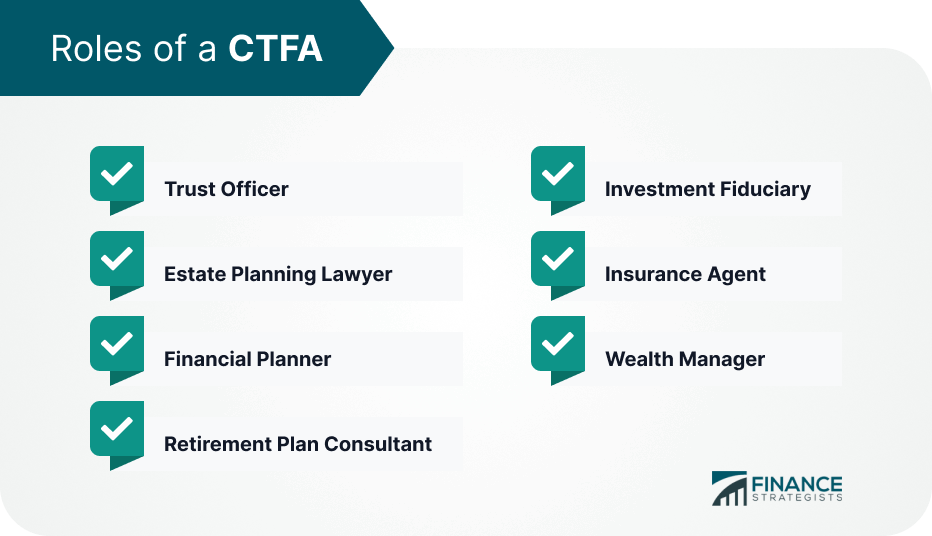

A Certified Trust and Fiduciary Advisor (CTFA) offers advanced education in the areas of trusts, estates, retirement planning, investments and financial planning – all with a fiduciary standard – or duty – of loyalty above all else. The CTFA designation is vested by the American Bankers Association (ABA) and is held by professionals who have met a rigorous set of requirements, including passing a comprehensive exam. CTFA used to stand for Certified Trust and Financial Advisor but has since been updated to Certified Trust and Fiduciary Advisor to reflect the fiduciary focus of the designation. The CTFA designation can give professionals an edge in a competitive job market, as it shows they are committed to continuing their education and upholding the fiduciary standard. Have a financial question? Click here. A CTFA can work in a variety of settings, including: banks, trust companies, insurance companies, brokerage firms, accounting firms, financial planning firms and estate planning law firms. A CTFA is qualified to work in a number of different roles, including: A CTFA can serve as a trust officer of a bank or trust company and be responsible for the fiduciary administration of customer wealth. A CTFA can provide legal advice on estate planning, including wills, trusts and estate tax matters. A CTFA is qualified to create individualized financial plans and manage portfolios for individuals, families and businesses. A CTFA can serve as a retirement plan consultant who provides guidance on 401(k), 403(b) and 457 accounts for employer-sponsored plans such as pensions, profit sharing and stock bonus plans. A CTFA is fully qualified to serve in an investment fiduciary capacity, including as an investment officer of a bank or trust company. A CTFA can provide insurance advice and sell life, disability income, property and casualty and long-term care insurance. A CTFA can serve as a wealth manager and help clients accumulate, protect and grow their wealth. Applicants of the CTFA designation are required to have at least 3 years experience in the field of wealth management and should have completed an accredited training program in the last seven years. The accredited training program should include any of these: If a candidate doesn't have any of those mentioned above, he or she should have: Only when an applicant possesses the above requirements will he or she be admitted for the CTFA exam. In order for applicants to take the exam, a payment of $750 should be given. In the case of retakes, payment amounts to $450. The four-hour long exam is composed of 200 multiple choice questions. The exam covers the following topics: It should be noted that examinees are not allowed to use a calculator or any mobile device during the test. To maintain the CTFA designation, holders are to do the following: A renewal discount is given to those who possess two or more ABA certifications. The CTFA designation is the mark of a professional who is dedicated to upholding the fiduciary standard and has the knowledge and experience to provide sound financial advice. The exam is challenging but with ample preparation, it can be passed. The CTFA designation is well worth the investment.Roles of a CTFA

Trust Officer

Estate Planning Lawyer

Financial Planner

Retirement Plan Consultant

Investment Fiduciary

Insurance Agent

Wealth Manager

CTFA Designation Requirements

The CTFA Exam

CTFA Renewal

Final Thoughts

Certified Trust and Fiduciary Advisor (CTFA) FAQs

The CTFA designation lasts for three years, and in order to renew it, holders must take 45 continuing education credits and uphold the CTFA certification's code of ethics.

The 200-question, four-hour long CTFA exam covers fiduciary and trust activities, financial planning, taxation law and planning, investment management, ethics.

Fiduciary means someone who is entrusted to act for another person or organization. A fiduciary must act in the best interest of his or her principal and do so with loyalty, honesty and prudence at all times.

Upon completion of the certification exam, one will receive the Certified Trust & Fiduciary Advisor (CTFA) designation which demonstrates that he or she has met the standards set forth by the American Bankers Association. The CTFA designation shows expertise in tax law, financial planning, investment management, estate planning, retirement plans and insurance.

CTFAs can work as investment advisors. They can also hold positions with insurance companies, banks and brokerages, accountants' firms, CPA firms and law firms.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.