A joint life annuity is a type of financial product typically purchased by couples looking to secure a consistent income stream during their retirement years. It's an insurance contract where the policyholder pays a lump sum or series of payments in exchange for regular disbursements, which begin either immediately or at a later date. The defining feature of a joint life annuity is that these payments continue until the last surviving annuitant passes away. The main difference between a joint life and a single life annuity lies in the payout phase. In a single life annuity, payments cease when the annuitant passes away, even if a spouse or dependant is still living. In contrast, a joint life annuity guarantees income for as long as either annuitant is alive, providing financial security for the surviving spouse. This is predicated on the principle that the older the annuitants are at the point of purchase, the higher the annuity payments tend to be. This directly correlates with the fact that life expectancy decreases with age, meaning that the insurer is likely to make a lesser number of payments as compared to when dealing with younger annuitants. Women tend to live longer than men, which means that an annuity for a man and a woman of the same age may pay out less than one for two men of the same age. The rationale here is that the insurance company is likely to make payments over a longer period when women are involved, thereby impacting the individual payment amounts. Certain insurance companies incorporate health evaluations into their calculation processes, looking at whether any of the annuitants have a health condition that could potentially shorten their life expectancy. In cases where health conditions exist that may lead to a reduced life span, annuity payments might be adjusted upwardly to compensate for the anticipated shorter payout duration. As a basic rule, a larger initial investment equates to higher annuity payments. This principle is straightforward; the more funds you put into the annuity, the more substantial the income stream you can expect to receive in return. The type of joint life annuity you purchase can affect the amount of your payments. Fixed annuities provide a guaranteed income, while variable annuities' payments can fluctuate based on the performance of the underlying investments. Indexed annuities offer payments linked to a particular index's performance, with a guaranteed minimum payment. For instance, you might prefer a joint-and-survivor annuity, which guarantees the continuation of payments until both annuitants have passed away. Alternatively, you might favor a joint life with last survivor increase option, which boosts payments when one annuitant passes away. These diverse options all influence the payment calculations differently, thereby affecting the final payment amounts. This is especially the case for fixed annuities, which rely heavily on interest rates. Generally, higher interest rates are associated with higher annuity payments. Therefore, the current financial market conditions, particularly interest rates, can have a considerable effect on the income derived from annuities. A joint life fixed annuity offers a guaranteed payout amount that does not change over the life of the annuity. It offers predictability and is less risky because the payment does not depend on the performance of underlying investments. A joint life variable annuity's payments fluctuate based on the performance of the investment subaccounts chosen by the annuitants. This type of annuity provides the potential for higher returns but also carries a higher risk because the payout can decrease if the investments perform poorly. A joint life indexed annuity's payments are tied to the performance of a specific market index, such as the S&P 500. These annuities often offer a guaranteed minimum payment, but the potential payout can be higher if the linked index performs well. A joint and survivor annuity continues payments for the life of both annuitants. After one annuitant passes away, payments continue to the surviving annuitant. The survivor's payment may continue at the same rate or be reduced, depending on the terms of the annuity contract. A joint life annuity with period certain offers payments for the longer of either the lives of the annuitants or a specific period (e.g., 10, 15, or 20 years). If both annuitants pass away before the end of the period certain, the remaining payments go to a named beneficiary. A joint life annuity can play a vital role in retirement income planning. It offers the assurance of a steady stream of income throughout the retirement years of both partners, eliminating the risk of outliving one's assets. While joint life annuities can form the bedrock of a retirement plan by providing guaranteed income, they should be integrated with other retirement investments like 401(k) plans, IRAs, and investment portfolios for a well-diversified strategy. The consistent income from annuities can allow retirees to take on a bit more risk with their other investments, potentially enhancing their overall returns. This assurance brings a degree of financial stability and emotional tranquility, knowing that should one partner pass away, the surviving individual will continue to receive an income stream, safeguarding them against financial hardship. When compared to two separate single life annuities, joint life annuities often yield higher cumulative payouts. This is attributed to the insurer's method of calculating the payouts, which takes into account the combined life expectancy of both annuitants, and not just one as in the case of single life annuities. Longevity risk refers to the danger of outliving one's financial resources. As modern medical advances result in people enjoying longer lives, managing this risk becomes a crucial aspect of retirement planning. Joint life annuities offer a viable solution to this concern. In the case of a joint and survivor annuity, the surviving spouse continues to receive annuity payments even after the death of the first spouse. This can be a critical income source for a surviving spouse, particularly if they had been financially dependent on the deceased spouse. Some joint life annuities offer inflation protection options, which can increase annuity payouts over time to keep pace with inflation. This can help preserve the purchasing power of the annuity income in the face of rising costs. Like most annuities, joint life annuities typically come with surrender charges. These are fees imposed if you withdraw more than a certain percentage of the contract's value within a specific period, usually in the first five to ten years of the contract. This can limit your flexibility to access funds. Joint life annuities usually provide lower initial payouts compared to a single life annuity for the same amount of premium. This is because the insurer expects to make payments over a longer period, given that they are covering two lives instead of one. Unless the joint life annuity includes an inflation protection feature, fixed annuity payments could lose purchasing power over time. This could erode the value of the guaranteed income stream, especially over long periods. Unless the annuity contract specifies a death benefit or period-certain feature, payments stop when both annuitants have passed away, even if this occurs shortly after the purchase of the annuity. If both annuitants die prematurely, the insurance company retains the remaining value of the annuity, which might otherwise have gone to heirs. Annuities, including joint life annuities, can be complex financial products with various fees, options, and riders. Understanding all the terms, costs, and potential benefits can be difficult, and there may be a lack of transparency in some contracts. If the insurance company issuing the annuity goes bankrupt, annuitants could lose their income, although state guaranty associations provide some level of protection. Before shopping for an annuity, consider your financial goals, retirement plans, current income, expected expenses, and overall financial health. Understanding your financial needs will help you determine how much income you'll need from an annuity. As discussed, there are several types of joint life annuities, including fixed, variable, indexed, and others. Make sure you understand the features, risks, and benefits of each type, and consider which would be the best fit for your circumstances. Annuity rates can vary considerably between different insurance companies, so it's worth shopping around. Comparing rates from several providers will ensure you get the best possible return on your investment. The reliability of your annuity payments will depend on the financial strength of the insurance company. Check the ratings of potential insurers with rating agencies like A.M. Best, Moody's, and Standard & Poor's to ensure they're financially stable. Look at what happens to your annuity if both annuitants pass away. Some annuities may offer a death benefit to your beneficiaries or continue payments for a guaranteed period, which can be an important factor in your decision. Annuities can come with a variety of fees and charges, such as management fees, surrender charges, and mortality and expense risk charges. Make sure you understand all the costs associated with an annuity before making a purchase. Annuities can be complex, and it's often helpful to consult with a financial advisor. They can help you navigate the intricacies of different annuity products and advise you based on your specific financial situation and retirement goals. Joint life annuities are a valuable financial tool for couples seeking a consistent income stream in retirement. By ensuring payments until the last surviving annuitant passes away, these annuities offer financial security and peace of mind for the surviving spouse. Factors such as age, gender, health status, investment amount, annuity type, payout options, and prevailing interest rates influence the payments of joint life annuities. While they play a crucial role in retirement income planning, it is important to integrate them with other investments for a well-diversified strategy. Joint life annuities provide lifetime income for both individuals, potential higher payouts, protection against longevity risk, spousal protection, and the possibility of inflation protection. However, they also come with drawbacks such as surrender charges, lower initial payouts, the potential loss of purchasing power, the possibility of no death benefit, complexity, and the risk of insurer insolvency. To choose the right joint life annuity, individuals should assess their financial needs, understand the different types, compare rates, consider the financial strength of the insurer, review death benefit provisions, understand fees and charges, and seek guidance from a financial advisor. By following these guidelines, individuals can make informed decisions that align with their specific financial goals and circumstances.What Is a Joint Life Annuity?

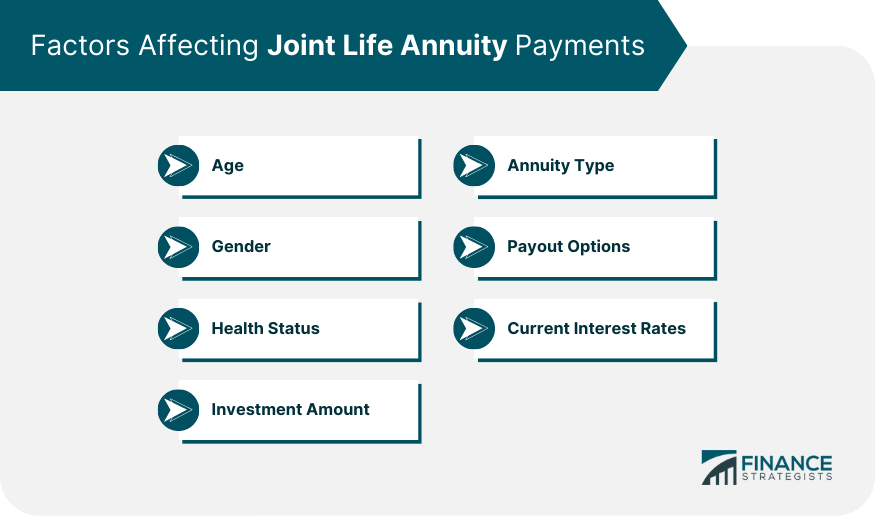

Factors Affecting Joint Life Annuity Payments

Age

Gender

Health Status

Investment Amount

Annuity Type

Payout Options

Current Interest Rates

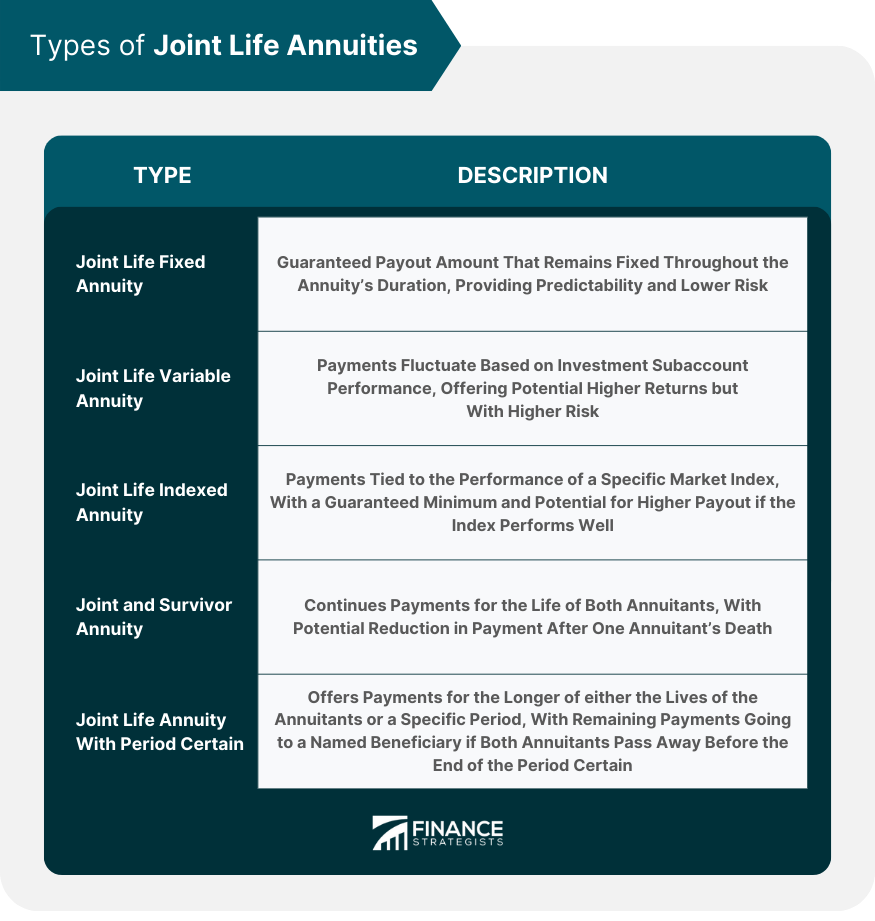

Types of Joint Life Annuities

Joint Life Fixed Annuity

Joint Life Variable Annuity

Joint Life Indexed Annuity

Joint and Survivor Annuity

Joint Life Annuity With Period Certain

Joint Life Annuity in Retirement Planning

Importance in Income Planning

Integration With Other Retirement Investments

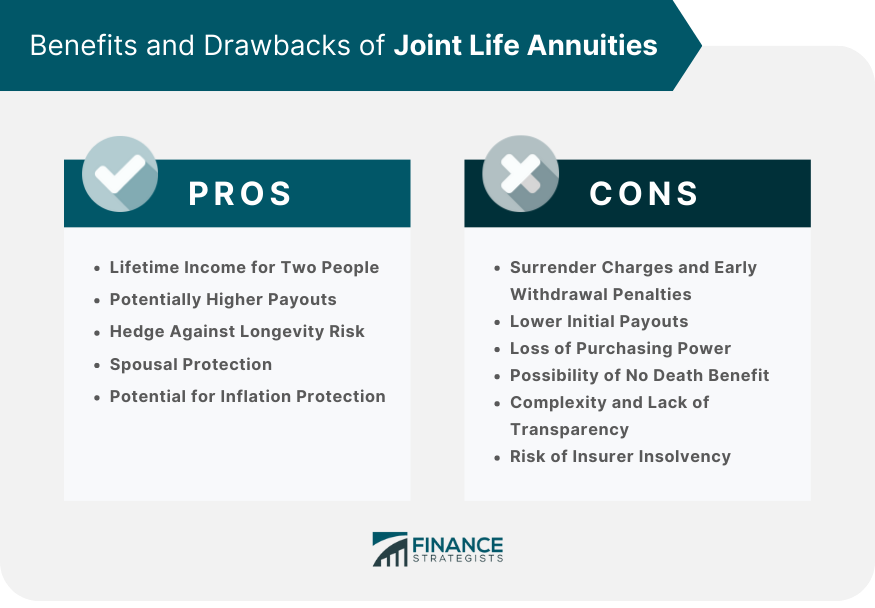

Benefits of a Joint Life Annuity

Lifetime Income for Two People

Potentially Higher Payouts

Hedge Against Longevity Risk

Spousal Protection

Potential for Inflation Protection

Drawbacks of a Joint Life Annuity

Surrender Charges and Early Withdrawal Penalties

Lower Initial Payouts

Loss of Purchasing Power

Possibility of No Death Benefit

Complexity and Lack of Transparency

Risk of Insurer Insolvency

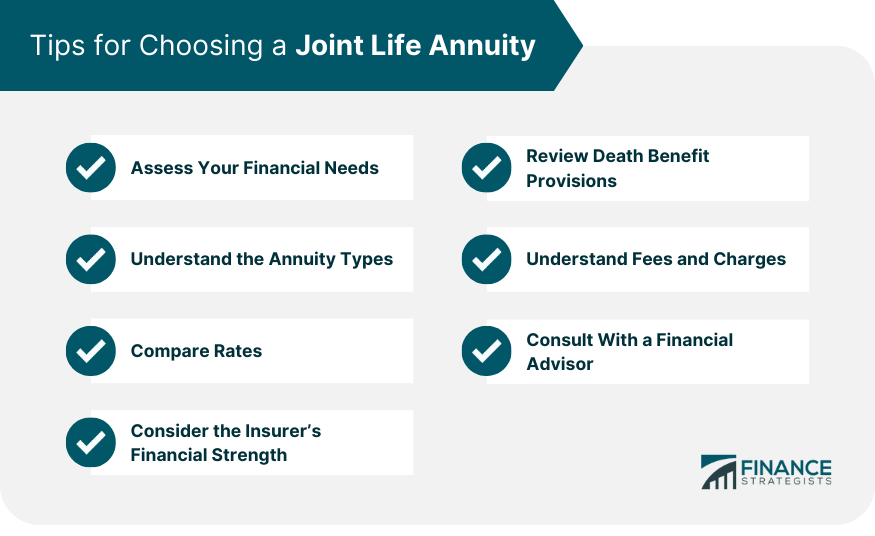

Tips for Choosing a Joint Life Annuity

Assess Your Financial Needs

Understand the Annuity Types

Compare Rates

Consider the Insurer’s Financial Strength

Review Death Benefit Provisions

Understand Fees and Charges

Consult With a Financial Advisor

Final Thoughts

Joint Life Annuity FAQs

The main difference is that a joint life annuity continues payments until the last surviving annuitant passes away, providing financial security for the surviving spouse, while a single life annuity ceases payments upon the annuitant's death, even if a spouse or dependant is still living.

Age and gender play a crucial role in determining joint life annuity payments. Generally, older annuitants receive higher payments, as their life expectancy is shorter. Additionally, women tend to receive lower annuity payments than men of the same age, as women typically have a longer life expectancy.

It depends on the type of joint life annuity. Fixed annuities offer a guaranteed payout amount that remains constant, while variable annuities' payments fluctuate based on the performance of underlying investments. Indexed annuities provide payments linked to the performance of a specific market index, with a guaranteed minimum payment.

Joint life annuities typically come with surrender charges, which are fees imposed if you withdraw more than a certain percentage of the contract's value within a specific period, usually the first five to ten years. These charges can limit your flexibility in accessing funds early.

Yes, it is recommended to consult with a financial advisor when considering a joint life annuity or any complex financial product. A financial advisor can help you understand the terms, costs, and potential benefits of the annuity, and provide personalized guidance based on your specific financial situation and retirement goals.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.