Powerball Annuity refers to a financial arrangement associated with the Powerball lottery, a popular multi-state lottery game in the United States. It is an option available to winners who choose to receive their winnings in installments over a specified period rather than a lump sum payment. This arrangement aims to provide long-term financial security and management for the winner. While the annuity option offers the advantage of a consistent income over an extended period, winners should carefully evaluate their personal financial goals and consult with professionals to determine whether a lump sum or annuity payout is more suitable for their circumstances. Once a winner decides to take the annuity option, they receive the first payment immediately, with the remaining paid out over 29 years, leading to 30 payments in total. The Powerball annuity payments are made annually. To combat inflation, each annuity payment increases by 5% compared to the last. This incremental increase helps maintain the purchasing power of the annuity payments over the years. The payments are spread over 29 years, providing a long-term, steady income for the lottery winner. Regardless of whether you choose the lump sum or the annuity, lottery winnings are subject to taxes. The federal government will withhold 24% of your winnings for tax purposes, and depending on where you live, additional state and local taxes may apply. Choosing the lump sum opens up more potential for investment. With a good investment strategy, you could potentially earn more than what the annuity would have paid out. However, investing comes with its own risks and requires financial acumen to navigate. Even though Powerball annuity payments increase by 5% each year, the real value of money might decrease over time due to inflation. However, this is mitigated by the escalating payments, preserving the real value of the annuity. Each option carries its own set of advantages and disadvantages. One of the most significant benefits of the Powerball annuity is the guarantee of financial security for nearly three decades. The winnings are spread out over 29 years, providing a steady income stream that can offer financial stability and peace of mind. The Powerball annuity is designed to account for inflation. Each annual payment is 5% larger than the previous year's, helping to maintain the purchasing power of the money you receive. Receiving a lump sum can lead to extravagant spending and poor investment decisions, particularly for those unaccustomed to managing such large sums. With an annuity, the extended payout schedule can promote fiscal responsibility and help prevent rash financial decisions. With the annuity, you only receive a small fraction of your winnings each year. This can be limiting if you wish to make significant purchases or investments early on, as the bulk of your winnings remains inaccessible. If the winner dies before all payments have been received, the remaining funds become part of the estate and may be subject to estate taxes. While the remaining annuity payments can be inherited by heirs, navigating these legal and financial issues can be complex. Life is unpredictable, and a lot can change over three decades. Changes in tax laws, personal circumstances, or financial needs might make the annuity less attractive in the future. Upon winning the Powerball jackpot, an individual encounters a significant choice: opt for the lump sum or the annuity. The lump sum presents the opportunity to receive the entirety of the winnings upfront. Yet, it's essential to note that the lump sum does not equate to the total jackpot amount publicized, as it signifies the present cash value of the annuity payments. Contrarily, the annuity selection enables the spreading of winnings over 29 years, equating to 30 payments (the immediate initial payment included). Each following payment witnesses a 5% increase from its predecessor, a measure implemented to offset inflation and a rising cost of living. The decision pivots around immediate gratification versus long-term financial security. The lump sum offers immediate financial latitude and the potential for significant investment. Meanwhile, the annuity can alleviate concerns about managing a considerable fortune or the fear of outliving the winnings, offering a degree of long-term financial certainty. Determining between the lump sum and annuity is influenced by an array of factors: one's age, financial acumen, fiscal aspirations, present financial situation, and risk tolerance. Critical to the decision-making process is an understanding of the consequences and potential implications of each choice. Powerball annuity payments are generally non-transferable. However, there are certain exceptions. In some cases, winners might be able to sell their future payments to a third party for a lump sum, but this usually comes with legal complications and financial consequences. In the event of the winner's death, the remaining annuity payments become part of the estate and will be passed onto their heirs. In situations of bankruptcy or significant debt, creditors may have a claim on your future lottery payments. The specifics can vary depending on the laws of the state where you live. Powerball Annuity is a financial arrangement offered to winners of the Powerball lottery, providing a structured payout over 29 years through 30 payments, each increasing by 5% annually to counteract inflation. This option ensures long-term financial security and disciplined financial management. However, important considerations must be taken into account. Tax implications apply to lump sum and annuity winnings, and investment opportunities should be weighed carefully. While the annuity guarantees a steady income stream, it limits immediate access to the full winnings, which could affect major purchases or investments. Estate complications may arise upon the winner's death, and bankruptcy or debt situations may also impact annuity payments. Understanding the legal aspects, including transferability and inheritance rules, is vital. Ultimately, the choice between Powerball Annuity and a lump sum depends on factors such as age, financial acumen, aspirations, and risk tolerance. Consulting with financial professionals is crucial in making an informed decision.Powerball Annuity Overview

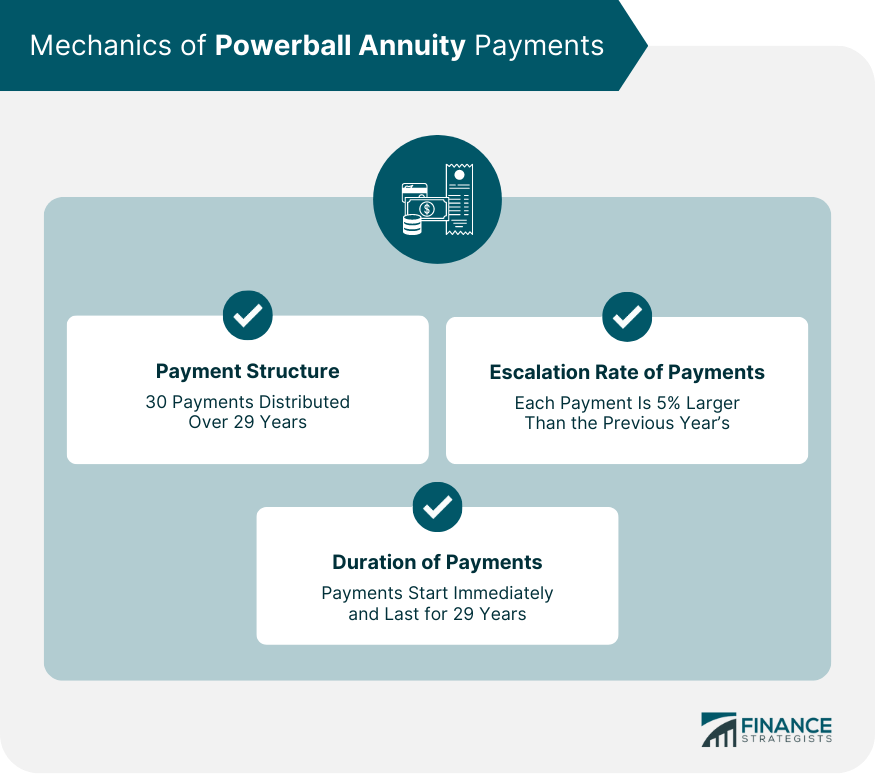

Mechanics of Powerball Annuity Payments

Overview of Payment Structure

Escalation Rate of Payments

Duration of Payments

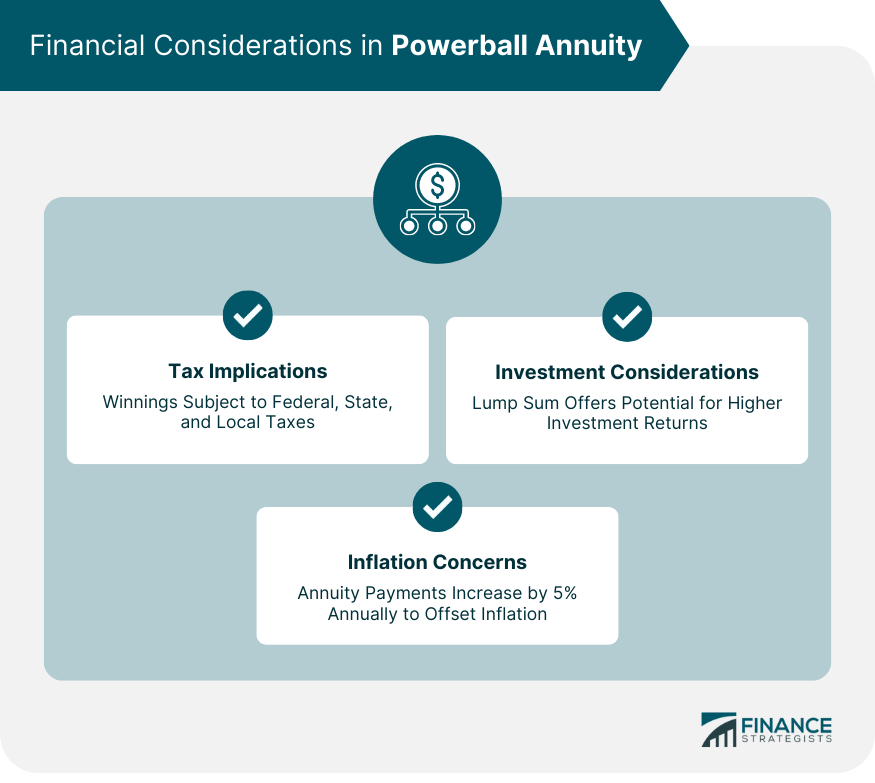

Financial Considerations in Powerball Annuity

Tax Implications

Investment Considerations

Inflation Concerns

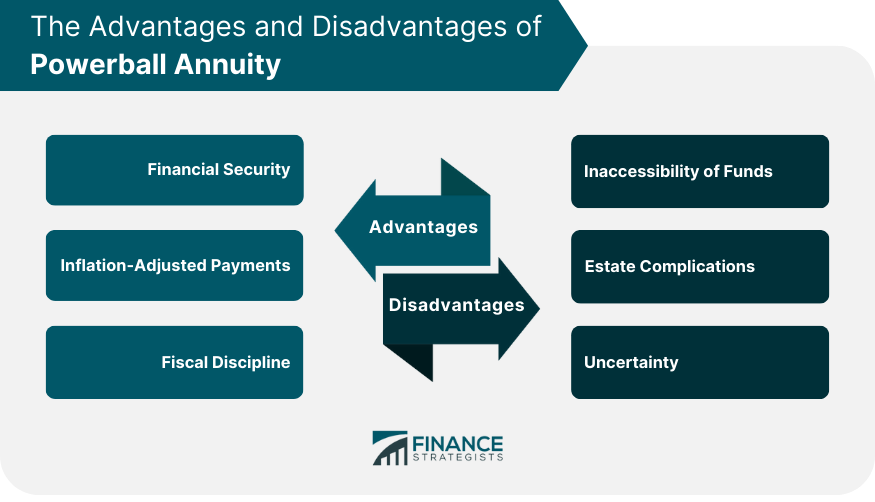

Advantages and Disadvantages of Powerball Annuity

Advantages of Powerball Annuity

Financial Security

Inflation-Adjusted Payments

Fiscal Discipline

Disadvantages of Powerball Annuity

Inaccessibility of Funds

Estate Complications

Uncertainty

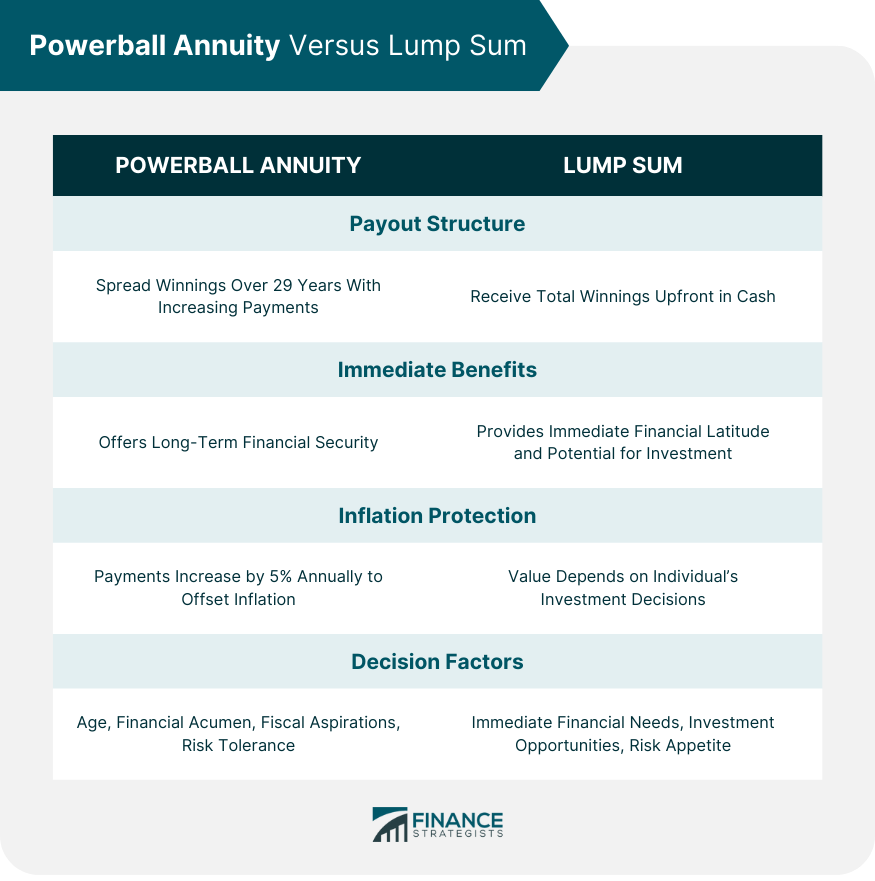

Powerball Annuity Versus Lump Sum

Explanation of Lump Sum Option

Explanation of Annuity Option

Comparative Analysis of the Two Options

Factors Influencing the Choice Between Lump Sum and Annuity

Legal Aspects of Powerball Annuity

Transferability of Annuity Payments

Estate Planning and Inheritance Issues

Bankruptcy and Debt Considerations

Bottom Line

Powerball Annuity FAQs

A Powerball Annuity refers to the payment option available to Powerball lottery winners, where they receive their prize money over 29 years, with 30 payments in total. Each payment increases by 5% from the previous year to account for inflation.

When you win the Powerball, you can choose to receive your winnings as a lump sum or as an annuity. The lump sum is a one-time payment of all your winnings at once. The annuity option, on the other hand, pays out your winnings over 29 years, with an increase of 5% each year to account for inflation.

Both lump sum and annuity winnings from the Powerball are subject to federal taxes. The federal government typically withholds 24% of your winnings for tax purposes. Depending on where you live, you may also need to pay state and local taxes.

Generally, Powerball annuity payments are non-transferable, meaning you can't give or sell them to someone else. However, if a winner passes away, the remaining annuity payments become part of their estate and can be inherited by their heirs.

The choice between a lump sum and an annuity depends on several factors, including age, financial situation, risk tolerance, and long-term financial goals. It's also crucial to consider the tax implications, potential investment opportunities, and the impact of inflation on your winnings.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.