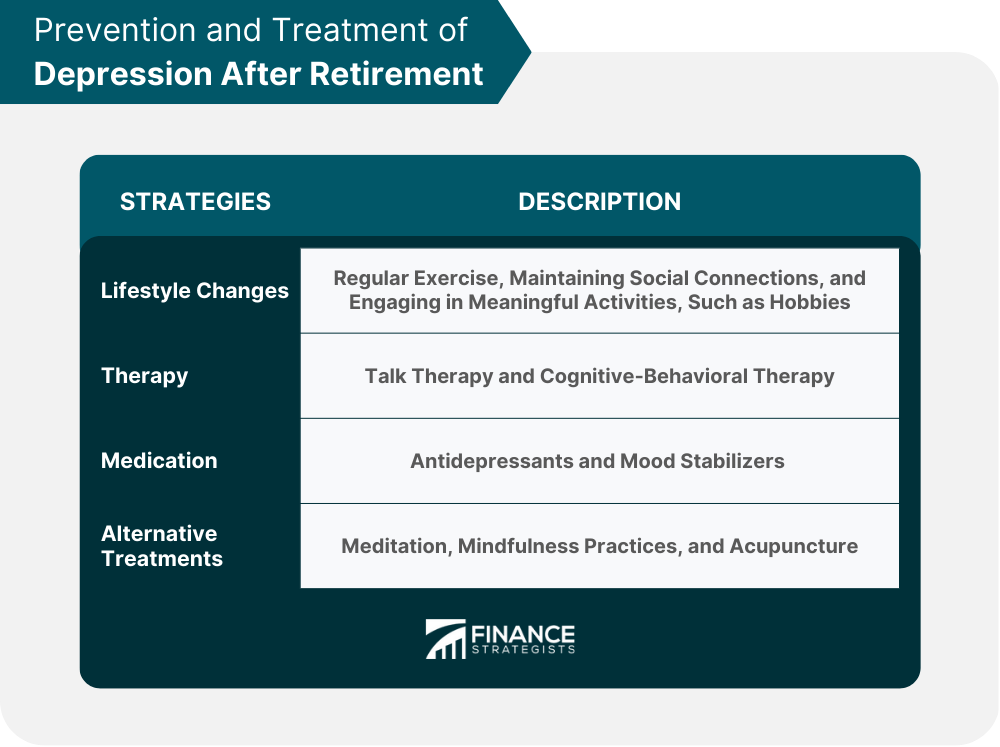

Prevention and Treatment of Depression After Retirement

Lifestyle Changes

Therapy

Medication and Alternative Treatments

Coping With Depression After Retirement

Conclusion

Depression After Retirement FAQs

Depression after retirement is a common mental health concern affecting some individuals who have retired or are planning to retire soon. It is characterized by feelings of sadness, hopelessness, and loss of interest in activities that once brought joy.

The risk factors for depression after retirement include age, gender, and pre-existing mental health conditions. Older adults are at an increased risk of developing depression after retirement, as well as women and individuals with pre-existing mental health conditions.

Depression after retirement can have significant impacts on an individual's physical and mental health, social relationships, and economic stability. It can lead to decreased energy levels, difficulty sleeping, changes in appetite, social isolation, and financial strain.

Treatment options for depression after retirement include therapy, medication, and alternative treatments such as meditation and mindfulness practices. Engaging in healthy activities and seeking social support from friends and family members can also help alleviate symptoms of depression.

Self-care strategies, such as exercise, healthy eating, and getting enough sleep, can improve physical health and reduce symptoms of depression. Seeking social support from friends and family members can also help alleviate feelings of loneliness and isolation.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.